The Thames Water Executive Bonus Scandal: What Went Wrong?

Table of Contents

H2: Failure of Corporate Governance at Thames Water

The core of the Thames Water executive bonus scandal lies in a fundamental failure of corporate governance. A misalignment of incentives, weak board oversight, and a lack of accountability created an environment where excessive bonuses were deemed acceptable despite demonstrably poor performance.

H3: Misaligned Incentives and Reward Structures

Thames Water's reward structure prioritized short-term profit maximization over long-term investment in crucial infrastructure upgrades. This resulted in a system where executives were handsomely rewarded for short-term gains, regardless of the detrimental long-term consequences for both the environment and customers.

- Bonuses prioritized short-term profit over long-term investment in infrastructure: Millions were paid out in bonuses while essential upgrades to aging sewage systems were neglected, leading to increased pollution incidents.

- Lack of transparency in bonus calculations and performance metrics: The opaque nature of the bonus calculations made it difficult for stakeholders to understand how these payouts were justified, fueling public suspicion and anger.

- Insufficient accountability mechanisms for executive performance: There was a lack of clear links between executive performance and bonus payments. Even when performance targets were missed, substantial bonuses still seemed to be awarded.

- Specific examples of lavish bonuses paid despite poor performance: [Insert specific examples of bonuses paid and the corresponding performance metrics, citing reputable news sources]. These examples demonstrate a clear disconnect between rewards and responsibility.

H3: Weak Board Oversight and Executive Accountability

The board of directors failed to provide adequate oversight of executive compensation and risk management. This lack of robust scrutiny allowed the excessive bonus culture to flourish.

- Insufficient board independence and oversight of executive compensation: The board lacked the independence necessary to effectively challenge executive decisions regarding compensation.

- Lack of robust risk management strategies: A lack of effective risk management allowed the company to operate with insufficient investment in infrastructure, increasing the likelihood of failures and environmental damage.

- Inadequate scrutiny of financial reporting and performance data: The board failed to thoroughly review and challenge the financial reports that allegedly masked the true state of the company's infrastructure and operational performance.

- Instances where the board failed to adequately challenge executive decisions: [Insert specific examples from reputable sources demonstrating board inaction or ineffective oversight].

H2: Regulatory Failures and Ofwat's Role

The regulatory body, Ofwat, also faces significant criticism for its perceived failure to adequately regulate Thames Water and prevent this scandal.

H3: Inadequate Enforcement of Regulations

Ofwat's alleged failure to hold Thames Water accountable for its performance and its handling of executive compensation has been a major point of contention.

- Ofwat's alleged failure to hold Thames Water accountable for its performance: Critics argue Ofwat was too lenient in its oversight, failing to impose sufficient penalties for breaches in regulations and poor performance.

- Effectiveness (or lack thereof) of existing regulations: The existing regulatory framework appears to be insufficient to prevent similar situations from arising in the future.

- Critique of Ofwat's regulatory framework concerning executive compensation: Ofwat’s guidelines on executive pay within water companies need strengthening, potentially needing to tie bonuses more closely to performance indicators that prioritize environmental protection and customer service.

- Examples of Ofwat's response (or lack thereof) to Thames Water's failings: [Insert specific examples from reputable sources illustrating Ofwat’s response – or lack thereof – to Thames Water’s actions].

H3: Need for Stronger Regulatory Oversight

The scandal underscores the urgent need for strengthened regulatory oversight within the water industry.

- Arguments for increased transparency and accountability in the water industry: Greater transparency in financial reporting, executive compensation, and operational data is vital.

- Suggestions for improved regulatory frameworks to prevent future scandals: A review of Ofwat's powers and the implementation of stronger penalties for non-compliance are crucial.

- Proposals for stricter penalties for non-compliance: Higher fines and potential legal action against executives responsible for misconduct should be considered.

- Specific policy recommendations for stronger regulatory oversight: [Suggest concrete recommendations, such as increased auditing, independent review boards, and stricter performance targets].

H2: The Public's Perception and the Ethical Dimensions

The Thames Water executive bonus scandal has significantly eroded public trust in both the company and the regulatory bodies responsible for overseeing it.

H3: Erosion of Public Trust

The outrage sparked by the scandal demonstrates a deep-seated distrust in the water industry’s ability to prioritize public service over shareholder value.

- The impact of the scandal on public trust in water companies and regulators: Public confidence in both Thames Water and Ofwat has plummeted.

- Public sentiment and reactions to the executive bonuses: Public outcry has manifested in protests, social media campaigns, and calls for increased accountability.

- The role of media coverage in shaping public opinion: Media coverage has played a crucial role in informing the public and shaping negative perceptions.

- Examples of public reaction, protests, and media coverage: [Cite specific examples of public reaction, protests, and media coverage, linking to reputable sources].

H3: Ethical Considerations and Corporate Social Responsibility

The ethical implications of awarding excessive bonuses while essential services are neglected are profound.

- Discussion of ethical dilemmas related to executive compensation in essential services: The scandal raises crucial questions about the ethical responsibilities of corporations providing essential services.

- The importance of corporate social responsibility in the water industry: Water companies must prioritize public good, environmental sustainability, and responsible use of resources.

- The need for a shift in corporate culture towards prioritizing public good: A fundamental shift in corporate culture is needed, moving away from a sole focus on shareholder value and towards a more socially responsible approach.

- Exploring the moral implications of the scandal and suggestions for ethical improvements: [Offer suggestions for ethical improvements, such as implementing ethical codes of conduct, promoting transparency, and establishing independent ethics committees].

3. Conclusion:

The Thames Water executive bonus scandal exemplifies a systemic failure of corporate governance, regulatory oversight, and ethical considerations. The misalignment of incentives, coupled with a lack of accountability at both the corporate and regulatory levels, allowed for excessive executive compensation despite poor service delivery and environmental damage.

Call to Action: We need urgent reform to prevent similar scandals. Increased transparency in executive compensation, stronger regulatory oversight, and a renewed emphasis on corporate social responsibility are crucial to ensure the water industry prioritizes the needs of its customers and the environment over shareholder profit. Let's demand better from Thames Water and all water companies, demanding greater accountability and an end to such outrageous displays of executive greed. Let’s hold them accountable and prevent future Thames Water executive bonus scandals. We must ensure that future water executive compensation is tied to tangible improvements in service delivery and environmental responsibility, and that regulatory oversight is robust enough to prevent a repetition of this scandal.

Featured Posts

-

Flash Flood Threat North Central Texas Braces For Intense Rainfall And Potential Flooding

May 25, 2025

Flash Flood Threat North Central Texas Braces For Intense Rainfall And Potential Flooding

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025 -

Ccmf 2025 Sold Out What To Expect Next Year

May 25, 2025

Ccmf 2025 Sold Out What To Expect Next Year

May 25, 2025 -

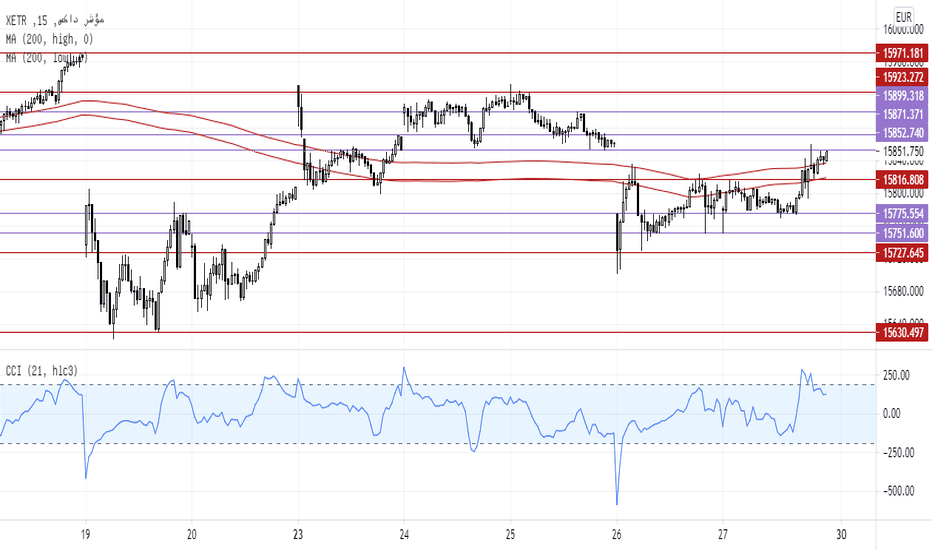

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 25, 2025

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 25, 2025 -

Myrtle Beach Fights Back Against Unsafe Beach Designation

May 25, 2025

Myrtle Beach Fights Back Against Unsafe Beach Designation

May 25, 2025

Latest Posts

-

Soerloth La Liga Da Kasip Kavurdu 4 Gol Birden

May 25, 2025

Soerloth La Liga Da Kasip Kavurdu 4 Gol Birden

May 25, 2025 -

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025 -

Real Madrid Doert Yildiz Oyuncu Hakkinda Sorusturma Baslatildi

May 25, 2025

Real Madrid Doert Yildiz Oyuncu Hakkinda Sorusturma Baslatildi

May 25, 2025 -

Atletico Madrid In Sevilla Zaferi 1 2 Lik Sonuc Ve Mac Oezeti

May 25, 2025

Atletico Madrid In Sevilla Zaferi 1 2 Lik Sonuc Ve Mac Oezeti

May 25, 2025 -

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 25, 2025

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 25, 2025