The Impact Of Tariffs On IPO Activity: A Current Market Analysis

Table of Contents

How Tariffs Affect Company Valuation and Profitability

Tariffs, essentially taxes on imported goods, create a ripple effect throughout the economy, significantly impacting businesses considering an IPO. Understanding this impact is crucial for both companies and investors.

Reduced Profit Margins

Tariffs directly increase the cost of imported goods and materials, immediately impacting a company's bottom line. This translates to:

- Reduced competitiveness in the global market: Higher production costs make it harder for companies to compete with businesses in countries without similar tariff burdens.

- Increased operational costs impacting margins: Companies may absorb some costs, reducing profit margins, or pass them on to consumers, potentially impacting demand.

- Potential for price increases leading to decreased consumer demand: Price hikes to offset tariff costs can lead to decreased consumer demand, further affecting profitability and impacting the attractiveness of the company for IPO investors.

Supply Chain Disruptions

Tariffs can severely disrupt established global supply chains, introducing uncertainty and delays. This instability can significantly influence a company's valuation before an IPO. Consider these points:

- Increased reliance on domestic suppliers (potentially at higher costs): Shifting to domestic suppliers may be necessary but can lead to increased costs if domestic options are limited or more expensive.

- Negotiating new supply contracts and potential delays: Finding and vetting new suppliers takes time and resources, potentially delaying production and impacting projected timelines for the IPO.

- Risk of production bottlenecks and missed deadlines: Supply chain disruptions can lead to production bottlenecks, resulting in missed deadlines and negatively affecting the company's reputation and investor confidence.

Investor Sentiment and Risk Assessment

The uncertainty generated by fluctuating tariff policies creates a more risk-averse investment environment. This directly impacts how investors perceive IPOs:

- Higher perceived risk associated with companies impacted by tariffs: Investors are more cautious about companies heavily reliant on imports or operating in sectors significantly affected by tariffs.

- Decreased investor confidence leading to lower demand for IPOs: Uncertainty makes investors hesitant to invest in companies facing tariff-related challenges, leading to lower demand during the IPO.

- Potential for lower IPO pricing and reduced capital raised: Reduced investor demand can force companies to lower their IPO pricing, resulting in less capital raised than initially projected.

Impact of Tariffs on Specific Sectors

Certain sectors are more vulnerable to tariff impacts than others. Understanding these sector-specific vulnerabilities is essential for evaluating IPO prospects.

Manufacturing and Technology

The manufacturing and technology sectors are especially vulnerable due to their global supply chains:

- Case studies of companies whose IPOs were delayed or scaled back due to tariff impacts: Examining real-world examples highlights the tangible effects of tariffs on IPO decisions. (Further research and specific examples would be needed here).

- Analysis of specific tariff impacts on different sub-sectors: The impact varies across sub-sectors within manufacturing and technology; some may be more heavily reliant on imported components than others.

- Discussion of hedging strategies used by companies in these sectors: Companies are employing various strategies, such as diversification of suppliers or regional production shifts, to mitigate tariff risks.

Consumer Goods and Retail

Tariffs significantly impact consumer goods and retail by affecting the price of imported goods:

- Analysis of the impact on pricing and consumer behavior: Increased prices due to tariffs can lead to decreased consumer demand, impacting sales and profitability.

- Discussion of the effect on retail margins and profitability: Retailers face a squeeze on margins as they grapple with increased costs and potential price sensitivity from consumers.

- Assessment of the long-term effects on consumer spending: Prolonged tariff impacts can lead to shifts in consumer spending patterns and long-term economic consequences.

Government Policy and Regulatory Uncertainty

Government intervention and policy uncertainty play a significant role in shaping the IPO landscape in the context of tariffs.

The Role of Government Intervention

Government policies can mitigate the negative effects of tariffs:

- Examples of government policies designed to support businesses affected by tariffs: Subsidies, tax breaks, and other incentives can help businesses offset tariff costs.

- Analysis of the effectiveness of these interventions on IPO activity: Evaluating the effectiveness of these interventions in stimulating IPO activity is crucial.

- Discussion of potential unintended consequences: Government interventions can sometimes have unintended consequences that need careful consideration.

Predicting Future Tariff Policies

The unpredictability of future tariff changes is a major source of investor hesitancy:

- Discussion of the challenges in forecasting future tariff policies: Predicting future tariff policies is inherently difficult due to geopolitical factors and changing trade relationships.

- Analysis of the impact of policy uncertainty on investor decisions: Uncertainty makes investors less willing to commit to long-term investments, impacting IPOs.

- Strategies for companies to mitigate the risk associated with tariff uncertainty: Businesses need to develop strategies to manage the risks associated with unpredictable tariff changes.

Conclusion

Tariffs and IPOs are intricately linked. The imposition and fluctuation of tariffs significantly impact company valuations, investor confidence, and the overall IPO market. Understanding these impacts is crucial for businesses considering an IPO and investors making investment decisions. By carefully considering the effects of tariffs on profitability, supply chains, and overall market sentiment, businesses can better position themselves for success in the current economic climate. Further research into specific sector-based analyses of the relationship between tariffs and IPOs is necessary for a more comprehensive understanding. Conducting thorough due diligence on how tariffs impact companies within the sectors they are considering is crucial for investors navigating this dynamic relationship between tariffs and IPOs.

Featured Posts

-

Anne Marie Davids Israel Performance A Eurovision 2025 Endorsement

May 14, 2025

Anne Marie Davids Israel Performance A Eurovision 2025 Endorsement

May 14, 2025 -

Tottenham Hotspur And Crystal Palace Battle For Young English Star

May 14, 2025

Tottenham Hotspur And Crystal Palace Battle For Young English Star

May 14, 2025 -

Sabalenkas Dominant Victory Over Mertens At Madrid Open

May 14, 2025

Sabalenkas Dominant Victory Over Mertens At Madrid Open

May 14, 2025 -

Societe Generale Appoints Alexis Kohler As Evp

May 14, 2025

Societe Generale Appoints Alexis Kohler As Evp

May 14, 2025 -

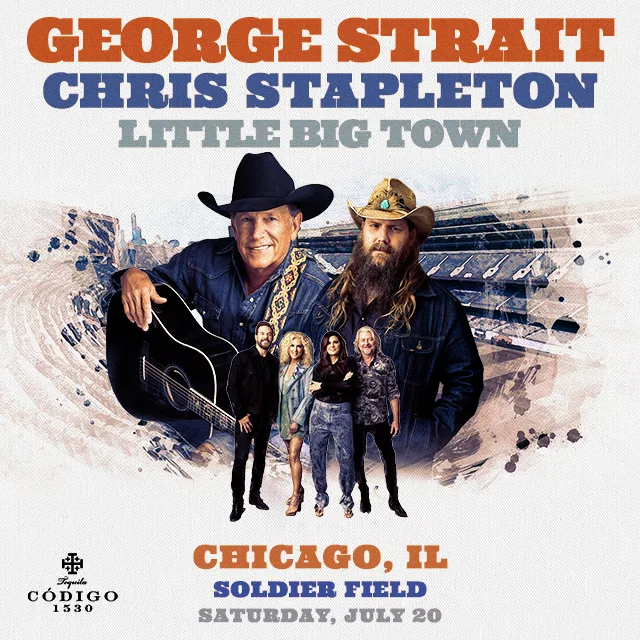

See The Dates George Strait And Chris Stapletons Joint 2025 Stadium Tour

May 14, 2025

See The Dates George Strait And Chris Stapletons Joint 2025 Stadium Tour

May 14, 2025