The Student Loan Crisis: Its Economic Ripple Effects

Table of Contents

Impact on Personal Finances and Consumer Spending

The crushing weight of student loan debt leaves borrowers with significantly less disposable income. This directly impacts consumer spending, a key driver of economic growth. The ripple effects are substantial and far-reaching, impacting various aspects of personal finance and the overall economy.

Reduced Disposable Income

The high monthly payments associated with student loans significantly reduce disposable income. This has a cascading effect on various aspects of personal finance:

- Reduced purchasing power: Borrowers postpone major purchases like homes, cars, and even starting families, delaying key life milestones. This postponement translates into less spending on durable goods, a significant component of the consumer price index (CPI).

- Lower savings rates: Debt repayment often takes priority over savings, hindering long-term financial security and retirement planning. This reduces the pool of available capital for investments, slowing economic growth.

- Increased financial stress: High levels of student loan debt contribute to anxiety, depression, and overall reduced well-being. This financial stress negatively impacts productivity and can lead to decreased work performance.

Delayed Homeownership and Investment

Student loan repayments often delay major life milestones like purchasing a home. This has significant implications for the real estate market and broader economic growth.

- Reduced housing demand: Fewer young adults can afford to enter the housing market, suppressing demand and potentially leading to price stagnation or even decline in certain areas.

- Impact on local economies: Decreased housing demand negatively affects related industries like construction, real estate, and home improvement, leading to job losses and economic stagnation in local communities.

- Missed investment opportunities: Funds that could have been invested in stocks, bonds, or other assets are instead used for debt repayment, reducing the overall investment pool and hindering economic growth.

Impact on the Labor Market and Entrepreneurship

The student loan crisis significantly impacts the labor market and the entrepreneurial spirit, creating a ripple effect that hinders economic progress.

Career Choices and Underemployment

The pressure to repay loans significantly influences career choices. Individuals might prioritize higher-paying jobs over personal passions or fulfilling careers, potentially leading to underemployment.

- Limited career exploration: The fear of debt prevents exploring less lucrative, but potentially more fulfilling career paths. This limits individual potential and societal innovation.

- Increased competition in high-paying fields: More individuals pursue high-paying jobs to address debt, increasing competition and potentially suppressing wage growth in those fields.

- Reduced entrepreneurial activity: The risk of entrepreneurship is often perceived as too high when burdened with substantial student loan debt. This limits innovation and job creation, negatively impacting economic growth.

Brain Drain and Economic Stagnation

Talented individuals might be forced to leave the country to pursue better job opportunities, leading to a "brain drain" and hindering economic innovation.

- Talent migration to countries with more favorable economic conditions: Individuals might seek relief from debt burdens by relocating to countries with more attractive job markets and lower living costs.

- Loss of skilled workforce: This loss impacts national economic productivity and competitiveness, potentially hampering technological advancement and overall economic growth.

- Reduced innovation and technological advancement: Stagnation in crucial sectors results from the loss of talented individuals who could have contributed to innovation and technological development.

Impact on the Overall Economy and Government Finances

The student loan crisis has a profound and pervasive impact on the overall economy and government finances, creating a cycle of debt and slow growth.

Slower Economic Growth

Reduced consumer spending and investment, coupled with a less dynamic labor market, contribute to slower overall economic growth.

- Lower GDP growth rates: The reduced consumer spending and investment directly translate into lower GDP growth rates, hindering national economic progress.

- Increased government spending on social welfare programs: The government must allocate more resources to social welfare programs to address the financial difficulties caused by the crisis.

- Reduced tax revenue: Due to lower income and employment levels among borrowers, the government collects less tax revenue, further straining its budget.

Government Debt and Default Risk

The increasing amount of student loan debt held by the government increases the national debt and poses potential risks of default.

- Increased government borrowing to cover loan defaults: As defaults rise, the government must borrow more money to cover the losses, adding to the national debt.

- Potential for credit rating downgrades: The escalating debt could lead to credit rating downgrades, increasing borrowing costs and impacting the government's ability to fund essential programs.

- Strain on government budget: The burden of student loan debt strains the government budget, potentially impacting funding for other essential programs and services.

Conclusion

The student loan crisis is not merely a personal financial burden; it's a systemic economic issue with far-reaching consequences. The reduced consumer spending, hampered labor market, and increased government debt all contribute to slower economic growth and broader societal instability. Addressing this crisis requires comprehensive solutions, including loan forgiveness programs, income-driven repayment plans, and increased access to affordable higher education. We need to act decisively to mitigate the devastating economic ripple effects of the student loan crisis and build a more sustainable and equitable future. Understanding the multifaceted nature of the student loan crisis is the first step towards finding effective solutions to improve the economic well-being of individuals and the nation. Let's work together to find solutions to this pressing issue and alleviate the burden of the student loan crisis.

Featured Posts

-

Understanding The Newark Airport Crisis

May 28, 2025

Understanding The Newark Airport Crisis

May 28, 2025 -

Jawa Barat 22 April Update Prakiraan Cuaca And Hujan Di Bandung

May 28, 2025

Jawa Barat 22 April Update Prakiraan Cuaca And Hujan Di Bandung

May 28, 2025 -

Open Ais South Korea Expansion Fueling Ai Growth

May 28, 2025

Open Ais South Korea Expansion Fueling Ai Growth

May 28, 2025 -

Pencarian Balita Tenggelam Di Waduk Wonorejo Diduga Terbawa Arus Dari Batu Ampar

May 28, 2025

Pencarian Balita Tenggelam Di Waduk Wonorejo Diduga Terbawa Arus Dari Batu Ampar

May 28, 2025 -

Pacers Vs Knicks Nba Responds To Tyrese Haliburtons Showcase

May 28, 2025

Pacers Vs Knicks Nba Responds To Tyrese Haliburtons Showcase

May 28, 2025

Latest Posts

-

2025 Comeback Confirmed Hybe Ceo Addresses Btss Extended Hiatus

May 30, 2025

2025 Comeback Confirmed Hybe Ceo Addresses Btss Extended Hiatus

May 30, 2025 -

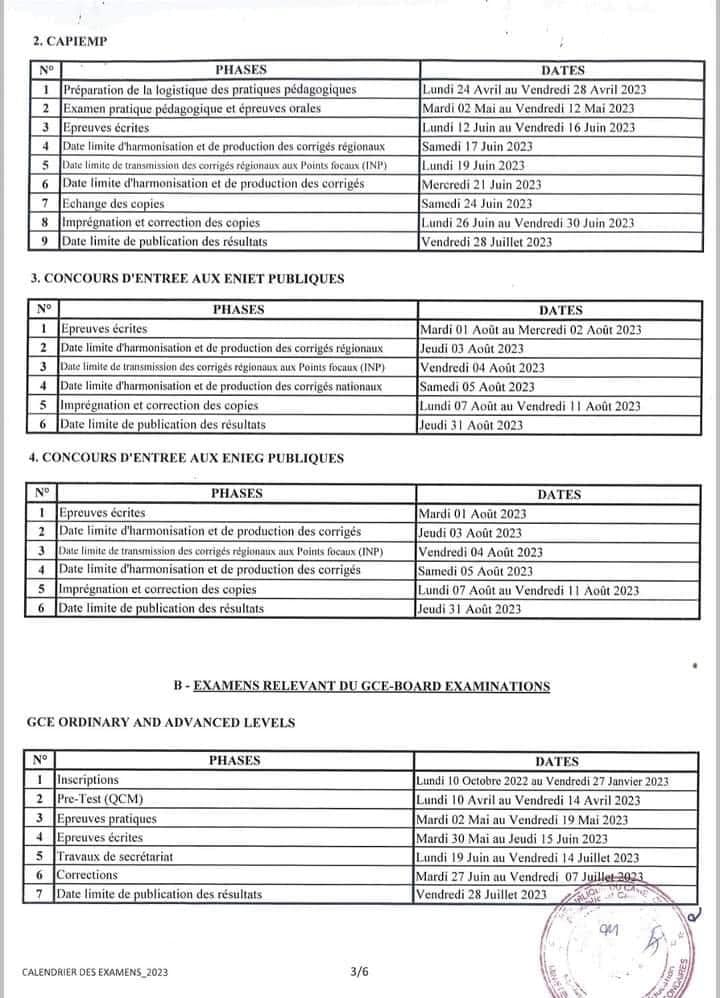

Bts 2025 Tout Savoir Sur Les Dates Des Epreuves Et Resultats

May 30, 2025

Bts 2025 Tout Savoir Sur Les Dates Des Epreuves Et Resultats

May 30, 2025 -

Hybe Ceos Update Btss 2025 Comeback And The Importance Of Member Time Off

May 30, 2025

Hybe Ceos Update Btss 2025 Comeback And The Importance Of Member Time Off

May 30, 2025 -

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025 -

Bts 2025 Calendrier Previsionnel Des Epreuves Et Dates De Resultats

May 30, 2025

Bts 2025 Calendrier Previsionnel Des Epreuves Et Dates De Resultats

May 30, 2025