The Derivatives Market And XRP's Stalled Recovery

Table of Contents

The Role of Cryptocurrency Derivatives in Price Volatility

The derivatives market plays a significant role in shaping the price volatility of cryptocurrencies like XRP. XRP derivatives, including futures and options contracts, allow traders to speculate on XRP's price movements without directly owning the asset. This introduces several factors that can amplify both upward and downward price swings.

-

High Leverage: The use of leverage in XRP derivatives trading magnifies both gains and losses. A small price movement can lead to substantial profits or losses, encouraging aggressive trading strategies that contribute to volatility. This heightened risk can lead to rapid price fluctuations, making it challenging to predict XRP's price direction.

-

Short Selling: The ability to short sell XRP through derivatives contracts allows traders to profit from price declines. This can exert significant downward pressure on the XRP price, especially if a substantial number of traders are betting against it. Short squeezes, where short sellers are forced to buy XRP to cover their positions, can also lead to dramatic price spikes, adding to overall market volatility.

-

Open Interest as a Sentiment Indicator: Monitoring the open interest (the total number of outstanding contracts) in XRP derivatives can provide insights into market sentiment. High open interest can suggest strong conviction in a particular price direction, either bullish or bearish, which can influence trading activity and subsequently, price.

-

Regulatory Gaps: The regulatory landscape surrounding crypto derivatives is still evolving. The lack of consistent global regulations creates opportunities for manipulation and exacerbates volatility. Different jurisdictions have different regulatory frameworks, leading to inconsistencies and challenges in oversight.

Regulatory Uncertainty and its Impact on XRP's Price

The ongoing SEC lawsuit against Ripple Labs, the creator of XRP, significantly impacts XRP's price and overall market sentiment. This regulatory uncertainty creates a climate of fear and uncertainty that deters institutional investment.

-

SEC Lawsuit's Lingering Shadow: The SEC lawsuit casts a long shadow over XRP, creating a significant legal hurdle for its wider adoption and price appreciation. The uncertainty surrounding the outcome keeps institutional investors on the sidelines, fearing potential regulatory repercussions.

-

Institutional Investor Hesitation: Institutional investors are typically risk-averse. The ongoing legal battle and lack of regulatory clarity surrounding XRP discourage large-scale investments, limiting liquidity and price support.

-

The Need for Regulatory Clarity: Clear and consistent regulatory frameworks are crucial for XRP's long-term price stability and broader adoption. A definitive resolution to the SEC lawsuit would significantly improve investor confidence and attract institutional capital.

-

Jurisdictional Differences: The differing regulatory approaches to cryptocurrencies across various jurisdictions further complicate the situation. This fragmented regulatory landscape creates additional uncertainty and hinders global adoption of XRP.

Trading Volume and Liquidity in the XRP Market

The relatively low trading volume and liquidity in the XRP market contribute significantly to price stagnation and its susceptibility to manipulation. A thin order book means that even small trades can cause significant price swings.

-

Low Trading Volume and Manipulation: Low trading volume makes XRP's price more vulnerable to manipulation by large market players. A relatively small amount of buying or selling pressure can disproportionately affect the price.

-

Liquidity Concerns: A lack of liquidity means wider bid-ask spreads, increasing transaction costs for traders. This can discourage participation, further reducing trading volume and hindering price discovery.

-

The Importance of Exchange Listings: Increased exchange listings and broader adoption can significantly boost trading volume and liquidity. More exchanges listing XRP will increase its accessibility and attract a larger pool of traders.

-

Order Book Depth Analysis: Analyzing the depth of the XRP order book provides valuable insights into the potential for large price swings. A shallow order book indicates vulnerability to manipulation and significant price volatility.

The Impact of Macroeconomic Factors on XRP's Price

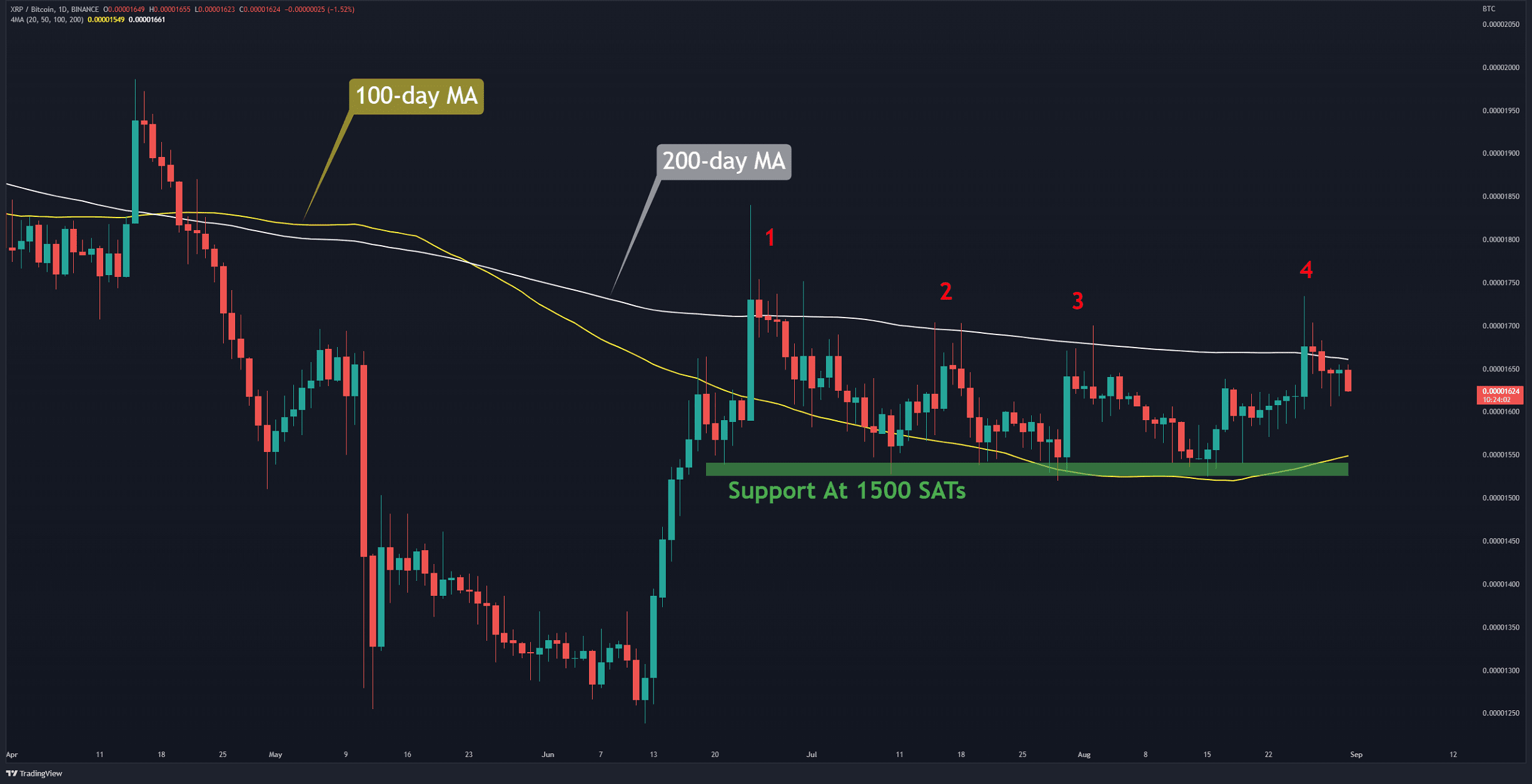

XRP's price is not immune to broader macroeconomic conditions and the performance of the overall cryptocurrency market, particularly Bitcoin. Negative macroeconomic news often leads to a “risk-off” sentiment, impacting all cryptocurrencies, including XRP.

-

Correlation with Bitcoin: Bitcoin's price movements often correlate with XRP's price. When Bitcoin's price falls, it typically drags other cryptocurrencies down with it, including XRP.

-

Risk-Off Sentiment: Negative macroeconomic news, such as rising inflation or geopolitical uncertainty, can lead investors to move away from riskier assets, including cryptocurrencies. This “risk-off” sentiment typically results in lower XRP prices.

-

Overall Market Cap Influence: Fluctuations in the overall cryptocurrency market capitalization significantly affect XRP's valuation. A decline in the overall market cap usually results in a decrease in XRP's price.

-

Investor Confidence: Broader investor confidence in the cryptocurrency market plays a vital role. Positive news and developments in the crypto space often lead to increased investment in XRP and other cryptocurrencies.

Conclusion

XRP's stalled recovery is a complex issue intertwined with the derivatives market's influence, regulatory uncertainty, trading volume limitations, and macroeconomic factors. High leverage in derivatives trading amplifies volatility, while the ongoing SEC lawsuit creates uncertainty deterring investors. Low trading volume exacerbates price stagnation. For sustainable XRP recovery, regulatory clarity, increased trading volume and liquidity, and positive macroeconomic conditions are paramount. Understanding the interplay of these factors is crucial for navigating the cryptocurrency market's dynamic landscape. Stay informed about XRP market developments and regulatory changes to make well-informed decisions regarding your XRP investments.

Featured Posts

-

Posodobitve O Zdravstvenem Stanju Papeza Stabilno A Negotova Prihodnost

May 07, 2025

Posodobitve O Zdravstvenem Stanju Papeza Stabilno A Negotova Prihodnost

May 07, 2025 -

Ravens Cut Justin Tucker Impact And Analysis Of The Veteran Kickers Release

May 07, 2025

Ravens Cut Justin Tucker Impact And Analysis Of The Veteran Kickers Release

May 07, 2025 -

Ps 5 Or Xbox Series S Understanding The Differences To Make The Right Choice

May 07, 2025

Ps 5 Or Xbox Series S Understanding The Differences To Make The Right Choice

May 07, 2025 -

Understanding Play Station Podcast Episode 512 True Blue

May 07, 2025

Understanding Play Station Podcast Episode 512 True Blue

May 07, 2025 -

The Enduring Success Of Lewis Capaldis Album A Winning Formula

May 07, 2025

The Enduring Success Of Lewis Capaldis Album A Winning Formula

May 07, 2025

Latest Posts

-

Capacites Geometriques Des Corneilles Performances Superieures Aux Babouins

May 08, 2025

Capacites Geometriques Des Corneilles Performances Superieures Aux Babouins

May 08, 2025 -

Cyndi Lauper And Counting Crows To Play Jones Beach

May 08, 2025

Cyndi Lauper And Counting Crows To Play Jones Beach

May 08, 2025 -

Le Pouvoir Geometrique Insoupconne Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025

Le Pouvoir Geometrique Insoupconne Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025 -

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025 -

Les Corneilles Et Leurs Competences Geometriques Exceptionnelles Surpassant Meme Les Babouins

May 08, 2025

Les Corneilles Et Leurs Competences Geometriques Exceptionnelles Surpassant Meme Les Babouins

May 08, 2025