The Tesla-Dogecoin Connection: Analyzing The Impact Of Elon Musk's Decisions

Table of Contents

Elon Musk's Influence on Dogecoin

Musk's Tweets and Dogecoin Price Volatility

Elon Musk's pronouncements on Dogecoin via Twitter have directly and dramatically impacted its price. His tweets often act as catalysts, causing significant price swings, both positive and negative. This volatility makes Dogecoin a highly speculative asset.

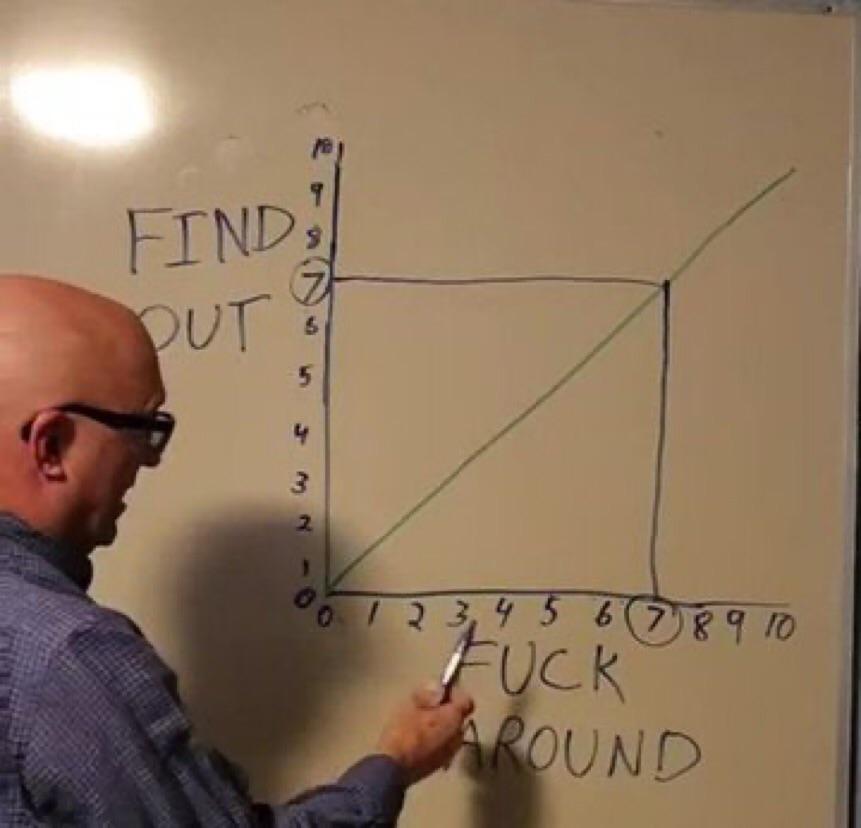

- Example 1: In February 2021, a single tweet from Musk mentioning Dogecoin sent its price soaring by over 20% in a matter of hours.

- Example 2: Conversely, negative or ambiguous statements have resulted in sharp price drops. This unpredictable nature highlights the inherent risk involved in Dogecoin investment.

- Pump and Dump Concerns: The correlation between Musk's tweets and Dogecoin price movements has raised concerns about potential "pump and dump" schemes, where prices are artificially inflated before being sold off by early investors. While no direct evidence links Musk to such schemes, the pattern warrants attention. [Insert chart/graph showing correlation between Musk's tweets and Dogecoin price here, if available].

Musk's Acceptance of Dogecoin as Payment

Tesla's brief acceptance of Dogecoin as payment for some merchandise significantly impacted both brands. While it boosted Dogecoin's perceived legitimacy and exposure, it also presented challenges.

- Pros: Increased Dogecoin adoption and visibility, positive brand association for Tesla, engagement with the crypto community.

- Cons: Volatility in Dogecoin's value posed challenges for Tesla's accounting, potential for fraud or scams, criticisms regarding environmental impact of Dogecoin mining. The temporary nature of this acceptance indicates the complexities inherent in using cryptocurrencies for commercial transactions.

The Meme Factor and Speculative Investment

Dogecoin's success is partly attributable to its meme-driven origins and its association with Elon Musk's celebrity. This meme-based appeal fuels speculative investment, driving price fluctuations beyond what's typically seen with established cryptocurrencies.

- Utility vs. Speculative Value: Unlike Bitcoin or Ethereum, which have defined utility in blockchain technology, Dogecoin's value primarily resides in its speculative nature. This lack of intrinsic value increases risk for investors.

- Risks of Meme Coin Investment: Investing in meme coins like Dogecoin is inherently risky due to their extreme volatility and lack of underlying utility. Investors should always conduct thorough due diligence and be prepared for potential significant losses.

The Tesla-Dogecoin Connection and Market Sentiment

Correlation vs. Causation

While a strong correlation exists between Musk's actions and Dogecoin's price, proving direct causation is difficult. Many factors influence both Dogecoin and Tesla's stock price.

- Other Market Influences: Overall market trends, regulatory changes affecting cryptocurrencies, broader economic conditions, and news related to Tesla's business all play a role. Isolating Musk's impact requires sophisticated econometric analysis.

Impact on Investor Confidence

Musk's actions significantly impact investor confidence in both Tesla and Dogecoin. Positive tweets can trigger buying sprees, while negative comments can lead to rapid sell-offs.

- Short-Term Gains vs. Long-Term Risks: While short-term gains are possible, the inherent volatility fueled by Musk's influence creates substantial long-term risks for investors in both assets. Investors need to be acutely aware of these risks.

Regulatory Scrutiny and Future Implications

The volatility surrounding the Tesla-Dogecoin connection has attracted regulatory scrutiny. The potential for future regulatory interventions could significantly impact both entities.

- Potential Regulatory Actions: Agencies like the SEC are likely to increase scrutiny on the relationship, potentially leading to investigations or new regulations concerning cryptocurrency endorsements and market manipulation.

- Long-Term Sustainability: The long-term sustainability of this relationship remains questionable. Increased regulation and a shift in market sentiment could lead to a decoupling of Tesla and Dogecoin's fates.

Conclusion

The Tesla-Dogecoin connection is a volatile and unpredictable relationship heavily influenced by Elon Musk's actions. While his pronouncements can lead to significant short-term gains, the inherent risks associated with this volatility cannot be ignored. Understanding the correlation between Musk's influence and market movements is crucial, but proving direct causation remains challenging due to numerous contributing factors. Investing in Dogecoin, or any cryptocurrency, requires careful consideration of the risks involved and diligent due diligence. Stay updated on the ever-evolving Tesla-Dogecoin connection by following reputable financial news sources and conducting your own in-depth research. Understanding the complexities of this relationship is crucial for navigating the volatile world of cryptocurrency investment.

Featured Posts

-

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025

Palantir Stock Pltr Pre Earnings Analysis Buy Before May 5th

May 09, 2025 -

Nyt Strands Wednesday Puzzle April 9 2025 Complete Guide

May 09, 2025

Nyt Strands Wednesday Puzzle April 9 2025 Complete Guide

May 09, 2025 -

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025 -

Will Nigel Farages Reform Party Move Beyond Rhetoric And Achieve Results

May 09, 2025

Will Nigel Farages Reform Party Move Beyond Rhetoric And Achieve Results

May 09, 2025 -

Heartbreaking Loss In F1 Colapinto And Perez Lead The Tributes

May 09, 2025

Heartbreaking Loss In F1 Colapinto And Perez Lead The Tributes

May 09, 2025