The Simplest Dividend Strategy: Maximizing Your Returns

Table of Contents

Understanding Dividend Investing Basics

Dividend investing involves purchasing stocks in companies that regularly pay out a portion of their profits to shareholders as dividends. This provides a steady stream of passive income, supplementing your capital appreciation. Understanding the basics is key to successfully implementing the simplest dividend strategy.

- What are Dividends? Dividends are payments made by a company to its shareholders, typically from its profits. These are usually paid out quarterly.

- Dividend Yield vs. Dividend Growth: Dividend yield is the annual dividend payment relative to the stock price (annual dividend/stock price). Dividend growth refers to the rate at which a company increases its dividend payments over time. Both are important factors to consider.

- Dividend Reinvestment Plans (DRIPs): DRIPs allow you to automatically reinvest your dividend payments into purchasing more shares of the same stock, accelerating your wealth accumulation through compounding.

- Risks of Dividend Investing: While offering significant advantages, dividend investing isn't without risks. Companies can reduce or eliminate dividends due to financial difficulties. Careful selection is crucial.

Selecting High-Quality Dividend Stocks

Choosing the right stocks is crucial for the success of your simplest dividend strategy. Focus on established companies with a proven track record.

- Established Companies with a History of Dividend Payments: Look for companies with a long history of paying consistent dividends, indicating financial stability and a commitment to shareholder returns.

- Consistent Dividend Increases: Prioritize companies that have a history of increasing their dividend payments annually, showcasing growth and confidence in their future performance. This signifies a healthy and growing business.

- Screening Tools: Several online platforms offer stock screening tools to help you find companies meeting your specific criteria. Examples include Yahoo Finance, Finviz, and others. Use these to filter for factors like dividend yield, payout ratio, and dividend growth rate.

- PortfolioDiversification: Don't put all your eggs in one basket! Diversify your portfolio across multiple sectors and companies to mitigate risk and enhance returns. This is key to any successful long-term investment strategy.

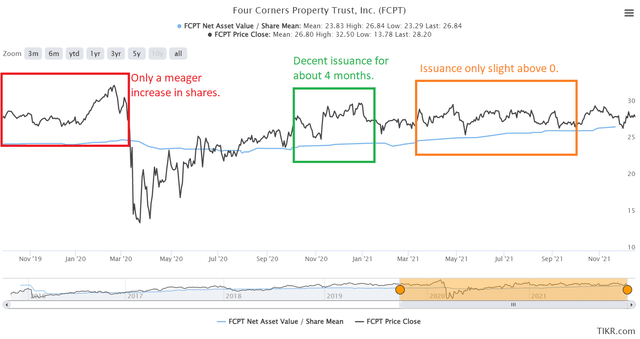

Assessing Dividend Sustainability

Before investing in any company, thoroughly assess its financial health to ensure the dividend is sustainable.

- Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A low payout ratio (generally below 60%) suggests the company can easily sustain its dividend payments even during economic downturns.

- Free Cash Flow: Analyze the company's free cash flow (FCF), which represents the cash generated after accounting for all expenses and capital expenditures. A strong FCF is essential to support dividend payments.

- Debt Levels: High debt levels can strain a company's ability to pay dividends. Look for companies with manageable debt levels relative to their equity and earnings.

- Overall Financial Stability: Consider the overall financial health of the company by reviewing its financial statements, including the balance sheet and income statement.

Implementing the Simplest Dividend Strategy: Buy and Hold

The simplest dividend strategy relies on a buy-and-hold approach—a cornerstone of long-term success.

- Core Principle: Buy high-quality dividend stocks and hold them for the long term, ideally for many years or even decades. This minimizes the impact of short-term market fluctuations.

- Minimizing Trading Activity: Frequent trading incurs transaction costs and taxes, eroding your returns. A buy-and-hold approach helps you avoid this.

- Patience and Riding Out Market Fluctuations: The market inevitably experiences ups and downs. Patience and the ability to withstand temporary setbacks are crucial for long-term success in dividend investing.

Reinvesting Dividends for Accelerated Growth

Reinvesting your dividends is a powerful tool to accelerate your returns.

- How Dividend Reinvestment Works (DRIPs): Many brokerage accounts offer DRIPs, automatically using your dividend payments to buy more shares of the same stock.

- The Snowball Effect: As your investment grows, so do your dividend payments, leading to a snowball effect of compounding returns. This is the essence of long-term wealth building.

- Tax Implications: Consult a financial advisor to understand the tax implications of dividend reinvestment in your specific jurisdiction.

Conclusion

The simplest dividend strategy hinges on identifying high-quality dividend stocks, adopting a buy-and-hold approach, and reinvesting dividends to accelerate growth. This straightforward method allows you to build a portfolio that generates passive income and offers substantial long-term growth potential. It’s a strategy that minimizes complexity while maximizing returns. Remember, this is a long-term game. Patience and discipline are essential.

Ready to start maximizing your returns with the simplest dividend strategy? Begin your research today and discover the power of passive income!

Featured Posts

-

Millions Stolen Federal Investigation Into Office365 Executive Account Breaches

May 10, 2025

Millions Stolen Federal Investigation Into Office365 Executive Account Breaches

May 10, 2025 -

Canadian Homeownership Crisis The Impact Of High Down Payments

May 10, 2025

Canadian Homeownership Crisis The Impact Of High Down Payments

May 10, 2025 -

A Clear Look At Trumps Policy On Transgender Individuals In The Military

May 10, 2025

A Clear Look At Trumps Policy On Transgender Individuals In The Military

May 10, 2025 -

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025 -

Invest In The Future A Guide To The Countrys Rising Business Hot Spots

May 10, 2025

Invest In The Future A Guide To The Countrys Rising Business Hot Spots

May 10, 2025