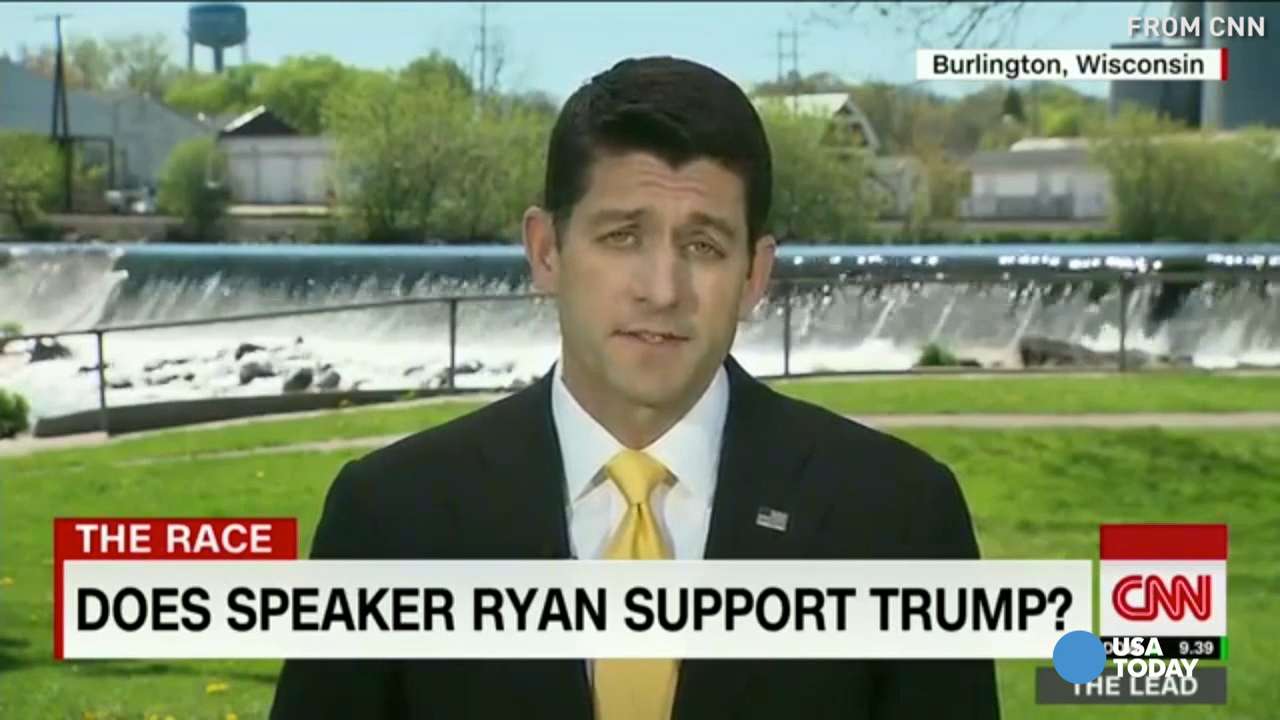

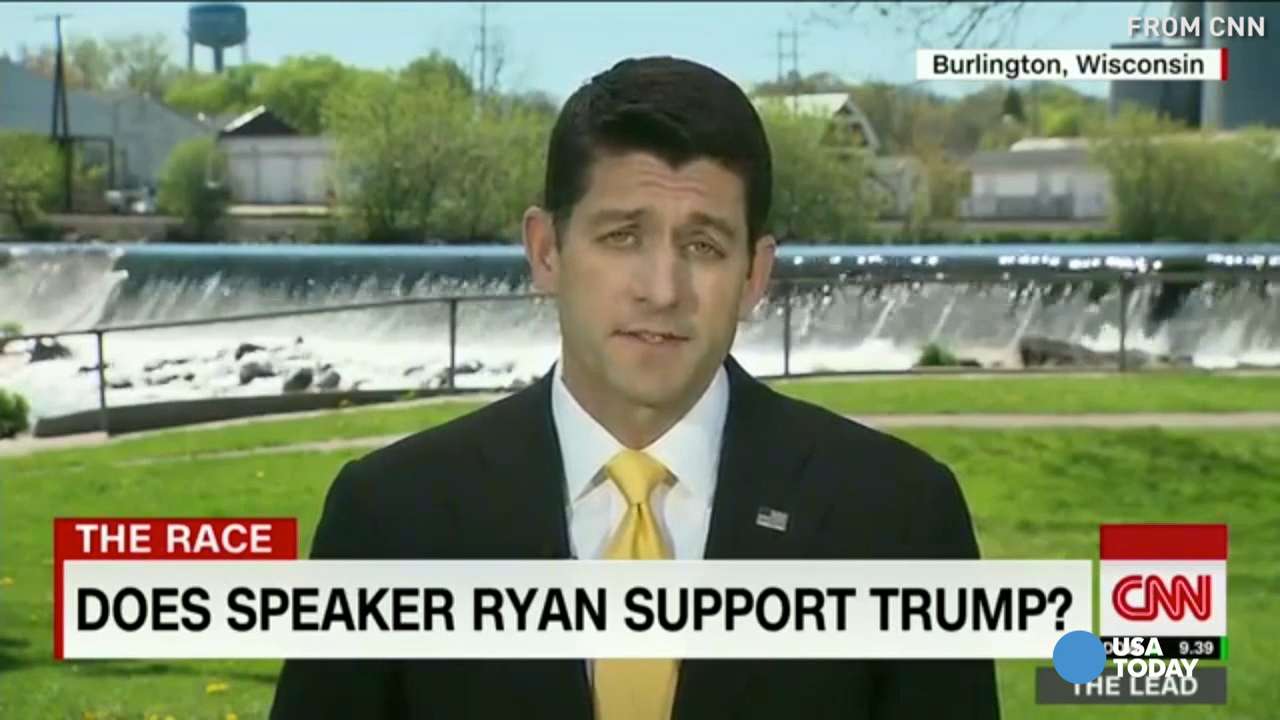

The Fate Of Trump's Tax Agenda: A Divided Republican Party

Table of Contents

Internal Republican Divisions on Tax Policy

The Republican party, far from being a monolithic entity on tax policy, is fractured into differing factions with distinct priorities. These divisions significantly impact the future of Trump's tax agenda. The main schism lies between fiscal conservatives, who prioritize balanced budgets and lower government spending, and pro-growth advocates, who believe tax cuts stimulate economic growth, even if it leads to increased deficits.

-

Differing stances on corporate vs. individual tax cuts: Fiscal conservatives often favor targeted tax cuts, arguing that broad-based cuts disproportionately benefit the wealthy. Pro-growth advocates, conversely, champion significant cuts for corporations, believing this will lead to job creation and economic expansion, ultimately benefiting all.

-

Tax simplification vs. targeted tax breaks: A significant point of contention lies in the approach to tax reform. Some Republicans advocate for simplifying the tax code, reducing loopholes, and creating a more equitable system. Others prefer targeted tax breaks for specific industries or demographics, potentially creating further complexities.

-

Influence of different Republican party wings: The Tea Party movement, with its emphasis on fiscal responsibility and limited government, exerts considerable influence on the party's more conservative wing. Establishment Republicans, meanwhile, often favor more moderate approaches to tax policy, seeking broader consensus and bipartisan support.

-

Lobbying groups and their influence: Powerful lobbying groups representing various sectors of the economy significantly impact Republican tax policy. These groups actively campaign for tax breaks and incentives that benefit their members, shaping the legislative agenda and influencing the debate within the party.

The Economic Impact of Trump's Tax Cuts – A Retrospective

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's tax agenda, significantly reduced corporate and individual income tax rates. While proponents predicted robust economic growth, the actual economic effects remain a subject of ongoing debate.

-

Impact on GDP growth: While GDP growth saw an initial bump following the tax cuts, determining their direct contribution is challenging, with other factors influencing economic performance.

-

Effects on income inequality: Critics argue that the tax cuts exacerbated income inequality, disproportionately benefiting high-income earners and corporations. Proponents counter that the resulting economic growth benefited everyone.

-

Impact on the national debt: The tax cuts significantly increased the national debt. This is a major point of contention for fiscal conservatives within the Republican party.

-

Impact on job creation: The link between the tax cuts and job creation is similarly debated, with evidence suggesting a modest impact but not the dramatic surge predicted by some.

The Biden Administration's Counter-Agenda and its Implications

The Biden administration has proposed a fundamentally different approach to tax policy, aiming to reverse some of the effects of Trump's tax cuts. This counter-agenda poses a significant challenge to the long-term survival of Trump's legacy.

-

Specific policy proposals: The Biden administration has proposed raising the corporate tax rate from 21% to 28%, reversing a key component of the Trump tax cuts. Further proposals include increased taxes on high-income earners and corporations.

-

Potential for legislative changes: The ability of the Biden administration to enact significant legislative changes depends on the political landscape. A narrow Democratic majority in Congress could make enacting sweeping changes difficult.

-

Political feasibility: The political feasibility of Biden's tax proposals is questionable, given the partisan divisions in Congress. Reaching bipartisan agreement on tax policy remains a major hurdle.

The Role of the Senate and House in Shaping Tax Policy

The legislative process for enacting tax policy is complex and often fraught with gridlock. The Senate and House of Representatives play crucial roles, and their power dynamics significantly influence the outcome.

-

Power dynamics within Congress: The balance of power between the two chambers, and within each chamber itself, plays a critical role. A unified party in control of both houses typically has an easier time passing legislation.

-

Potential for bipartisan compromise: Given the highly partisan nature of tax policy debates, bipartisan compromise is difficult but not impossible. Finding common ground requires significant negotiation and political will.

-

Influence of individual senators and representatives: Individual senators and representatives, particularly those holding key committee positions, exert significant influence on the legislative process. Their personal stances and political considerations often determine the final outcome.

Conclusion

The future of Trump's tax agenda remains highly uncertain. Internal divisions within the Republican party, the mixed economic impact of the tax cuts, and the Biden administration's counter-agenda create a complex and volatile situation. Understanding the interplay of these factors is crucial for predicting the long-term effects on the US economy. Understanding the future of Trump's tax agenda requires ongoing attention. Stay informed about the evolving political landscape and the potential impact on the economy. Continue following developments related to Trump's tax agenda for the latest updates and analysis.

Featured Posts

-

Uncover The Perfect Hot Weather Drink

May 22, 2025

Uncover The Perfect Hot Weather Drink

May 22, 2025 -

Analyzing Liverpools Win Over Psg Arne Slots Insight And Goalkeeping Analysis

May 22, 2025

Analyzing Liverpools Win Over Psg Arne Slots Insight And Goalkeeping Analysis

May 22, 2025 -

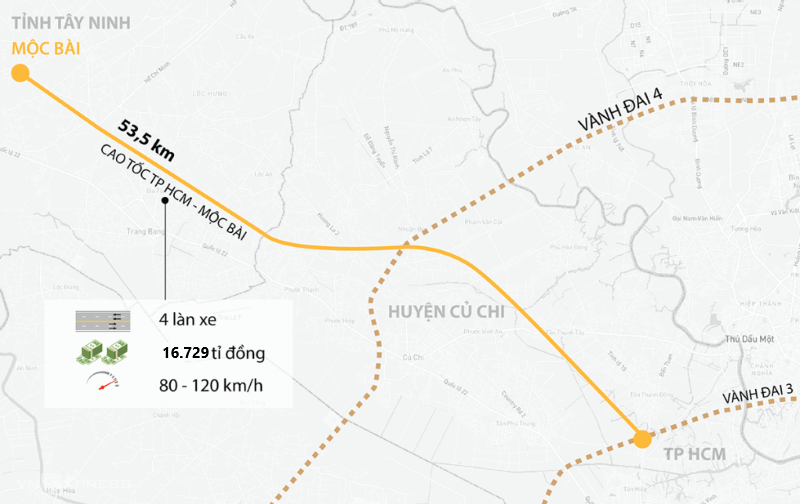

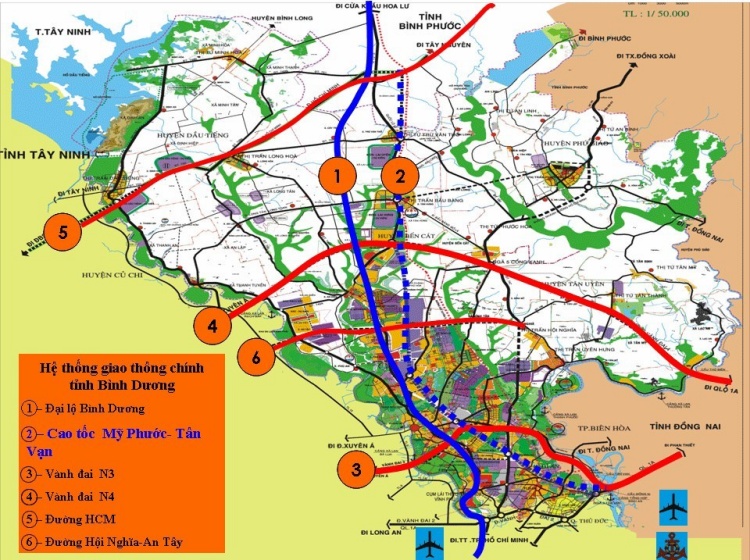

Cau Va Duong Cao Toc Binh Duong Tay Ninh Huong Dan Va Ban Do

May 22, 2025

Cau Va Duong Cao Toc Binh Duong Tay Ninh Huong Dan Va Ban Do

May 22, 2025 -

Kaliningrad V Fokuse Ugroza Zakhvata So Storony Nato Po Slovam Patrusheva

May 22, 2025

Kaliningrad V Fokuse Ugroza Zakhvata So Storony Nato Po Slovam Patrusheva

May 22, 2025 -

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Practices

May 22, 2025

Abn Amro Facing Investigation Dutch Central Bank Scrutinizes Bonus Practices

May 22, 2025

Latest Posts

-

Giai Phap Nang Cap Ha Tang Giao Thong Ket Noi Tp Hcm Binh Duong

May 22, 2025

Giai Phap Nang Cap Ha Tang Giao Thong Ket Noi Tp Hcm Binh Duong

May 22, 2025 -

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025

Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025 -

Du An Ha Tang Giao Thong Tp Hcm Binh Duong Dong Luc Phat Trien Kinh Te

May 22, 2025

Du An Ha Tang Giao Thong Tp Hcm Binh Duong Dong Luc Phat Trien Kinh Te

May 22, 2025 -

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025