The Rising Cost Of Offshore Wind: Impact On Investment

Table of Contents

Factors Driving Up Offshore Wind Costs

Several interconnected factors are contributing to the escalating cost of offshore wind projects, threatening to slow down the much-needed expansion of this renewable energy source.

Increasing Material and Labor Costs

The cost of raw materials essential for offshore wind turbine construction has skyrocketed. Steel, concrete, and specialized components are all subject to significant price inflation. This is exacerbated by supply chain disruptions, impacting project timelines and budgets. Furthermore, the industry faces a severe shortage of skilled labor, particularly welders, technicians, and engineers, leading to wage inflation and competition for expertise.

- Supply chain disruptions: Global events and geopolitical instability have created bottlenecks in the supply of crucial materials.

- Inflation: Broad economic inflation impacts the cost of all components and services involved in offshore wind farm construction.

- Increased demand for skilled workers: The rapid expansion of the offshore wind sector outpaces the availability of trained personnel.

- Rising transportation costs: The logistical challenges of transporting massive turbine components to offshore locations add significantly to the overall cost.

Technological Challenges and R&D Expenditure

Developing offshore wind farms presents unique technological hurdles. Site surveys for optimal locations are complex and costly. Designing foundations capable of withstanding the challenging seabed conditions in deep waters demands significant engineering expertise and innovation. Grid connection presents another major obstacle, requiring substantial investment in new infrastructure. Furthermore, continuous research and development are necessary to improve turbine efficiency and reduce costs, adding to the overall expenditure.

- Deepwater installation challenges: Installing turbines in deeper waters is significantly more complex and expensive than in shallower waters.

- Grid infrastructure limitations: Existing grid infrastructure often needs upgrading to accommodate the large influx of power from offshore wind farms.

- Research and development costs for next-generation turbines: Innovation in turbine design, materials, and installation techniques requires substantial investment.

- Cable laying complexities: Laying and maintaining the extensive network of underwater cables connecting offshore wind farms to the grid is challenging and costly.

Regulatory Hurdles and Permitting Delays

Navigating the regulatory landscape for offshore wind projects is often a lengthy and complex process. Environmental impact assessments (EIAs), stakeholder consultations, and obtaining various permits can significantly prolong project timelines, adding substantial costs. These delays contribute to increased financing costs and potential project cancellations.

- Lengthy permitting processes: Bureaucratic hurdles and lengthy review processes increase project development times and costs.

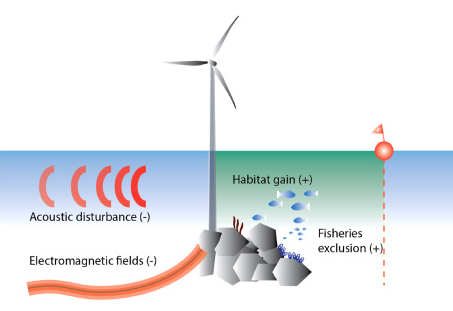

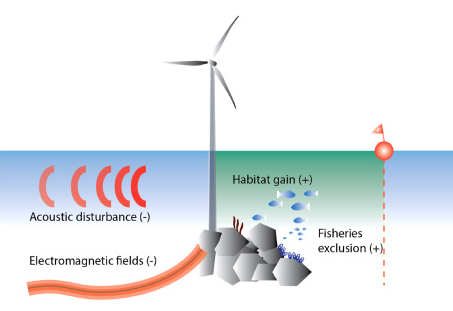

- Stakeholder engagement: Extensive consultations with local communities, fishermen, and other stakeholders are necessary but can be time-consuming.

- Environmental impact assessments (EIA): Rigorous environmental assessments are crucial but add to the project’s cost and duration.

- Grid connection approvals: Securing the necessary approvals for grid connection is a critical but often protracted process.

- Navigational and fisheries considerations: Careful planning is required to minimize disruption to shipping lanes and fishing activities.

Impact on Investment Decisions

The rising costs of offshore wind are having a significant impact on investment decisions within the sector.

Reduced Investor Confidence

The increased cost uncertainties are making offshore wind projects less attractive to investors. Higher internal rates of return (IRR) are now demanded to compensate for the increased risks, potentially deterring investment. Securing project financing is becoming more challenging, with investors becoming more risk-averse.

- Higher internal rate of return (IRR) requirements: Investors require higher returns to justify the increased risk associated with higher costs.

- Increased risk profiles: Cost overruns and delays increase the uncertainty and risk associated with offshore wind investments.

- Difficulty securing project financing: Banks and financial institutions are becoming more cautious in lending for offshore wind projects.

- Competition for capital: Offshore wind projects are competing with other investment opportunities for limited capital.

Project Delays and Cancellations

Cost overruns and difficulties securing financing can lead to project delays or even cancellations. This not only impacts the achievement of renewable energy targets but also results in financial losses for investors and developers, potentially creating stranded assets – investments that fail to generate a return.

- Impact on renewable energy targets: Delays and cancellations threaten the ability to meet national and international renewable energy goals.

- Stranded assets risk: Projects that are delayed or cancelled can result in significant financial losses for investors.

- Financial losses for investors and developers: Cost overruns and delays can lead to substantial financial losses.

Government Support and Subsidies

Government policies, subsidies, and incentives play a crucial role in mitigating the impact of rising costs and attracting investment in offshore wind. Tax credits, renewable energy mandates, government guarantees, and power purchase agreements (PPAs) can help to make offshore wind projects more financially viable.

- Tax credits: Tax incentives can reduce the overall cost of offshore wind projects, making them more attractive to investors.

- Renewable energy mandates: Government mandates requiring a certain percentage of electricity to come from renewable sources create demand and incentivize investment.

- Government guarantees: Government guarantees can reduce the risk associated with offshore wind investments, making them more attractive to lenders and investors.

- Power purchase agreements (PPAs): PPAs provide long-term contracts for the purchase of electricity generated by offshore wind farms, providing price certainty and reducing investment risk.

Conclusion

The rising cost of offshore wind is a significant challenge that needs urgent attention. Increasing material and labor costs, technological complexities, and regulatory hurdles are all contributing factors. These rising costs are impacting investor confidence, leading to project delays and cancellations, and potentially hindering the progress of the global energy transition. However, offshore wind remains crucial for a sustainable energy future. Collaborative efforts among governments, developers, investors, and researchers are essential to address the cost challenges and ensure the continued growth of the offshore wind industry. Further research and innovation, coupled with supportive government policies, are critical to reducing the cost of offshore wind and making it a more attractive investment opportunity. Delve deeper into this vital area and consider the impact of the rising cost of offshore wind on your own investment strategies and the future of renewable energy. Learn more about investment opportunities in innovative offshore wind technologies to help drive down costs and contribute to a cleaner, more sustainable future.

Featured Posts

-

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 03, 2025

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 03, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Share And Future Outlook

May 03, 2025

Chinas Impact On Bmw And Porsche Sales Market Share And Future Outlook

May 03, 2025 -

Post La Fire Housing Crisis Landlord Price Gouging Claims Investigated

May 03, 2025

Post La Fire Housing Crisis Landlord Price Gouging Claims Investigated

May 03, 2025 -

Lee Anderson Celebrates Councillors Move To Reform Party

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform Party

May 03, 2025 -

Cangkang Telur Manfaat Kreatif Untuk Pertanian Dan Peternakan

May 03, 2025

Cangkang Telur Manfaat Kreatif Untuk Pertanian Dan Peternakan

May 03, 2025

Latest Posts

-

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025 -

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025 -

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025