The Canadian Mortgage Landscape: A Case Study Of 10-Year Term Preferences

Table of Contents

Why Canadians Choose 10-Year Mortgage Terms

Canadians are increasingly opting for 10-year mortgage terms for several compelling reasons. Understanding these advantages can help you determine if a 10-year fixed-rate mortgage is the right choice for your financial situation.

Rate Security and Long-Term Financial Planning

A primary driver behind the popularity of 10-year mortgages is the inherent rate security they offer. Locking into a fixed-rate mortgage for a decade provides:

- Predictable Monthly Payments: Knowing your exact mortgage payment for ten years significantly simplifies budgeting and long-term financial planning. This stability is particularly attractive to those seeking predictable expenses.

- Improved Long-Term Financial Planning: With fixed monthly payments, you can accurately forecast other financial obligations like savings goals, investments, and retirement planning. This allows for a more comprehensive and secure long-term financial strategy.

- Reduced Refinancing Stress: Avoiding the need to refinance every few years eliminates the associated costs, paperwork, and potential rate increases that come with shorter-term mortgages. A 10-year fixed-rate mortgage offers peace of mind and reduces the frequency of having to navigate the mortgage renewal process.

This long-term stability makes a 10-year fixed-rate mortgage an attractive option for those prioritizing predictable long-term mortgage rates in Canada.

Potential for Lower Interest Rates (Long-Term Fixed)

Ten-year fixed-rate mortgages often come with lower interest rates compared to shorter-term options, especially during periods of stable or declining interest rates.

- Locking in Favorable Rates: Securing a lower interest rate for a longer period can lead to substantial savings over the life of the mortgage. This advantage is particularly significant when interest rates are relatively low. By comparing 10-year fixed mortgage rates Canada with shorter term options, you can identify potential savings.

- Long-Term Cost Savings: The cumulative effect of even a small difference in interest rates over ten years can result in significant cost savings.

- Access to Best Mortgage Rates: Shopping around and comparing the best mortgage rates in Canada across different lenders is crucial to securing the most favorable interest rate possible for a 10-year term.

Building Equity Faster

With a longer amortization period (the time it takes to pay off your mortgage), 10-year terms often result in larger monthly payments. While this might seem daunting, it also means:

- Accelerated Equity Growth: Higher payments contribute to faster equity building, meaning you own a larger portion of your home sooner. This can be a significant advantage for those looking to build wealth through their home.

- Faster Path to Homeownership: Faster equity growth can lead to a quicker path to outright homeownership.

- Utilizing Home Equity: The faster equity build-up can allow for access to home equity loans or lines of credit in the future should you need it. Utilizing a mortgage amortization calculator Canada can help illustrate how much faster your equity grows with a 10-year term.

Disadvantages of 10-Year Mortgage Terms

While the benefits are clear, it's crucial to acknowledge the potential downsides of committing to a 10-year mortgage term.

Potential for Rate Increases

The biggest risk with a 10-year term is the potential for interest rates to increase significantly during that period.

- Locked-in Rate Exposure: If interest rates rise substantially, you'll be locked into a potentially higher rate than what might be available at the time of renewal.

- Higher Overall Interest Paid: Should rates decline during your 10-year term, you will be paying a higher interest rate than what is currently available on the market. This is a key consideration when examining variable mortgage rates Canada in comparison to fixed-rate options.

- Impact on Affordability: Unexpected rate hikes can strain your budget, especially if your income doesn't increase proportionally.

Limited Flexibility

The rigidity of a 10-year term means limited flexibility in adapting to changing circumstances.

- Refinancing Penalties: Breaking a mortgage early usually involves significant penalties, making it difficult to refinance even if better rates become available. Understanding mortgage penalty calculation Canada is crucial.

- Life Changes and Financial Hardship: Unexpected events like job loss, illness, or family changes can make mortgage payments challenging to manage with a longer-term commitment. Consider this when considering breaking a mortgage.

Market Volatility

The Canadian mortgage market is subject to fluctuations influenced by various economic factors.

- Economic Uncertainty: A 10-year period encompasses considerable market volatility. Changes in interest rates, inflation, and economic growth directly impact the mortgage market.

- Unforeseen Circumstances: Unforeseeable life events can significantly alter your financial situation and your ability to manage a 10-year mortgage. Understanding Canadian mortgage market trends and economic factors affecting mortgage rates is key to managing risk.

Factors to Consider Before Opting for a 10-Year Term

Before committing to a 10-year mortgage term, carefully consider the following:

Personal Financial Situation

Analyze your current financial stability: income consistency, debt levels, and emergency funds. A stable financial situation is crucial for successfully managing a 10-year mortgage commitment.

Risk Tolerance

Assess your comfort level with the potential for interest rate fluctuations. Are you comfortable with the possibility of higher payments if rates rise? A higher risk tolerance might suit a longer term.

Long-Term Financial Goals

Align your mortgage choice with your long-term financial objectives. Does a 10-year mortgage support your overall financial plan? Will it impact other financial goals like saving for retirement or investments?

Consult a Mortgage Broker

Seeking advice from a qualified mortgage broker in Canada is highly recommended. They can help you explore various mortgage options, assess your risk tolerance, and determine the most suitable term for your situation. Utilizing a mortgage broker Canada can significantly ease the decision-making process and secure the best rates possible.

Conclusion

Choosing a 10-year mortgage term in Canada presents both significant advantages and potential drawbacks. The decision hinges on your individual financial circumstances, risk tolerance, and long-term financial goals. The potential for lower rates and increased stability needs to be weighed against the lack of flexibility and potential exposure to rate increases over a longer period. Thorough research, financial planning, and consultation with a mortgage professional are crucial before committing to a 10-year mortgage or any other mortgage term. Understanding the nuances of the Canadian mortgage market and exploring various options are key to making an informed decision about your 10-year mortgage in Canada. Contact a mortgage broker today to discuss your options for securing a suitable mortgage term.

Featured Posts

-

Mindy Kalings Nsfw Comedy Series Heads To Hulu

May 06, 2025

Mindy Kalings Nsfw Comedy Series Heads To Hulu

May 06, 2025 -

New Womens Fitness Apparel Nike Teams Up With Skims

May 06, 2025

New Womens Fitness Apparel Nike Teams Up With Skims

May 06, 2025 -

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash Lizzo Doechii And More

May 06, 2025

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash Lizzo Doechii And More

May 06, 2025 -

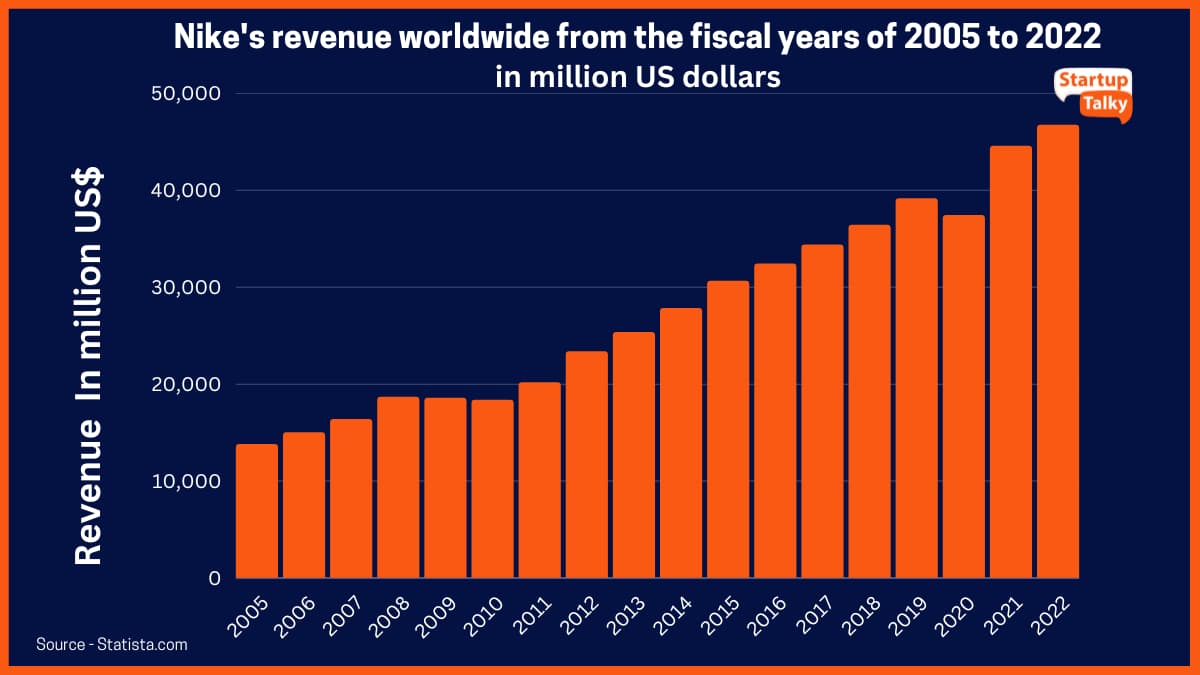

Nike Revenue Projections A Five Year Slump

May 06, 2025

Nike Revenue Projections A Five Year Slump

May 06, 2025 -

Federal Charges Massive Office365 Data Breach Nets Millions For Hacker

May 06, 2025

Federal Charges Massive Office365 Data Breach Nets Millions For Hacker

May 06, 2025

Latest Posts

-

Popovichs Spurs Future Uncertain Espn Reports Coach Unlikely To Return This Season

May 06, 2025

Popovichs Spurs Future Uncertain Espn Reports Coach Unlikely To Return This Season

May 06, 2025 -

The Future Of The Spurs Concerns Arise Following A Worrying Gregg Popovich Update

May 06, 2025

The Future Of The Spurs Concerns Arise Following A Worrying Gregg Popovich Update

May 06, 2025 -

Is This The End Of The Gregg Popovich Era In The Nba A Recent Development Sparks Concern

May 06, 2025

Is This The End Of The Gregg Popovich Era In The Nba A Recent Development Sparks Concern

May 06, 2025 -

Popovichs Health Raises Questions About His Nba Legacy

May 06, 2025

Popovichs Health Raises Questions About His Nba Legacy

May 06, 2025 -

Gregg Popovichs Uncertain Future A Concerning Development In The Nba

May 06, 2025

Gregg Popovichs Uncertain Future A Concerning Development In The Nba

May 06, 2025