The Impact Of Trump's Trade War On Gold Prices

Table of Contents

Increased Economic Uncertainty and Safe-Haven Demand for Gold

Trade wars, by their very nature, inject significant economic uncertainty into global markets. This uncertainty stems from the unpredictable nature of tariff increases, retaliatory measures, and the disruption of established supply chains. Such instability naturally drives investors towards safe-haven assets, assets perceived as relatively stable and less susceptible to market fluctuations. Gold, with its long history as a store of value, fits this description perfectly.

- Increased market volatility due to trade disputes: The unpredictable nature of the Trump trade war led to heightened volatility across various asset classes, making riskier investments less appealing.

- Decline in investor confidence in riskier assets: As uncertainty mounted, investors sought to preserve capital, shifting away from equities and other riskier investments.

- Flight to safety: investors seeking preservation of capital: Gold's inherent stability made it a prime destination for investors seeking to protect their wealth during times of economic turmoil.

- Gold's historical role as a safe haven during economic turmoil: Throughout history, gold has consistently served as a safe haven asset during periods of economic and political instability, reinforcing its appeal during the trade war. This is a key reason why many investors viewed it as a gold investment opportunity.

Impact of the US Dollar on Gold Prices During the Trade War

The relationship between the US dollar and gold prices is generally inverse. A strengthening dollar often leads to lower gold prices (as gold is priced in USD), while a weakening dollar tends to boost gold prices as investors seek alternative stores of value. The Trump trade war significantly impacted the value of the dollar, creating further complexity in understanding the gold price movements.

- Strengthening dollar often leads to lower gold prices (priced in USD): When the dollar is strong, it becomes more expensive to buy gold for investors holding other currencies.

- Weakening dollar can boost gold prices as investors seek alternatives: A weaker dollar makes gold more attractive to international investors, increasing demand and potentially driving up prices.

- The impact of trade war uncertainty on the dollar's value: The uncertainty created by the trade war itself influenced the dollar's value, creating periods of both strengthening and weakening, impacting gold prices accordingly.

- Examples of specific periods where dollar movements correlated with gold price changes: Analyzing specific periods during the trade war reveals instances where dollar fluctuations directly correlated with changes in gold prices, highlighting the intricate interplay between the two.

Inflationary Pressures and Gold as an Inflation Hedge

Trade wars can generate inflationary pressures through various mechanisms. Tariffs increase the cost of imported goods, and supply chain disruptions can lead to shortages and price increases. Gold, historically, has served as a reliable inflation hedge, protecting purchasing power.

- Tariffs increasing the cost of goods: Tariffs imposed during the trade war directly increased the price of certain imported goods, contributing to inflationary pressures.

- Supply chain disruptions leading to price increases: Disruptions to global supply chains caused by the trade war led to shortages of some goods, further fueling inflation.

- Gold's historical role as an inflation hedge: Gold's value tends to increase during inflationary periods as it retains its purchasing power while fiat currencies lose value.

- How investors used gold to protect against potential inflation stemming from the trade war: Many investors viewed gold as a valuable tool to mitigate the risks associated with the inflation that could result from the trade war.

Geopolitical Risks and Gold's Appeal

The Trump trade war wasn't just an economic event; it significantly heightened geopolitical risks. The escalation of trade tensions created global uncertainty, further boosting gold's appeal as a safe haven asset.

- Escalation of trade tensions leading to global uncertainty: The unpredictable nature of the trade war and the potential for further escalation fueled uncertainty in global markets.

- Impact of trade disputes on international relations: The trade war strained relationships between major global powers, adding to the overall sense of geopolitical risk.

- Gold's role as a hedge against geopolitical uncertainty: Gold's stability and its lack of dependence on any single government or economy made it an attractive hedge against geopolitical instability.

Long-Term Effects of the Trade War on the Gold Market

The Trump trade war's impact on the gold market extended beyond the immediate period of heightened tensions. The increased economic uncertainty, even after the trade war's most intense phase, left a lasting impression on investor sentiment.

- Lasting impact of increased economic uncertainty on gold demand: The trade war created a climate of persistent uncertainty, which may continue to influence investors' decisions to favor gold.

- Changes in investor behavior towards gold post-trade war: The experience of the trade war may have shifted long-term investor behavior, leading to increased interest in precious metals as a diversification strategy.

- Long-term implications for the gold market's volatility: The volatility induced by the trade war could have lasting implications on the gold market's future price swings.

Conclusion

The Trump trade war significantly impacted gold prices. Increased economic uncertainty, fluctuations in the US dollar's value, and inflationary pressures all contributed to a surge in demand for gold as a safe haven asset and inflation hedge. The heightened geopolitical risks further amplified gold's appeal. Understanding the impact of global events like the Trump trade war is crucial for informed investment decisions. Learn more about the role of gold in diversifying your portfolio and protecting against economic uncertainty. Invest wisely in gold and other precious metals to safeguard your financial future. Consider consulting a financial advisor to determine the appropriate strategy for your individual investment needs.

Featured Posts

-

Texas Flash Flood Warning Urgent Alert For North Central Region

May 26, 2025

Texas Flash Flood Warning Urgent Alert For North Central Region

May 26, 2025 -

Hsv Aufstieg Zurueck In Der Bundesliga

May 26, 2025

Hsv Aufstieg Zurueck In Der Bundesliga

May 26, 2025 -

Deti Naomi Kempbell Vneshnost Syna I Docheri Legendarnoy Modeli

May 26, 2025

Deti Naomi Kempbell Vneshnost Syna I Docheri Legendarnoy Modeli

May 26, 2025 -

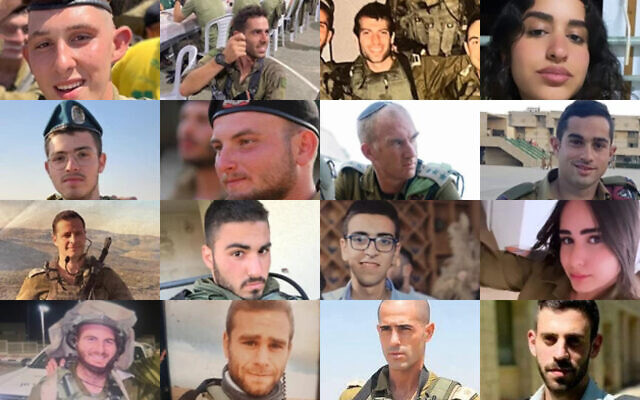

Idf Soldiers Held In Gaza Their Stories Of Strength And Perseverance

May 26, 2025

Idf Soldiers Held In Gaza Their Stories Of Strength And Perseverance

May 26, 2025 -

Disparition De La Semaine Des 5 Heures Precisions De La Rtbf

May 26, 2025

Disparition De La Semaine Des 5 Heures Precisions De La Rtbf

May 26, 2025

Latest Posts

-

Comparatif Le Samsung Galaxy S25 Ultra 256 Go Face A La Concurrence Top Produit

May 28, 2025

Comparatif Le Samsung Galaxy S25 Ultra 256 Go Face A La Concurrence Top Produit

May 28, 2025 -

Test And Avis Samsung Galaxy S25 512 Go Un Bon Plan A Saisir

May 28, 2025

Test And Avis Samsung Galaxy S25 512 Go Un Bon Plan A Saisir

May 28, 2025 -

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix 699 90 E

May 28, 2025

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix 699 90 E

May 28, 2025 -

Offre Speciale Samsung Galaxy S25 Ultra 256 Go Top Produit A 953 75 E

May 28, 2025

Offre Speciale Samsung Galaxy S25 Ultra 256 Go Top Produit A 953 75 E

May 28, 2025 -

Test Et Avis Samsung Galaxy S25 256 Go 699 90 E Une Bonne Affaire

May 28, 2025

Test Et Avis Samsung Galaxy S25 256 Go 699 90 E Une Bonne Affaire

May 28, 2025