The Future Of CoreWeave Stock: Predictions And Potential

Table of Contents

CoreWeave, a rapidly expanding cloud computing company specializing in high-performance computing (HPC) and artificial intelligence (AI) infrastructure, has quickly become a name to watch in the tech industry. This article delves into the potential future of CoreWeave stock, exploring predictions, growth opportunities, and risks to help you navigate this exciting—and potentially lucrative—investment landscape. We will analyze market trends, competition, and CoreWeave's unique strengths to offer valuable insights into the company's trajectory and the potential for CoreWeave investment.

CoreWeave's Competitive Advantages and Market Position

CoreWeave's success stems from its strategic focus and ability to capitalize on key market trends. Let's examine its competitive advantages:

Dominating the High-Performance Computing (HPC) Market

CoreWeave has established itself as a leader in providing specialized infrastructure for demanding AI workloads. Their competitive edge lies in offering superior speed, scalability, and cost-effectiveness compared to giants like AWS, Google Cloud, and Azure. This advantage is built upon several key factors:

- Superior GPU offerings and access: CoreWeave provides access to a vast pool of high-end GPUs, crucial for training complex AI models and accelerating computationally intensive tasks. This surpasses the offerings of many competitors.

- Customized solutions tailored to client needs: Unlike one-size-fits-all solutions, CoreWeave offers flexible and customizable cloud computing solutions, allowing clients to optimize their resources and reduce costs. This personalized approach is a significant differentiator.

- Strong partnerships with leading AI companies: CoreWeave has forged strategic alliances with key players in the AI industry, ensuring access to cutting-edge technologies and a wider reach within the market. These collaborations strengthen their position as a reliable and innovative HPC provider.

Growth Opportunities in the Booming AI Sector

The AI market is experiencing explosive growth, and CoreWeave is ideally positioned to capitalize on this expansion. The increasing demand for powerful AI infrastructure, including advanced GPUs and robust data centers, creates a fertile ground for CoreWeave's services.

- Expanding client base in various AI-driven industries: CoreWeave is actively expanding its client base across diverse sectors such as finance, healthcare, and scientific research, all heavily reliant on advanced AI capabilities.

- Strategic acquisitions and partnerships to broaden capabilities: CoreWeave is actively pursuing strategic acquisitions and partnerships to enhance its technology stack and expand its service offerings, further solidifying its market position.

- Investment in research and development to stay ahead of the curve: Continuous investment in R&D is vital for maintaining a competitive edge in the rapidly evolving AI landscape. CoreWeave's commitment to innovation ensures it remains at the forefront of technological advancements.

Analyzing Financial Performance and Projections

Analyzing CoreWeave's financial performance is crucial for assessing its investment potential. While publicly available financial data may be limited at this stage, analyzing available information and industry trends can help us formulate projections.

Revenue Growth and Profitability

[Insert available data on CoreWeave's historical revenue growth, profitability, and expense ratios here. This section requires publicly available financial statements or reliable third-party analyses. If this data is unavailable, replace this section with a general discussion of expected growth based on market trends and industry benchmarks. For example:]

While precise financial figures are not yet publicly available for CoreWeave, the explosive growth of the AI and HPC markets strongly suggests significant revenue growth potential. Industry analysts predict substantial expansion in cloud computing spending over the next five years, presenting a favorable climate for CoreWeave's continued growth.

- Historical revenue growth rate (if available): [Insert data or substitute with a statement explaining the lack of publicly available data.]

- Projected revenue growth over the next 3-5 years: [Insert projections or a discussion of projected growth based on market analysis.]

- Key financial metrics and their implications: [Discuss key metrics relevant to cloud computing companies and their potential impact on CoreWeave's valuation.]

Valuation and Potential Return on Investment

Estimating CoreWeave's future stock price is inherently speculative. However, using various valuation models based on industry comparables and projected growth rates can provide a range of potential outcomes.

- Potential price targets based on different valuation scenarios: [Provide a range of potential price targets, clearly stating the assumptions and limitations of the analysis.]

- Risk factors that could impact stock performance: This includes competitive pressures, economic downturns, and regulatory changes.

- Comparison with competitor valuations: Comparing CoreWeave's valuation multiples (e.g., Price-to-Sales ratio) to those of publicly traded competitors in the cloud computing space can provide context for potential future valuations.

Disclaimer: Stock prices are inherently volatile, and any predictions are speculative. Past performance is not indicative of future results.

Potential Risks and Challenges Facing CoreWeave

Despite its promising prospects, CoreWeave faces several challenges that investors should carefully consider:

Competition and Market Saturation

The cloud computing market is highly competitive. Established players like AWS, Google Cloud, and Azure possess significant market share and resources. New entrants also continually emerge.

- Key competitors and their strengths: Analyzing the strengths of major competitors is essential for understanding the competitive landscape.

- Potential strategies to mitigate competitive pressure: CoreWeave's strategies for maintaining a competitive edge, such as innovation, strategic partnerships, and superior customer service, are crucial.

- Analysis of market saturation risks: Understanding the potential for market saturation and CoreWeave’s ability to maintain its growth trajectory is crucial.

Economic Factors and Market Volatility

Macroeconomic factors, such as interest rate hikes and inflation, can significantly impact the demand for cloud computing services. Furthermore, CoreWeave stock is susceptible to broader market volatility.

- Sensitivity analysis of key economic variables: Assessing how sensitive CoreWeave's performance is to changes in economic indicators is crucial.

- Strategies to manage risk during economic downturns: Exploring CoreWeave's strategies to weather economic downturns, such as cost optimization and diversified revenue streams, is important.

- Impact of geopolitical events: Geopolitical instability can also affect investment sentiment and market conditions, adding another layer of risk.

Conclusion

The future of CoreWeave stock presents a compelling investment opportunity, driven by its strong position in the rapidly expanding AI and HPC markets. Its technological advantages and strategic partnerships offer significant growth potential. However, investors must acknowledge the inherent risks associated with the competitive landscape and macroeconomic factors. Before making any investment decisions, it is crucial to conduct thorough due diligence, diversify your portfolio, and consult with a qualified financial advisor. Understanding the factors influencing the future of CoreWeave stock is paramount for making informed investment choices. Remember, all investments carry inherent risk.

Featured Posts

-

Car Dealers Intensify Fight Against Ev Mandates

May 22, 2025

Car Dealers Intensify Fight Against Ev Mandates

May 22, 2025 -

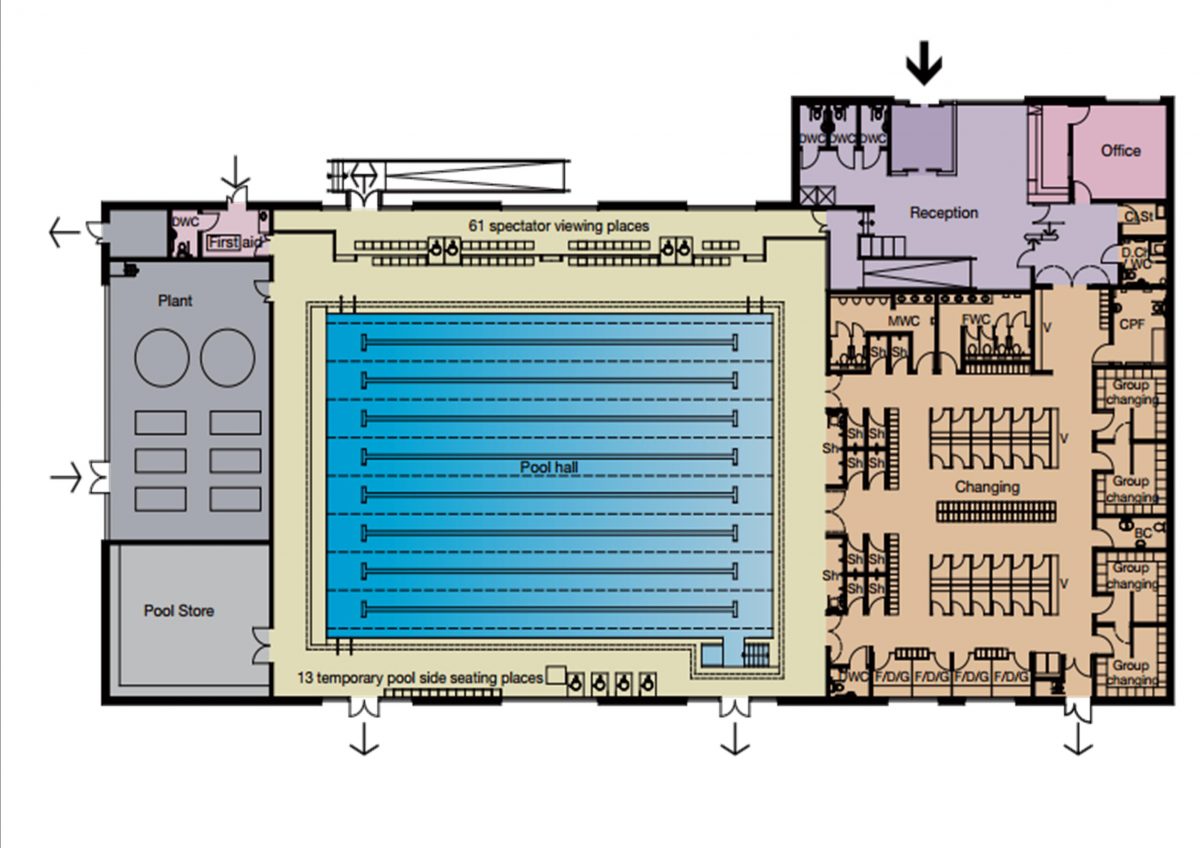

Nices Bold Plan A State Of The Art Olympic Swimming Pool Facility

May 22, 2025

Nices Bold Plan A State Of The Art Olympic Swimming Pool Facility

May 22, 2025 -

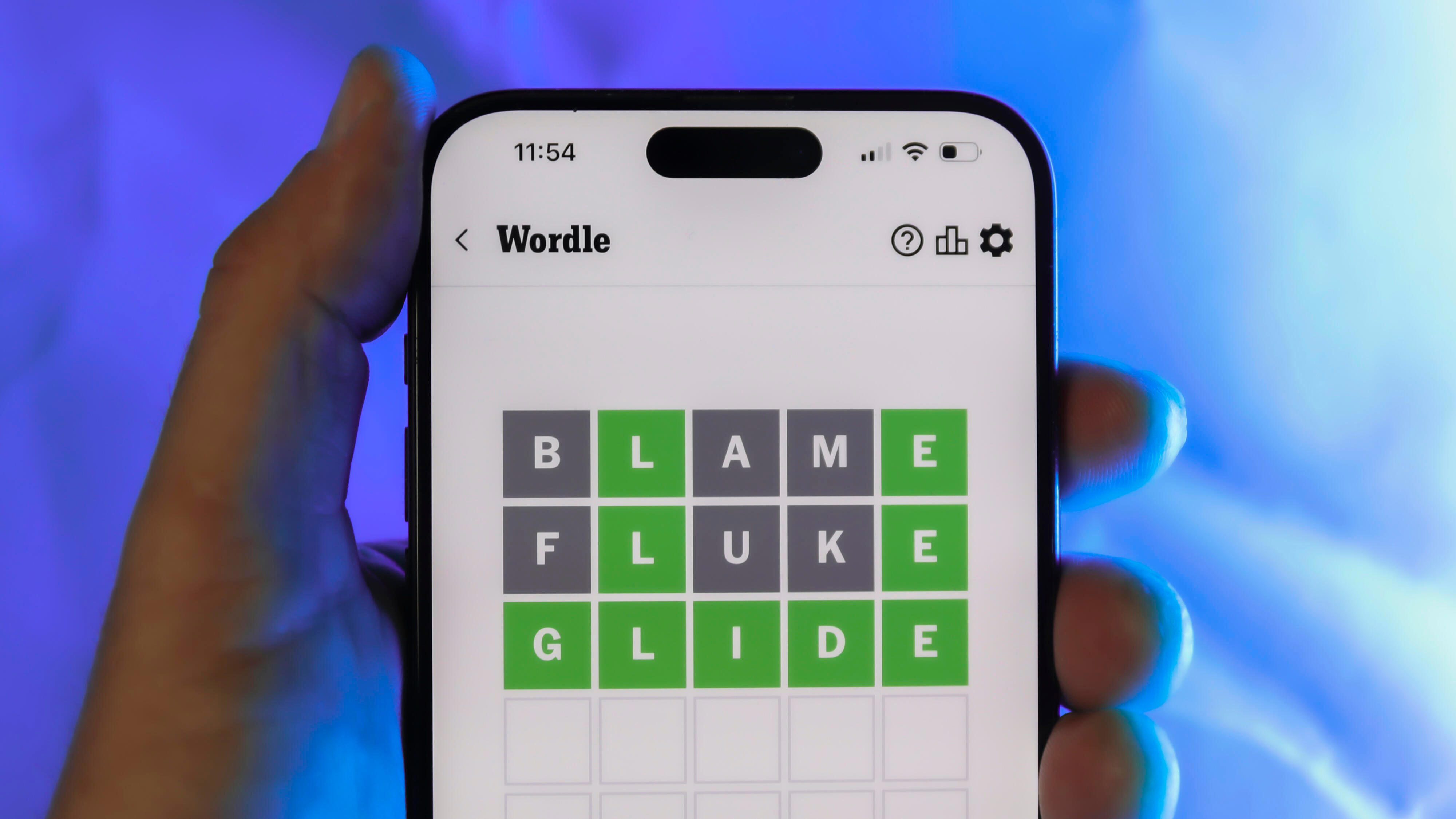

Nyt Wordle Hints And Solution For March 18 Wordle 1368

May 22, 2025

Nyt Wordle Hints And Solution For March 18 Wordle 1368

May 22, 2025 -

Todays Nyt Wordle Hints Answer And Help For March 18 1368

May 22, 2025

Todays Nyt Wordle Hints Answer And Help For March 18 1368

May 22, 2025 -

Eu Trade Policy Macrons Push For European Goods

May 22, 2025

Eu Trade Policy Macrons Push For European Goods

May 22, 2025

Latest Posts

-

Wordle 363 Hints And Clues For Thursday March 13th

May 22, 2025

Wordle 363 Hints And Clues For Thursday March 13th

May 22, 2025 -

Wordle Today 1 363 Hints Clues And Answer For Thursday March 13th

May 22, 2025

Wordle Today 1 363 Hints Clues And Answer For Thursday March 13th

May 22, 2025 -

Wordle Puzzle 1407 April 26 2025 Answer Hints And Tips

May 22, 2025

Wordle Puzzle 1407 April 26 2025 Answer Hints And Tips

May 22, 2025 -

Wordle 356 Solution Hints And Clues For March 6th Game

May 22, 2025

Wordle 356 Solution Hints And Clues For March 6th Game

May 22, 2025 -

Solve Wordle 356 Hints And The Answer For March 6th

May 22, 2025

Solve Wordle 356 Hints And The Answer For March 6th

May 22, 2025