The Next Fed Chair Inherits A Trump-Made Mess

Table of Contents

The Trump Tax Cuts: A Double-Edged Sword

The 2017 tax cuts, a cornerstone of the Trump administration's economic policy, represent a significant legacy for the next Fed Chair. While proponents lauded the short-term economic boost, critics warned of long-term fiscal risks. This double-edged sword presents a complex challenge for navigating future monetary policy.

Short-Term Growth vs. Long-Term Debt

The tax cuts undeniably spurred short-term economic growth. However, this came at a steep price.

- Increased short-term GDP growth: The initial economic stimulus resulted in a temporary boost to GDP growth.

- Substantial increase in the national debt: The significant reduction in tax revenue led to a substantial increase in the national debt, placing a long-term burden on the economy.

- Effect on corporate investment: While some corporations used the tax savings for investment, much of it went to stock buybacks and increased shareholder dividends, not necessarily translating into widespread job creation or increased productivity.

- Impact on income inequality: The tax cuts disproportionately benefited high-income earners, potentially exacerbating income inequality.

This combination of short-term gains and long-term fiscal instability creates a difficult balancing act for the next Fed Chair, who must consider both economic growth and fiscal sustainability in their policy decisions. The interplay of fiscal policy (tax cuts) and monetary policy (Fed actions) will be critical in the coming years.

The Legacy of Inflationary Pressure

Another crucial aspect of the tax cuts is their potential to fuel inflation.

- Increased consumer spending: Increased disposable income due to lower taxes fueled consumer spending, putting upward pressure on prices.

- Impact on wage growth: While wage growth increased slightly, it didn't keep pace with the rise in prices, potentially leading to decreased purchasing power.

- Potential for future interest rate hikes: To combat potential inflation, the Fed might need to increase interest rates, which could slow down economic growth and potentially trigger a recession.

- Relationship between tax cuts and inflation: The long-term relationship between tax cuts and inflation is complex and debated among economists. The next Fed Chair must carefully monitor these indicators.

Trade Wars and Supply Chain Disruptions

The Trump administration's aggressive trade policies, including tariffs and trade wars, left a lasting impact on the global economy and pose a significant challenge for the next Fed Chair.

The Impact of Tariffs on Businesses and Consumers

The imposition of tariffs on imported goods had significant consequences:

- Increased prices for imported goods: Tariffs directly increased the prices of imported goods, impacting consumers and businesses reliant on global supply chains.

- Impact on manufacturing: American manufacturers faced increased costs for imported materials, reducing competitiveness and impacting profitability.

- Effects on agricultural exports: Retaliatory tariffs from other countries negatively affected American agricultural exports, impacting farmers and rural communities.

- Disruption of global supply chains: Trade wars created uncertainty and disrupted established global supply chains, leading to shortages and increased costs.

Long-Term Effects on Global Economic Relations

The trade disputes initiated by the Trump administration had long-term consequences beyond immediate economic impacts:

- Damage to international relationships: The aggressive trade tactics strained relationships with key trading partners, undermining international cooperation.

- Uncertainty for businesses: The unpredictable nature of trade policy created uncertainty for businesses, hindering investment and long-term planning.

- Potential for retaliatory tariffs: The imposition of tariffs often triggered retaliatory measures from other countries, escalating trade disputes and harming global trade.

- Impact on free trade agreements: The Trump administration's withdrawal from or renegotiation of several trade agreements further destabilized global economic relations.

Deregulation and Its Consequences

The Trump administration's push for deregulation across various sectors also presents a complex challenge for the next Fed Chair.

Environmental Rollbacks and Economic Risks

The rollback of environmental regulations had significant economic and environmental implications:

- Increased pollution: Weakening environmental standards led to increased pollution, impacting public health and the environment.

- Impact on climate change mitigation: The deregulation hampered efforts to mitigate climate change, potentially leading to long-term economic costs associated with climate-related disasters.

- Costs associated with environmental damage: The economic costs of environmental damage, including healthcare expenses and cleanup efforts, are substantial.

- Potential for future regulations: The future might see a reversal of these deregulation policies, leading to further economic uncertainty.

Financial Market Volatility and Oversight

Deregulation also impacted the stability of the financial sector:

- Increased risk-taking: Reduced regulatory oversight encouraged increased risk-taking by financial institutions, potentially increasing the likelihood of future financial crises.

- Potential for future financial crises: The weakening of financial regulations could lead to increased systemic risk and the potential for another major financial crisis.

- The role of the Fed in maintaining financial stability: The Fed plays a crucial role in maintaining financial stability, and the legacy of deregulation adds complexity to this task.

- Challenges for financial regulation: The next Fed Chair will face significant challenges in ensuring financial stability in a less regulated environment.

Conclusion

The next Fed Chair will face an unprecedented challenge: navigating a complex economic landscape significantly shaped by the Trump administration's policies. From the lingering effects of tax cuts and trade wars to the consequences of deregulation, the incoming chair must address a multitude of inherited issues that could significantly impact the U.S. and global economy. Understanding these complexities is crucial for making informed decisions about monetary policy and ensuring sustainable economic growth. Analyzing the full scope of the “Trump-made mess” is vital for the next Fed Chair and for all those interested in the future of the U.S. economy. Stay informed about the implications for the next Fed Chair and the ongoing challenges facing the Trump Economy.

Featured Posts

-

Federal Trade Commission Launches Probe Into Open Ai And Chat Gpt

Apr 26, 2025

Federal Trade Commission Launches Probe Into Open Ai And Chat Gpt

Apr 26, 2025 -

The Impact Of Chinese Auto Manufacturers On The Global Car Market

Apr 26, 2025

The Impact Of Chinese Auto Manufacturers On The Global Car Market

Apr 26, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

Apr 26, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

Apr 26, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

Apr 26, 2025

Understanding The Value Of Middle Management In Todays Workplace

Apr 26, 2025 -

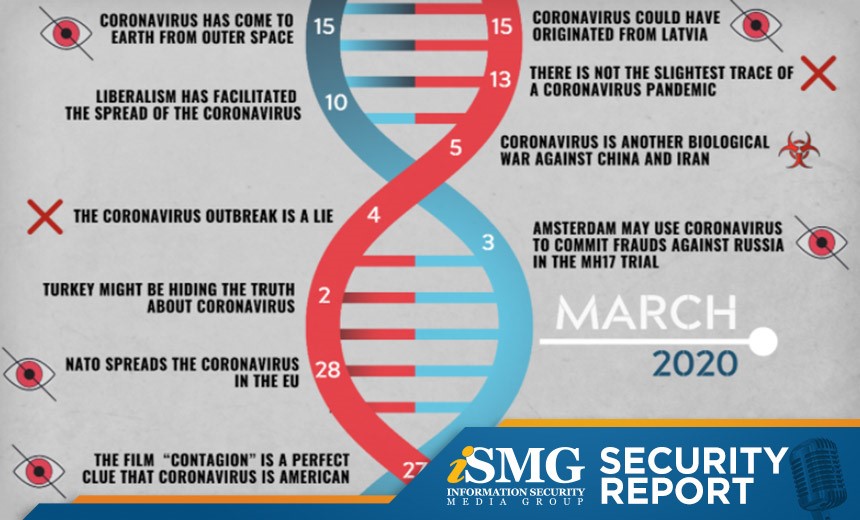

Russias Disinformation Campaign Denmark Highlights False Greenland News Targeting The Us

Apr 26, 2025

Russias Disinformation Campaign Denmark Highlights False Greenland News Targeting The Us

Apr 26, 2025

Latest Posts

-

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Professional Choices

Apr 27, 2025 -

Ariana Grandes Transformation Finding The Right Professionals For Hair And Tattoos

Apr 27, 2025

Ariana Grandes Transformation Finding The Right Professionals For Hair And Tattoos

Apr 27, 2025 -

Get Professional Help Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025

Get Professional Help Ariana Grandes Stunning Hair And Tattoo Makeover

Apr 27, 2025 -

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Role Of Professionals

Apr 27, 2025

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Role Of Professionals

Apr 27, 2025 -

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Transformation

Apr 27, 2025

Professional Hair And Tattoo Artists Inspired By Ariana Grandes Transformation

Apr 27, 2025