The Connection Between Late Student Loan Payments And Credit

Table of Contents

How Late Student Loan Payments Impact Your Credit Score

Your student loan payment history significantly impacts your credit score, a vital number influencing your financial life. Let's delve into the specifics.

Understanding Credit Reporting Agencies

Experian, Equifax, and TransUnion are the three major credit reporting agencies in the United States. They collect and track your financial information, including your student loan payment history. This information includes:

- Payment history (on-time or late)

- Loan amount

- Loan status (current, delinquent, etc.)

Even one late payment can negatively affect your credit score. These agencies meticulously record every detail, and this information directly influences your creditworthiness.

The FICO Score and Student Loans

Your FICO score, a widely used credit scoring model, heavily weighs your payment history. Student loan payments are a substantial part of this history:

- Payment history accounts for a significant percentage (around 35%) of your FICO score.

- Late payments drastically lower your score. Even a single 30-day late payment can have a substantial negative impact.

A lower credit score leads to higher interest rates on future loans (mortgages, auto loans, credit cards), making borrowing more expensive, or even loan denials altogether.

Types of Negative Reporting

The severity of a negative mark on your credit report depends on how late your payment is:

- 30-day late: This is the least severe, but still negatively impacts your score.

- 60-day late: A more serious mark, significantly impacting your credit score.

- 90-day late or more: This indicates severe delinquency, leading to the most significant score decrease and potentially further consequences.

The length of delinquency also matters. The longer a payment remains delinquent, the more damage it inflicts on your credit report.

Consequences of Delinquent Student Loan Payments

The consequences of consistently late student loan payments extend far beyond a lowered credit score.

Difficulty Obtaining Future Loans

Late payments make it harder to secure future loans:

- Higher interest rates: Lenders perceive you as a higher risk, resulting in significantly higher interest rates.

- Loan denial: Severe delinquency can lead to loan applications being outright rejected.

- Difficulty securing credit cards: Building or maintaining good credit with credit cards becomes extremely challenging.

These difficulties can significantly impact major financial goals, such as buying a home or a car.

Wage Garnishment and Tax Refunds

For seriously delinquent loans, the government can intervene:

- Wage garnishment: A portion of your wages can be legally seized to pay off your debt.

- Offsetting tax refunds: Your tax refund can be used to pay down your student loan debt.

These actions are severe and have significant long-term financial implications.

Damage to Your Credit History

Negative marks on your credit report can stay for years:

- Late payment entries typically remain on your credit report for seven years.

- This lengthy record severely impacts your ability to secure favorable loan terms in the future.

Credit counseling and debt management programs can help repair credit after delinquency, but it takes time and effort.

Strategies for Avoiding Late Student Loan Payments

Proactive steps can significantly reduce the risk of late payments and protect your credit.

Budgeting and Financial Planning

Effective budgeting is key:

- Track your expenses: Use budgeting apps or spreadsheets to monitor your spending.

- Prioritize loan payments: Make student loan payments a top priority in your budget.

- Explore budgeting apps: Many free or low-cost apps can help you manage your finances.

Financial literacy and careful planning are crucial for managing student loan debt effectively.

Automatic Payments and Reminders

Automate your payments whenever possible:

- Reduce the risk of missed payments: Automatic payments ensure timely payments regardless of your schedule.

- Set up payment reminders: Even with automatic payments, reminders can help you stay on top of your finances.

This simple strategy significantly reduces the likelihood of late payments and their negative consequences.

Loan Consolidation and Repayment Plans

Explore options like loan consolidation and income-driven repayment plans:

- Loan consolidation: Combines multiple loans into a single loan with potentially lower interest rates.

- Income-driven repayment plans: Base your monthly payments on your income, making payments more manageable.

Research different repayment options to find the one that best suits your financial situation. The federal government offers resources to help you explore these options.

Conclusion

Late student loan payments have a significant negative impact on your credit score and overall financial health. Understanding the connection between late student loan payments and credit is paramount. By establishing a budget, exploring repayment options, and ensuring timely payments, you can protect your credit score and secure a brighter financial future. Learn more about managing your student loan debt and preventing late payments today!

Featured Posts

-

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 17, 2025

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 17, 2025 -

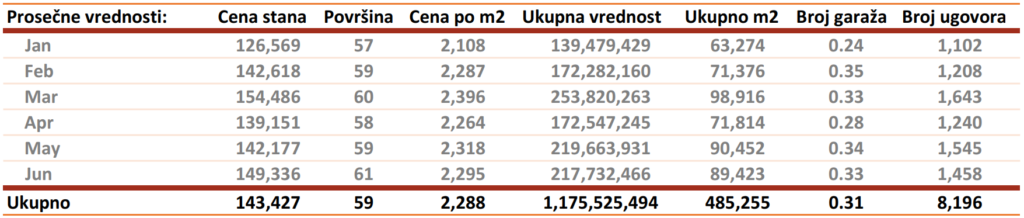

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025 -

Yankees Mariners Prediction Mlb Betting Odds And Expert Picks For Tonight

May 17, 2025

Yankees Mariners Prediction Mlb Betting Odds And Expert Picks For Tonight

May 17, 2025 -

Partido Almeria Eldense Transmision En Vivo La Liga Hyper Motion

May 17, 2025

Partido Almeria Eldense Transmision En Vivo La Liga Hyper Motion

May 17, 2025 -

Ultraviolette Tesseract E Scooter Rs 1 45 Lakh Launch Price And Key Details

May 17, 2025

Ultraviolette Tesseract E Scooter Rs 1 45 Lakh Launch Price And Key Details

May 17, 2025