The Impact Of US Regulations On Elon Musk's Net Worth And Tesla's Valuation

Table of Contents

Environmental Regulations and Tesla's Growth

The US regulatory environment, particularly concerning environmental protection and clean energy, has been a major driver of Tesla's success and, consequently, Elon Musk's wealth.

The Clean Energy Push

Government incentives have significantly boosted Tesla's sales and market share. These policies directly impact Tesla's profitability and, therefore, Musk's net worth.

- Tax credits for EV purchases: The federal tax credit for electric vehicles, along with state-level incentives, has made Tesla vehicles more affordable and attractive to consumers. This has translated into increased sales and a stronger market position for Tesla.

- State-level incentives for EV adoption: Many states have implemented their own incentives, such as rebates, tax exemptions, and high-occupancy vehicle lane access, further stimulating demand for Tesla vehicles.

- Federal funding for charging station infrastructure: Government investments in building a nationwide network of charging stations have addressed a key concern for potential EV buyers, increasing consumer confidence and driving sales.

These incentives have had a quantifiable impact. For example, the federal tax credit alone is estimated to have added billions of dollars to Tesla's revenue, directly influencing Tesla's stock price and, consequently, Elon Musk's net worth. The precise figures vary based on the yearly changes in credits and Tesla's sales performance.

Navigating Emission Standards

Meeting stringent US emission standards, primarily set by the Environmental Protection Agency (EPA) and the California Air Resources Board (CARB), has presented both challenges and opportunities for Tesla.

- Meeting EPA and CARB standards: Tesla's commitment to meeting and exceeding these standards has established its reputation as a leader in clean energy transportation. This compliance has been essential for market access and acceptance.

- Competition from other automakers: The increasing pressure from other automakers to meet similar standards has driven innovation within the industry. Tesla's early adoption of electric vehicle technology gave them a significant first-mover advantage.

- Innovation driven by regulatory pressure: The regulatory landscape has incentivized Tesla to continuously innovate in battery technology, vehicle efficiency, and overall sustainability, furthering its competitive edge. This ongoing innovation is a major factor in Tesla’s valuation.

Tesla's technological advancements in battery technology and vehicle efficiency, directly influenced by these regulations, are key to its continued growth and market dominance. The pressure to comply has pushed Tesla to develop superior battery technology and more efficient powertrains, securing its position in the EV market.

Securities and Exchange Commission (SEC) Scrutiny and its Consequences

Elon Musk's frequent and often controversial public statements have led to significant SEC scrutiny, with both positive and negative consequences for Tesla's valuation and Musk's personal wealth.

Controversial Tweets and Market Manipulation

Musk's use of Twitter to announce significant company decisions or make speculative statements has repeatedly drawn the attention of the SEC.

- SEC fines and settlements: The SEC has levied fines and imposed restrictions on Musk's public communications following investigations into potential market manipulation through his tweets.

- Impact on investor confidence: These events have created volatility in Tesla's stock price, impacting investor confidence and potentially eroding shareholder value.

- Limitations on Musk's public communication: The SEC's oversight has placed limitations on Musk's ability to make public statements about Tesla, affecting the company's public image and communication strategy.

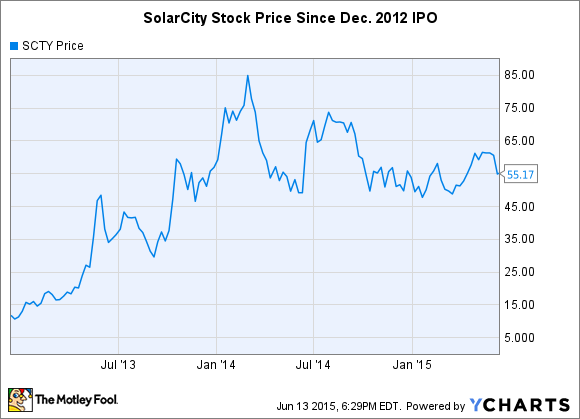

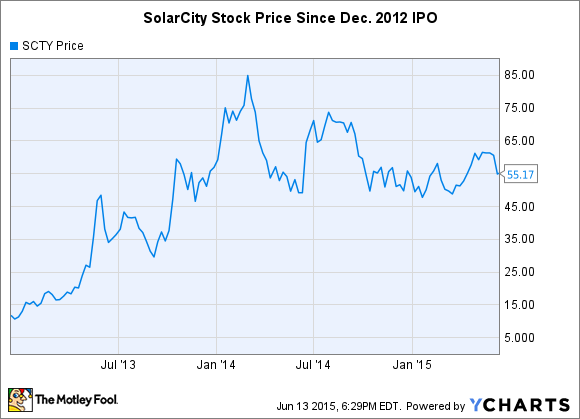

The volatility of Tesla's stock price in relation to SEC actions and Musk's public statements highlights the risks associated with such behavior. Significant price swings have directly impacted Musk's net worth, demonstrating the interconnectedness of regulatory oversight and his personal fortune.

Corporate Governance Regulations

Corporate governance regulations significantly influence Tesla's operations and Musk's leadership.

- Board composition and independence: The composition and independence of Tesla's board of directors are subject to SEC regulations and shareholder scrutiny.

- Executive compensation: Musk's compensation package, as with other publicly traded companies, is subject to regulatory guidelines and shareholder votes.

- Internal controls and compliance: Maintaining robust internal controls and complying with corporate governance regulations are crucial for Tesla's long-term success and investor confidence.

These regulations shape Tesla's business practices and affect investor perceptions, impacting the company’s overall valuation. Strong corporate governance contributes to investor confidence and a stable stock price, while deficiencies can lead to negative impacts on the company’s reputation and valuation.

Autonomous Driving Regulations and Future Implications

The development and deployment of autonomous driving technology face a complex and evolving regulatory landscape in the US. This directly impacts Tesla's valuation and future prospects.

The Race to Self-Driving Technology

Regulations governing autonomous vehicle testing and deployment are crucial for Tesla's Full Self-Driving (FSD) program.

- Federal and state regulations on autonomous vehicle testing and deployment: The patchwork of federal and state regulations creates a complex environment for developing and deploying autonomous vehicles.

- Safety standards for self-driving cars: Ensuring the safety of autonomous vehicles is paramount, requiring rigorous testing and adherence to strict safety standards.

- Competition in the autonomous vehicle market: The regulatory landscape influences the competitive landscape, with companies vying for market share and regulatory approval.

The regulatory environment significantly affects Tesla's FSD program and its potential impact on future profitability. Clear and consistent regulations are essential to encourage innovation while ensuring public safety.

Liability and Insurance Considerations

The legal and regulatory challenges related to liability for accidents involving autonomous vehicles are significant for Tesla.

- Product liability laws: Determining liability in the event of an accident involving a self-driving car raises complex legal questions.

- Insurance requirements for autonomous vehicles: The insurance industry is grappling with the unique challenges of insuring autonomous vehicles, which influences Tesla’s operational costs and risk profile.

- Data privacy regulations: The collection and use of data by autonomous vehicles raise significant data privacy concerns that require careful regulatory consideration.

Potential legal risks associated with autonomous driving technology could significantly affect Tesla's stock price and overall valuation. Addressing these legal and regulatory hurdles is crucial for Tesla's continued success in the autonomous driving market.

Conclusion

This article has explored the multifaceted impact of US regulations on Elon Musk's net worth and Tesla's valuation. From the boost provided by clean energy incentives to the challenges posed by SEC scrutiny and the evolving landscape of autonomous driving regulations, the relationship is complex and dynamic. Understanding these regulatory influences is crucial for anyone seeking to analyze Tesla's future trajectory and the factors shaping Elon Musk's considerable wealth. For further insights into the interplay between government policy and the success of innovative companies like Tesla, continue exploring the complexities of US regulations and their effects on Elon Musk's net worth and Tesla's valuation.

Featured Posts

-

Is Daycare Too Soon A Parents Guide To Navigating Early Childcare Decisions

May 09, 2025

Is Daycare Too Soon A Parents Guide To Navigating Early Childcare Decisions

May 09, 2025 -

How Harry Styles Reacted To That Awful Snl Impression

May 09, 2025

How Harry Styles Reacted To That Awful Snl Impression

May 09, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Collection For Lilysilk

May 09, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Collection For Lilysilk

May 09, 2025 -

Analysis Jessica Tarlovs Rebuttal Of Jeanine Pirros Trade War Views

May 09, 2025

Analysis Jessica Tarlovs Rebuttal Of Jeanine Pirros Trade War Views

May 09, 2025 -

127 Years Of Brewing History Anchor Brewing Company To Close

May 09, 2025

127 Years Of Brewing History Anchor Brewing Company To Close

May 09, 2025