The Private Credit Job Hunt: 5 Do's And Don'ts For Success

Table of Contents

Do's of the Private Credit Job Hunt

Do: Network Strategically

Networking is paramount in the private credit world. Building relationships with professionals in the field can open doors that traditional job applications simply can't. A strong network can provide invaluable insights, lead to unadvertised opportunities, and ultimately increase your chances of securing a position.

- Attend industry events: Private equity conferences, credit fund meetings, and industry networking events are invaluable for meeting potential employers and learning about new opportunities.

- Utilize LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords and connect with recruiters specializing in private credit and professionals at your target firms. Engage with their content and participate in relevant groups.

- Informational interviews: Reach out to professionals in private credit for informational interviews. These conversations provide invaluable insights into different roles, firms, and the industry's dynamics. They also allow you to build relationships and potentially uncover hidden job opportunities.

- Leverage alumni networks: If applicable, tap into your alumni network. Many successful professionals in private credit are happy to connect with and mentor alumni from their alma maters.

Do: Tailor Your Resume and Cover Letter

Generic applications rarely cut it in the competitive private credit job market. A targeted approach, showcasing your relevant skills and experience, is essential. Each application should be meticulously crafted to align with the specific requirements and culture of the target firm.

- Quantify achievements: Instead of simply listing responsibilities, quantify your achievements whenever possible. For example, instead of "Managed a portfolio of assets," write "Managed a $50 million portfolio of assets, increasing returns by 15%."

- Use keywords: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

- Showcase understanding of private credit principles: Demonstrate your familiarity with leveraged buyouts, distressed debt, mezzanine financing, senior secured loans, and other key concepts within private credit.

- Customize: Never submit the same resume and cover letter for multiple applications. Tailor each application to the specific firm and role.

Do: Master the Interview Process

The interview stage is critical. Thorough preparation is key to showcasing your technical skills and demonstrating your suitability for the role. Private credit interviews often involve rigorous technical questions, behavioral assessments, and case studies.

- Practice answering common private credit interview questions: Brush up on your financial modeling, valuation, and credit analysis skills. Practice answering common questions about your experience, strengths, weaknesses, and career goals.

- Research the firm and interviewer: Understand the firm's investment strategy, portfolio, and culture. Research the interviewer's background and experience to tailor your responses and demonstrate genuine interest.

- Prepare insightful questions: Asking well-thought-out questions demonstrates your engagement and genuine interest in the role and the firm.

- Demonstrate enthusiasm and passion: Let your enthusiasm for private credit shine through. Showcase your interest in the industry and your commitment to a career in this dynamic field.

Do: Highlight Relevant Skills and Experience

Private credit firms look for specific skill sets and experience. Highlighting these qualities strategically in your application materials is crucial for standing out from the competition.

- Financial modeling and valuation skills: Demonstrate proficiency in building financial models, conducting valuations, and performing sensitivity analysis.

- Credit analysis and underwriting experience: Showcase your experience in analyzing credit risk, underwriting loans, and structuring debt transactions.

- Strong analytical and problem-solving abilities: Highlight your ability to analyze complex financial data, identify key risks and opportunities, and develop effective solutions.

- Experience with debt instruments: Demonstrate your understanding and experience with various debt instruments, including senior secured loans, mezzanine debt, subordinated debt, and distressed debt.

Don'ts of the Private Credit Job Hunt

Don't: Neglect Your Online Presence

Your online presence reflects your professionalism and brand. A strong online profile can significantly enhance your chances of securing a private credit role.

- Maintain a professional LinkedIn profile: Ensure your profile is complete, accurate, and up-to-date. Use keywords relevant to private credit and highlight your achievements.

- Ensure your resume is easily accessible online: Make your resume easily accessible through LinkedIn or a personal website.

- Be mindful of your social media presence: Review your social media profiles and ensure they present a professional image.

Don't: Apply Broadly Without Targeting

Sending out mass applications without proper research is inefficient and ineffective. A targeted approach, focusing on firms and roles that align with your skills and interests, significantly improves your chances of success.

- Research firms thoroughly: Before applying to any firm, thoroughly research its investment strategy, portfolio, culture, and team.

- Target specific roles: Focus on roles that align with your skills, experience, and career goals.

- Tailor your application materials: Customize your resume and cover letter to match the specific requirements of each role.

Don't: Underestimate the Importance of Due Diligence

Due diligence is essential in any job search, and even more so in the competitive private credit industry. Researching potential employers thoroughly demonstrates your professionalism and commitment.

- Understand the firm's investment strategy and portfolio: Familiarize yourself with the firm's investment focus, target sectors, and recent transactions.

- Research the firm's culture and values: Understand the firm's work environment, values, and employee reviews.

- Learn about the team you'll be working with: Research the team members you may be working with to better understand their experience and expertise.

Don't: Rush the Process

The private credit job hunt can be lengthy. Patience and persistence are key. Don't get discouraged by rejections; view them as learning opportunities and continue to refine your approach.

- Be prepared for a lengthy process: The interview process for private credit roles can be extensive, involving multiple rounds of interviews and assessments.

- Stay positive and persistent: Maintain a positive attitude throughout the job search and don't give up easily.

- Network continuously: Continue to network, even after receiving rejections. Maintain your connections and build new relationships.

Conclusion

Successfully navigating the private credit job hunt requires a strategic and targeted approach. By following the "dos" and avoiding the "don'ts" outlined above, you can significantly increase your chances of landing your dream private credit job. Remember, the private credit market is highly competitive, but the rewards are substantial. Implement this advice, refine your approach based on feedback, and master the private credit job search to secure your place in this exciting and lucrative field. Land your dream private credit job today!

Featured Posts

-

How Ai Learns And Doesn T A Guide To Responsible Implementation

May 31, 2025

How Ai Learns And Doesn T A Guide To Responsible Implementation

May 31, 2025 -

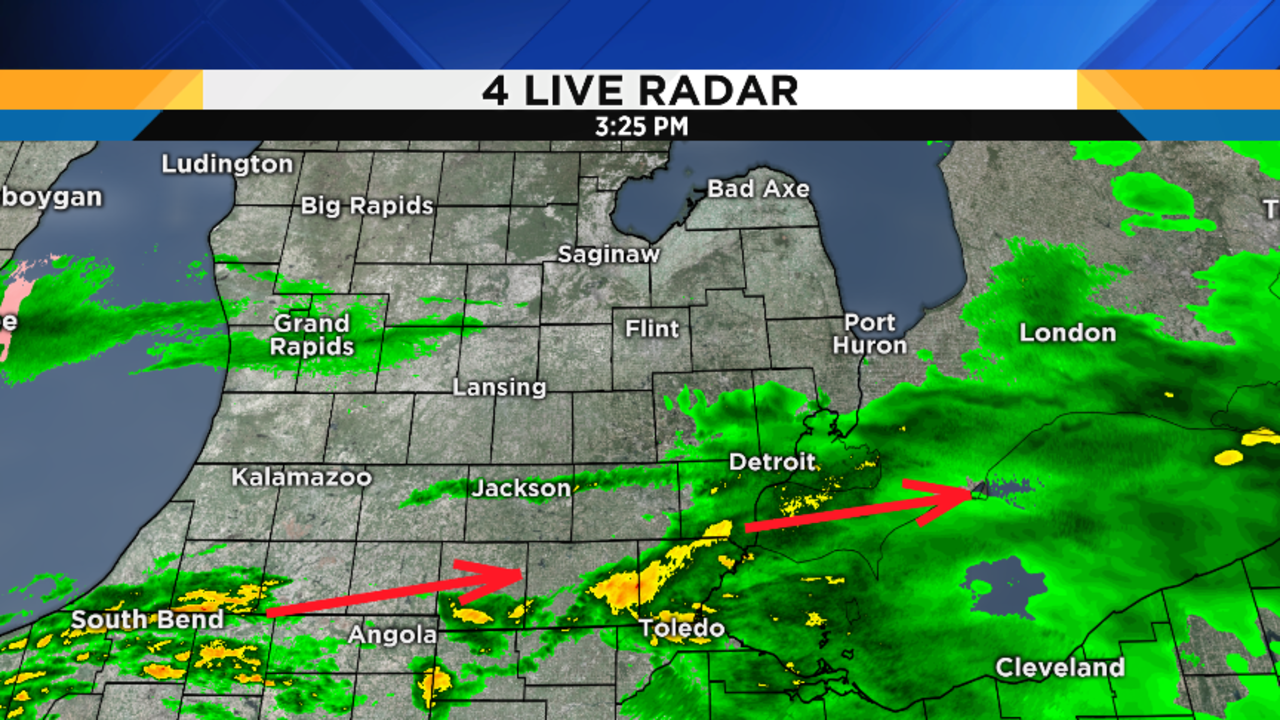

Metro Detroit Weather Sunny Skies After A Cool Monday

May 31, 2025

Metro Detroit Weather Sunny Skies After A Cool Monday

May 31, 2025 -

Jaime Munguias Drug Test Result Official Statement Released

May 31, 2025

Jaime Munguias Drug Test Result Official Statement Released

May 31, 2025 -

Pope Leo Xiv And The Giro D Italia A Historic Vatican Encounter

May 31, 2025

Pope Leo Xiv And The Giro D Italia A Historic Vatican Encounter

May 31, 2025 -

How To Achieve The Good Life Steps To A Meaningful Existence

May 31, 2025

How To Achieve The Good Life Steps To A Meaningful Existence

May 31, 2025