The Role Of Tax Credits In Growing Minnesota's Film Industry

Table of Contents

Attracting Film Productions to Minnesota through Tax Incentives

Film tax credits act as powerful incentives, encouraging production companies to choose Minnesota as their filming location over competing states. These credits significantly reduce production costs, increasing profitability and making Minnesota a more attractive option. By offering these Minnesota film tax credits, the state directly impacts the bottom line for film productions.

- Reduced production costs leading to increased profitability: Tax credits effectively lower the overall budget, making projects more financially viable.

- Access to a skilled workforce: Minnesota boasts a growing pool of skilled film professionals, further enhanced by training programs like those offered at local film schools and community colleges.

- Unique Minnesota locations and landscapes as a selling point: From the stunning North Shore to the vibrant cities of Minneapolis and St. Paul, Minnesota offers diverse and visually captivating locations ideal for a variety of film genres. This unique geography enhances the appeal of location filming in the state.

- Examples of successful productions attracted by the credits: Highlighting specific films and television shows that have filmed in Minnesota due to the tax credit program serves as powerful evidence of its success. (Insert examples here with links if possible). This showcases the positive impact of Minnesota film tax credits on the industry.

Boosting Job Creation and Local Employment in the Film Sector

Film productions generate a wide array of jobs, from crew members and actors to caterers, transportation providers, and countless other support services. This influx of employment has a multiplier effect, boosting the local economy significantly beyond the immediate film production. The economic growth driven by film industry jobs in Minnesota is undeniable.

- Statistics on job creation related to film tax credits: Quantifiable data illustrating the number of jobs created directly and indirectly due to the tax credit program is crucial to demonstrating its effectiveness. (Insert relevant statistics and sources here).

- Examples of local businesses benefiting from film productions: Highlighting specific businesses (restaurants, hotels, equipment rental companies) that experience increased revenue as a result of film productions showcases the broader economic impact.

- Highlighting the impact on specific communities: Focusing on the positive effects on smaller towns or specific neighborhoods where filming occurs underscores the program's regional benefits. This illustrates the positive effects of employment opportunities derived from the film industry.

Supporting the Development of Local Film Infrastructure and Talent

The increased activity spurred by Minnesota film tax credits indirectly contributes to the development of robust film infrastructure in Minnesota. It encourages investment in studio spaces, equipment rental facilities, and post-production services. This, in turn, fosters the growth of local talent development, offering invaluable on-the-job training and mentorship opportunities.

- Examples of infrastructure improvements supported by the industry's growth: Mention any new studio facilities, equipment rental businesses, or post-production houses that have emerged or expanded due to the increased demand.

- Highlighting local film schools and training initiatives: Showcase the role of educational institutions in providing skilled professionals to the industry and the contribution of film training programs to the workforce.

- Showcase success stories of Minnesota-based filmmakers: Featuring local filmmakers who have thrived thanks to the supportive environment created by the tax credit program and improved film infrastructure in Minnesota is a powerful testament to its effectiveness.

Analyzing the Effectiveness of Minnesota's Film Tax Credit Program

A comprehensive evaluation of the Minnesota film tax credit effectiveness requires a thorough cost-benefit analysis. This involves comparing the financial investment in the tax credit program with the resulting economic benefits, including job creation, increased tax revenue, and tourism.

- Cost-benefit analysis of the program: Present data illustrating the return on investment (ROI) of the program. (Include relevant data and sources here).

- Comparison with other states' film incentive programs: A comparative analysis with other states' successful film incentive programs can offer valuable insights into best practices and potential areas for improvement.

- Recommendations for future policy adjustments: Based on the analysis, propose potential adjustments to the program, such as expanding eligibility criteria or increasing the credit amount, to further enhance its effectiveness. This will inform future film industry policy in the state.

The Future of Minnesota's Film Industry and Tax Credits

In conclusion, Minnesota film tax credits play a critical role in the growth and development of the state's film industry. They attract productions, stimulate job creation, encourage infrastructure development, and foster the cultivation of local talent. Continued investment in and expansion of these credits are essential to ensure the continued prosperity and economic growth of Minnesota’s burgeoning film sector. To learn more about the Minnesota film tax credit program and how you can support its continued development, visit [Insert link to relevant government resources here]. Let's work together to support Minnesota film and grow Minnesota’s film industry! Let's advocate for film tax credit expansion to ensure a thriving future for Minnesota filmmaking.

Featured Posts

-

Turbulenzen In Der Bundesliga Lask Schwaechelt Klagenfurt Droht Der Abstieg

Apr 29, 2025

Turbulenzen In Der Bundesliga Lask Schwaechelt Klagenfurt Droht Der Abstieg

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers Insights And Reassurance

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers Insights And Reassurance

Apr 29, 2025 -

Court Rules In Favor Of Ayesha Howard In Custody Case Against Anthony Edwards

Apr 29, 2025

Court Rules In Favor Of Ayesha Howard In Custody Case Against Anthony Edwards

Apr 29, 2025 -

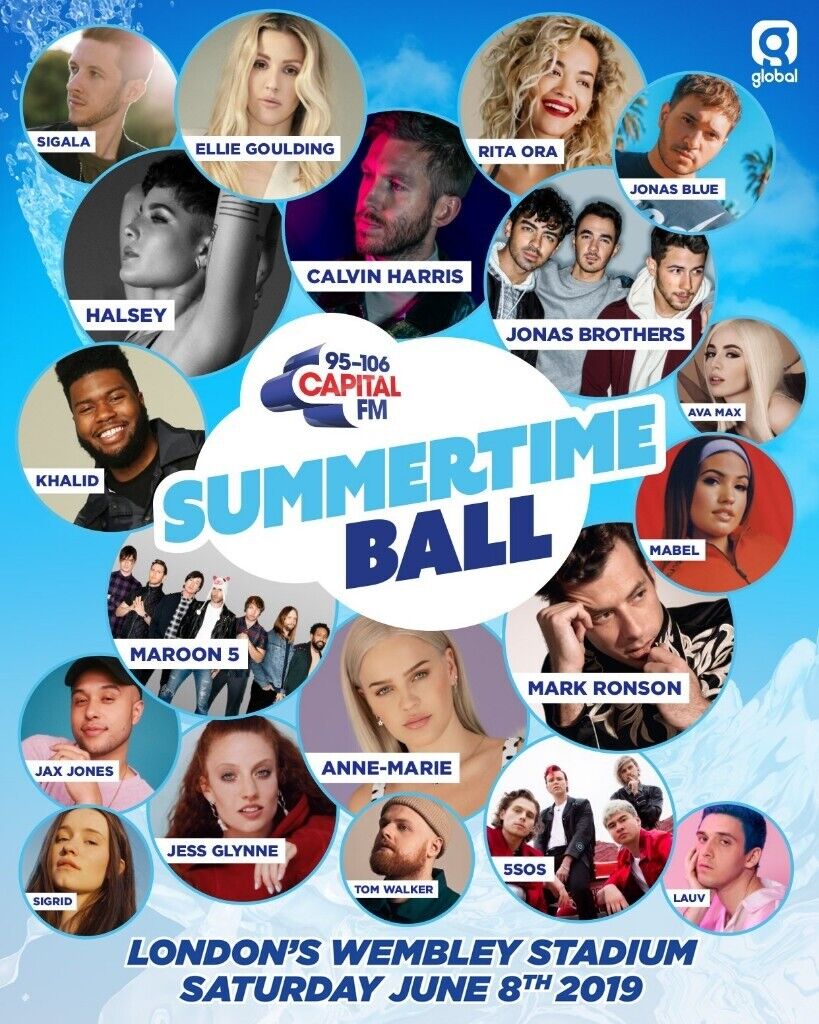

Securing Capital Summertime Ball 2025 Tickets Your Step By Step Plan

Apr 29, 2025

Securing Capital Summertime Ball 2025 Tickets Your Step By Step Plan

Apr 29, 2025 -

Fox News Faces Defamation Lawsuit From January 6th Figure Ray Epps

Apr 29, 2025

Fox News Faces Defamation Lawsuit From January 6th Figure Ray Epps

Apr 29, 2025