The Economic Fallout Of The Student Loan Crisis: What To Expect

Table of Contents

Impact on Consumer Spending and Economic Growth

The sheer weight of student loan debt significantly impacts consumer spending and overall economic growth. The crippling repayments leave borrowers with less disposable income, creating a ripple effect across various sectors.

Reduced Disposable Income

Student loan payments consume a significant portion of borrowers' income, leaving less for spending on goods and services.

- Decreased consumer spending weakens economic growth. Reduced purchasing power translates directly into lower demand for goods and services, slowing economic expansion.

- Reduced demand impacts various sectors, from retail to tourism. Businesses reliant on consumer spending feel the pinch, leading to potential job losses and reduced investment.

- Studies show a strong correlation between student loan debt and decreased consumer confidence. The burden of debt weighs heavily on individuals, impacting their outlook on future financial stability and willingness to spend. This uncertainty further dampens economic activity.

Delayed Major Purchases

High debt burdens force many borrowers to postpone major life decisions like buying a home, starting a family, or investing in retirement.

- This impacts housing markets and other related industries. The inability to save for a down payment significantly hinders homeownership rates amongst younger generations, impacting the housing market's overall health.

- It contributes to a slower overall economic expansion. Delayed major purchases represent a significant reduction in overall economic activity, further hindering growth.

- The inability to save for a down payment significantly hinders homeownership rates amongst younger generations. This delays a key milestone for many, impacting family formation and long-term financial security.

Ripple Effects on the Labor Market

The student loan crisis isn't confined to personal finances; it has significant repercussions for the labor market, impacting employment, career choices, and entrepreneurial activity.

Underemployment and Career Choice Limitations

Graduates burdened by debt may accept lower-paying jobs to manage their repayments, hindering career progression and contributing to underemployment.

- This leads to underemployment and a loss of potential economic productivity. Individuals are forced to compromise their career aspirations to meet loan repayment obligations.

- Individuals might forgo pursuing entrepreneurial ventures due to financial constraints. The fear of defaulting on loans discourages risk-taking and limits the potential for job creation through new businesses.

- The pressure to repay loans quickly can lead to hasty career decisions that aren’t necessarily aligned with skills or passion. This can result in reduced job satisfaction and long-term economic disadvantages.

Impact on Entrepreneurship and Small Business Growth

High student loan debt discourages entrepreneurship as individuals are less likely to risk investing their savings or seeking loans to start a business.

- This limits innovation and job creation. A vibrant entrepreneurial sector is essential for economic dynamism and job growth. Student loan debt stifles this crucial element.

- It slows the growth of the small business sector, which is a crucial driver of economic growth. Small businesses are significant contributors to job creation and economic diversity; reducing their number negatively impacts the overall economy.

- Access to capital for start-ups is further hindered by existing loan burdens. The additional financial strain makes securing funding for new ventures even more challenging.

The Long-Term Fiscal Implications for the Nation

The student loan crisis presents substantial long-term fiscal implications for the nation, impacting government spending and potentially creating systemic risks.

Increased Government Spending on Student Aid Programs

The increasing need for student aid programs puts a strain on government budgets, potentially impacting other essential public services.

- This could lead to cuts in other essential public services. Increased spending on student loan programs might necessitate reductions in other crucial areas like infrastructure, healthcare, or education.

- It increases the national debt. Government spending on student aid programs adds to the national debt, impacting future generations' financial stability.

- The cost of loan forgiveness programs, if implemented, would be substantial and necessitates careful consideration. While loan forgiveness might offer immediate relief, its long-term economic implications require thorough analysis.

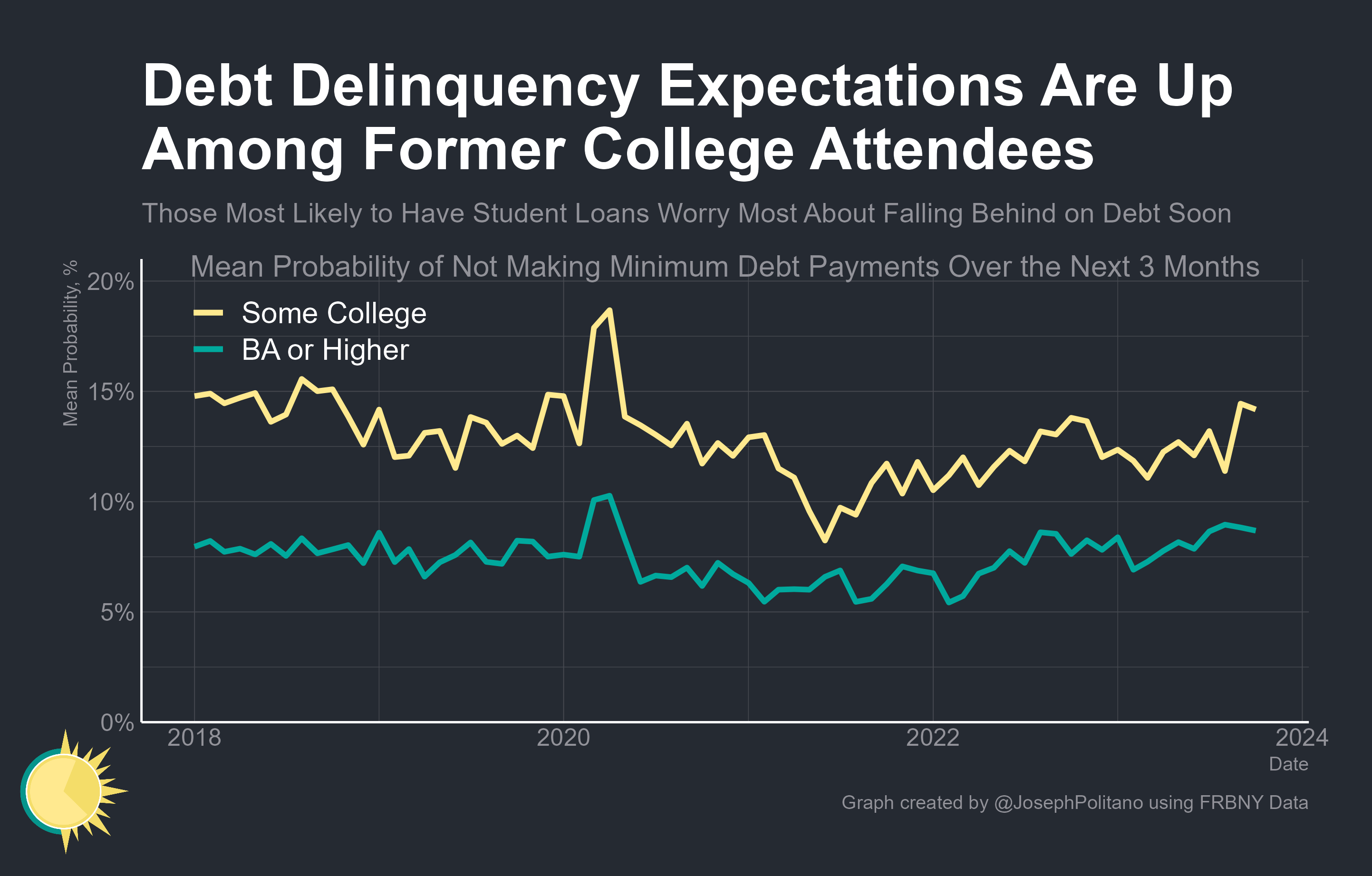

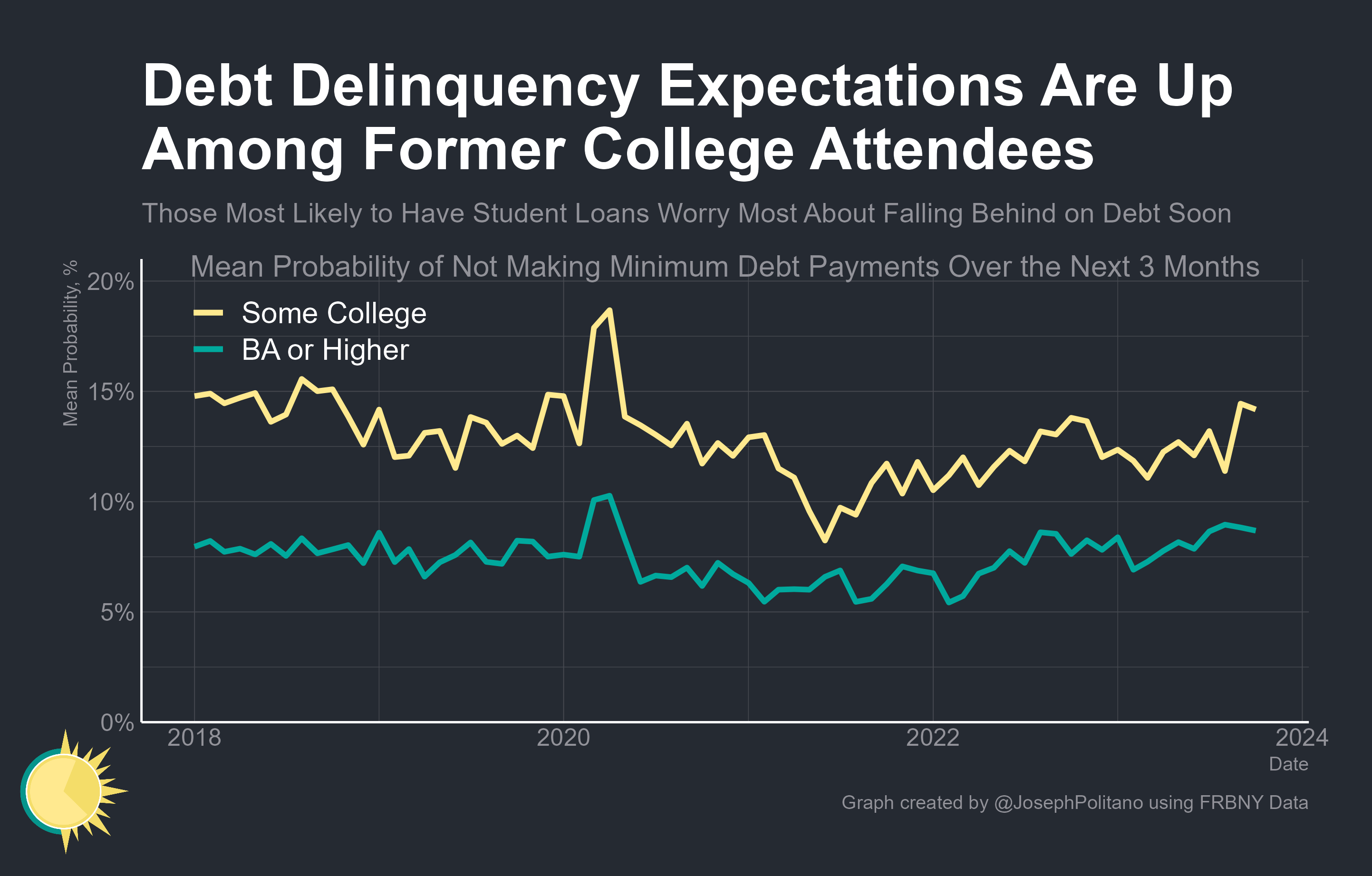

Potential for Systemic Risk

A widespread default on student loans could have significant implications for the financial system, potentially triggering a financial crisis impacting the broader economy.

- This could trigger a financial crisis impacting the broader economy. A significant increase in loan defaults could create instability in the financial system, leading to a domino effect.

- The government might need to intervene with costly bailouts. To prevent a systemic collapse, the government may be forced to intervene with expensive bailout packages.

- The increasing rate of student loan defaults poses a systemic risk to the financial stability of the nation. This growing risk warrants immediate attention and proactive strategies to mitigate its potential impact.

Conclusion

The student loan crisis presents a multifaceted economic threat with far-reaching consequences. From hindering consumer spending and impacting the labor market to creating long-term fiscal burdens, the implications are severe. Understanding the potential economic fallout is crucial for policymakers and individuals alike. We need proactive strategies to address the student loan crisis and mitigate its devastating economic consequences. Take action today by learning more about student loan repayment options and advocating for responsible student loan reform to lessen the impact of the student loan crisis.

Featured Posts

-

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025 -

Kanye Wests Wife Bianca Censori Stuns In Black Lingerie And Stilettos

May 28, 2025

Kanye Wests Wife Bianca Censori Stuns In Black Lingerie And Stilettos

May 28, 2025 -

Roland Garros 2024 Alcaraz And Swiateks Winning Starts

May 28, 2025

Roland Garros 2024 Alcaraz And Swiateks Winning Starts

May 28, 2025 -

Prakiraan Cuaca Akurat Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025

Prakiraan Cuaca Akurat Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025 -

Marlins 2025 Opening Day Roster Predicting The Final Lineup

May 28, 2025

Marlins 2025 Opening Day Roster Predicting The Final Lineup

May 28, 2025

Latest Posts

-

Dyl Twrw Yusjl Asmh Fy Tarykh Jyrw Iytalya Bfwzh Altarykhy Llmksyk

May 30, 2025

Dyl Twrw Yusjl Asmh Fy Tarykh Jyrw Iytalya Bfwzh Altarykhy Llmksyk

May 30, 2025 -

Almksyk Tktb Altarykh Fy Jyrw Iytalya Bfdl Dyl Twrw

May 30, 2025

Almksyk Tktb Altarykh Fy Jyrw Iytalya Bfdl Dyl Twrw

May 30, 2025 -

Altzam Dwytshh Bnk Balnmw Fy Alswq Alimaraty

May 30, 2025

Altzam Dwytshh Bnk Balnmw Fy Alswq Alimaraty

May 30, 2025 -

Jyrw Iytalya Dyl Twrw Ysjl Fwza Tarykhya Llmksyk

May 30, 2025

Jyrw Iytalya Dyl Twrw Ysjl Fwza Tarykhya Llmksyk

May 30, 2025 -

Dwytshh Bnk Khtt Twsye Alkhdmat Almalyt Fy Alimarat

May 30, 2025

Dwytshh Bnk Khtt Twsye Alkhdmat Almalyt Fy Alimarat

May 30, 2025