The Reasons Behind The Recent Bitcoin Mining Boom

Table of Contents

The Rise of Institutional Investors and Increased Institutional Adoption

The growing involvement of large institutional investors is a significant driver of the Bitcoin mining boom. This shift from individual miners to large-scale corporate players has fundamentally reshaped the landscape. Increased institutional Bitcoin mining signifies a growing acceptance of Bitcoin as a viable asset class and a belief in its long-term potential.

- Increased institutional investment reduces risk perception, attracting more capital: The entry of established financial institutions lends credibility to Bitcoin mining, mitigating the perceived risks and attracting substantial capital inflows. This reduces the reliance on individual investors and allows for larger, more stable operations.

- Sophisticated mining operations benefit from economies of scale: Institutional miners leverage economies of scale, negotiating better rates for hardware, electricity, and other resources. This cost advantage allows them to maintain profitability even during periods of price volatility.

- This influx of capital leads to expansion of mining farms and increased hash rate: The increased investment translates directly into the expansion of mining farms, leading to a significant increase in the overall Bitcoin network hash rate. This enhances the network's security and resilience.

- Examples of large-scale institutional mining initiatives: Several publicly traded companies and private investment firms have made significant investments in Bitcoin mining, demonstrating the growing institutional interest and its impact on the Bitcoin mining boom. These initiatives showcase the commitment of large players to securing the Bitcoin network and profiting from its growth. Examples include (insert relevant examples here, ensuring they are up-to-date).

Technological Advancements in Bitcoin Mining Hardware

Improvements in ASIC (Application-Specific Integrated Circuit) chip technology are another critical factor contributing to the Bitcoin mining boom. The development of more efficient and powerful ASIC miners has dramatically lowered the barrier to entry and increased the profitability of mining.

- More efficient ASIC miners consume less energy while increasing hashing power: Advances in chip design have led to ASIC miners that deliver significantly higher hashing power while consuming less energy. This translates into lower operating costs and improved profitability.

- The development of more energy-efficient hardware makes mining more profitable, especially in regions with low electricity costs: The reduction in energy consumption makes mining economically viable in regions with access to cheaper electricity, further fueling the boom. This has led to a geographic shift in mining operations.

- Discussion of specific advancements in chip technology and their impact on the Bitcoin mining boom: (Insert details on specific technological advancements such as improved chip architecture, manufacturing processes, or cooling systems. Mention specific manufacturers and their contributions).

- Mention of the impact of specialized hardware on decentralization: While the use of specialized hardware like ASIC miners has centralized some aspects of mining, it also has led to a more secure and robust network overall. The increased hash rate acts as a deterrent against attacks.

Geopolitical Factors and Regulatory Landscape

Governmental regulations and policies significantly influence Bitcoin mining activity. Favorable regulatory environments and access to low-cost energy have driven the migration of miners to specific regions.

- Some regions offer favorable regulatory environments and low electricity costs: Countries with clear regulatory frameworks, stable political environments, and access to abundant renewable energy resources have become attractive destinations for Bitcoin mining operations.

- The impact of China's mining ban and subsequent migration of miners to other regions: China's crackdown on Bitcoin mining in 2021 resulted in a significant shift of mining operations to other countries, including the US, Kazakhstan, and others. This migration significantly impacted the global distribution of mining hash rate.

- Analysis of how different government policies incentivize or discourage Bitcoin mining activity: Government policies, such as tax incentives, energy subsidies, or outright bans, have a direct impact on the profitability and location of Bitcoin mining operations.

- Discussion on the environmental impact of Bitcoin mining and how regulations are addressing these concerns: The environmental impact of Bitcoin mining, particularly energy consumption, is a growing concern. Regulations aimed at promoting sustainable energy sources and reducing carbon emissions are becoming increasingly important.

The Price of Bitcoin and Mining Profitability

The price of Bitcoin is directly correlated with the profitability of Bitcoin mining. Higher Bitcoin prices lead to increased mining rewards, making mining more attractive and contributing to the boom.

- Higher Bitcoin prices directly translate to higher mining rewards: The reward for successfully mining a block of Bitcoin transactions is directly proportional to the Bitcoin price. Higher prices mean greater rewards, incentivizing more mining activity.

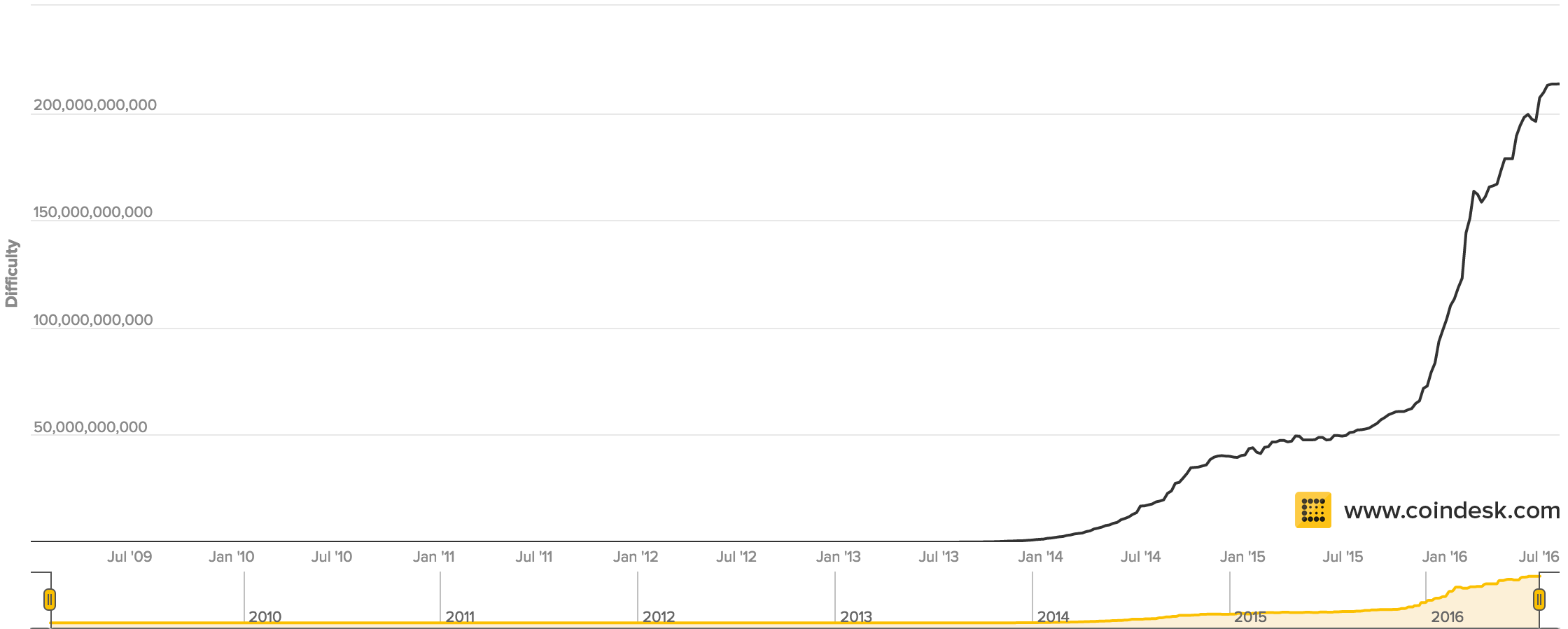

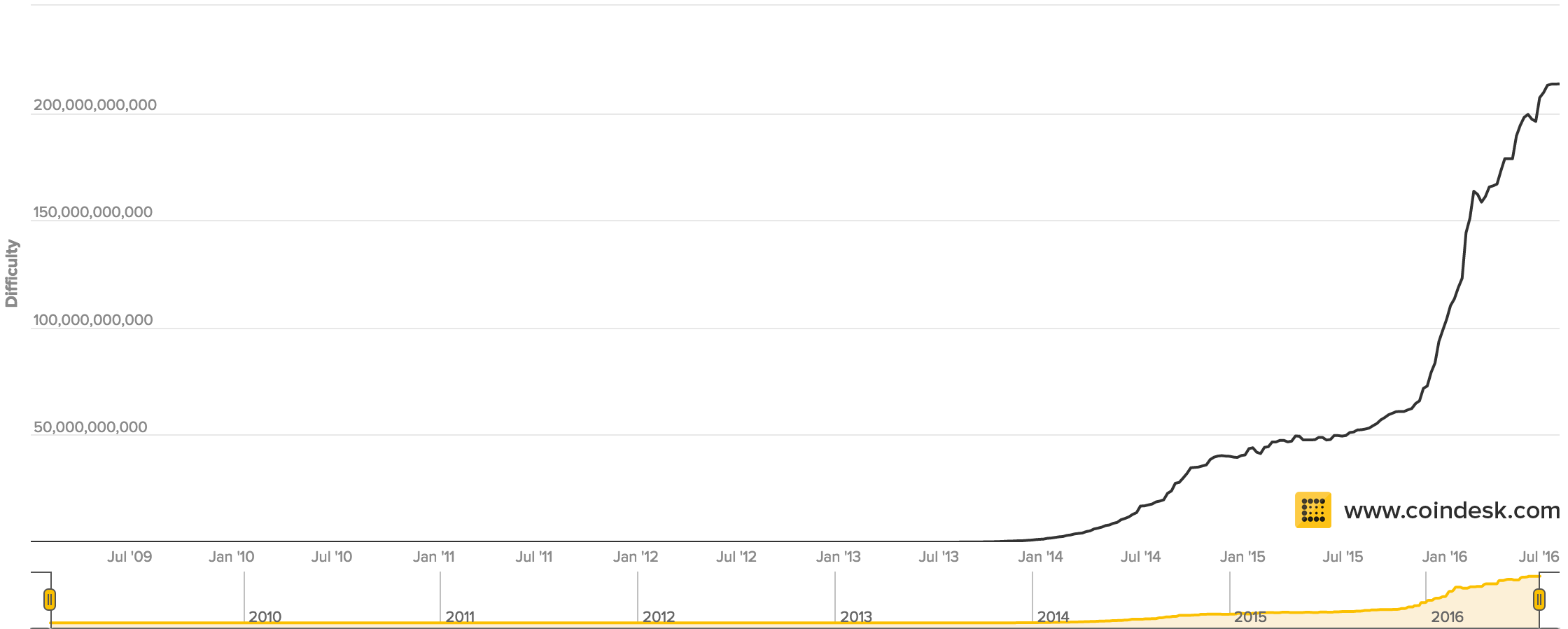

- Explanation of the mining difficulty adjustment and its impact on profitability: The Bitcoin network automatically adjusts its mining difficulty to maintain a consistent block generation time. Increased mining activity leads to increased difficulty, impacting profitability.

- Analysis of the relationship between Bitcoin's price volatility and the boom-bust cycles in mining activity: Bitcoin's price volatility creates boom-and-bust cycles in the mining industry. Sharp price drops can make mining unprofitable, leading to a decline in activity.

- Discussion of alternative revenue streams for miners beyond block rewards (e.g., transaction fees): Miners can generate revenue from transaction fees, which are paid by users to prioritize their transactions. This diversification of revenue streams can help mitigate risks associated with price volatility.

Conclusion

The recent Bitcoin mining boom is a multifaceted phenomenon driven by a confluence of factors. Increased institutional investment, technological advancements in mining hardware, evolving geopolitical landscapes, and the price of Bitcoin itself all play crucial roles. Understanding these intertwined elements provides crucial insight into the future of Bitcoin mining and the broader cryptocurrency landscape. To stay informed about the latest developments and the ongoing impact of the Bitcoin Mining Boom, continue researching industry trends and news related to Bitcoin mining. Stay ahead of the curve and understand the dynamic forces shaping the future of this crucial aspect of the Bitcoin ecosystem.

Featured Posts

-

3 Actions You Can Take This International Transgender Day Of Visibility

May 09, 2025

3 Actions You Can Take This International Transgender Day Of Visibility

May 09, 2025 -

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025 -

Meet The Iditarod Rookies A Look At Seven Teams Chasing Nome

May 09, 2025

Meet The Iditarod Rookies A Look At Seven Teams Chasing Nome

May 09, 2025 -

Elizabeth City Road Fatal Accident Leaves Two Pedestrians Dead

May 09, 2025

Elizabeth City Road Fatal Accident Leaves Two Pedestrians Dead

May 09, 2025 -

Ferdinand Changes Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Ferdinand Changes Champions League Final Prediction Psg Vs Arsenal

May 09, 2025