The Potential Of XRP (Ripple) For Long-Term Financial Growth

Table of Contents

XRP's Role in Cross-Border Payments and Remittances

XRP's speed and low transaction costs offer a compelling alternative to traditional cross-border payment systems. RippleNet, Ripple's payment network, leverages XRP to facilitate faster and cheaper international transactions for banks and financial institutions. This technology has the potential to revolutionize the global remittance market, a multi-trillion dollar industry currently plagued by high fees, slow processing times, and a lack of transparency. XRP's disruptive potential stems from its ability to significantly reduce these issues.

- Faster transaction speeds compared to SWIFT: XRP transactions settle in seconds, compared to days or even weeks for traditional SWIFT transfers.

- Lower transaction fees compared to traditional methods: XRP's significantly lower fees make international transfers more affordable for both businesses and consumers.

- Increased transparency and traceability of transactions: The XRP Ledger provides a transparent and auditable record of all transactions, improving accountability and security.

- Potential for reduced fees for consumers sending remittances: By streamlining the process and reducing costs for financial institutions, XRP can lead to lower fees for consumers sending money across borders.

The global remittance market is enormous, estimated to be worth hundreds of billions of dollars annually. Even a small market share captured by XRP could translate into substantial growth for investors.

Institutional Adoption and Partnerships Driving XRP Growth

The growing adoption of XRP by major financial institutions is a key indicator of its long-term potential. RippleNet boasts a substantial network of banks and payment providers, utilizing XRP for their cross-border payment solutions. These partnerships lend credibility to XRP and signal a shift towards wider acceptance within the traditional financial system. Regulatory developments, while presenting some challenges, are also driving innovation and clearer guidelines for cryptocurrency usage within established frameworks.

- List of key financial institutions using RippleNet: This list includes major players globally, demonstrating the widespread interest and adoption of XRP within the banking sector. (Note: Specific names would need to be researched and included here for the most up-to-date information).

- Examples of successful implementations of XRP in cross-border payments: Real-world examples of successful XRP usage showcase the technology's practical application and its impact on efficiency and cost savings. (Again, specific examples need to be researched and included).

- Discussion of regulatory hurdles and their potential impact: A realistic assessment of regulatory challenges is crucial, acknowledging that ongoing developments might impact XRP's growth trajectory.

Recent strategic partnerships and announcements further solidify XRP's position within the financial landscape. Continued partnerships and successful implementations will be vital to its continued growth.

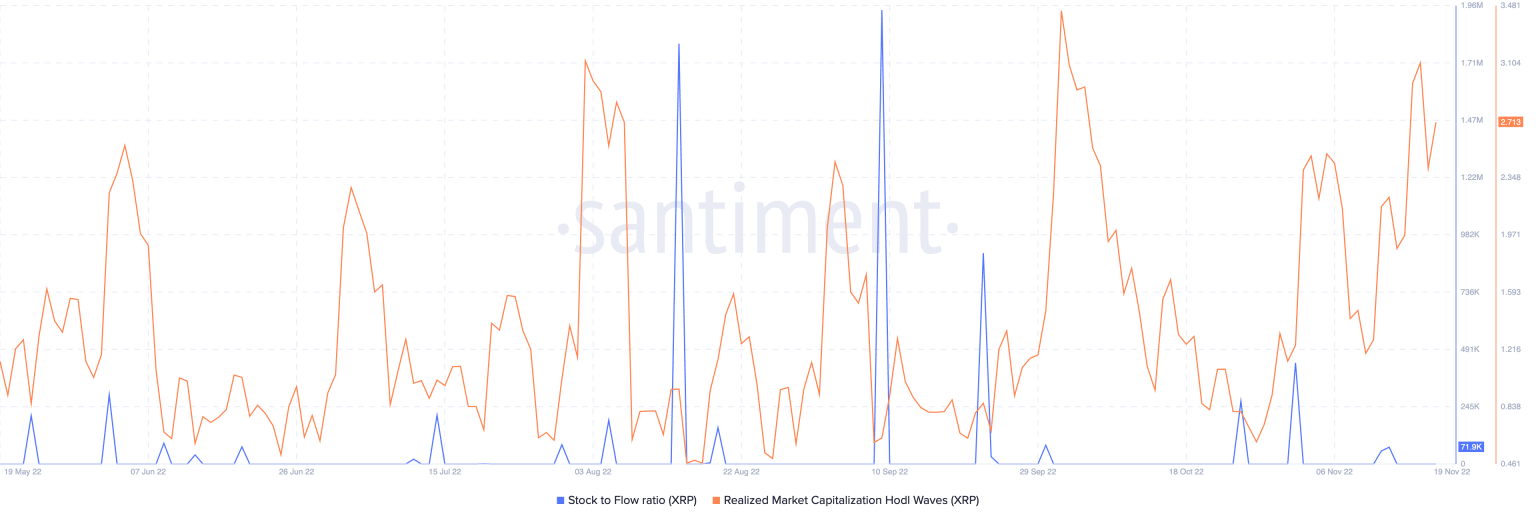

The Technological Advantages of XRP and its Scalability

XRP's technology offers several advantages over other cryptocurrencies. Its consensus mechanism, the Ripple Protocol Consensus Algorithm (RPCA), is designed for speed and efficiency, processing transactions significantly faster than many other blockchain networks. This speed, combined with its low energy consumption (compared to proof-of-work cryptocurrencies like Bitcoin), makes it a more environmentally friendly and cost-effective solution. The scalability of the XRP Ledger is another key factor, allowing it to handle a large volume of transactions without compromising speed or security.

- Explanation of the XRP Ledger's consensus mechanism (RPCA): A detailed explanation of RPCA and its benefits regarding transaction speed and security is crucial.

- Comparison of transaction speeds and fees with other cryptocurrencies: This comparison will highlight XRP’s competitive edge.

- Details on energy consumption and environmental impact: Highlighting XRP's energy efficiency positions it as a more sustainable option.

Ongoing development and upgrades to the XRP Ledger further enhance its capabilities, ensuring it remains competitive and adaptable in the ever-evolving cryptocurrency landscape.

Managing Risk and Volatility in XRP Investments

It's crucial to acknowledge the inherent volatility of the cryptocurrency market. Investing in XRP, or any cryptocurrency, involves risk. However, employing effective risk management strategies can mitigate potential losses.

- Importance of diversification in a portfolio: Diversification is a fundamental principle of investing, reducing reliance on any single asset.

- Explanation of dollar-cost averaging: Dollar-cost averaging can help smooth out the effects of volatility by spreading investments over time.

- Recommendations for risk management: Providing specific recommendations on risk management will be crucial for investors.

- Resources for further research and due diligence: Pointing investors to credible sources for research is vital.

Thorough research and a clear understanding of your risk tolerance are essential before investing in XRP.

Investing in the Future with XRP (Ripple): A Long-Term Perspective

XRP's potential for long-term growth stems from its real-world applications in cross-border payments, its increasing institutional adoption, and its technologically advanced and efficient system. While volatility remains a factor, strategic investment and risk management techniques can help navigate this uncertainty. The unique advantages of XRP, such as speed, low transaction costs, and scalability, position it as a strong contender in the future of finance.

Explore the potential of XRP and understand how this innovative cryptocurrency might contribute to your long-term financial strategy. Start your research on XRP today!

Featured Posts

-

Dyrynh Dshmny Ka Khatmh Gjranwalh Myn Fayrng Se 5 Afrad Hlak Mlzm Grftar

May 08, 2025

Dyrynh Dshmny Ka Khatmh Gjranwalh Myn Fayrng Se 5 Afrad Hlak Mlzm Grftar

May 08, 2025 -

Saving Private Ryan Ranking Its 10 Best Characters

May 08, 2025

Saving Private Ryan Ranking Its 10 Best Characters

May 08, 2025 -

Cybercriminal Makes Millions From Executive Office365 Account Hacks

May 08, 2025

Cybercriminal Makes Millions From Executive Office365 Account Hacks

May 08, 2025 -

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025 -

Vesprem Go Sobori Ps Zh Desetta Poredna Pobeda Vo Ligata Na Shampionite

May 08, 2025

Vesprem Go Sobori Ps Zh Desetta Poredna Pobeda Vo Ligata Na Shampionite

May 08, 2025