Three More Rate Cuts Predicted By Desjardins For Bank Of Canada

Table of Contents

Desjardins' Reasoning Behind the Prediction

Desjardins' prediction of three further Bank of Canada interest rate reductions rests on a careful analysis of several key economic indicators. Their economic outlook points to a confluence of factors suggesting the need for continued monetary policy easing. The primary reasons cited include:

-

Falling Inflation, but not Fast Enough: While inflation is decreasing, Desjardins believes the pace is too slow to meet the Bank of Canada's target, necessitating further rate reductions to cool things down.

-

Slowing Economic Growth: The Canadian economy is showing signs of deceleration. Desjardins anticipates a significant slowdown in economic growth in the coming months, potentially bordering on a recession.

-

Rising Unemployment Concerns: There are growing concerns about rising unemployment, adding pressure on the Bank of Canada to stimulate the economy through lower interest rates.

-

Weakening Canadian Dollar: A weaker Canadian dollar can contribute to higher import prices and inflation. Desjardins' analysis incorporates this factor into its prediction.

These conclusions are detailed in several recent Desjardins reports, notably those authored by [mention specific report names and economists if available, linking to the reports if possible]. Unlike some analysts who predict only one or two cuts, Desjardins anticipates a more aggressive approach to monetary policy easing.

Potential Impacts of Three More Rate Cuts

The predicted three interest rate cuts could have far-reaching consequences across the Canadian economy. Let’s analyze some key areas:

-

Mortgage Rates: Lower interest rates will directly translate to lower mortgage rates, potentially boosting the housing market and making homeownership more accessible for some.

-

Consumer Spending: Reduced borrowing costs should incentivize increased consumer spending, providing a much-needed boost to economic activity. This could lead to greater economic stimulus.

-

Canadian Dollar and International Trade: Lower interest rates typically weaken a nation's currency. A weaker Canadian dollar could benefit export-oriented industries but increase the cost of imports.

-

Risks Associated with Further Cuts: While rate cuts can stimulate the economy, there is a risk that they could reignite inflationary pressures if not carefully managed. This requires a delicate balancing act by the Bank of Canada. The potential for increased inflation is a risk Desjardins acknowledges.

What This Means for Canadians

The predicted rate cuts will have a direct impact on Canadian personal finances. Here’s how you can prepare:

-

Mortgage Refinancing: Consider refinancing your mortgage to lock in lower rates and potentially save money on your monthly payments.

-

Budget Adjustments: Lower interest rates might allow for increased discretionary spending. However, it’s crucial to adjust your budget responsibly and avoid overspending.

-

Investment Strategies: Lower interest rates might influence your investment strategy. Consult with a financial advisor to determine the best course of action for your portfolio.

-

Debt Management: While lower rates make borrowing cheaper, it's vital to manage your debt responsibly and avoid accumulating excessive debt.

Conclusion

Desjardins' prediction of three more Bank of Canada interest rate cuts signals a significant shift in monetary policy, driven by concerns about slowing economic growth, stubbornly high inflation, and rising unemployment. This forecast, while offering potential benefits like lower mortgage rates and increased consumer spending, also carries risks, particularly the possibility of reigniting inflation. Understanding these implications is crucial for Canadians to effectively manage their personal finances and prepare for the economic changes ahead. Stay updated on the latest Bank of Canada interest rate predictions from Desjardins and plan your financial strategy accordingly. For more in-depth analysis, visit the Desjardins website [insert link to relevant Desjardins page].

Featured Posts

-

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 23, 2025

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 23, 2025 -

Alix Earle From Tik Tok Star To Dwtss Savviest Influencer

May 23, 2025

Alix Earle From Tik Tok Star To Dwtss Savviest Influencer

May 23, 2025 -

Alghmwd Yktnf Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Ilyas Rwdryjyz Fy Dayrt Alatham

May 23, 2025

Alghmwd Yktnf Qdyt Mqtl Mwzfy Alsfart Alisrayylyt Ilyas Rwdryjyz Fy Dayrt Alatham

May 23, 2025 -

Valerie Rodriguez Confirmada Como Nueva Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025

Valerie Rodriguez Confirmada Como Nueva Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025 -

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 23, 2025

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 23, 2025

Latest Posts

-

Grossfeuer In Essen Heisingen Polizeimeldung Und Feuerwehr Einsatz Am 07 04 2025

May 23, 2025

Grossfeuer In Essen Heisingen Polizeimeldung Und Feuerwehr Einsatz Am 07 04 2025

May 23, 2025 -

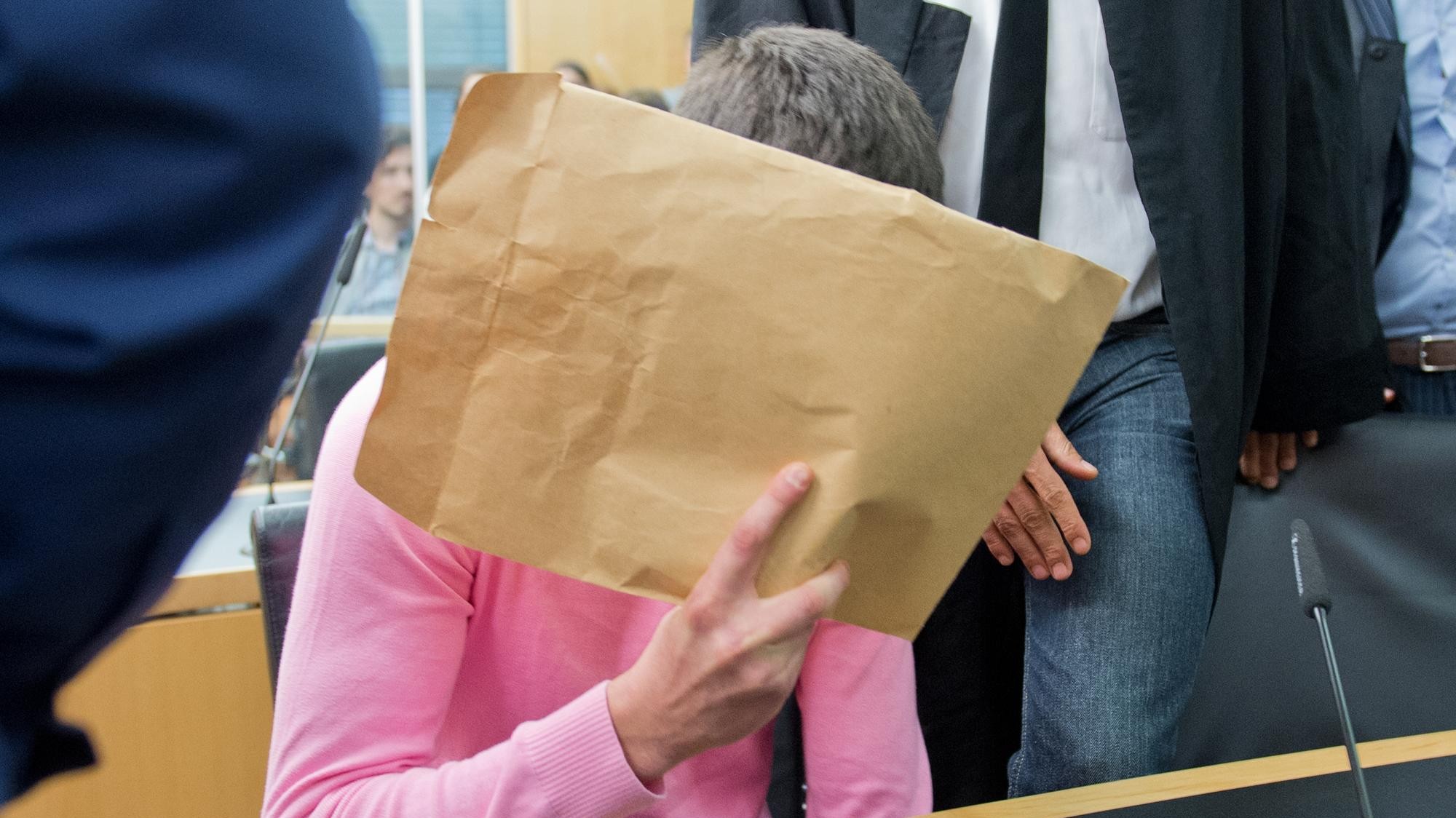

Notenmanipulation An Nrw Hochschule Angeklagte Erhalten Gefaengnisstrafen

May 23, 2025

Notenmanipulation An Nrw Hochschule Angeklagte Erhalten Gefaengnisstrafen

May 23, 2025 -

Uniklinikum Essen Und Seine Nachbarschaft Berichte Und Geschichten

May 23, 2025

Uniklinikum Essen Und Seine Nachbarschaft Berichte Und Geschichten

May 23, 2025 -

Nrw Universitaet Urteil Im Fall Der Notenmanipulation Haftstrafen Verhaengt

May 23, 2025

Nrw Universitaet Urteil Im Fall Der Notenmanipulation Haftstrafen Verhaengt

May 23, 2025 -

Alsltat Alalmanyt Tshn Hmlt Mdahmat Ela Mshjeyn Ryadyyn

May 23, 2025

Alsltat Alalmanyt Tshn Hmlt Mdahmat Ela Mshjeyn Ryadyyn

May 23, 2025