The First 100 Days: Assessing The U.S. Dollar's Trajectory Under The Current Presidency

Table of Contents

Early Economic Indicators and Their Impact on the Dollar

The initial economic data released during a president's first 100 days provides crucial insights into the health of the U.S. economy and its impact on the dollar's value. Several key indicators are particularly relevant: inflation rate, GDP growth, unemployment rate, and consumer confidence. These factors are interconnected and collectively influence investor sentiment and, consequently, the dollar's strength.

-

Inflation Rate: High inflation erodes purchasing power and can lead to the Federal Reserve raising interest rates. While this can initially strengthen the dollar, persistently high inflation can also weaken it in the long run by discouraging investment. Analyzing the inflation figures from the first 100 days is therefore critical for understanding the dollar's potential trajectory.

-

GDP Growth: Strong GDP growth usually indicates a healthy economy, attracting foreign investment and bolstering demand for the dollar. Conversely, slow GDP growth can weaken the currency. Forecasts for GDP growth during and after the first 100 days offer valuable insight into the dollar's future.

-

Unemployment Rate: A low unemployment rate typically signals a strong economy, further strengthening the dollar. Conversely, high unemployment can weaken investor confidence and thus, the currency. The trend in unemployment during the first 100 days provides a significant data point.

-

Consumer Confidence: High consumer confidence translates to increased spending and economic activity, positively impacting the dollar. Low consumer confidence can lead to decreased spending and weaker economic growth, potentially weakening the dollar. Tracking consumer confidence levels is vital for understanding the overall economic sentiment and its reflection in the currency market.

The Administration's Economic Policies and Their Potential Effects

The administration's economic policies significantly influence the U.S. dollar's trajectory. Fiscal policy (government spending and taxation), monetary policy (interest rates and money supply), trade policy (tariffs and trade agreements), and regulatory changes all play a role.

-

Fiscal Policy: Significant tax cuts can stimulate economic growth but may also increase the budget deficit, potentially weakening the dollar if investors perceive increased risk. Conversely, increased government spending on infrastructure could boost the economy and strengthen the dollar.

-

Monetary Policy: Changes in interest rates by the Federal Reserve directly impact the dollar's value. Raising interest rates typically strengthens the dollar by attracting foreign investment seeking higher returns. Lowering interest rates can weaken the dollar.

-

Trade Policy: Imposing tariffs can lead to trade wars and negatively impact economic growth, weakening the dollar. Negotiating new trade agreements can have the opposite effect.

-

Regulatory Changes: Deregulation can boost business investment and economic growth, strengthening the dollar. Increased regulation can have the opposite effect.

Global Economic Factors Influencing the Dollar's Trajectory

The U.S. dollar is not an island; its value is influenced by global economic conditions. Global inflation, geopolitical risks, and international trade dynamics all play a significant role.

-

Global Inflation: High global inflation can weaken the dollar as investors seek assets in countries with lower inflation.

-

Geopolitical Risks: Geopolitical instability often leads investors to seek the safety of the U.S. dollar, strengthening it. However, prolonged instability can negatively impact global trade and weaken the dollar.

-

International Trade: Changes in global trade patterns, including the rise of new economic powers, can influence the demand for the U.S. dollar.

-

Foreign Exchange Reserves: Central banks around the world hold significant U.S. dollar reserves. Changes in these reserves can influence the dollar's value.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence significantly influence the U.S. dollar's performance. Stock market performance, bond yields, and currency trading activity all reflect this sentiment.

-

Stock Market Performance: A strong stock market usually boosts investor confidence and strengthens the dollar. Conversely, a weak stock market can weaken the dollar.

-

Bond Yields: Changes in U.S. Treasury bond yields influence the dollar's attractiveness to investors. Higher yields typically attract more investment and strengthen the dollar.

-

Currency Trading Activity: The volume and direction of currency trading significantly impact the dollar's value. High trading volumes often indicate increased volatility.

-

Market Volatility: Periods of high market volatility can lead to uncertainty and decreased investor confidence, potentially weakening the dollar.

Conclusion

Predicting the U.S. dollar's trajectory during and after the first 100 days requires careful consideration of various interacting factors. Early economic indicators, the administration's economic policies, global economic conditions, and market sentiment all contribute to the overall picture. Continuous monitoring of these elements is crucial for understanding the dollar's performance. Staying informed about economic data releases, policy announcements, and global events is paramount. To gain a comprehensive understanding of the U.S. dollar's future prospects, continue following the analysis of the U.S. dollar's trajectory under the current presidency. Subscribe to our updates for in-depth insights and further analysis of the U.S. dollar's future.

Featured Posts

-

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

The Future Of Browsers Perplexitys Ceo And The Battle Against Googles Ai

Apr 28, 2025

The Future Of Browsers Perplexitys Ceo And The Battle Against Googles Ai

Apr 28, 2025 -

Increased Pressure On Ev Mandates Dealerships Voice Concerns

Apr 28, 2025

Increased Pressure On Ev Mandates Dealerships Voice Concerns

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

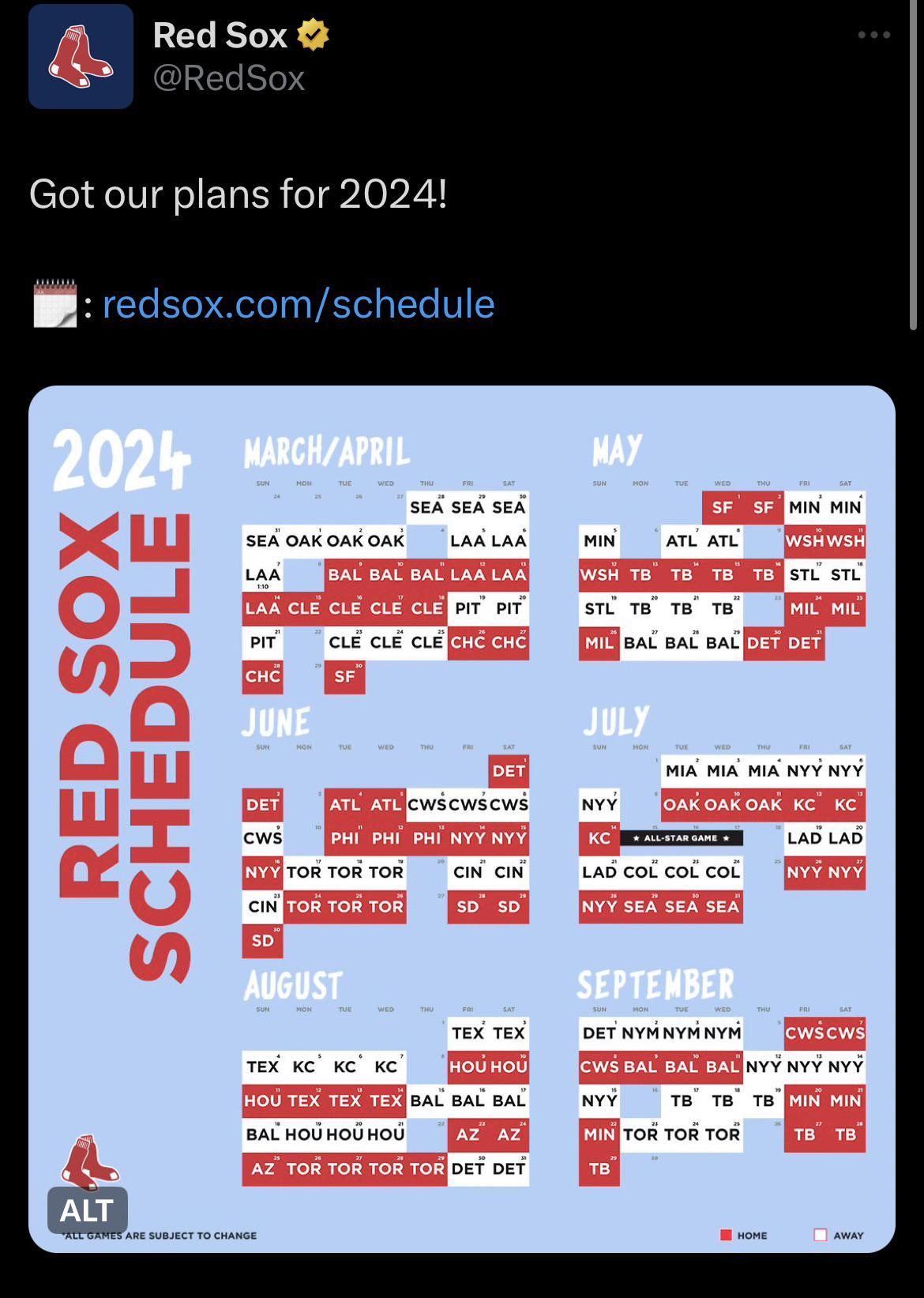

Quietly Dominant Could This Red Sox Player Be A Breakout Star

Apr 28, 2025

Quietly Dominant Could This Red Sox Player Be A Breakout Star

Apr 28, 2025