The UK Bottled Water Market: Why You Won't Find Dasani

Table of Contents

The UK's Unique Taste Preferences for Bottled Water

The UK's bottled water market is characterized by distinct consumer preferences that differ significantly from those in other parts of the world. A strong preference for naturally sourced water is evident, with consumers often prioritizing spring water and mineral water over purified options. This preference is deeply rooted in the UK's understanding and appreciation of its diverse water sources, each with its unique mineral profile and taste characteristics. The prevalence of "hard water" in many regions also shapes consumer choices, with some individuals finding the taste of naturally harder waters more appealing than the softer, often purified, alternatives.

Popular UK bottled water brands, such as Highland Spring and Buxton, have successfully capitalized on these preferences. Highland Spring, for example, emphasizes its natural source in the Scottish Highlands, appealing to consumers seeking a pure and refreshing taste. Similarly, Buxton leverages its naturally sourced mineral water, highlighting its unique mineral composition.

- Strong preference for naturally sourced water.

- Less demand for purified water compared to other markets.

- Regional variations in taste preferences influence brand loyalty. For instance, a brand popular in the south of England might not resonate as strongly in Scotland.

Intense Competition in the UK Bottled Water Market

The UK bottled water market is fiercely competitive, saturated with both established domestic brands and international players. This creates significant barriers to entry for new brands, such as Dasani. Established brands benefit from strong brand recognition and consumer loyalty, built up over years of marketing and distribution efforts. They command a substantial market share, leaving limited space for newcomers to gain a foothold.

Successful brands employ aggressive marketing strategies, focusing on highlighting their unique selling points, whether it's the source of their water, its mineral content, or its environmental credentials. They invest heavily in distribution networks, ensuring their products are readily available across a wide range of retail outlets.

- High barriers to entry for new brands.

- Established brands enjoy strong brand recognition and loyalty.

- Aggressive marketing and distribution strategies are crucial.

Distribution and Logistics Challenges for Dasani in the UK

Importing and distributing bottled water within the UK presents considerable logistical hurdles. Transportation costs can be substantial, particularly given the volume of water required to supply a large market. Furthermore, import regulations and customs procedures add complexity and cost to the supply chain. Brexit has further complicated matters, impacting import/export dynamics and potentially increasing costs and administrative burdens. Efficient distribution networks are vital for success in the UK, requiring extensive warehousing, transportation infrastructure, and a well-established retailer network.

- High transportation costs.

- Complex import regulations.

- Efficient distribution networks are essential for success.

Conclusion: Understanding Dasani's Absence in the UK Bottled Water Market

Dasani's absence from the UK bottled water market can be attributed to a combination of factors: the UK's unique taste preferences for naturally sourced water, the intensely competitive market landscape dominated by established brands, and the logistical complexities associated with importing and distributing bottled water into the UK. Understanding consumer preferences and the intricate dynamics of this market is paramount for any brand aiming for success within this competitive landscape.

Learn more about navigating the complexities of the UK bottled water market and discover strategies for success. Gaining insights into consumer behaviour and market trends is key to overcoming the challenges faced by new entrants and achieving a profitable position within the UK's thriving bottled water sector.

Featured Posts

-

Anthony Edwards Baby Mama Drama Ignites Twitter

May 16, 2025

Anthony Edwards Baby Mama Drama Ignites Twitter

May 16, 2025 -

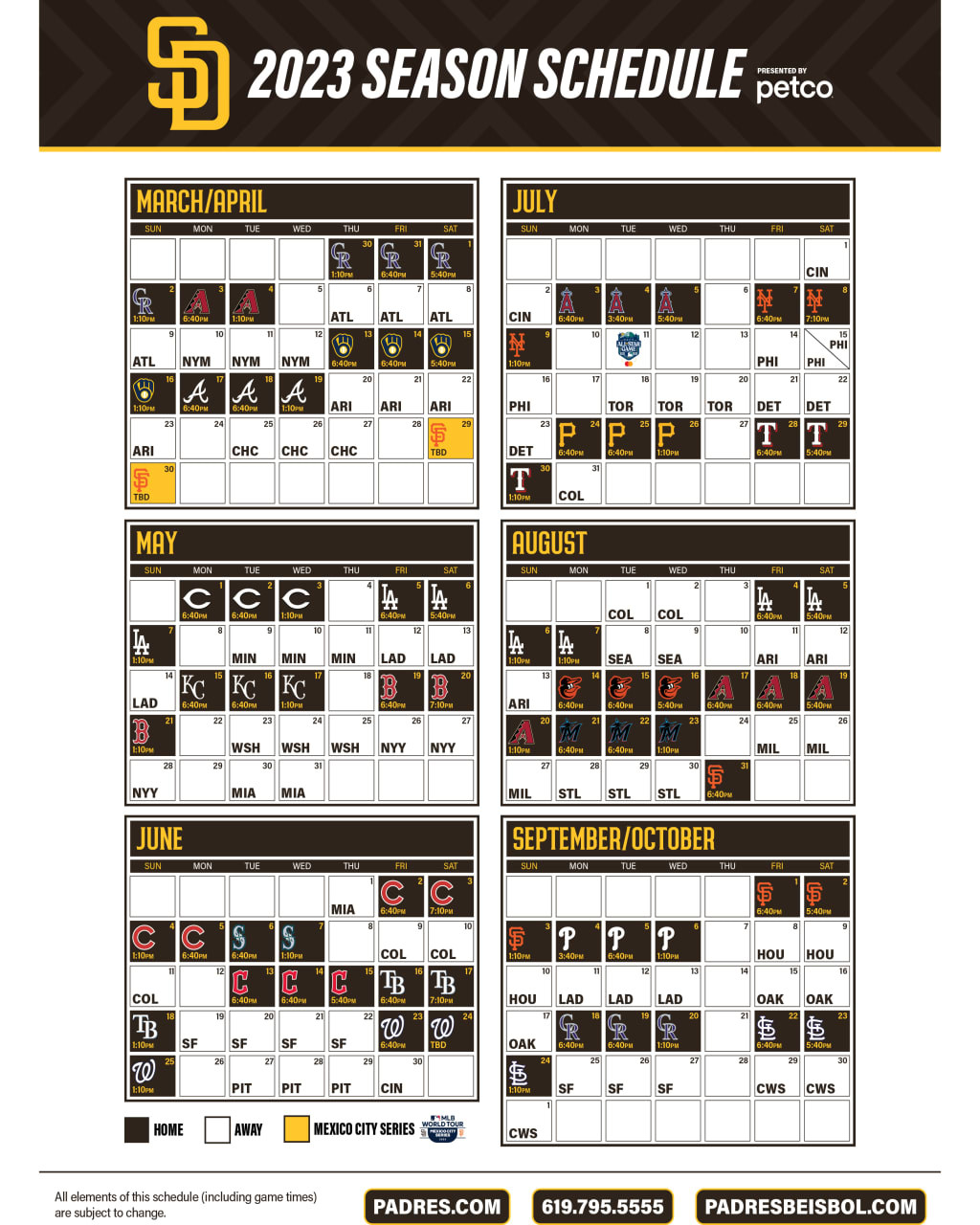

2025 Padres Regular Season Games Where To Watch

May 16, 2025

2025 Padres Regular Season Games Where To Watch

May 16, 2025 -

Fanatics Supporting The Celtics Back To Back Nba Finals Bid With Official Gear

May 16, 2025

Fanatics Supporting The Celtics Back To Back Nba Finals Bid With Official Gear

May 16, 2025 -

Hornets Vs Celtics Nba Game Tonights Predictions Picks And Odds Breakdown

May 16, 2025

Hornets Vs Celtics Nba Game Tonights Predictions Picks And Odds Breakdown

May 16, 2025 -

Australias Election Weighing The Pitches Of Albanese And Dutton

May 16, 2025

Australias Election Weighing The Pitches Of Albanese And Dutton

May 16, 2025