The Underappreciated Value Of News Corp: A Comprehensive Analysis

Table of Contents

H2: News Corp's Diversified Portfolio: A Key Strength

News Corp's strength lies in its remarkably diversified portfolio, spanning various media sectors and offering resilience against market fluctuations. This diversification mitigates risk and creates multiple avenues for growth.

H3: Dominance in News and Publishing:

News Corp holds a commanding position in the news and publishing world. Its flagship titles, such as The Wall Street Journal, The Times, and The Sun, boast immense brand recognition and influence. This dominance translates into substantial revenue streams and market share.

- Market Share: The Wall Street Journal maintains a leading position in the US financial news market, while The Sun holds a significant share of the UK tabloid market. Precise figures vary by publication and reporting period, but their combined market influence is undeniable.

- Revenue Figures: While specific revenue figures fluctuate, the consistent profitability of these publications demonstrates their enduring value and appeal. Annual reports provide detailed breakdowns of revenue generation across various segments.

- Brand Recognition: The established brands within News Corp's publishing portfolio possess unmatched global recognition and trust, creating a significant barrier to entry for competitors.

- Digital Strategies: News Corp is actively pursuing digital transformation strategies, expanding its online presence and subscriber bases for many of its publications. This digital shift is vital for long-term sustainability and growth.

H3: The Power of Television and Entertainment:

While the sale of Fox Corporation to Disney significantly altered News Corp's structure, the remaining entertainment assets still contribute to its overall value. Although no longer a major player in broadcast television, News Corp maintains a presence in the entertainment landscape. Future acquisitions or partnerships in this sector could significantly boost growth.

- Viewership Data: While detailed viewership figures are not always publicly available for all News Corp entertainment holdings, the success of certain properties (where applicable) can indicate the potential for growth and revenue generation.

- Revenue Streams: Revenue streams are diverse and may include licensing agreements, content distribution, and other ventures within the entertainment space.

- Potential for Growth in Streaming: News Corp could leverage its existing content libraries and brands to expand into the rapidly growing streaming market. Strategic partnerships in this field could further accelerate growth.

- Partnerships: Strategic partnerships with other entertainment companies could provide access to wider audiences and new revenue opportunities.

H3: Real Estate Holdings and Other Diversification:

News Corp also benefits from strategic real estate holdings and other diversified investments. These assets contribute to the company's overall value and provide additional streams of revenue.

- Asset Values: The value of News Corp's real estate holdings can fluctuate depending on market conditions, but they contribute to the company's net asset value.

- Rental Income: Rental income from properties provides a consistent revenue stream, enhancing the company’s financial stability.

- Potential for Future Development or Sale: These assets present opportunities for future development or strategic sales, potentially unlocking significant value for shareholders.

H2: Undervaluation Factors and Market Misperceptions

Despite its diversified portfolio, News Corp faces challenges that contribute to its undervaluation in the market.

H3: Legacy Media Concerns and Digital Transition:

The shift to digital media has presented significant challenges for traditional media companies like News Corp. Investors often express concerns about declining print readership and the costs associated with digital transformation.

- Competition from Digital Media: News Corp faces intense competition from digital-native news and entertainment platforms.

- Declining Print Readership: The decline in print readership is a significant challenge, requiring News Corp to accelerate its transition to digital platforms.

- Strategies for Digital Transformation: News Corp is actively investing in digital strategies, including paywalls, subscription models, and digital-first content creation. The success of these strategies will be crucial for future growth.

H3: Geopolitical Risks and Regulatory Uncertainty:

News Corp's international operations expose it to geopolitical risks and regulatory uncertainty in various markets. These factors can impact profitability and investor sentiment.

- Specific Geographical Risks: Operating in different countries introduces exposure to political instability, economic downturns, and regulatory changes.

- Regulatory Changes: Changes in media regulations in different jurisdictions can impact News Corp's operations and profitability.

- Potential Impacts on Profitability: Geopolitical risks and regulatory uncertainty can negatively affect profitability and create challenges for long-term planning.

H3: Short-Term Focus of the Market:

The market's short-term focus may be overlooking News Corp's long-term potential. Investors often prioritize immediate financial results over long-term strategic value.

- Market Sentiment Analysis: Negative market sentiment towards traditional media can overshadow the long-term value of News Corp's assets.

- Analyst Reports: Some analyst reports may fail to adequately capture the full value of News Corp's diversified portfolio and long-term growth potential.

- Investor Behavior: Short-term investor behavior can lead to undervaluation of companies with significant long-term potential.

H2: Future Prospects and Growth Potential of News Corp

Despite the challenges, News Corp possesses significant potential for future growth.

H3: Digital Transformation Strategies and Successes:

News Corp's ongoing digital transformation is showing signs of success, with increasing digital subscriptions and revenue generation from online platforms.

- Specific Digital Platforms: News Corp is actively developing and improving its digital platforms to attract and retain subscribers.

- Subscriber Growth: Growth in digital subscribers indicates the success of its digital transformation efforts.

- Revenue from Digital Channels: Increasing revenue from digital channels demonstrates the growing contribution of digital platforms to overall revenue.

H3: Strategic Acquisitions and Partnerships:

Strategic acquisitions and partnerships could further enhance News Corp's market position and unlock additional growth opportunities.

- Potential Acquisition Targets: Identifying and acquiring companies that complement News Corp’s existing portfolio could accelerate growth.

- Synergistic Partnerships: Partnerships with other companies can provide access to new markets and technologies.

- Expected Return on Investment: Careful selection of acquisition targets and partners can ensure a positive return on investment.

H3: Long-Term Value Creation:

News Corp's diversified portfolio and ongoing digital transformation efforts position it for long-term value creation.

- Long-Term Financial Projections: While predictions are inherently uncertain, positive long-term financial projections support the argument for News Corp’s undervaluation.

- Potential for Dividend Growth: Consistent profitability and future growth could lead to increased dividend payouts for shareholders.

- Overall Value Proposition: The overall value proposition of News Corp is compelling, considering its diversified assets, strong brands, and growth potential.

3. Conclusion:

This comprehensive analysis reveals that News Corp’s true value remains significantly underappreciated by the market. Its diversified portfolio, encompassing leading news publications, strategic real estate holdings, and opportunities in the evolving digital landscape, offers considerable resilience and long-term growth potential. While challenges remain in adapting to the digital age and navigating geopolitical uncertainties, News Corp's strategic initiatives and potential for future acquisitions point toward a bright future. It's time to take a closer look at the potential of News Corp and consider its strategic positioning for long-term growth. Investors should carefully consider the long-term value proposition of News Corp stock and its potential for significant returns.

Featured Posts

-

Porsche 911 Melyrehato Nezet Az 80 Millios Extrakra

May 25, 2025

Porsche 911 Melyrehato Nezet Az 80 Millios Extrakra

May 25, 2025 -

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 25, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 25, 2025 -

Cheshire Deeside M56 Traffic Major Delays After Collision

May 25, 2025

Cheshire Deeside M56 Traffic Major Delays After Collision

May 25, 2025 -

Listen Now Joy Crookes Shares New Single I Know You D Kill

May 25, 2025

Listen Now Joy Crookes Shares New Single I Know You D Kill

May 25, 2025 -

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 25, 2025

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 25, 2025

Latest Posts

-

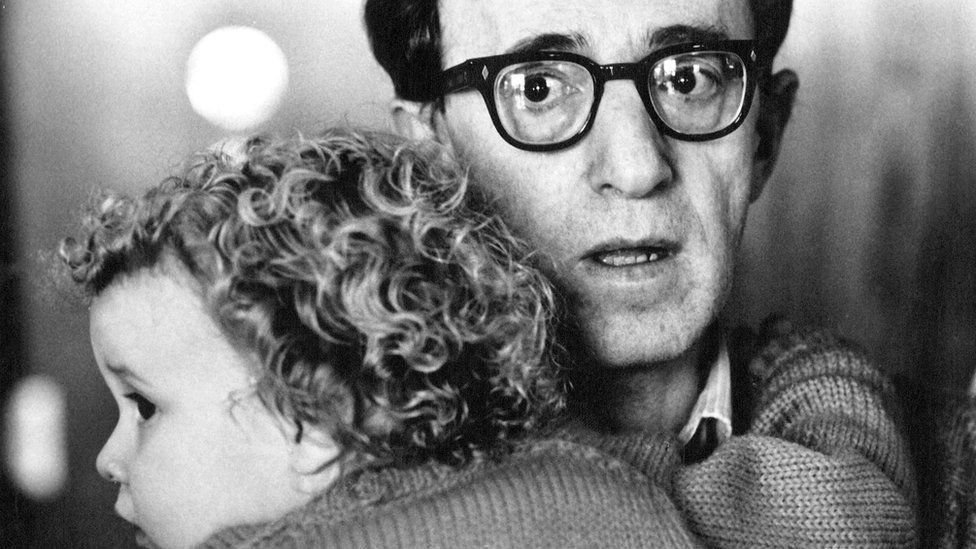

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025 -

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025