The Impact Of National Debt On Mortgage Rates And Affordability

Table of Contents

How National Debt Influences Interest Rates

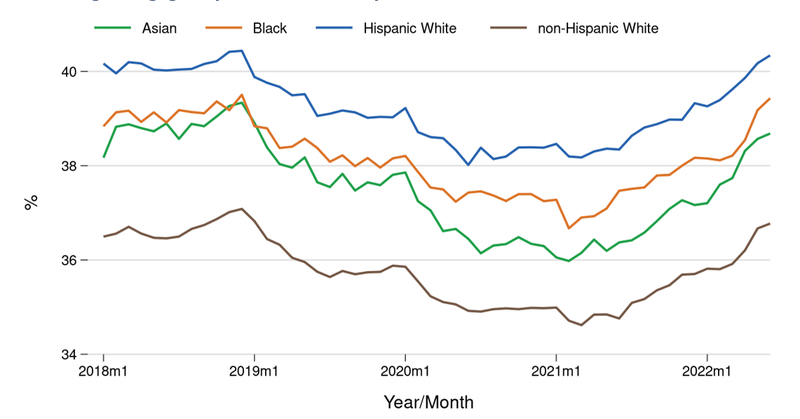

The connection between national debt and interest rates is complex but significant. The government, to finance its debt, borrows money from various sources, including both domestic and international markets. This increased government borrowing increases the overall demand for loanable funds. Think of it like this: more people (or entities in this case, the government) wanting to borrow money means the price of borrowing – the interest rate – goes up. This increased demand drives up interest rates across the board, impacting not only government bonds but also mortgages.

- Increased government borrowing competes with private sector borrowing. When the government borrows heavily, it competes with businesses and individuals for the same pool of available funds. This competition pushes interest rates higher.

- Higher demand for funds leads to higher interest rates to incentivize lending. Lenders, to compensate for the increased risk and demand, charge higher interest rates to make lending profitable.

- The Federal Reserve's response to high national debt can impact interest rate policies. The Federal Reserve, in an attempt to control inflation (often exacerbated by high national debt), might raise interest rates further, indirectly impacting mortgage rates.

- Inflation, often linked to high national debt, also pushes interest rates upwards. High inflation erodes the purchasing power of money, leading lenders to demand higher interest rates to protect against future losses. This is a vicious cycle, where high national debt contributes to inflation, which in turn leads to higher interest rates. Keywords: Interest rate hikes, government borrowing, inflation, monetary policy, Federal Reserve.

The Direct Impact on Mortgage Affordability

Higher interest rates directly translate to higher mortgage payments. This increased cost significantly impacts mortgage affordability, making homeownership a more challenging goal for many. The impact is multifaceted:

- Increased monthly payments reduce the affordability of homes for potential buyers. Even a small increase in interest rates can substantially increase the monthly mortgage payment, making a desirable home unaffordable for many potential buyers.

- Higher rates can shrink the pool of eligible borrowers. Lenders become stricter with their lending criteria, limiting the number of people who qualify for a mortgage. This is particularly challenging for first-time homebuyers with limited savings.

- It might necessitate larger down payments or shorter loan terms. To compensate for higher interest rates, borrowers might need to make larger down payments or opt for shorter loan terms to keep their monthly payments manageable.

- The impact is felt most acutely by first-time homebuyers and those with lower incomes. These groups are often the most vulnerable to changes in mortgage rates due to their limited financial resources and saving capacity. Keywords: Mortgage affordability, home buying, purchasing power, down payment, loan terms, first-time homebuyers.

Indirect Effects of National Debt on the Housing Market

The effects of high national debt don't stop at higher mortgage rates. The ripple effect extends to the broader economy and consequently, the housing market:

- Economic uncertainty can decrease consumer confidence and housing demand. High national debt can lead to economic instability and uncertainty, making people hesitant to make significant financial commitments like buying a home.

- Potential job losses can reduce borrowers' ability to qualify for mortgages. Economic downturns linked to high national debt can lead to job losses, reducing people's ability to meet the financial requirements for a mortgage.

- Investor sentiment in the real estate market can be negatively affected. Investors, sensing economic instability, might withdraw from the real estate market, decreasing investment and potentially lowering property values.

- Government policies aimed at addressing high national debt can have unintended consequences on the housing sector. Austerity measures, for example, could inadvertently negatively impact the housing market. Keywords: Economic uncertainty, consumer confidence, housing market instability, job security, real estate investment.

Strategies for Navigating High National Debt and Mortgage Rates

Despite the challenges presented by a high national debt environment, there are strategies that potential homebuyers can employ to improve their chances of securing a mortgage:

- Improve your credit score to qualify for better rates. A high credit score is crucial for securing favorable interest rates.

- Save a larger down payment to reduce the loan amount. A larger down payment minimizes the loan amount, leading to lower monthly payments.

- Compare interest rates from multiple lenders. Shop around to find the most competitive interest rates and mortgage options.

- Consider government-backed mortgage programs (if applicable). Programs like FHA loans can offer more accessible mortgage options for first-time homebuyers.

- Consult with a financial advisor. A financial advisor can provide personalized guidance tailored to your financial situation. Keywords: Credit score, down payment, mortgage lenders, loan options, financial advisor.

Conclusion

The impact of national debt on mortgage rates and affordability is undeniable. Understanding the mechanisms through which rising national debt influences interest rates and subsequently limits access to homeownership is crucial for both potential homebuyers and policymakers. By being informed and proactively addressing financial preparedness, individuals can mitigate the challenges posed by a high national debt environment. Learning about the impact of national debt on mortgages empowers you to make informed decisions regarding your homeownership aspirations. Take control of your financial future and learn more about how national debt impacts mortgages today!

Featured Posts

-

Review Of Unc Tar Heels Athletics March 10 16

May 19, 2025

Review Of Unc Tar Heels Athletics March 10 16

May 19, 2025 -

Swissquote Bank On The Latest Developments In Sovereign Bond Markets

May 19, 2025

Swissquote Bank On The Latest Developments In Sovereign Bond Markets

May 19, 2025 -

The Publics Response To The Income Disparity Between Colin Jost And Scarlett Johansson

May 19, 2025

The Publics Response To The Income Disparity Between Colin Jost And Scarlett Johansson

May 19, 2025 -

Pargs Armenian Survivor Eurovision Song Contest 2024

May 19, 2025

Pargs Armenian Survivor Eurovision Song Contest 2024

May 19, 2025 -

Nyt Connections Puzzle 674 Solutions April 15th

May 19, 2025

Nyt Connections Puzzle 674 Solutions April 15th

May 19, 2025