The Long-Term Effects Of Trump's China Tariffs On The US Economy

Table of Contents

Impact on US Manufacturing and Industry

Trump's China tariffs significantly impacted US manufacturing and industry, leading to a complex interplay of positive and negative consequences.

Increased Prices for Consumers

Tariffs directly increased prices for consumers on a wide range of imported goods, from electronics and furniture to clothing and toys. This reduction in purchasing power dampened consumer spending, a crucial driver of US economic growth.

- Examples: Prices of washing machines, solar panels, and certain types of steel increased significantly.

- Statistical Data: Studies showed a measurable increase in inflation directly attributable to the tariffs, impacting lower-income households disproportionately. Specific data points should be sourced from reputable economic research institutions. (Note: Insert actual data and sources here).

- Keywords: Inflation, consumer spending, import prices, manufacturing costs, price hikes.

Shifting Production and Reshoring

Faced with higher tariffs, some US companies attempted to reshore production – bringing manufacturing back to the US – or nearshoring – shifting production to nearby countries like Mexico. However, the results were mixed.

- Success Stories: Some sectors, particularly those with high transportation costs, saw successful reshoring initiatives, leading to job creation in specific regions.

- Failures: Many companies found reshoring to be economically unviable due to higher labor costs and infrastructure limitations in the US. Others shifted production to other countries outside the scope of the tariffs, bypassing the intended effects.

- Keywords: Reshoring, nearshoring, supply chain disruption, manufacturing jobs, offshoring.

Competitiveness of US Industries

The long-term impact of Trump's China tariffs on the competitiveness of US industries is a subject of ongoing debate. While some sectors benefited from reduced competition, others faced significant challenges.

- Analysis of Specific Industries: The steel industry experienced some short-term gains due to reduced imports. However, the agricultural sector suffered considerably due to China's retaliatory tariffs.

- Comparison with Global Competitors: The tariffs arguably increased the cost of doing business in the US, hindering the competitiveness of certain sectors against global rivals.

- Keywords: Global competitiveness, trade deficit, industry performance, competitive advantage.

Agricultural Sector and the Trade War

The agricultural sector was among the hardest hit by Trump's China tariffs and the subsequent trade war.

Impact on US Farmers

US farmers faced significant challenges due to reduced exports to China, a major market for many agricultural products. Government aid programs partially mitigated the losses, but the long-term effects remain significant.

- Examples of Affected Agricultural Products: Soybeans, pork, and wheat experienced sharp declines in exports to China.

- Data on Export Losses and Farm Bankruptcies: (Insert actual data and sources here showing export losses and any increase in farm bankruptcies attributed to the tariffs).

- Keywords: Agricultural exports, farm subsidies, trade negotiations, food prices, farm incomes.

China's Retaliatory Tariffs

China responded to Trump's tariffs with its own retaliatory tariffs on US agricultural products, further exacerbating the negative impact on the US agricultural sector.

- Specific Examples of Retaliatory Tariffs: China imposed high tariffs on soybeans, leading to a significant drop in US exports.

- Effect on US Exports: This led to substantial financial losses for US farmers and a decline in the overall competitiveness of US agriculture in the global market.

- Keywords: Retaliatory tariffs, trade retaliation, bilateral trade, trade disputes.

Long-Term Economic Consequences and Global Trade Relations

Trump's China tariffs had far-reaching consequences extending beyond specific sectors, impacting overall economic health and international trade relations.

Impact on the US Trade Deficit

The intended effect of the tariffs was to reduce the US trade deficit. However, the impact was complex and the long-term results are debatable. Some argue that the tariffs did little to reduce the deficit, while others contend that their impact was obscured by other economic factors.

- Data on Trade Deficits Before and After Tariffs: (Insert actual data and sources here comparing trade deficits before and after the imposition of tariffs).

- Analysis of Contributing Factors: Many factors influence trade deficits, including exchange rates and global economic conditions, making it difficult to isolate the impact of the tariffs.

- Keywords: Trade balance, trade deficit, economic growth, trade imbalances.

Damage to Global Trade Relationships

The trade war significantly damaged US relationships with China and other trading partners, creating uncertainty and undermining global economic cooperation.

- Examples of Strained Trade Relationships: The tariffs strained relations not only with China but also with other countries affected by the trade war.

- Impact on Global Economic Cooperation: The trade war highlighted the risks of protectionist policies and their potential to disrupt global economic stability.

- Keywords: Trade agreements, international trade, geopolitical relations, trade wars.

Uncertainty and Investment

The uncertainty created by the imposition of tariffs negatively impacted business investment and economic growth. Businesses hesitated to commit to long-term investments due to the unpredictable trade environment.

- Data on Business Investment: (Insert actual data and sources here illustrating any decline in business investment during the period of tariff uncertainty).

- Economic Forecasts Affected by Tariffs: Economic forecasts were frequently adjusted downwards to account for the negative impact of the trade war on economic growth.

- Keywords: Business investment, economic uncertainty, long-term economic growth, investment decisions.

Conclusion

Trump's China tariffs had a multifaceted impact on the US economy. While some sectors experienced short-term benefits, others suffered significant losses. The agricultural sector was particularly hard hit, and the overall impact on the US trade deficit remains a subject of debate. Furthermore, the tariffs damaged US relationships with China and other trading partners, undermining global economic cooperation and creating uncertainty that hampered business investment. Understanding the complexities of Trump's China tariffs and their lasting effects on the US economy is vital for informed discussions about future trade policies. Further research into the specific impacts on individual sectors will provide a more complete picture of this complex economic issue.

Featured Posts

-

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025 -

The Blaugrana Legacy Ramiro Helmeyers Contribution

Apr 29, 2025

The Blaugrana Legacy Ramiro Helmeyers Contribution

Apr 29, 2025 -

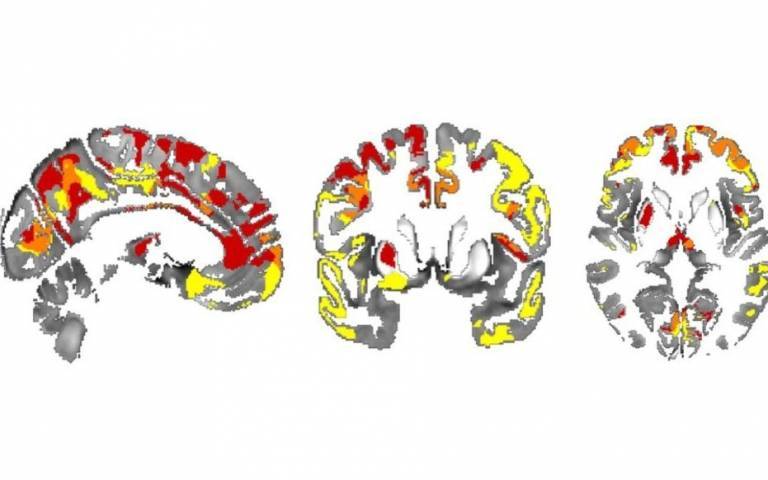

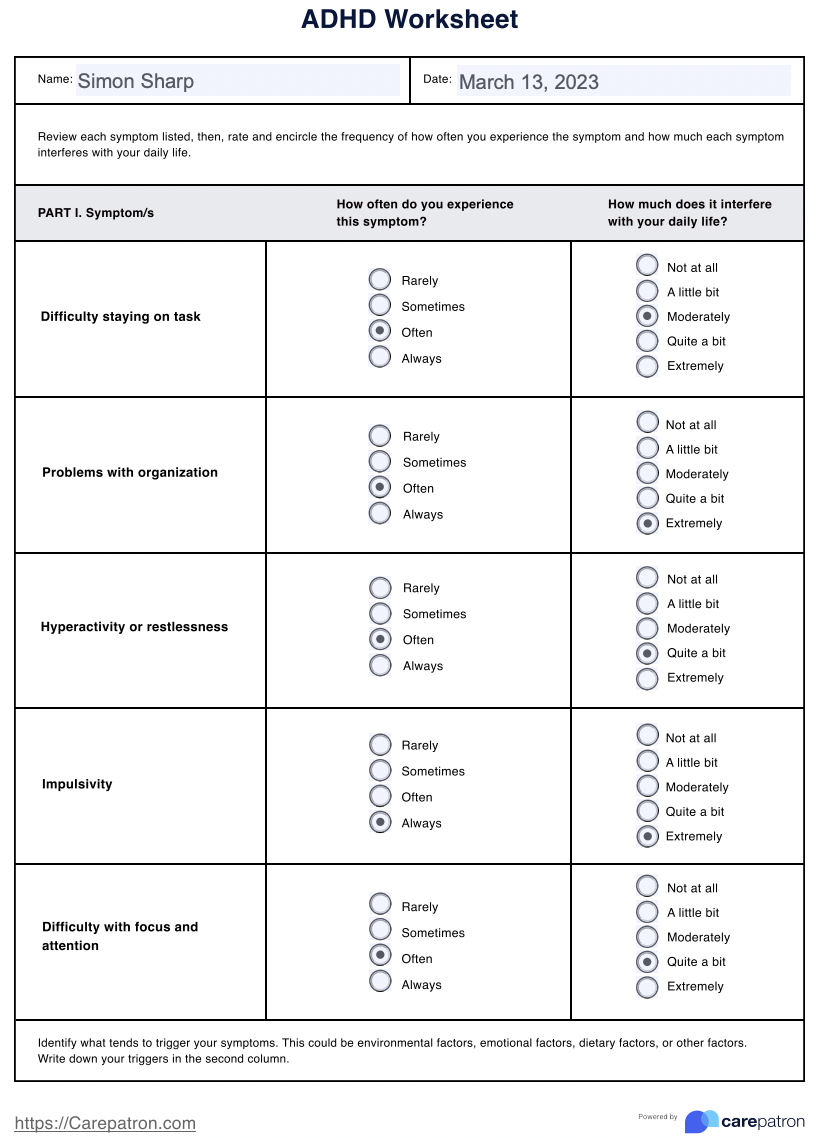

The Impact Of Brain Iron On Adhd And Cognitive Decline With Age

Apr 29, 2025

The Impact Of Brain Iron On Adhd And Cognitive Decline With Age

Apr 29, 2025 -

Understanding The Risks Research On Driving Safety For People With Adhd

Apr 29, 2025

Understanding The Risks Research On Driving Safety For People With Adhd

Apr 29, 2025 -

North Koreas Ukraine Involvement Troop Deployment Confirmed By Pyongyang

Apr 29, 2025

North Koreas Ukraine Involvement Troop Deployment Confirmed By Pyongyang

Apr 29, 2025