The Low Uptake Of 10-Year Mortgages In Canada: Reasons And Implications

Table of Contents

High Interest Rate Sensitivity and Uncertainty

The primary reason for the low uptake of 10-year mortgages in Canada is the inherent risk associated with long-term fixed rates. Fluctuations in Canadian interest rates over a decade can significantly impact affordability, leading to what's often referred to as mortgage payment shock. Predicting interest rate movements with any certainty over such a long period is extremely challenging. Even seasoned financial experts struggle with this.

- Predicting interest rate movements over 10 years is highly challenging. Economic forecasts are inherently uncertain, and unexpected events (like global pandemics or economic downturns) can drastically alter interest rate trajectories.

- A potential rise in interest rates could make monthly payments significantly higher than anticipated. Locking into a fixed rate for ten years means you're committed to that payment regardless of market shifts. If rates rise, those with shorter-term mortgages can refinance at a lower rate.

- Borrowers may prefer the flexibility of shorter-term mortgages to adapt to changing economic conditions. A 5-year mortgage Canada option allows for reassessment and refinancing based on changing circumstances like job security, income, or family size.

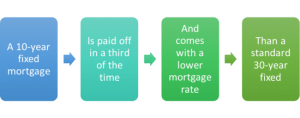

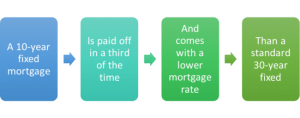

- The perceived risk outweighs the potential benefits of a lower long-term interest rate for many borrowers. While a 10-year mortgage might offer a slightly lower initial interest rate compared to shorter terms, the fear of potential significant increases outweighs this benefit for many. The perceived interest rate risk often outweighs any potential long-term savings.

Lack of Awareness and Understanding

Many Canadian homeowners aren't aware of the option of a 10-year mortgage, or they misunderstand its implications. This lack of awareness stems from several factors contributing to low uptake. A lack of proper financial education, combined with limited marketing efforts by lenders, plays a significant role.

- Limited marketing and promotion of 10-year mortgages by lenders. Lenders often prioritize shorter-term mortgages, which are more frequently sought after. This focus may unintentionally overshadow the potential benefits of longer-term options.

- Insufficient information available to consumers on the pros and cons of long-term mortgages. Clear, concise information explaining the complexities of long-term mortgage amortization and interest calculations is crucial.

- Many Canadians rely on advice from mortgage brokers who may not prioritize 10-year options. Brokers are often incentivized to sell the most common mortgage products. A proactive discussion with a broker about long-term mortgage options is crucial.

- Complexity of understanding mortgage amortization schedules and interest calculations. The inherent complexity of these calculations can deter some borrowers from even considering a 10-year mortgage. Simplified explanations and educational resources are needed.

Preference for Flexibility and Shorter-Term Options

Canadians often favor the flexibility of shorter-term mortgages, such as 5-year terms. This preference allows homeowners to refinance or renegotiate their mortgage rates as market conditions change, potentially securing better rates during periods of lower interest rates. This flexibility is attractive considering the volatility of the Canadian housing market.

- Shorter-term mortgages allow for easier adjustments to changing financial circumstances. Life events like job changes, family additions, or unexpected expenses can impact a borrower's ability to manage mortgage payments.

- The possibility of refinancing at a lower rate after a 5-year term is attractive. This potential for savings is a strong motivator for many Canadians to opt for shorter-term mortgages.

- Uncertainty around future employment or income levels influences the choice for shorter-term commitments. The desire for predictability and financial security encourages borrowers to choose shorter terms.

- The Canadian housing market's volatility can influence the desire for shorter-term mortgage commitments. Uncertainties in the housing market may lead to a preference for shorter-term mortgages to mitigate risk.

Implications for the Canadian Mortgage Market

The low uptake of 10-year mortgages has important implications for the stability and predictability of the Canadian mortgage market. This lack of diversity in mortgage terms impacts lenders, economic forecasting, housing affordability, and even the Bank of Canada's monetary policy decisions.

- Limited diversification of mortgage terms increases risk for lenders. A concentration of shorter-term mortgages exposes lenders to greater risk when interest rates fluctuate.

- Reduced predictability of long-term interest rate trends impacts economic forecasting. Accurate economic modeling requires understanding the distribution of mortgage terms across the market.

- Potential impact on the overall affordability of housing in Canada. The availability of diverse mortgage terms could influence housing affordability, impacting access to homeownership.

- Implications for the Bank of Canada's monetary policy decisions. Understanding the impact of different mortgage terms on the broader economy is crucial for effective monetary policy.

Conclusion

The low uptake of 10-year mortgages in Canada results from a combination of factors including high interest rate sensitivity, lack of awareness, and a preference for flexibility. These factors have significant implications for the Canadian mortgage market, affecting stability, affordability, and economic forecasting. Understanding the nuances of different mortgage terms, like the 10-year mortgage, is crucial for making informed financial decisions. Consult with a financial advisor to determine which mortgage term aligns with your individual circumstances and risk tolerance. Explore the potential benefits of a 10-year mortgage and consider if it could be the right long-term solution for you. Don't hesitate to compare different mortgage options and make an informed choice that secures your financial future. Choosing the right mortgage term, whether it's a 5-year mortgage Canada or a 10-year mortgage Canada, requires careful consideration of your individual financial situation.

Featured Posts

-

Sheins Faltering London Ipo A Tariff Induced Setback

May 04, 2025

Sheins Faltering London Ipo A Tariff Induced Setback

May 04, 2025 -

Dispelling The Rumors The Truth Behind The Another Simple Favor Cast Dynamics

May 04, 2025

Dispelling The Rumors The Truth Behind The Another Simple Favor Cast Dynamics

May 04, 2025 -

Temperature Plunge In West Bengal Latest Weather Report

May 04, 2025

Temperature Plunge In West Bengal Latest Weather Report

May 04, 2025 -

Singapore Elections A Test Of The Paps Grip On Power

May 04, 2025

Singapore Elections A Test Of The Paps Grip On Power

May 04, 2025 -

Nhl Playoffs Analyzing The Tight Western Conference Wild Card Race

May 04, 2025

Nhl Playoffs Analyzing The Tight Western Conference Wild Card Race

May 04, 2025

Latest Posts

-

Cancelled Fight Impacts Ufc 314 Knockout Artists Clash Off

May 04, 2025

Cancelled Fight Impacts Ufc 314 Knockout Artists Clash Off

May 04, 2025 -

Ufc 314 Results Volkanovski Vs Lopes Full Fight Card Winners And Losers

May 04, 2025

Ufc 314 Results Volkanovski Vs Lopes Full Fight Card Winners And Losers

May 04, 2025 -

Ufc 314 Suffers Setback Highly Anticipated Knockout Match Removed

May 04, 2025

Ufc 314 Suffers Setback Highly Anticipated Knockout Match Removed

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Fight Card Date And Where To Watch

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Fight Card Date And Where To Watch

May 04, 2025 -

Ufc 314 Everything You Need To Know About Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Everything You Need To Know About Volkanovski Vs Lopes

May 04, 2025