The Financial Viability Of Offshore Wind Farms Under Scrutiny

Table of Contents

High Capital Expenditure and Financing Challenges

Developing an offshore wind farm requires a substantial upfront investment. The high capital expenditure (CAPEX) is a significant hurdle to overcome, encompassing various stages from initial site assessment and environmental impact studies to the procurement of specialized equipment, complex construction, and grid connection. Securing project financing is a major challenge, often requiring a complex blend of government subsidies, private equity investment, and debt financing from banks and other financial institutions.

- High initial capital costs compared to onshore wind: Offshore wind projects face inherently higher costs due to the challenging marine environment, requiring specialized vessels, equipment, and skilled labor.

- Complex permitting processes and regulatory hurdles: Navigating the permitting process can be lengthy and complex, involving multiple stakeholders and potentially lengthy delays, adding to overall project costs.

- Dependence on government incentives and subsidies: Many offshore wind projects rely heavily on government support mechanisms, such as tax credits, feed-in tariffs, and Contracts for Difference (CfDs), to make them financially attractive to investors. The availability and stability of these incentives are crucial.

- Risk associated with fluctuating energy prices and carbon credit markets: Revenue from electricity sales can be susceptible to energy price volatility. Similarly, the value of carbon credits, a potential supplementary revenue stream, can also fluctuate significantly.

Operational Costs and Maintenance Considerations

The ongoing operational expenditure (OPEX) associated with offshore wind farms is considerable. The harsh marine environment necessitates robust and specialized maintenance procedures. Regular inspections, repairs, and component replacements are essential to ensure the continued operational efficiency and longevity of the wind turbines and associated infrastructure.

- High maintenance costs due to offshore location and specialized equipment: Accessing offshore wind turbines for maintenance requires specialized vessels and equipment, significantly increasing operational costs.

- Repair and replacement of turbines and other infrastructure: Turbine failures and the need for component replacements can be costly, especially given the remote location and the specialized skills required for repairs.

- Impact of extreme weather events on operational costs: Offshore wind farms are exposed to harsh weather conditions, increasing the risk of damage and the need for costly repairs. Insurance premiums also reflect these heightened risks.

- Specialized workforce requirements and training costs: Maintaining and operating offshore wind farms requires a highly skilled workforce with specialized training, contributing to the overall operational costs.

Revenue Streams and Energy Price Volatility

Offshore wind farm operators can generate revenue through various channels. Power Purchase Agreements (PPAs) are a key revenue source, providing long-term contracts for electricity sales to utilities or corporations. Government subsidies and carbon credit revenues can supplement these income streams, boosting overall profitability. However, the volatility of energy prices poses a significant risk to project returns.

- Power Purchase Agreements (PPAs) and their impact on revenue: PPAs provide price certainty for a defined period but might not fully capture the upside potential of fluctuating market prices.

- Government support schemes and their influence on profitability: Government incentives play a vital role in making offshore wind projects financially viable, particularly in the early stages of development.

- Revenue from carbon credits and environmental markets: The sale of carbon credits provides additional revenue streams and can significantly contribute to project profitability, especially with increasing carbon pricing policies.

- Managing risks associated with fluctuating electricity prices: Effective hedging strategies are crucial to mitigate the risk of unpredictable electricity prices and ensure the long-term financial stability of offshore wind projects.

Technological Advancements and Cost Reduction Strategies

Technological innovation is vital to improving the financial viability of offshore wind farms. Advancements in turbine design, construction techniques, and maintenance strategies are continuously driving down the cost of offshore wind energy.

- Larger turbine sizes and improved efficiency: Larger turbines capture more wind energy, increasing overall power output and reducing the cost per unit of electricity.

- Advancements in floating offshore wind technology: Floating offshore wind technology expands the potential deployment areas to deeper waters, opening up new opportunities for offshore wind farm development.

- Optimized construction methods and project management: Improved construction techniques and streamlined project management processes can contribute to significant cost savings.

- Innovation in maintenance and repair technologies: Technological advances in remote sensing, predictive maintenance, and drone technology are improving the efficiency and reducing the costs of maintenance operations.

The Role of Government Policy and Regulatory Frameworks

Supportive government policies and efficient regulatory frameworks are crucial for the financial viability of offshore wind farms. Clear and stable policies create a predictable and attractive investment climate, attracting private investment and encouraging long-term growth in the sector.

- Renewable energy targets and support mechanisms: Ambitious renewable energy targets and supportive government policies are critical drivers of offshore wind development.

- Permitting processes and regulatory efficiency: Streamlined permitting processes and efficient regulatory frameworks are essential to reduce delays and costs associated with project development.

- Grid connection and infrastructure development policies: Adequate grid infrastructure is essential for the successful integration of offshore wind energy into the national power grid.

- Tax incentives and other financial support measures: Government tax incentives and other financial support measures can make offshore wind projects more financially attractive to investors.

Assessing the Future of Offshore Wind Farm Finance

The financial viability of offshore wind farms presents a complex interplay of factors, encompassing high upfront investment, significant operational costs, energy price volatility, and the critical role of government support. While challenges remain, technological advancements, cost reduction strategies, and supportive policy environments offer significant opportunities for the long-term success of this crucial renewable energy source. To ensure a sustainable future for renewable energy, continued research and open discussion regarding the financial viability of offshore wind farms are crucial. Let's work together to make this vital energy source a financially sound and environmentally responsible reality.

Featured Posts

-

The Justice Departments Decision To End School Desegregation Analysis And Impact

May 03, 2025

The Justice Departments Decision To End School Desegregation Analysis And Impact

May 03, 2025 -

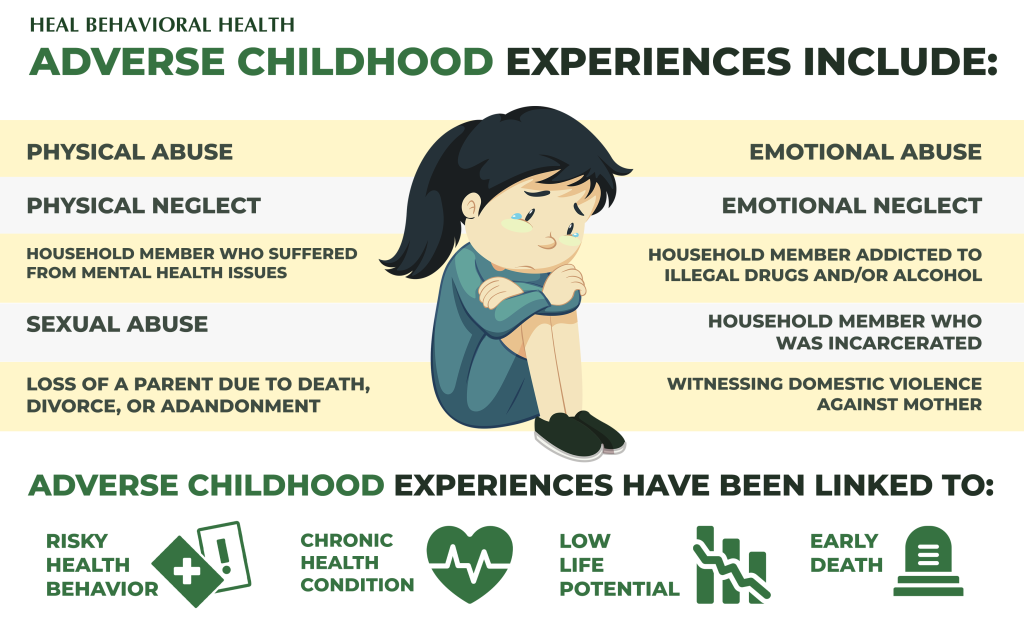

A Generations Future Investing In Childhood Mental Health Now

May 03, 2025

A Generations Future Investing In Childhood Mental Health Now

May 03, 2025 -

South Koreas Prime Minister Hans Resignation Presidential Bid Imminent

May 03, 2025

South Koreas Prime Minister Hans Resignation Presidential Bid Imminent

May 03, 2025 -

Avrupa Ile Ortak Gelecegimiz Is Birliginin Oenemi

May 03, 2025

Avrupa Ile Ortak Gelecegimiz Is Birliginin Oenemi

May 03, 2025 -

Is Valorant Mobile Coming Soon Tencents Plans Revealed

May 03, 2025

Is Valorant Mobile Coming Soon Tencents Plans Revealed

May 03, 2025

Latest Posts

-

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025 -

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025 -

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025