The Trump Years And Dogecoin: Examining Elon Musk's Unwavering Support

Table of Contents

The Trump Presidency and the Rise of Populism

The Trump presidency ushered in an era of political and economic uncertainty, fostering a climate ripe for unconventional investment strategies. Trump's populist rhetoric and anti-establishment stance resonated with a segment of the population disillusioned with traditional institutions. This sentiment extended to the financial world, creating an environment where alternative assets, including cryptocurrencies, gained traction.

The increased skepticism towards traditional financial institutions, coupled with a desire for "anti-establishment" investments, fueled the rise in popularity of alternative investments like Dogecoin. This period saw a growing distrust in established systems, leading many investors to seek out assets perceived as less susceptible to manipulation or control by traditional power structures.

- Increased skepticism towards traditional financial institutions.

- Rise in popularity of alternative investments, including cryptocurrencies.

- Growing influence of social media on financial markets, amplifying populist sentiments.

- A general increase in market volatility across various asset classes.

Elon Musk's Influence on Dogecoin

Elon Musk's public endorsements of Dogecoin, primarily through his prolific Twitter activity, played a pivotal role in shaping its trajectory. His tweets, often cryptic and playful, yet carrying significant weight due to his massive following, sent Dogecoin's price on wild swings. This influence highlighted the immense power of social media in manipulating cryptocurrency markets.

Musk's known penchant for unconventional investments and his embrace of meme culture perfectly aligned with Dogecoin's origins as a joke cryptocurrency. His actions, while seemingly impulsive, demonstrated a calculated understanding of market psychology and the power of social media manipulation. His involvement raises crucial questions about the ethical and legal implications of such influential figures wielding power over volatile financial instruments.

- Examples of specific tweets like "Dogecoin is the people's crypto" and their immediate impact on Dogecoin's price.

- Analysis of the strong correlation between Musk's Twitter activity and Dogecoin's market fluctuations.

- Discussion on potential legal and ethical implications of such significant influence on market behavior, including potential accusations of market manipulation.

Dogecoin's Volatility and Market Speculation

Dogecoin experienced extreme price swings, directly correlated with Musk's actions and broader market trends. These fluctuations were driven not by fundamental value, but largely by speculation and social media hype. This highlights the inherent risks associated with meme coins and the importance of informed decision-making.

The cryptocurrency's volatile nature makes it an exceptionally risky investment. While quick gains are possible, substantial losses can occur just as rapidly. The lack of inherent value, unlike assets backed by tangible resources or strong fundamentals, exacerbates this risk.

- Key price milestones and the events (like Musk's tweets or broader market trends) that triggered them.

- Comparison with other cryptocurrencies, highlighting Dogecoin's significantly higher volatility.

- Analysis of investor sentiment, showing how easily it can shift and drastically impact the price.

The Role of Social Media in Cryptocurrency Markets

The Dogecoin phenomenon underscores the increasing power of social media in shaping cryptocurrency markets. Platforms like Twitter can amplify positive or negative sentiment, causing rapid price movements based on hype rather than underlying value. This influence presents both opportunities and significant risks.

The ease with which social media can be used to manipulate market sentiment necessitates a cautious approach to investment decisions. This underlines the need for stronger regulatory oversight in social media-driven markets, to protect investors from potentially harmful manipulation.

- Examples of other cryptocurrencies impacted by social media trends, illustrating the widespread influence.

- Discussion on the urgent need for regulatory oversight to mitigate the risks of social media manipulation in cryptocurrency markets.

Conclusion

The intertwined relationship between the Trump years, Elon Musk's influence, and Dogecoin's volatility demonstrates the significant impact of social media and key figures on the cryptocurrency market. Dogecoin's journey showcases the risks of investing in highly speculative meme coins driven primarily by hype and social media trends, rather than fundamental value. The inherent volatility and susceptibility to manipulation make it a high-risk asset.

While Dogecoin's story is fascinating, understanding the complexities of the cryptocurrency market, especially the influence of social media and key players like Elon Musk, is crucial for informed investment decisions. Learn more about responsible investing in Dogecoin and other cryptocurrencies before making any investment choices. Further research into the intersection of politics, social media, and cryptocurrency markets is vital to navigate this ever-evolving landscape.

Featured Posts

-

Acquisition Sanofi Un Nouvel Anticorps Prometteur De Dren Bio

May 31, 2025

Acquisition Sanofi Un Nouvel Anticorps Prometteur De Dren Bio

May 31, 2025 -

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025 -

La Brascada Receta Facil Y Rapida Del Bocadillo Valenciano

May 31, 2025

La Brascada Receta Facil Y Rapida Del Bocadillo Valenciano

May 31, 2025 -

Researchers Find Link Between Canadian Wildfires Nyc Cooling And Air Toxicants

May 31, 2025

Researchers Find Link Between Canadian Wildfires Nyc Cooling And Air Toxicants

May 31, 2025 -

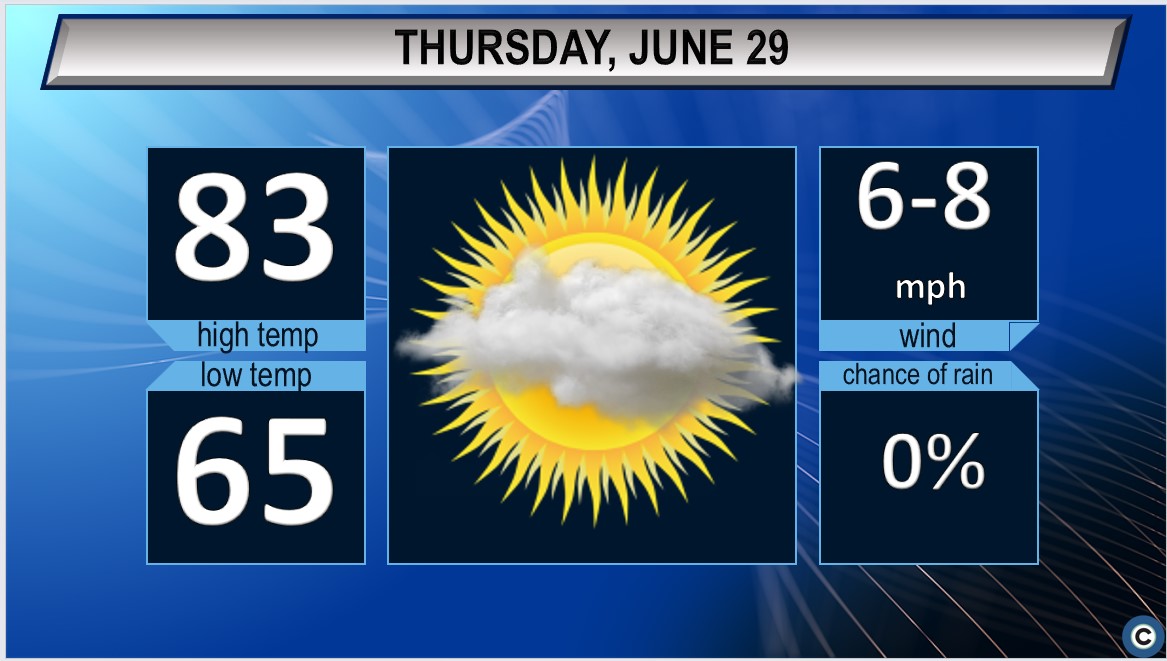

Northeast Ohio Thursday Rain Returns

May 31, 2025

Northeast Ohio Thursday Rain Returns

May 31, 2025