The Growing Impact Of Climate Risk On Home Mortgages

Table of Contents

Increased Risk Assessments and Underwriting

Mortgage lenders are increasingly factoring climate risk into their lending decisions. This translates to a more rigorous assessment process for borrowers and properties.

More Stringent Mortgage Approvals

Lenders are becoming much more discerning about properties located in high-risk climate zones. This heightened scrutiny leads to stricter underwriting criteria, potentially resulting in:

- Increased scrutiny of property location: Lenders are meticulously examining proximity to floodplains, wildfire zones, and areas prone to extreme weather events like hurricanes and severe storms. This includes analyzing historical weather data and projected future risks.

- Use of advanced risk modeling and climate data: Sophisticated algorithms and climate models are being integrated into the underwriting process to provide a more accurate assessment of risk. This means lenders are going beyond simple flood zone maps to consider a wider range of climate-related hazards.

- Higher down payments or stricter credit score requirements: For properties in high-risk areas, borrowers may face demands for larger down payments or stricter credit score requirements to compensate for the increased risk.

The Rise of Climate-Related Disclosures

Transparency is paramount. Mortgage lenders are increasingly adopting, or are legally required to adopt, more comprehensive disclosures regarding climate-related risks:

- Disclosure of flood risks, wildfire risks, and other climate-related hazards: Borrowers now receive clearer information about the specific climate risks associated with their prospective property. This includes detailed reports outlining the likelihood and potential severity of various hazards.

- Transparency regarding the potential impact of climate change on property value: Lenders are acknowledging the potential for decreased property values in high-risk zones and are making this information readily available to prospective borrowers.

- Requirement for homeowners to disclose known climate-related issues: Homeowners are expected to be upfront about any known climate-related issues, such as previous flooding or damage from wildfires, to ensure complete transparency in the mortgage application process.

Impact on Property Values and Insurance

Climate change is significantly affecting property values and insurance availability, creating major challenges for homeowners and potential buyers.

Decreasing Property Values in High-Risk Zones

Properties located in areas vulnerable to climate change impacts, such as coastal regions prone to sea-level rise or areas susceptible to wildfires, are experiencing a decline in value. This impacts homeowners’ equity and lenders’ collateral:

- Reduced demand for properties in high-risk areas leading to lower sale prices: The market is reflecting the increased risk, resulting in reduced buyer interest and lower sale prices for properties in vulnerable locations.

- Difficulty in obtaining adequate property insurance coverage: As risks increase, insurers are becoming more reluctant to offer coverage or are significantly increasing premiums, making it harder to secure adequate protection.

- Increased insurance premiums for homes in high-risk zones: Homeowners in high-risk areas face substantially higher insurance premiums, significantly impacting their monthly expenses.

The Challenges of Obtaining Homeowners Insurance

Securing adequate homeowners insurance is becoming increasingly difficult and expensive in climate-vulnerable areas, impacting mortgage applications:

- Rising premiums and restricted availability of insurance policies: Insurance companies are carefully assessing the risks and are either increasing premiums significantly or refusing coverage altogether in high-risk areas.

- Impact of insurance denials on mortgage applications: Inability to secure homeowners insurance can lead to mortgage application denials, as lenders require adequate coverage as a condition of the loan.

- The importance of early assessment of insurance risks before purchasing a home: It's crucial for prospective homebuyers to research insurance availability and costs before making an offer on a property.

Navigating the Changing Mortgage Landscape

The shifting landscape requires proactive strategies from homebuyers and lenders alike.

Choosing Climate-Resilient Properties

Mitigating risk begins with choosing properties built to withstand climate change impacts:

- Importance of considering elevation, building materials, and landscaping: Homes built on higher ground, using fire-resistant materials, and incorporating smart landscaping techniques are better equipped to handle extreme weather events.

- Researching local zoning regulations and building codes: Understanding local regulations can help identify properties built to withstand specific climate hazards.

- Seeking properties with features that enhance resilience to extreme weather: Features like reinforced roofs, storm shutters, and drought-tolerant landscaping can increase a property's resilience.

Understanding Your Climate Risk

Thorough research is essential before making a significant investment:

- Utilizing online resources and tools to assess climate risk: Several online resources and tools can help assess the climate risk of a specific property location.

- Consulting with real estate agents and environmental specialists: Seek advice from professionals knowledgeable about climate risk and local conditions.

- Reviewing historical weather data and future projections: Understanding past weather patterns and projected future climate scenarios can provide a clearer picture of the risks.

Conclusion

Climate risk is fundamentally altering the home mortgage landscape. Increased scrutiny from lenders, challenges in securing insurance, and potential declines in property value are realities for homebuyers and homeowners. By understanding these climate-related risks and making informed decisions, you can navigate this changing market and secure a sustainable and secure home mortgage. It's crucial to consider the growing impact of climate risk on your home mortgage and make informed decisions to protect your investment. Learn more about mitigating climate risk and securing a sustainable home mortgage today.

Featured Posts

-

Real Madrid Ancelotti Sonrasi Teknik Direktoer Adaylari

May 21, 2025

Real Madrid Ancelotti Sonrasi Teknik Direktoer Adaylari

May 21, 2025 -

Betalen Met Tikkie Een Handleiding Voor Nederlandse Bankgebruikers

May 21, 2025

Betalen Met Tikkie Een Handleiding Voor Nederlandse Bankgebruikers

May 21, 2025 -

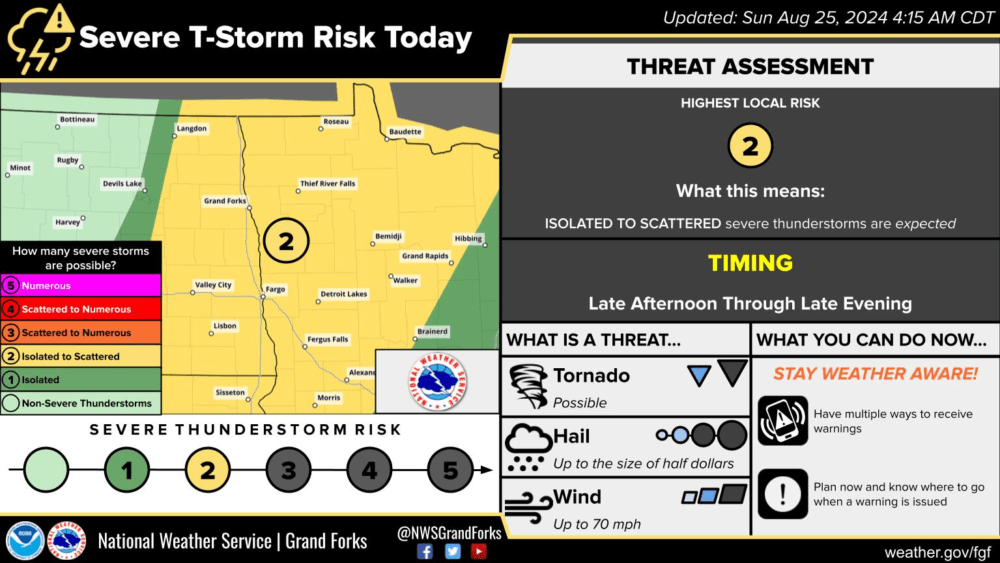

Overnight Storm Potential Severe Weather Risk On Monday

May 21, 2025

Overnight Storm Potential Severe Weather Risk On Monday

May 21, 2025 -

31 Month Jail Term For Social Media Post Tory Councillors Wife Appeals

May 21, 2025

31 Month Jail Term For Social Media Post Tory Councillors Wife Appeals

May 21, 2025 -

49 Dogs Rescued From Licensed Breeder In Washington County

May 21, 2025

49 Dogs Rescued From Licensed Breeder In Washington County

May 21, 2025

Latest Posts

-

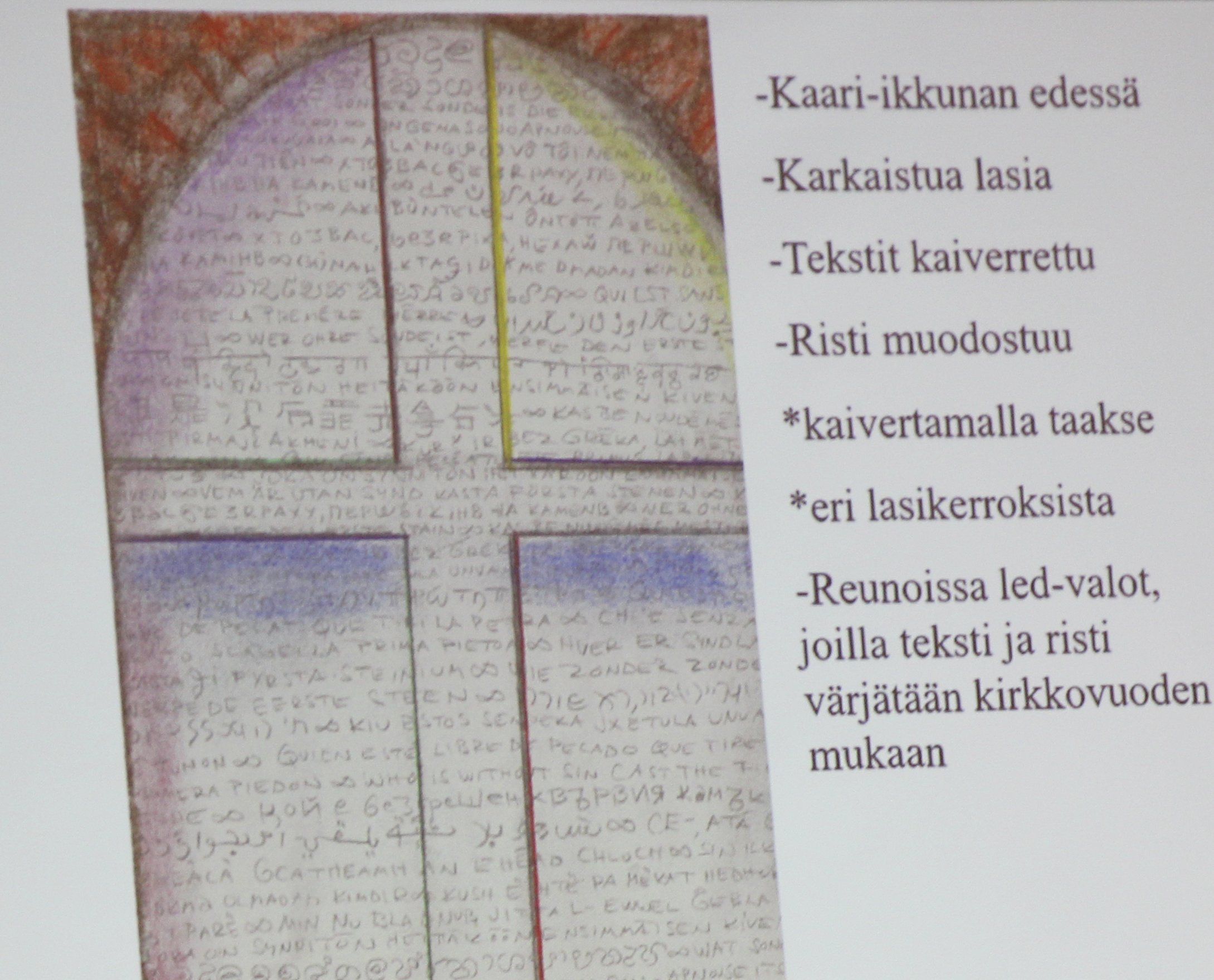

Huuhkajat Saavat Uutta Voimaa Kaellmanista

May 21, 2025

Huuhkajat Saavat Uutta Voimaa Kaellmanista

May 21, 2025 -

Kaellmanin Nousu Huuhkajien Hyoekkaeyksen Tulevaisuuden Lupaus

May 21, 2025

Kaellmanin Nousu Huuhkajien Hyoekkaeyksen Tulevaisuuden Lupaus

May 21, 2025 -

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopenkillae

May 21, 2025

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopenkillae

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentaellae Ja Sen Ulkopuolella

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentaellae Ja Sen Ulkopuolella

May 21, 2025 -

Friisin Yllaetykset Kamara Ja Pukki Sivussa Avauskokoonpanossa

May 21, 2025

Friisin Yllaetykset Kamara Ja Pukki Sivussa Avauskokoonpanossa

May 21, 2025