The Connection Between Federal Debt And Your Mortgage: Understanding The Risks

Table of Contents

How Federal Debt Influences Interest Rates

The relationship between government borrowing and interest rates is fundamental. The government finances its debt largely through the issuance of treasury bonds. When the government borrows heavily, it increases the demand for loanable funds in the bond market. This increased demand pushes up interest rates not just for government bonds, but also across the board, affecting everything from corporate loans to, crucially, mortgage rates. Think of it like this: more people competing for a limited supply of money drives up the price (i.e., the interest rate).

- Increased government borrowing increases demand for loanable funds. This is a simple supply and demand dynamic.

- Higher demand leads to higher interest rates. The increased competition for available capital forces lenders to charge more.

- Higher interest rates directly impact mortgage rates. Mortgage lenders base their rates on the broader interest rate environment.

- The Federal Reserve's role in managing inflation and interest rates is also critical. The Fed uses monetary policy tools to influence interest rates and control inflation, often walking a tightrope between economic growth and price stability.

The Impact of Inflation on Mortgage Rates and Home Prices

High inflation, often a consequence of sustained high federal debt, further complicates the picture. Inflation erodes the purchasing power of your money; each dollar buys you less. To combat inflation, central banks, like the Federal Reserve, frequently raise interest rates. This, in turn, leads to higher mortgage payments, making homes less affordable. Simultaneously, inflation can also drive up home prices, creating a double whammy for prospective homebuyers.

- Inflation erodes the purchasing power of money. This means your income buys less, making it harder to afford a home.

- Central banks often raise interest rates to combat inflation. This is a standard monetary policy tool.

- Higher interest rates lead to increased mortgage payments. A small increase in the interest rate can significantly impact your monthly payment.

- Inflation can also drive up home prices, further impacting affordability, creating a challenging environment for both buyers and sellers.

Inflation's Effect on the Housing Market

The combined effect of inflation and higher interest rates creates volatility in the housing market. While increased demand (fueled by factors like population growth or low inventory) can push prices higher, higher interest rates reduce buying power, eventually cooling demand and potentially leading to price corrections. This dynamic interplay makes the housing market susceptible to significant fluctuations.

- Increased demand and reduced supply can push prices higher. This is a classic case of supply and demand imbalances.

- Higher interest rates reduce buying power, cooling demand. Fewer people can afford to buy at higher prices.

- The overall impact of inflation on housing market stability is a significant risk factor for both homeowners and prospective buyers.

Understanding the Federal Reserve's Role

The Federal Reserve (the Fed) plays a crucial role in managing the economy. Its monetary policies, including tools like quantitative easing (QE) and interest rate hikes, significantly impact the bond market and, consequently, mortgage rates. The Fed’s actions are a direct response to economic conditions, including managing inflation and addressing the implications of high federal debt.

- The Fed's tools for managing inflation and interest rates include adjusting the federal funds rate, implementing quantitative easing, and managing reserve requirements.

- How the Fed's actions affect the bond market and mortgage rates is a complex process but ultimately results in changes to borrowing costs.

- Potential consequences of the Fed's policies on the housing market range from increased affordability to market instability depending on the chosen approach.

Protecting Yourself from the Risks

Navigating the complexities of a market influenced by rising federal debt requires proactive financial planning. Understanding your options and mitigating potential risks is crucial.

- Strategies for mitigating the risks of rising interest rates include locking in a fixed-rate mortgage, carefully managing your debt, and building a financial safety net.

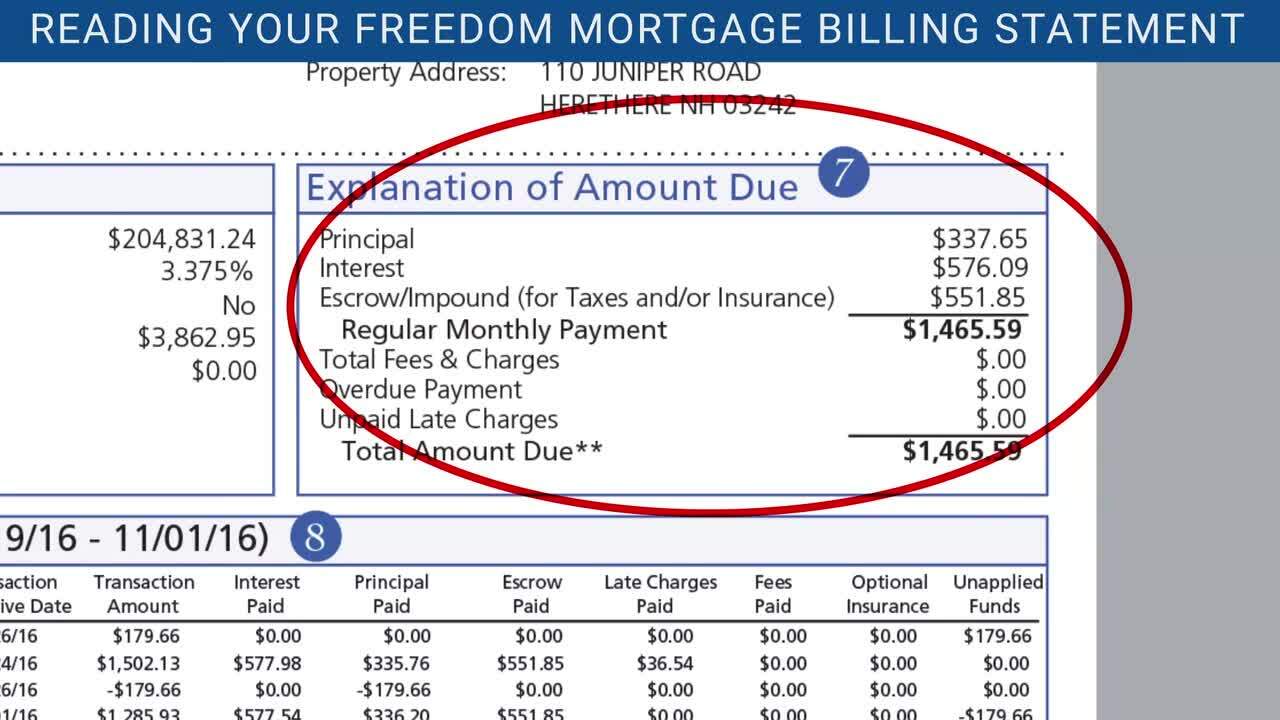

- Understanding different mortgage options, such as fixed-rate mortgages and adjustable-rate mortgages (ARMs), allows you to choose the option best suited to your circumstances and risk tolerance.

- Importance of financial planning and budgeting helps to manage your finances effectively and prepare for potential changes in interest rates.

- Seeking professional financial advice from a qualified financial advisor is crucial to navigate the intricacies of mortgage planning and risk management in the current economic climate.

Conclusion: The Connection Between Federal Debt and Your Mortgage: Taking Action

The connection between federal debt and your mortgage is undeniable. Rising federal debt influences interest rates, contributes to inflation, and creates volatility in the housing market, directly impacting mortgage rates and home affordability. Understanding this connection is paramount for making informed financial decisions. Stay informed about the impact of federal debt on your mortgage, explore different mortgage options, and seek professional advice. Take control of your financial future by understanding the connection between Federal Debt and Your Mortgage.

Featured Posts

-

Indian Defense Group Highlights Chinese Satellite Assistance To Pakistan

May 19, 2025

Indian Defense Group Highlights Chinese Satellite Assistance To Pakistan

May 19, 2025 -

To Tampoy Ton Fonon Nees Apodeikseis Kai Anatropes

May 19, 2025

To Tampoy Ton Fonon Nees Apodeikseis Kai Anatropes

May 19, 2025 -

Collier County Mothers Plea For Safer School Buses Following Incorrect Stop Incident

May 19, 2025

Collier County Mothers Plea For Safer School Buses Following Incorrect Stop Incident

May 19, 2025 -

Luca Haenni And Eurovision 2025 A Collaboration In The Works

May 19, 2025

Luca Haenni And Eurovision 2025 A Collaboration In The Works

May 19, 2025 -

Preserving History The Struggle To Save The Jersey Battle Of Flowers

May 19, 2025

Preserving History The Struggle To Save The Jersey Battle Of Flowers

May 19, 2025