The Risks And Rewards Of Investing In XRP (Ripple)

Table of Contents

Understanding XRP's Potential Rewards

XRP, designed for fast and efficient cross-border payments, holds significant appeal for investors. Let's explore the potential benefits:

High Growth Potential

XRP's past price performance demonstrates its capacity for substantial growth. While past performance is not indicative of future results, analyzing historical trends can inform potential future scenarios.

- Past Price Surges: XRP has experienced periods of remarkable price appreciation, highlighting its potential for exponential growth. However, these surges were often followed by equally dramatic declines, emphasizing the inherent volatility.

- Catalysts for Future Growth: Several factors could drive future XRP price increases. Widespread adoption by financial institutions, strategic partnerships, and successful implementation of Ripple's payment solutions could all contribute to increased demand and a higher market capitalization.

- Market Capitalization: While XRP's market capitalization is substantial compared to many other cryptocurrencies, it's still significantly smaller than Bitcoin or Ethereum, suggesting potential for further expansion. This potential for growth attracts investors looking for high-reward, high-risk opportunities.

Use Cases and Adoption

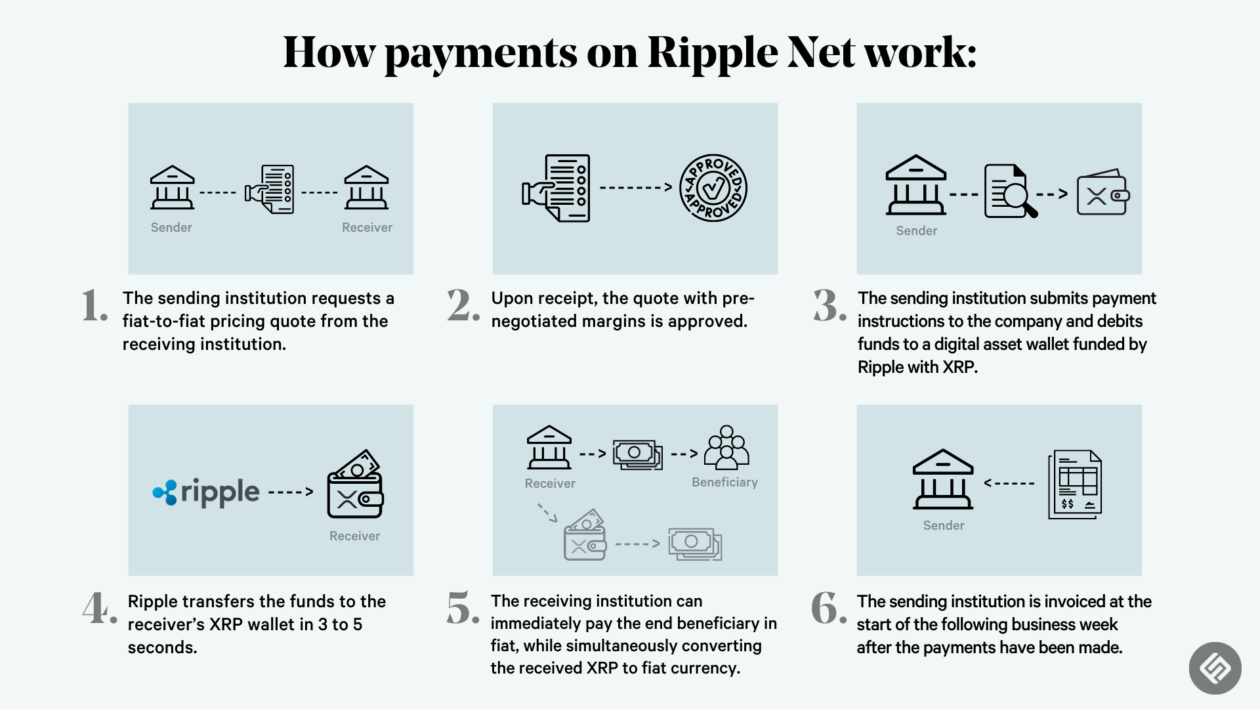

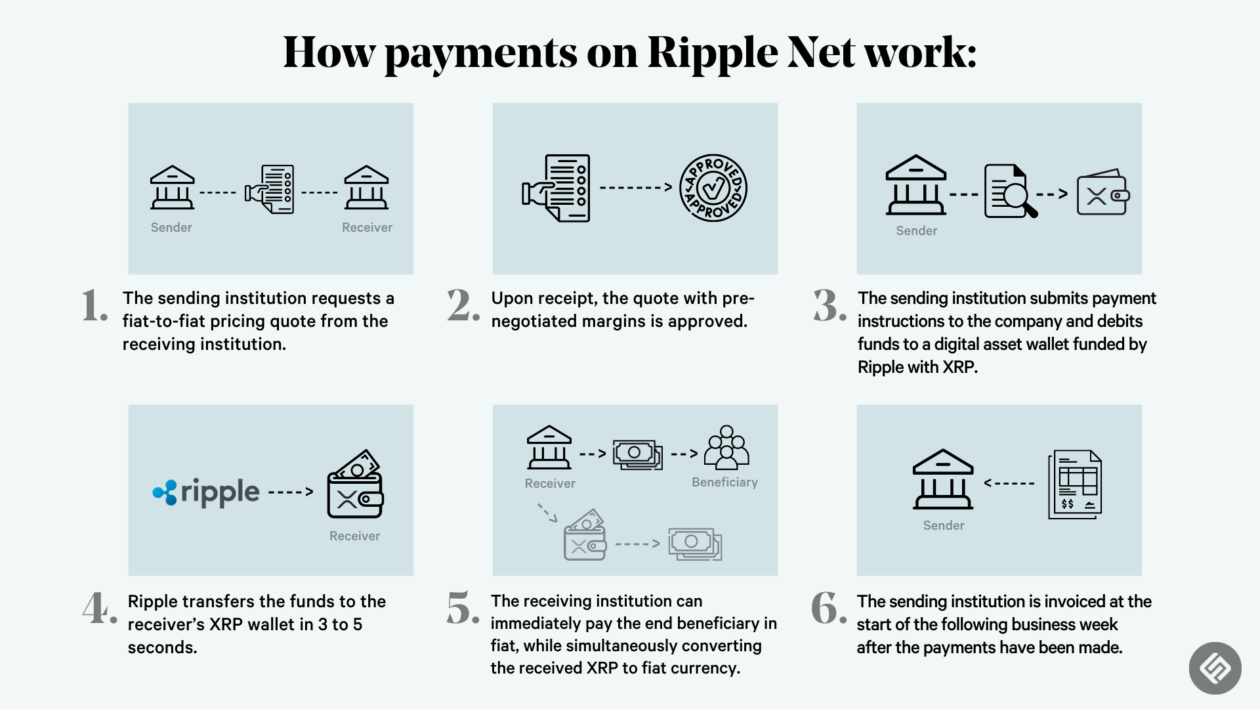

XRP's primary utility lies in facilitating fast and inexpensive cross-border payments through RippleNet, Ripple's payment network. This real-world application differentiates it from many other cryptocurrencies focused solely on speculation.

- Ripple's Partnerships: Ripple has established partnerships with numerous major financial institutions globally, including banks and payment providers. This adoption validates XRP's utility and potential within the established financial system.

- Speed and Low Cost: XRP transactions are significantly faster and cheaper than traditional banking systems, offering a compelling alternative for international payments. This efficiency is a key selling point driving adoption.

- Impact on Global Payments: Successful adoption of XRP could revolutionize the global payments industry, potentially increasing demand and driving up its price. This potential for disruptive innovation attracts forward-thinking investors.

Diversification Benefits

Adding XRP to a diversified investment portfolio can offer unique benefits. Its price movements often don't correlate directly with traditional assets or other cryptocurrencies, potentially mitigating overall portfolio risk.

- Uncorrelated Returns: Because XRP's price is driven by factors distinct from traditional markets (e.g., adoption by financial institutions), it can provide a hedge against traditional asset downturns. This lack of correlation is attractive to investors seeking portfolio diversification.

- Unique Characteristics: XRP's focus on payments and its adoption by financial institutions differentiate it from other cryptocurrencies primarily used for speculation. This difference makes it a unique asset to include in a diversified portfolio.

Navigating the Risks of XRP Investment

Despite the potential rewards, investing in XRP carries significant risks. Understanding these risks is crucial before committing any capital.

Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price can fluctuate dramatically in short periods, leading to substantial gains or losses.

- Past Price Crashes: XRP's history includes significant price drops, demonstrating the potential for substantial losses. Investors need to be prepared for such volatility.

- Influencing Factors: Several factors influence XRP's price, including regulatory developments, market sentiment, and competition from other cryptocurrencies. Understanding these factors is essential for managing risk.

- Risk Tolerance: Investing in XRP requires a high risk tolerance. Only invest an amount you can afford to lose entirely.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies is constantly evolving and remains uncertain. Regulatory actions can significantly impact XRP's price and even its legality in certain jurisdictions.

- Ongoing Legal Battles: Ripple faces ongoing legal challenges, the outcome of which could substantially affect XRP's price and future prospects.

- Regulatory Implications: Different jurisdictions have different regulatory frameworks for cryptocurrencies. These variations create uncertainty and potential risks for investors.

Technological Risks

Like any technology, XRP is susceptible to technological risks. These risks could impact its functionality, security, and overall value.

- Potential for Hacking: Cryptocurrency exchanges and wallets are potential targets for hackers, and XRP is not immune to such risks.

- Scalability Issues: While XRP's transaction speed is a strength, scalability issues could arise with increased adoption.

- Competition: Other cryptocurrencies offer similar functionalities to XRP, creating competitive pressures that can impact its price and adoption.

Security Risks

Storing and securing XRP requires careful consideration. Loss of private keys or exchange hacks can result in irreversible loss of funds.

- Secure Wallets: Using secure hardware wallets is crucial for protecting your XRP holdings. Software wallets carry a higher risk of compromise.

- Exchange Risks: Storing XRP on exchanges exposes it to the risk of exchange hacks or insolvency.

Conclusion: Weighing the Risks and Rewards of XRP (Ripple) Investment

Investing in XRP presents a compelling opportunity for high growth potential driven by real-world applications and potential disruption of the global payments industry. However, this potential is intertwined with significant risks, including substantial volatility, regulatory uncertainty, and technological challenges. Before investing in XRP or any cryptocurrency, thoroughly research the market, understand your risk tolerance, and diversify your investments appropriately. Weigh the risks and rewards of XRP carefully before investing. Learn more about XRP investing and make informed decisions.

Featured Posts

-

50 000 Fine For Anthony Edwards Nba Addresses Players Vulgar Comment

May 07, 2025

50 000 Fine For Anthony Edwards Nba Addresses Players Vulgar Comment

May 07, 2025 -

Significant Xrp Buy Whale Transaction Sparks Market Speculation

May 07, 2025

Significant Xrp Buy Whale Transaction Sparks Market Speculation

May 07, 2025 -

Wildfire Betting A Reflection Of Modern Societys Relationship With Disaster

May 07, 2025

Wildfire Betting A Reflection Of Modern Societys Relationship With Disaster

May 07, 2025 -

Clipper Late Rally Falls Short Against Cavaliers

May 07, 2025

Clipper Late Rally Falls Short Against Cavaliers

May 07, 2025 -

An Interview Anthony Edwards Probes Obamas Presidential Achievements

May 07, 2025

An Interview Anthony Edwards Probes Obamas Presidential Achievements

May 07, 2025

Latest Posts

-

A Look At Matt Damons Career Ben Afflecks Insight

May 08, 2025

A Look At Matt Damons Career Ben Afflecks Insight

May 08, 2025 -

Pierce County Park Project Demolishing A 160 Year Old Home

May 08, 2025

Pierce County Park Project Demolishing A 160 Year Old Home

May 08, 2025 -

Demolition Of Historic Pierce County Home Makes Way For New Park

May 08, 2025

Demolition Of Historic Pierce County Home Makes Way For New Park

May 08, 2025 -

Matt Damons Calculated Career Ben Afflecks Perspective

May 08, 2025

Matt Damons Calculated Career Ben Afflecks Perspective

May 08, 2025 -

A New Challenger Appears Rethinking The Best War Film After Saving Private Ryan

May 08, 2025

A New Challenger Appears Rethinking The Best War Film After Saving Private Ryan

May 08, 2025