The D-Wave Quantum (QBTS) Stock Crash: Causes And Implications

Table of Contents

Financial Performance and Investor Sentiment

The D-Wave Quantum stock crash can be partly attributed to the company's financial performance and the resulting negative investor sentiment. Understanding the interplay of these factors is key to comprehending the QBTS stock's decline.

Disappointing Financial Results

D-Wave's recent financial reports reveal a concerning picture. The company has consistently reported significant losses, a high cash burn rate, and a failure to meet projected revenue targets. This underperformance has eroded investor confidence and fueled the QBTS stock crash.

- Missed Revenue Targets: Several quarters have shown substantial discrepancies between projected revenue and actual results, indicating challenges in securing and delivering contracts.

- Increased Operating Expenses: Rising operating expenses, particularly in research and development, have further impacted profitability and widened the financial gap.

- Comparison to Competitors: Compared to other players in the quantum computing sector, D-Wave's financial performance appears less robust, highlighting the competitive pressure facing the company. This comparative analysis underscores the challenges D-Wave faces in achieving market leadership.

Negative Market Sentiment and Analyst Downgrades

Negative press coverage, coupled with analyst downgrades, has significantly contributed to the negative market sentiment surrounding QBTS. This downward spiral amplified the sell-off.

- Negative News Coverage: Reports highlighting the company's financial struggles and technological challenges have fuelled investor anxieties, leading to a decline in stock price.

- Analyst Downgrades: Several financial analysts have lowered their price targets for QBTS, citing concerns about the company's future prospects and financial viability. These downgrades often trigger further selling pressure.

- Links to Relevant Articles and Reports: [Insert links to relevant news articles and financial analyst reports here]. Providing direct links increases credibility and offers further insight for the reader.

Technological Challenges and Competition

The inherent difficulties in developing and scaling quantum computing technology, combined with increasing competition, have further exacerbated the D-Wave Quantum stock crash.

Technological Hurdles in Quantum Computing

Quantum computing is a complex and challenging field. D-Wave's focus on adiabatic quantum computation (annealing) presents specific limitations compared to gate-based approaches employed by competitors.

- Annealing vs. Gate-based Quantum Computing: Annealing, while effective for specific optimization problems, lacks the versatility of gate-based quantum computers, limiting its applicability across a wider range of tasks.

- Technological Roadblocks: D-Wave continues to grapple with scaling its technology to larger qubit counts and improving qubit coherence times – critical factors limiting performance and impacting investor confidence.

Increasing Competition in the Quantum Computing Market

The quantum computing market is rapidly evolving with stronger competitors emerging and challenging D-Wave’s market position.

- Key Competitors: Major players like IBM, Google, IonQ, and Rigetti are making significant strides in developing and commercializing quantum computing technologies, creating intense competition.

- Market Positioning: D-Wave's current market share and technological advantages are being challenged by these competitors, impacting investor confidence in QBTS’s long-term viability.

Macroeconomic Factors and Overall Market Conditions

The broader macroeconomic environment and investor sentiment towards high-risk sectors played a significant role in the QBTS stock crash.

Impact of the Broader Market Downturn

The overall market downturn, characterized by rising interest rates and inflation, significantly impacted investor risk appetite.

- Correlation with Market Indices: The correlation between QBTS performance and broader market indices like the Nasdaq Composite demonstrates the influence of macroeconomic factors on the stock’s volatility.

- Investor Risk Aversion: Rising interest rates and inflation have increased investor risk aversion, leading to a sell-off in high-growth, high-risk sectors like quantum computing.

Investor Risk Tolerance and Sector-Specific Concerns

Investor sentiment towards high-growth, high-risk sectors like quantum computing has shifted, further contributing to the QBTS stock crash.

- Impact of Risk Aversion on QBTS: Investors are increasingly wary of investing in early-stage technology companies with unproven business models, further impacting QBTS.

- Outlook for Early-Stage Tech Companies: The overall outlook for investment in early-stage technology companies is currently cautious, as investors prioritize more established and less risky investments.

Conclusion

The D-Wave Quantum (QBTS) stock crash is a multi-faceted event resulting from a combination of disappointing financial performance, technological challenges, fierce competition, and unfavorable macroeconomic conditions. Understanding these intertwined factors is crucial for navigating the volatile quantum computing investment landscape. Investors need to carefully weigh the risks associated with QBTS and other quantum computing stocks before making investment decisions. Further research into D-Wave's long-term strategy, technological advancements, and competitive positioning is essential for evaluating the company's future prospects. Stay informed about developments in the D-Wave Quantum stock and the broader quantum computing sector to make informed investment choices. Continuously monitor the D-Wave Quantum stock and related news for a comprehensive understanding of the evolving situation.

Featured Posts

-

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 21, 2025 -

Rising Yields And The Sell America Trend A Market Analysis

May 21, 2025

Rising Yields And The Sell America Trend A Market Analysis

May 21, 2025 -

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025 -

Canada Post Facing Potential End Of Daily Door To Door Mail Delivery

May 21, 2025

Canada Post Facing Potential End Of Daily Door To Door Mail Delivery

May 21, 2025 -

Arne Slot And Luis Enrique On Liverpool Luck Alisson And The Future

May 21, 2025

Arne Slot And Luis Enrique On Liverpool Luck Alisson And The Future

May 21, 2025

Latest Posts

-

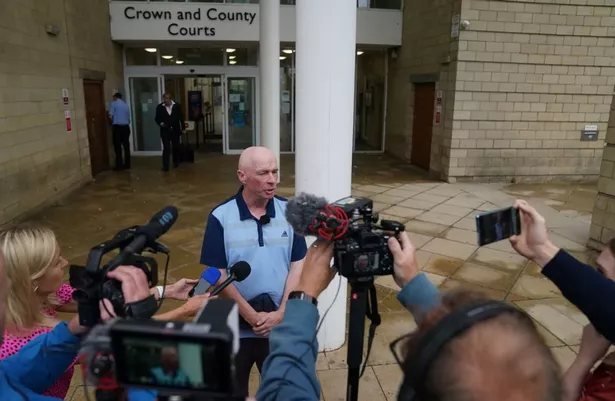

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025 -

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025 -

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025 -

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025