The SEC And XRP: Navigating The Commodity Vs. Security Debate

Table of Contents

The SEC's Case Against XRP

The SEC's case against Ripple hinges on the application of the Howey Test, a landmark legal precedent used to determine whether an investment constitutes a security.

The Howey Test and its Application to XRP

The Howey Test establishes four elements necessary for an investment contract to be classified as a security:

-

Investment of money: Investors provided funds to acquire XRP.

-

Common enterprise: The SEC argues that investors were participating in a common enterprise with Ripple and other XRP holders.

-

Expectation of profits: The SEC claims that investors purchased XRP with the expectation of profits derived from Ripple's efforts.

-

Efforts of others: The SEC contends that Ripple's efforts were essential to the success of XRP, and investors relied on these efforts for profit.

-

Specific Instances Cited by the SEC: The SEC points to Ripple's programmatic sales of XRP to institutional investors and its marketing efforts as evidence of investment contracts. They argue these sales were not simply sales of a commodity but rather offerings of securities.

-

Programmatic Sales: The SEC argues that Ripple's large-scale sales of XRP, not only to institutional investors but also through exchanges, constituted an unregistered securities offering. This large-scale distribution, they argue, inherently suggests an expectation of profit driven by Ripple's actions.

-

Ripple's Sales and Marketing: The SEC highlights Ripple's marketing materials and communications as evidence of an intent to attract investors seeking profits.

Ripple's Defense

Ripple counters the SEC's arguments by emphasizing XRP's decentralized nature and its function as a payment currency.

- XRP's Independence from Ripple: Ripple argues that XRP operates independently of the company, highlighting its open-source nature and widespread use on various exchanges. They contend that the price of XRP is not solely dependent on Ripple's actions.

- Comparison to Other Cryptocurrencies: Ripple's defense compares XRP to other cryptocurrencies widely considered commodities, arguing that the SEC's actions set a dangerous precedent that could affect the entire crypto market.

- Lack of Investor Expectation Tied to Ripple's Efforts: Ripple maintains that many XRP purchases were made without an expectation of profit driven specifically by Ripple's activities. They assert that investors purchased XRP for its utility as a digital asset, not solely as an investment.

The Broader Implications for Crypto Regulation

The outcome of the SEC vs. Ripple case will have significant implications far beyond Ripple and XRP.

The Impact on Other Cryptocurrencies

The ruling could significantly alter the regulatory landscape for numerous cryptocurrencies and tokens.

- Ripple Effects on the Broader Crypto Market: A ruling against Ripple could trigger a wave of SEC enforcement actions against other cryptocurrency projects, creating widespread uncertainty and potentially chilling innovation in the sector.

- Uncertainty Facing Similar Projects: Projects that utilize similar distribution methods or marketing strategies to Ripple could face increased regulatory scrutiny and legal challenges.

- Potential for Regulatory Clarity (or Further Confusion): The case may provide greater regulatory clarity, or conversely, may further deepen the existing ambiguity surrounding crypto regulation.

The Future of Crypto Regulation in the US

The court's decision will likely influence the evolution of regulatory frameworks in the US.

- Potential Changes to the Regulatory Landscape: The ruling could spur Congress to create more comprehensive legislation or push regulatory agencies to develop clearer guidelines for classifying crypto assets.

- Congress's Role in Establishing Clearer Guidelines: The legal uncertainty highlights the need for legislative action to create a clearer regulatory framework for cryptocurrencies.

- Impact on Investor Protection and Innovation: Striking a balance between investor protection and fostering innovation within the crypto industry remains a significant challenge for regulators.

Understanding the Legal Arguments and Key Players

This section provides a brief overview of the key arguments and individuals involved.

Key Legal Arguments Presented by Both Sides

- SEC: XRP was sold as an unregistered security, violating federal securities laws. Ripple's marketing materials and sales practices fostered an expectation of profit based on Ripple's efforts.

- Ripple: XRP is a decentralized digital asset and functions as a currency, not a security. The Howey Test does not apply. Sales were not intended to constitute an investment contract.

Key Individuals and Entities Involved

- Securities and Exchange Commission (SEC): The plaintiff in the case, responsible for enforcing federal securities laws.

- Ripple Labs: The defendant, the company behind XRP.

- Brad Garlinghouse: CEO of Ripple Labs.

- Christian Larsen: Co-founder of Ripple Labs.

- Judge Analisa Torres: The judge presiding over the case in the Southern District of New York.

Conclusion

The SEC vs. Ripple case concerning XRP represents a pivotal moment in the evolution of cryptocurrency regulation. The court's decision will have significant implications not only for Ripple and XRP but also for the broader crypto industry. Understanding the arguments surrounding XRP's classification as a security or commodity is crucial for navigating this complex legal landscape. Staying informed about the ongoing developments in this case, and future regulatory pronouncements, is essential for all participants in the cryptocurrency market. Therefore, continue to research and follow updates on the SEC and XRP debate to make informed decisions about your involvement in the crypto space.

Featured Posts

-

Analysis Xrp Ripple Investment Strategy Under 3

May 02, 2025

Analysis Xrp Ripple Investment Strategy Under 3

May 02, 2025 -

Egkrithike I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Stoxoi Kai Draseis

May 02, 2025

Egkrithike I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Stoxoi Kai Draseis

May 02, 2025 -

Tulsa Street Crews Prepare For Winter Weather Pre Treatment Underway

May 02, 2025

Tulsa Street Crews Prepare For Winter Weather Pre Treatment Underway

May 02, 2025 -

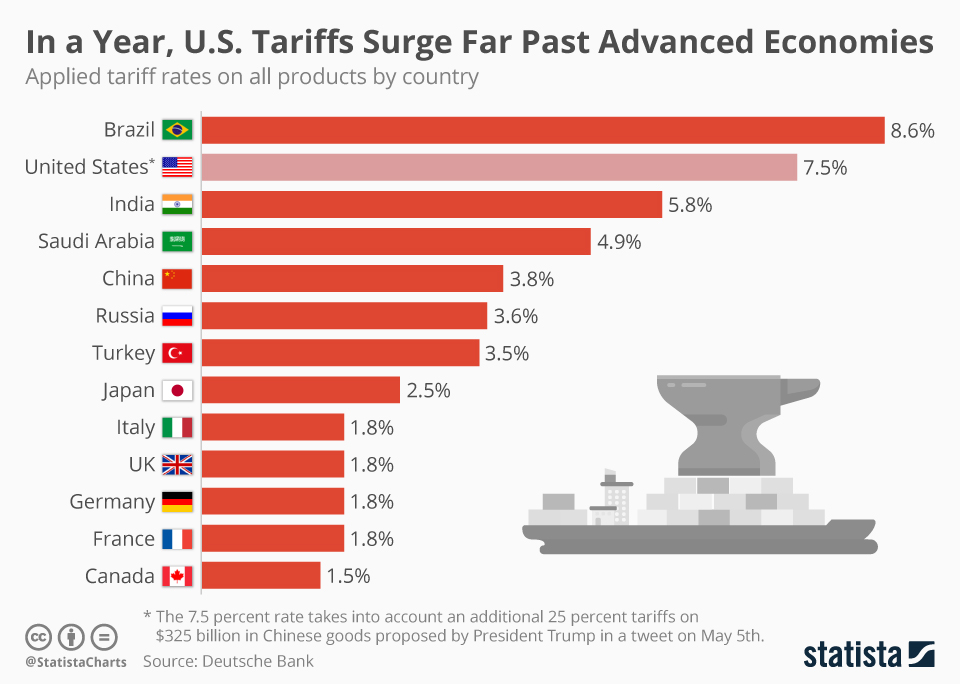

The Bank Of Canada And Trump Tariffs Examining The April Interest Rate Discussion

May 02, 2025

The Bank Of Canada And Trump Tariffs Examining The April Interest Rate Discussion

May 02, 2025 -

Sf Actor Workshop Co Founder And Renowned Actress Priscilla Pointer Passes Away At 100

May 02, 2025

Sf Actor Workshop Co Founder And Renowned Actress Priscilla Pointer Passes Away At 100

May 02, 2025

Latest Posts

-

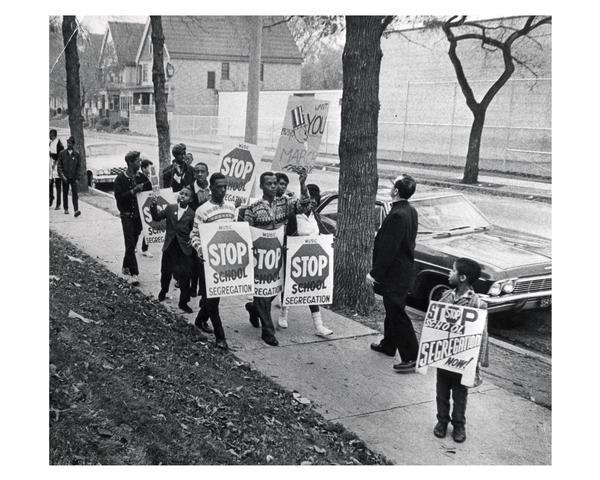

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025 -

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025 -

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025

School Desegregation The End Of An Era Examining The Dojs Decision

May 02, 2025 -

School Desegregation Order Terminated Analyzing The Justice Departments Action

May 02, 2025

School Desegregation Order Terminated Analyzing The Justice Departments Action

May 02, 2025 -

School Desegregation The Implications Of The Justice Departments Recent Action

May 02, 2025

School Desegregation The Implications Of The Justice Departments Recent Action

May 02, 2025