The Ripple (XRP) Phenomenon: A Path To Financial Independence?

Table of Contents

Understanding Ripple (XRP) and its Technology

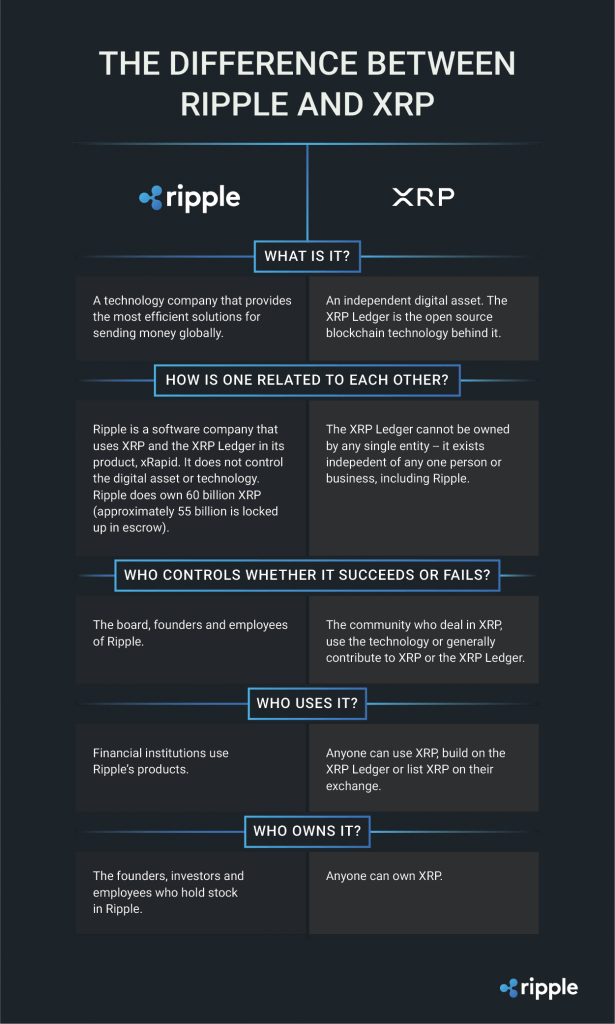

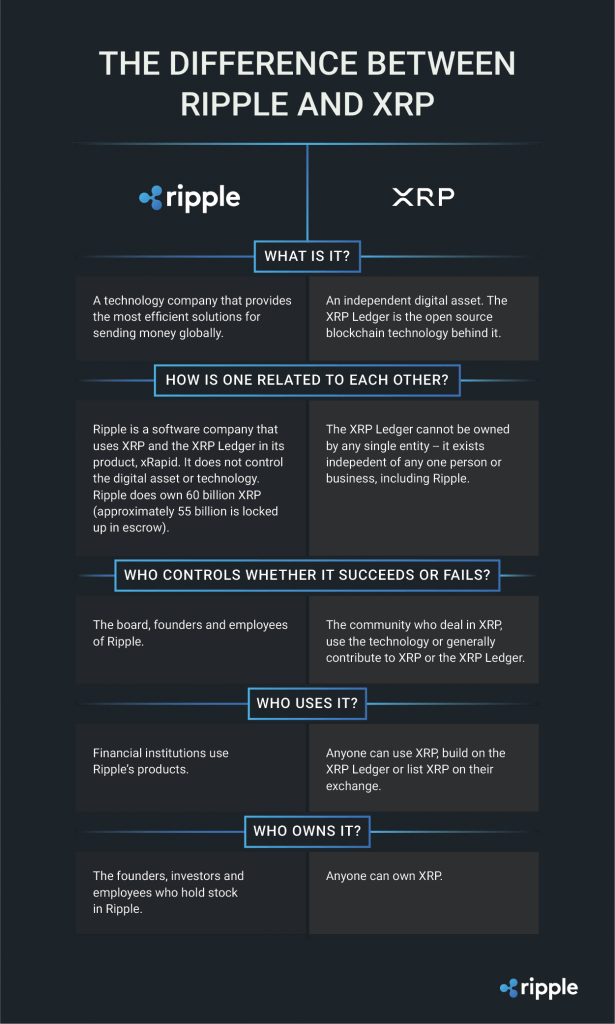

Ripple (XRP) is a cryptocurrency designed to facilitate fast and efficient international money transfers. Unlike Bitcoin, which relies on a decentralized proof-of-work system, XRP operates on a unique consensus mechanism within the RippleNet network. This network connects banks and financial institutions, enabling them to transfer various currencies, including fiat and cryptocurrencies, quickly and affordably.

- XRP's role in RippleNet: XRP acts as a bridge currency, facilitating conversions between different currencies during transactions on the RippleNet network. This reduces transaction times and costs significantly.

- Transaction speed and fees: XRP transactions are significantly faster and cheaper than those on networks like Bitcoin and Ethereum. This speed and efficiency are crucial for attracting large financial institutions seeking seamless cross-border payments.

- Scalability and potential adoption: Ripple's technology is designed for high scalability, capable of handling a large volume of transactions per second. This scalability is a key factor contributing to its potential for widespread adoption in the global financial system.

- Regulatory challenges and legal battles: Ripple has faced regulatory scrutiny and legal battles, particularly in the United States, impacting its price and overall market sentiment. Navigating the evolving regulatory landscape is a crucial consideration for investors.

XRP's Potential for Investment and Returns

The potential for profit from XRP investment is undeniable, but it's crucial to acknowledge the inherent risks. The cryptocurrency market is notoriously volatile, and XRP is no exception.

- Historical price analysis: XRP has experienced periods of dramatic price increases and significant drops. Examining historical highs and lows provides valuable context for understanding its volatility and potential for future growth.

- Factors influencing XRP price: Market sentiment, regulatory news (like the ongoing SEC lawsuit), and the rate of adoption by financial institutions all play significant roles in determining XRP's price. Positive developments often lead to price increases, while negative news can cause substantial drops.

- Investment strategies: Investors can adopt various strategies, from long-term holding (HODLing) based on a belief in its long-term potential to short-term trading based on price fluctuations. Each carries different levels of risk and reward.

- Portfolio diversification: Diversifying your cryptocurrency portfolio by investing in various cryptocurrencies, including Ripple (XRP), and other asset classes (like stocks and bonds) is crucial for mitigating risk. Don't put all your eggs in one basket.

The Risks Associated with XRP Investment

Investing in XRP, like any cryptocurrency, involves substantial risk. The highly volatile nature of the market necessitates a cautious and informed approach.

- Market volatility: The price of XRP can fluctuate dramatically in short periods, potentially resulting in significant losses. News, market sentiment, and regulatory changes can trigger sharp price movements.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and uncertainty surrounding XRP's regulatory status poses a considerable risk. Legal challenges can significantly impact its price and future prospects.

- Potential for scams: The cryptocurrency market is susceptible to scams and fraudulent activities. Exercise extreme caution and only invest through reputable and regulated platforms.

- Importance of thorough research: Before investing in XRP or any cryptocurrency, conduct extensive due diligence, understanding the technology, market dynamics, and associated risks.

Alternatives to XRP for Financial Independence

While XRP offers potential, achieving financial independence requires a diversified approach. Consider these alternatives:

- Traditional investments: Stocks, bonds, and real estate are established investment vehicles with varying levels of risk and return. They can play a vital role in a diversified portfolio.

- Other cryptocurrencies: Exploring other cryptocurrencies with different functionalities and potential can further diversify your investment strategy.

- Diversified portfolio: A well-diversified investment portfolio, combining traditional assets and cryptocurrencies like XRP, is crucial for mitigating risk and maximizing long-term returns.

Conclusion

Ripple (XRP) presents a potentially lucrative investment opportunity, but it's essential to acknowledge the significant risks involved. Its potential for facilitating fast and inexpensive transactions is attractive, but its price volatility and regulatory uncertainty cannot be overlooked. Remember, thorough research, prudent risk management, and diversification are paramount for responsible cryptocurrency investment and achieving financial independence. While Ripple (XRP) offers intriguing possibilities, remember that investing in cryptocurrency involves significant risk. Thoroughly research the Ripple (XRP) market and other investment options before making any decisions. Are you ready to explore the potential of Ripple (XRP) and other cryptocurrencies as part of your financial independence journey? Learn more about responsible cryptocurrency investing today.

Featured Posts

-

Ireland On High Alert After Frances Six Nations Win Against Italy

May 01, 2025

Ireland On High Alert After Frances Six Nations Win Against Italy

May 01, 2025 -

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025

Michael Sheen And Sharon Horgans British Drama Finds A New Home

May 01, 2025 -

Grote Stroomstoring Breda 30 000 Huishoudens Zonder Stroom

May 01, 2025

Grote Stroomstoring Breda 30 000 Huishoudens Zonder Stroom

May 01, 2025 -

Michael Sheen Donates 100 000 To Clear 1 Million Debt A Charitable Act

May 01, 2025

Michael Sheen Donates 100 000 To Clear 1 Million Debt A Charitable Act

May 01, 2025 -

Groningen Malek F Verdacht Van Neersteken Patient In Van Mesdagkliniek

May 01, 2025

Groningen Malek F Verdacht Van Neersteken Patient In Van Mesdagkliniek

May 01, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025 -

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025 -

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025 -

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025