The China Factor: Analyzing The Automotive Industry's Dependence And Risks

Table of Contents

China as a Massive Automotive Market

China's automotive market is the world's largest, offering immense growth potential for both domestic and international players. This makes understanding the nuances of the Chinese automotive market paramount for any global automotive strategy.

Market Size and Growth Potential

China's automotive market size dwarfs all others. In recent years, it has consistently accounted for a significant portion of global car sales. Growth projections, while fluctuating based on economic conditions and government policies, remain positive, especially within specific segments.

- Market Size Statistics: China's annual car sales frequently exceed 20 million units, surpassing the combined sales of many other major markets.

- Growth Projections: While the overall growth rate may be slowing from the hyper-growth years, specific segments like electric vehicles (EVs) and SUVs continue to demonstrate significant expansion.

- Specific Market Segments: The EV market China is booming, driven by government incentives and growing environmental awareness. The SUV market China also shows strong growth, reflecting changing consumer preferences towards larger vehicles. These factors need to be accounted for in any assessment of the China factor.

Consumer Preferences and Trends

Understanding the unique preferences and buying behaviors of Chinese consumers is crucial for success in this market. Chinese consumers demonstrate sophisticated tastes and are increasingly demanding in terms of technology and features.

- Brand Loyalty: While some international brands enjoy strong brand recognition, Chinese consumers are increasingly open to domestic brands, which are rapidly improving in quality and technological sophistication.

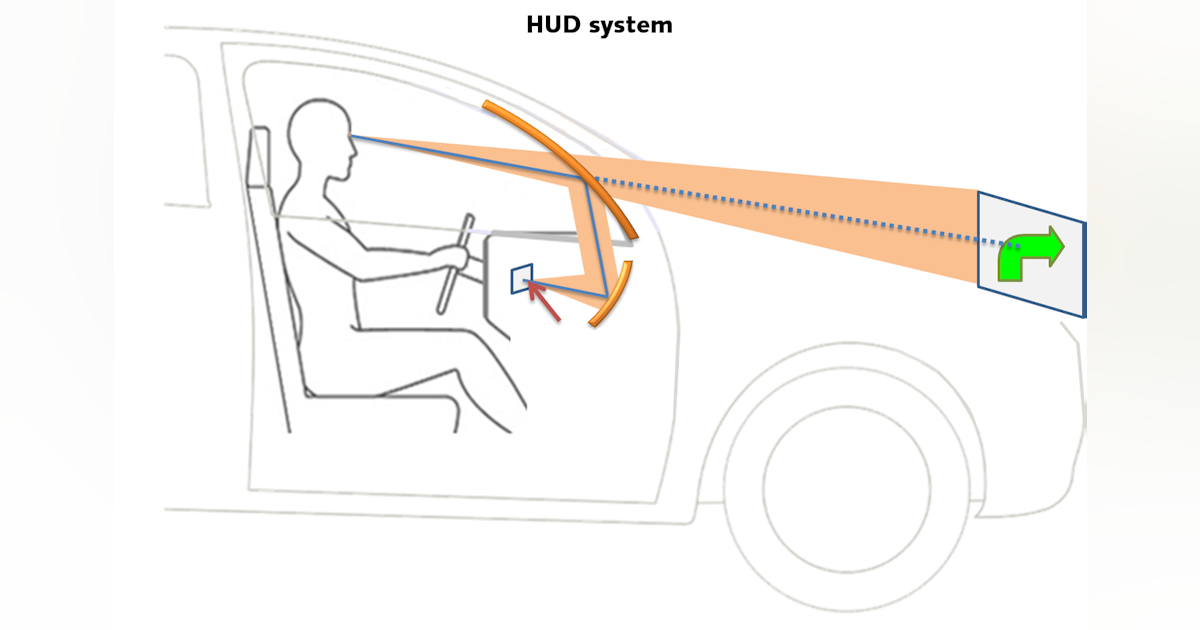

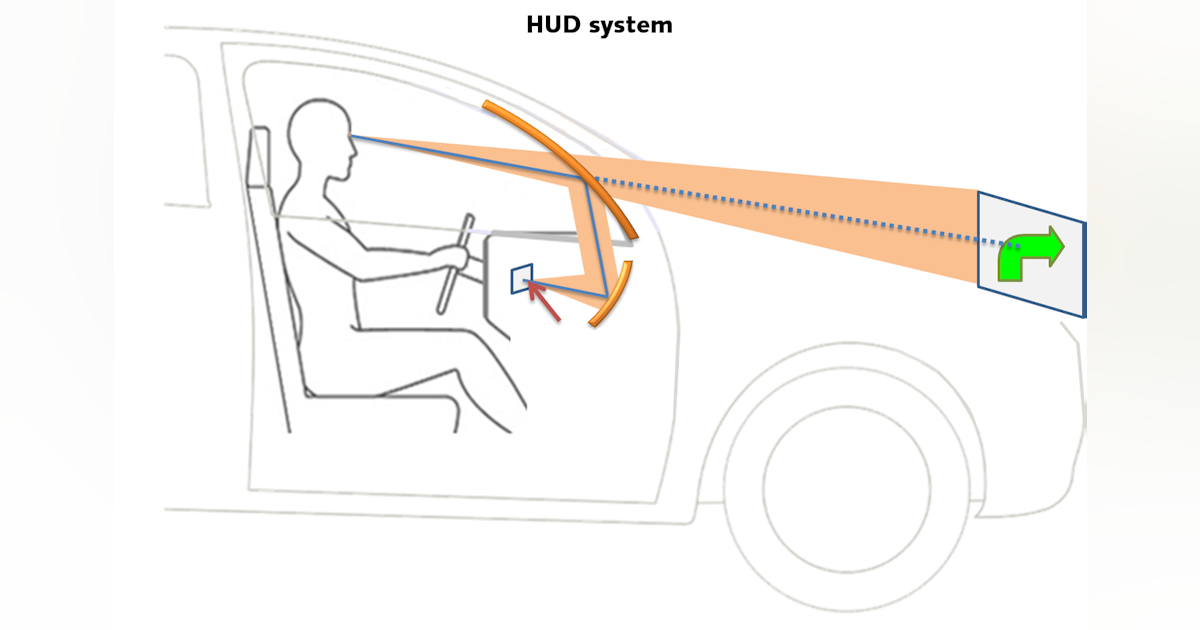

- Technological Preferences: Connected cars, advanced driver-assistance systems (ADAS), and other technological features are highly valued by Chinese consumers. Failing to meet these expectations can severely impact market penetration.

- Emerging Trends: The rise of ride-hailing services and shared mobility options is altering the traditional automotive landscape in China, demanding new strategies from established players. The luxury car market China is also experiencing robust growth, demonstrating a shift towards higher-end vehicles among a growing affluent population.

China as a Manufacturing Powerhouse

China's dominance in automotive manufacturing stems from its highly competitive manufacturing costs and a vast, skilled workforce. However, this reliance carries inherent risks that need careful consideration.

Manufacturing Capabilities and Costs

China offers several significant advantages for automotive manufacturing:

- Supply Chains: A well-established and extensive supply chain network provides easy access to parts and components.

- Cost Savings: Lower labor costs and other production expenses significantly reduce the overall manufacturing costs. This is a key aspect of the China factor for many global automotive companies.

- Potential Drawbacks: While labor costs remain comparatively lower than in many other countries, they are gradually rising. Geopolitical factors and trade tensions also present potential drawbacks.

Supply Chain Dependence and Risks

Many global automakers rely heavily on Chinese suppliers for parts and components, creating significant vulnerability.

- Geopolitical Risks: Trade disputes and geopolitical instability can disrupt supply chains, leading to production delays and increased costs.

- Potential Disruptions: Natural disasters, pandemics, and other unforeseen events can severely impact the availability of parts sourced from China.

- Diversification Strategies: To mitigate risks, automotive companies are increasingly diversifying their supply chains, exploring manufacturing options in other countries to reduce dependence on a single source. This diversification is a crucial element of navigating the China factor.

Geopolitical Risks and Regulatory Hurdles

The automotive industry faces significant challenges from geopolitical factors and China's complex regulatory environment.

Trade Wars and Tariffs

The ongoing trade tensions between China and other countries, such as the US, have significantly impacted the automotive industry.

- Impact of Tariffs: Tariffs imposed on imported vehicles and auto parts have increased costs and reduced competitiveness.

- Trade Disputes: Trade disputes can lead to uncertainty and disrupt investment plans, hindering the industry's growth.

Regulatory Environment and Compliance

Navigating China's complex regulatory landscape requires significant effort and expertise from foreign automakers.

- Emission Standards: China's increasingly stringent emission standards necessitate significant investments in cleaner technologies.

- Safety Regulations: Compliance with China's safety regulations is crucial to avoid costly recalls and reputational damage. This regulatory landscape is a key component of the China factor.

Conclusion

The "China factor" is a double-edged sword for the automotive industry. While China presents an enormous market opportunity and a cost-effective manufacturing base, dependence on this single market and its complex regulatory environment poses considerable risks. Companies must carefully assess their exposure, diversify their operations, and proactively manage these challenges to thrive in the future. Understanding the nuances of the China factor is paramount for long-term success in the global automotive landscape. Develop a robust China strategy to navigate the opportunities and mitigate the risks associated with this crucial market and manufacturing hub. Don't underestimate the China factor – your future success may depend on it.

Featured Posts

-

Fortalecimiento Del Sistema Penitenciario Entrega De Siete Vehiculos

May 03, 2025

Fortalecimiento Del Sistema Penitenciario Entrega De Siete Vehiculos

May 03, 2025 -

Diner Presidentiel L Avertissement De Sardou A Macron

May 03, 2025

Diner Presidentiel L Avertissement De Sardou A Macron

May 03, 2025 -

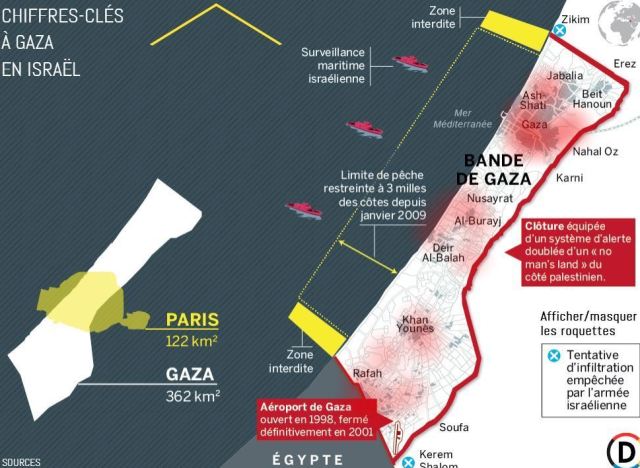

Israel Et L Aide Humanitaire A Gaza Les Preoccupations De Macron

May 03, 2025

Israel Et L Aide Humanitaire A Gaza Les Preoccupations De Macron

May 03, 2025 -

The Financial Landscape Of Bess Deployment In Belgium A 270 M Wh Case Study

May 03, 2025

The Financial Landscape Of Bess Deployment In Belgium A 270 M Wh Case Study

May 03, 2025 -

La Fin De La Francafrique Selon Emmanuel Macron Analyse De Son Discours Au Gabon

May 03, 2025

La Fin De La Francafrique Selon Emmanuel Macron Analyse De Son Discours Au Gabon

May 03, 2025

Latest Posts

-

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025 -

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025 -

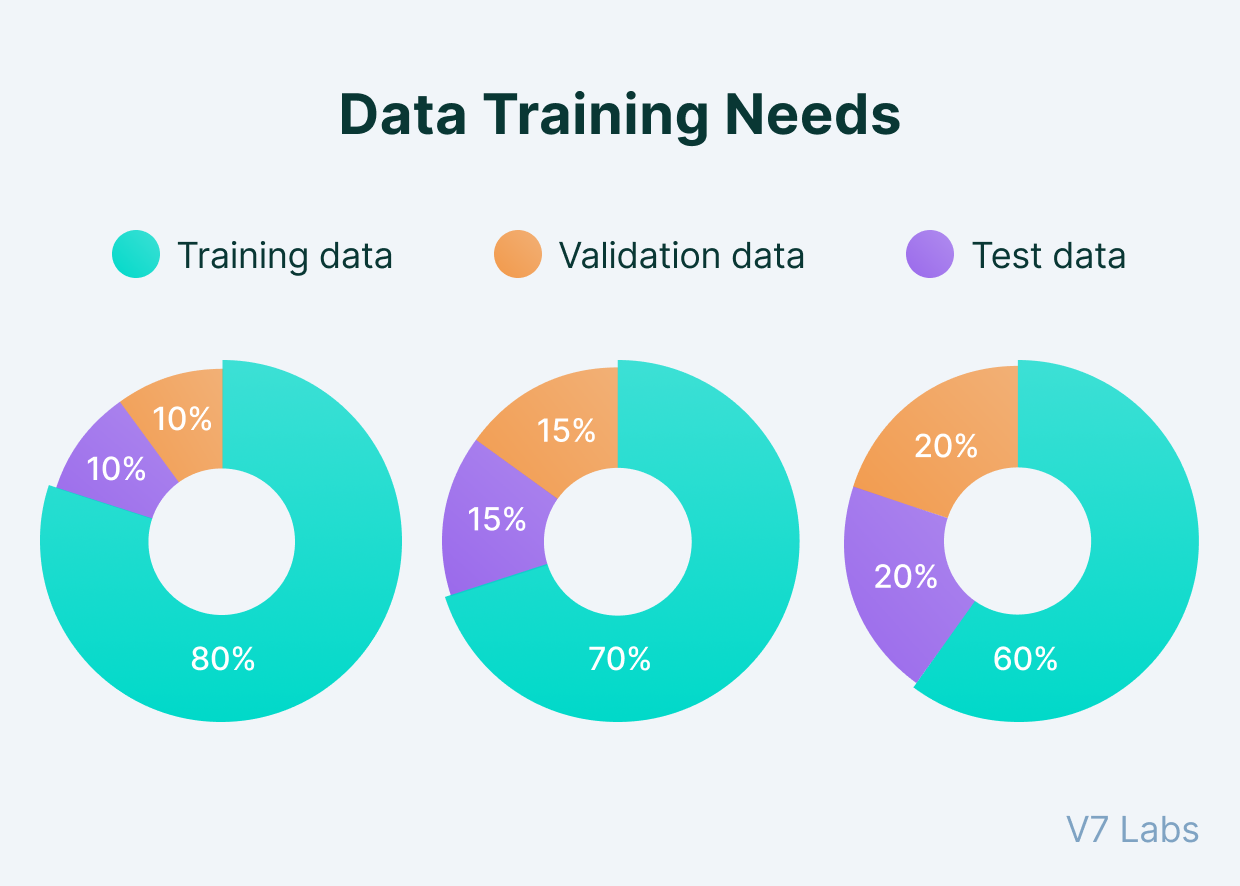

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025 -

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025 -

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025