The Impact Of Post-Liberation Day Tariffs On Donald Trump's Billionaire Network

Table of Contents

Direct Impact on Trump-Owned Businesses

The post-Liberation Day tariffs had a direct and multifaceted impact on various industries, significantly affecting Trump's business interests.

Analysis of Tariffs on Specific Industries

The tariffs specifically targeted several sectors crucial to Trump's business portfolio. Let's examine a few:

- Real Estate: Increased construction costs due to tariffs on imported materials (steel, lumber, etc.) likely impacted the profitability of Trump's real estate ventures. Delayed projects and reduced margins could have resulted.

- Hospitality: Tariffs on imported goods (linens, furniture, appliances) used in Trump hotels and resorts increased operational costs, potentially affecting pricing strategies and profit margins. Reduced tourist spending due to overall economic uncertainty also played a role.

- Retail: If Trump held any retail interests impacted by tariffs on imported goods, the increased costs would have directly translated into higher retail prices, potentially impacting sales and consumer demand.

Specific examples of Trump businesses significantly impacted, along with quantifiable data (if available from reliable financial reports or news articles), should be included here. For instance, if a specific hotel saw a decrease in occupancy due to higher prices, that data should be cited.

Supply Chain Disruptions and their Ripple Effects

The tariffs caused significant disruption to global supply chains, further impacting Trump’s businesses:

- Increased Import Costs: Tariffs led to a substantial increase in the cost of imported goods, directly affecting the cost of production and potentially leading to price increases.

- Delays in Production: The complexity of navigating new tariff regulations caused delays in the delivery of essential materials and components, disrupting production schedules and impacting overall business efficiency.

- Reduced Profitability: The combined impact of increased costs and production delays resulted in a decrease in the overall profitability of several businesses within Trump's network.

Indirect Effects on Trump's Financial Network

Beyond the direct impact on his businesses, the tariffs also had significant indirect consequences on Trump's broader financial network.

Impact on Investments and Holdings

The economic uncertainty created by the tariffs impacted the market value of Trump's diverse investments and holdings:

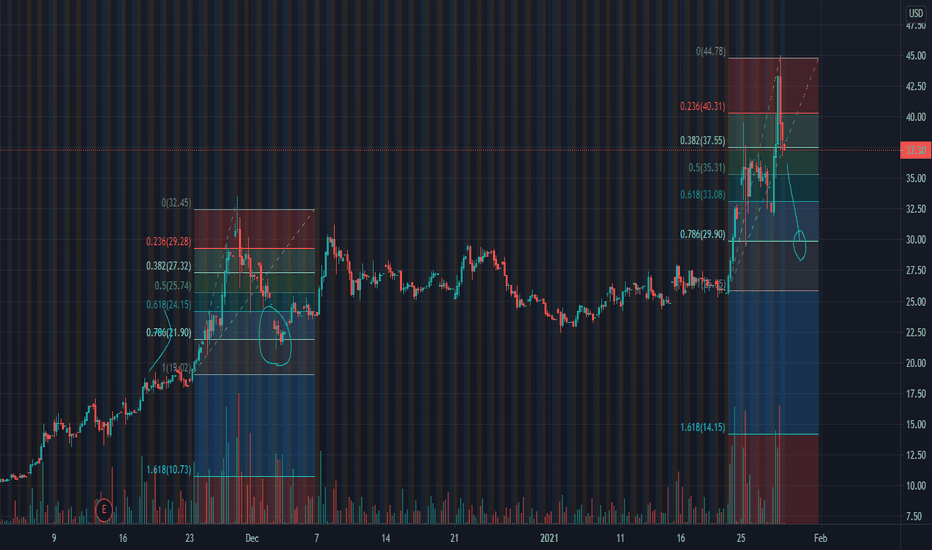

- Market Fluctuations: Global market volatility, partially fueled by tariff-related uncertainty, resulted in potential gains or losses in the value of Trump's stock market investments and other financial holdings. A detailed analysis of the specific market movements during this period would provide further insight.

- Indirect Losses: Companies within Trump's network that relied heavily on international trade were likely affected by the tariffs, leading to indirect financial losses for Trump himself.

- Decreased Valuation of Assets: The negative economic impact of the tariffs might have decreased the overall valuation of some of Trump’s assets, impacting his net worth.

Influence on Business Relationships and Partnerships

The tariffs also impacted Trump's business relationships and partnerships, both domestically and internationally:

- Strained Relationships: Tariffs may have strained relationships with international partners due to increased costs and trade disputes.

- Legal Challenges: The implementation of tariffs could have led to legal challenges or disputes between Trump's businesses and international partners.

- Shifting Alliances: The changing economic landscape may have forced Trump to re-evaluate his business alliances and partnerships, potentially leading to shifts in his overall network.

Political Ramifications and Public Perception

The post-Liberation Day tariffs and their impact on Trump's business empire had significant political consequences.

Trump's Public Statements and Policy Responses

Trump's public statements and responses to the economic repercussions of his own policies warrant careful scrutiny:

- Motivations: Analyzing Trump’s statements helps understand his motivations behind implementing the tariffs – were they purely economic, or were there underlying political objectives?

- Policy Adjustments: Did Trump's administration make any policy adjustments in response to the negative economic consequences? These adjustments should be documented and analyzed.

- Communication Strategy: How did Trump frame the economic impact of the tariffs in public communications? What was his narrative, and how was it received?

Public and Media Reaction to the Economic Effects

The public and media reaction to the economic impact of the tariffs on Trump's network played a crucial role in shaping public perception:

- Public Opinion: Public opinion polls and surveys reflecting sentiment towards the tariffs and their impact on Trump's businesses are key to understanding the overall reaction.

- Media Coverage: Analyzing media coverage of this issue can reveal the prevailing narratives and the overall tone of the reporting.

- Impact on Reputation: The economic consequences of the tariffs significantly influenced public perception of Trump’s business acumen and leadership abilities.

Conclusion: Long-Term Implications of Post-Liberation Day Tariffs on Donald Trump's Billionaire Network

The Post-Liberation Day Tariffs on Donald Trump's Billionaire Network had profound and multifaceted impacts, both direct and indirect. The tariffs affected specific industries, disrupted supply chains, and influenced the overall value of Trump's investments. The political ramifications, as seen through Trump's public statements and the public's reaction, further complicated the picture. Analyzing these impacts is crucial for understanding the long-term economic consequences and the complex relationship between trade policy and the financial landscape of powerful business figures. We encourage further research into the long-term effects of tariffs on Donald Trump's business empire, and invite you to share your insights and perspectives in the comments section below. Let's continue the discussion on analyzing the impact of post-Liberation Day tariffs and their far-reaching effects.

Featured Posts

-

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 09, 2025

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 09, 2025 -

Harry Styles Snl Impression Backlash A Disappointing Performance

May 09, 2025

Harry Styles Snl Impression Backlash A Disappointing Performance

May 09, 2025 -

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025 -

Roman Fate Season 2 A Potential Replacement Show To Avoid Spoilers

May 09, 2025

Roman Fate Season 2 A Potential Replacement Show To Avoid Spoilers

May 09, 2025 -

Eus Response To Us Tariffs French Minister Advocates For Further Action

May 09, 2025

Eus Response To Us Tariffs French Minister Advocates For Further Action

May 09, 2025