The Posthaste Threat: Unrest In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Central banks globally are aggressively raising interest rates to combat inflation. This directly impacts bond prices, as existing bonds with lower coupon rates become less attractive compared to newly issued bonds with higher yields. This is a key aspect of interest rate risk, a significant concern for investors in the global bond market.

-

Higher interest rates lead to lower bond prices. When interest rates rise, newly issued bonds offer higher yields, making older bonds with lower yields less desirable, thus depressing their price. This inverse relationship is fundamental to understanding bond market dynamics.

-

The yield curve inverts as short-term rates surpass long-term rates, signaling potential recession. An inverted yield curve, where short-term bond yields exceed long-term yields, is often seen as a predictor of economic slowdowns or recessions. This is because it suggests investors anticipate lower future interest rates, impacting bond valuation across the entire curve.

-

Investors face significant interest rate risk, impacting portfolio returns. Interest rate risk is the risk that changes in interest rates will negatively impact the value of a bond portfolio. This risk is amplified in a period of rising rates, as seen currently in the global bond market.

-

Diversification across maturities is crucial to manage interest rate risk. Holding bonds with varying maturities can help mitigate interest rate risk. A well-diversified portfolio is less vulnerable to the impact of interest rate fluctuations within the fixed income space.

Inflation's Persistent Grip on the Bond Market

High and persistent inflation erodes the purchasing power of fixed-income investments. This necessitates higher yields to compensate for inflation, leading to further volatility in the bond market. Understanding inflation risk is paramount for navigating the current global bond market conditions.

-

Inflation outpacing bond yields leads to negative real returns. When inflation rises faster than bond yields, investors experience a decline in the real value of their investment, impacting their overall returns. This is a significant concern for long-term investors.

-

Investors need to factor in inflation expectations when making investment decisions. Investors must consider anticipated inflation when assessing the attractiveness of different bond investments. Accurate inflation forecasting is critical for making informed decisions.

-

Inflation-linked bonds (ILBs) offer some protection against inflation risk. ILBs adjust their principal value based on inflation, providing a hedge against rising prices. They are a valuable tool for mitigating inflation risk within a diversified bond portfolio.

-

Monitoring CPI and other inflation indicators is essential. Closely following key economic indicators, such as the Consumer Price Index (CPI), helps investors anticipate future inflation and adjust their investment strategies accordingly.

Recessionary Fears and Their Impact on Credit Risk

The threat of a global recession increases the likelihood of defaults on corporate and sovereign bonds. Investors become more risk-averse, demanding higher yields for taking on increased credit risk. This heightened credit risk significantly impacts the global bond market.

-

Recessionary environments lead to higher default rates. Economic downturns increase the probability of businesses and governments failing to meet their debt obligations, increasing default risk across the board.

-

Credit ratings agencies play a crucial role in assessing credit risk. Agencies like Moody's, S&P, and Fitch provide credit ratings that help investors assess the risk of default. Careful evaluation of these ratings is crucial in mitigating credit risk.

-

Diversification across credit ratings is essential for mitigating credit risk. Investing across different credit ratings reduces exposure to potential losses from defaults. A balanced portfolio is less vulnerable to concentrated risk.

-

Careful due diligence is necessary before investing in high-yield bonds. High-yield bonds, while offering higher returns, carry significantly higher credit risk. Thorough research and analysis are necessary before investing in this segment of the global bond market.

Strategies for Navigating the Unrest in the Global Bond Market

Given the current volatility, investors need to adopt robust strategies to manage risk and protect their portfolios. Effective risk management is critical for successfully navigating the challenges of the global bond market.

-

Diversify across different bond types (government, corporate, municipal). Diversification across various bond types reduces the overall risk to your portfolio by spreading your investments among different asset classes.

-

Implement a well-defined asset allocation strategy. A clear asset allocation strategy helps align your investments with your risk tolerance and financial goals. This is a fundamental aspect of managing risk in any market, especially the volatile global bond market.

-

Consider shorter-term bonds to reduce interest rate risk. Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds, minimizing the impact of rising rates on your portfolio.

-

Explore alternative fixed-income investments. Consider alternatives such as inflation-protected securities or preferred stocks to diversify your fixed-income portfolio and enhance its resilience.

-

Employ a bond laddering strategy to manage maturity risk. Bond laddering involves staggering the maturities of your bonds to reduce the impact of interest rate changes and reinvestment risk.

Conclusion

The "posthaste" threat to the global bond market is undeniable. Rising interest rates, persistent inflation, and recessionary fears are creating a challenging environment for fixed-income investors. However, by understanding the key factors driving this volatility and implementing appropriate risk management strategies, investors can navigate this turbulent landscape effectively. Don't underestimate the "posthaste" threat; proactive portfolio management and a diversified approach are crucial for success in the current global bond market. Start planning your strategy today to mitigate the risks associated with global bond market volatility and build a resilient fixed-income portfolio.

Featured Posts

-

Atlantida Celebration Sc Ingressos Para Nando Reis Armandinho Di Ferrero E Outros

May 23, 2025

Atlantida Celebration Sc Ingressos Para Nando Reis Armandinho Di Ferrero E Outros

May 23, 2025 -

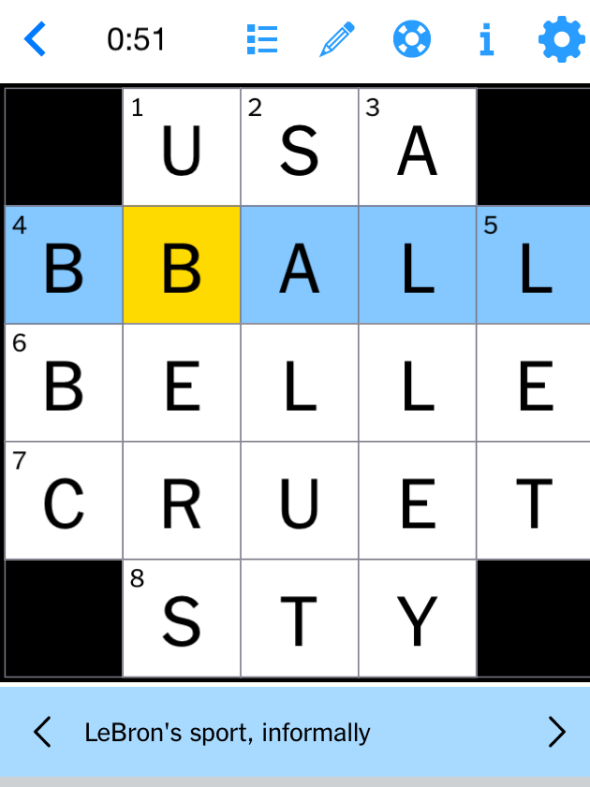

Nyt Mini Crossword March 26 2025 Full Solutions And Hints

May 23, 2025

Nyt Mini Crossword March 26 2025 Full Solutions And Hints

May 23, 2025 -

Who Drummer Addresses Dismissal Following Royal Albert Hall Incident

May 23, 2025

Who Drummer Addresses Dismissal Following Royal Albert Hall Incident

May 23, 2025 -

Jonathan Groff The Just In Time Performance And His Intense Drive To Perform

May 23, 2025

Jonathan Groff The Just In Time Performance And His Intense Drive To Perform

May 23, 2025 -

Big Rig Rock Report 3 12 Essential Updates From 99 5 The Fox

May 23, 2025

Big Rig Rock Report 3 12 Essential Updates From 99 5 The Fox

May 23, 2025

Latest Posts

-

South Floridas Ferrari Challenge Intense Racing Days Arrive

May 24, 2025

South Floridas Ferrari Challenge Intense Racing Days Arrive

May 24, 2025 -

Jymypaukku Tuukka Taponen Ja F1 Mahdollisuus 2024

May 24, 2025

Jymypaukku Tuukka Taponen Ja F1 Mahdollisuus 2024

May 24, 2025 -

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025

New Ferrari Flagship Facility Launch Bangkok Post Coverage

May 24, 2025 -

Ferrari Challenge South Florida Hosts Thrilling Racing Days

May 24, 2025

Ferrari Challenge South Florida Hosts Thrilling Racing Days

May 24, 2025 -

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025