The BofA Perspective: Why Stretched Stock Market Valuations Shouldn't Worry You

Table of Contents

BofA's Rationale Behind a Positive Outlook Despite High Valuations

BofA's positive outlook, despite seemingly high stock market valuations, rests on several key pillars. Their analysts believe that several factors outweigh the concerns surrounding current price-to-earnings ratios and other valuation metrics.

-

Strong Corporate Earnings Growth Projections: BofA's recent reports project robust corporate earnings growth for the coming years. This projected growth, fueled by various economic factors and innovation, suggests that current valuations may be justified by future earnings potential. (Note: Specific data and report citations would be included here if available).

-

Continued Positive Economic Growth Forecasts: BofA's economic forecasts point towards continued, albeit potentially slower, economic growth. This sustained growth, while acknowledging inflationary pressures and interest rate hikes, provides a supportive backdrop for corporate profitability and stock market performance. (Note: Sources for these forecasts should be cited here).

-

The Impact of Technological Innovation: BofA highlights the transformative power of technological innovation as a key driver of future economic growth and corporate earnings. This innovation is expected to fuel productivity gains, create new markets, and drive the valuations of companies at the forefront of technological advancements.

-

Historically Low Interest Rates Relative to Inflation and Valuation: While interest rates have risen, BofA's analysis suggests they remain historically low when considered against inflation and current valuation levels. This relative low interest rate environment continues to support borrowing and investment, underpinning economic activity and stock market performance.

Addressing the Concerns: Why High Valuations Aren't Necessarily a Bearish Indicator

The concern surrounding high valuations is understandable. However, BofA's analysis suggests that a nuanced perspective is necessary.

-

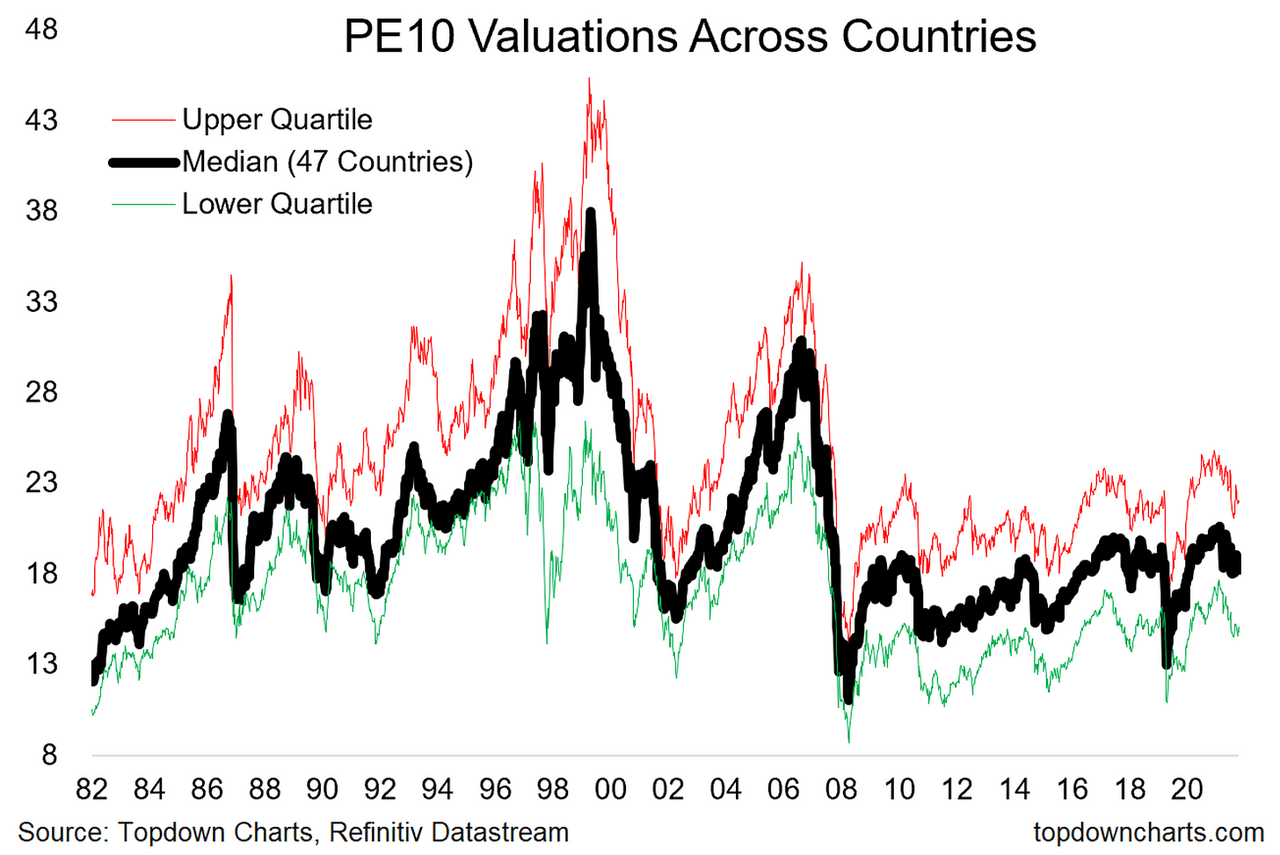

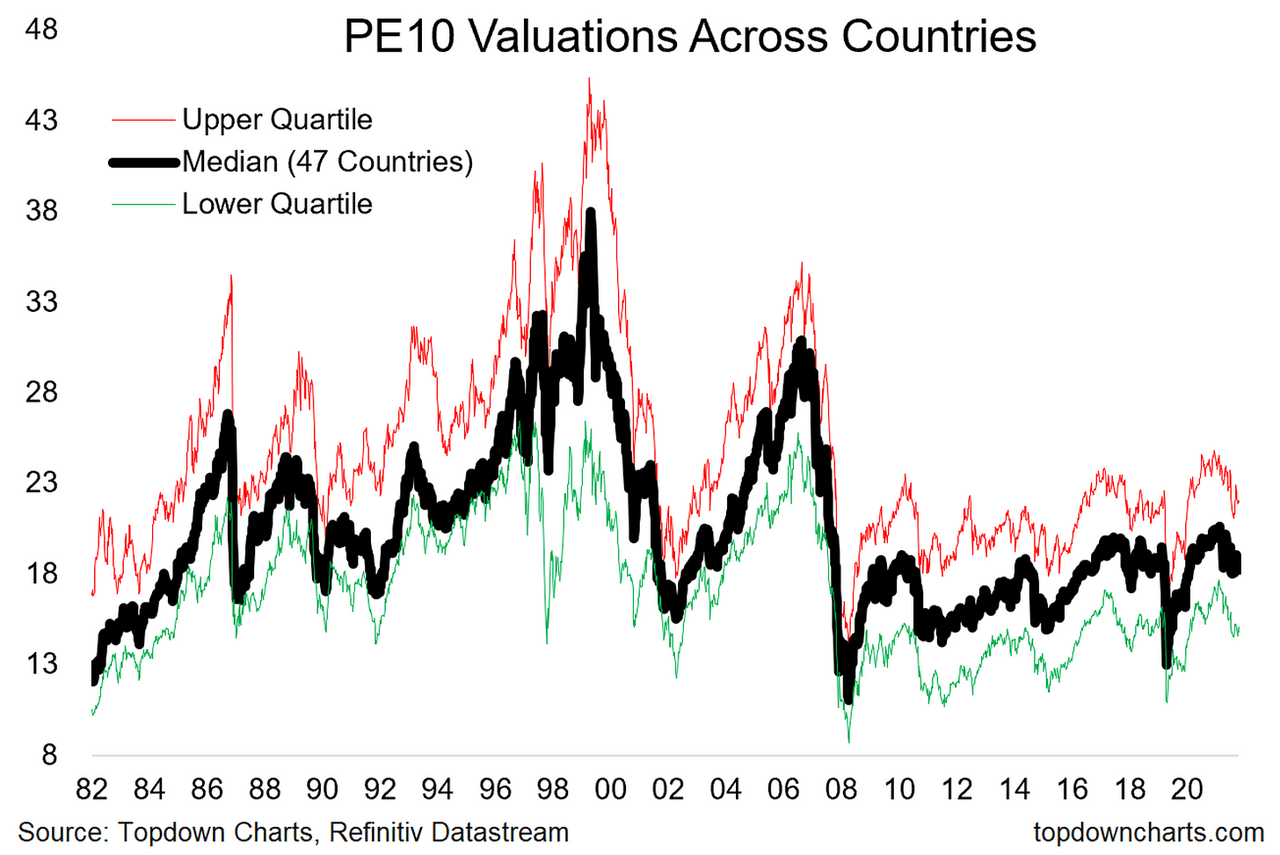

Relative Valuations: BofA likely emphasizes the importance of relative valuations. Comparing current valuations to historical averages and to other asset classes, such as bonds, provides context. High valuations in the stock market might still be attractive relative to the low yields available in the bond market, for instance.

-

Sustained Earnings Growth Exceeding Valuation Growth: The key is whether earnings growth can outpace valuation growth. If companies continue to deliver strong earnings increases, even if valuations remain elevated, the market might still provide positive returns for investors.

-

Limitations of Traditional Valuation Metrics: Traditional valuation metrics, such as P/E ratios, may not fully capture the dynamics of a rapidly evolving economic and technological landscape. BofA may argue that these metrics need to be considered in the context of other factors, such as future growth prospects.

-

Specific Sectors Outperforming Despite Higher Valuations: BofA might identify specific sectors, such as technology or healthcare, that are expected to outperform despite higher valuations. These sectors are anticipated to benefit disproportionately from technological advancements and secular growth trends.

The Importance of Long-Term Investment Strategy in a Volatile Market

BofA likely stresses the importance of a long-term perspective in navigating market volatility. Short-term fluctuations should not dictate investment decisions.

-

Diversified Portfolio: A well-diversified portfolio across various asset classes and sectors is crucial to mitigate risk and potentially capture upside potential from different market segments.

-

Long-Term Investment Horizon: Investors should focus on their long-term financial goals and avoid emotional reactions to short-term market swings. Time in the market, rather than timing the market, is often a more effective strategy.

-

Regular Portfolio Rebalancing: Regularly rebalancing your portfolio to maintain your target asset allocation helps control risk and capitalize on market opportunities.

-

Disciplined Investing: Sticking to your investment plan and avoiding impulsive decisions based on short-term market noise is essential for long-term success.

BofA's Recommended Investment Strategies (Optional)

(This section would include specific recommendations from BofA reports, if available. Examples could include sector-specific investment suggestions, suggested asset allocation strategies, and risk management considerations.)

Conclusion

BofA's perspective suggests that stretched stock market valuations, while a legitimate concern, should not necessarily cause panic. Strong corporate earnings growth projections, continued economic expansion (albeit at a potentially slower pace), and the potential for outperformance in specific sectors all contribute to a cautiously optimistic outlook. Remember, a long-term investment strategy is crucial to navigate market volatility effectively.

Don't let stretched stock market valuations deter you. Understand the BofA perspective and build a robust investment plan for long-term success. (Include a link to relevant BofA resources if available)

Featured Posts

-

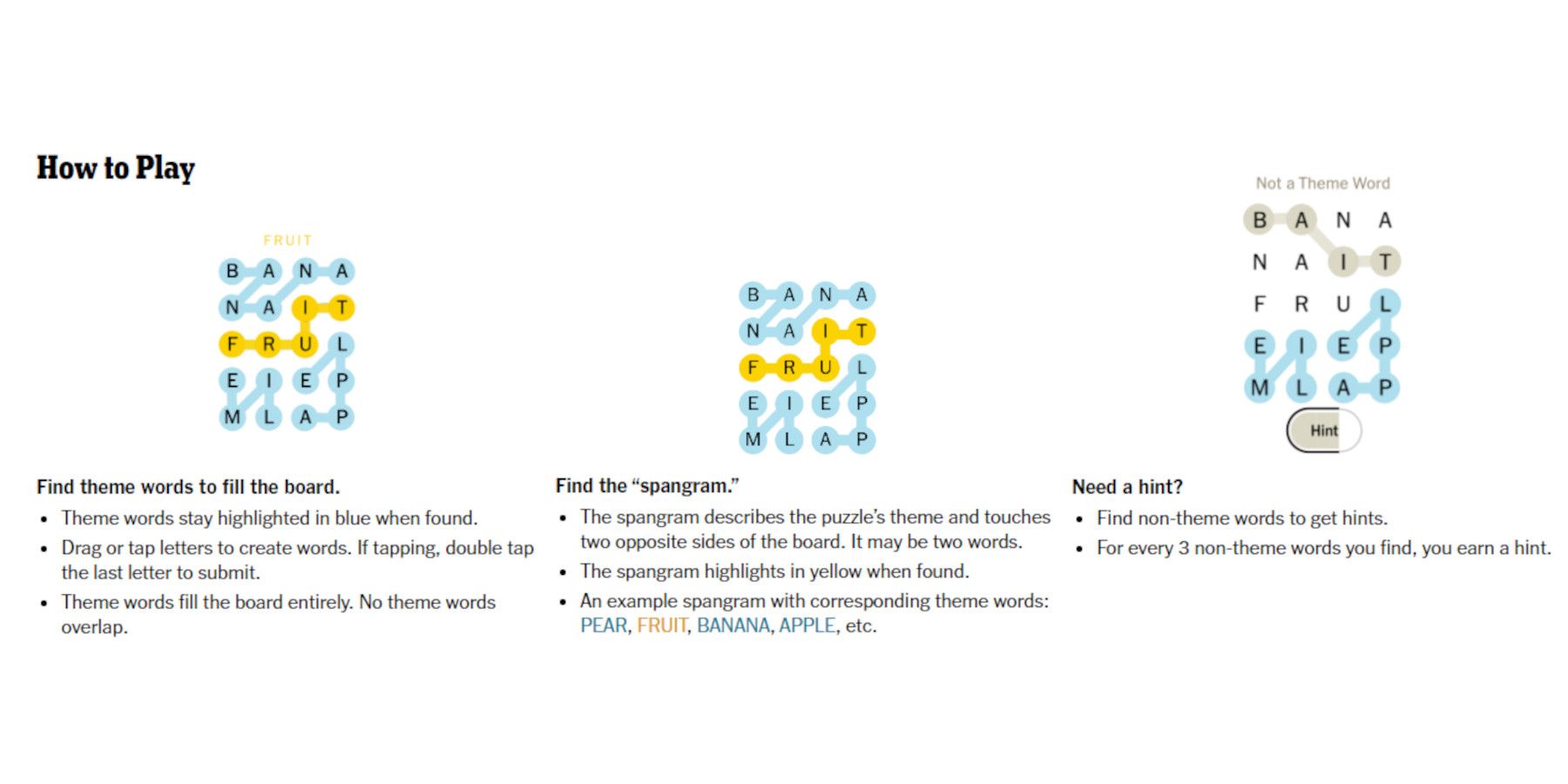

Complete Guide To Solving Nyt Strands Puzzle April 3 2025

Apr 29, 2025

Complete Guide To Solving Nyt Strands Puzzle April 3 2025

Apr 29, 2025 -

Adhd And Driving Research Based Safety Strategies

Apr 29, 2025

Adhd And Driving Research Based Safety Strategies

Apr 29, 2025 -

Shop The Hudsons Bay Liquidation Huge Markdowns On Everything

Apr 29, 2025

Shop The Hudsons Bay Liquidation Huge Markdowns On Everything

Apr 29, 2025 -

Adult Adhd From Suspicion To Effective Management

Apr 29, 2025

Adult Adhd From Suspicion To Effective Management

Apr 29, 2025 -

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 29, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

Apr 29, 2025