Thursday's CoreWeave (CRWV) Stock Decline: A Deep Dive

Table of Contents

Market-Wide Factors Influencing CRWV Stock

Several macroeconomic factors likely contributed to Thursday's broader market downturn, indirectly impacting CRWV's stock price.

Broad Market Volatility

- The Nasdaq Composite and S&P 500 experienced notable declines on Thursday, indicating a general negative sentiment across the market. This widespread volatility often affects individual stocks, regardless of their specific performance. News reports highlighted concerns about [insert specific news impacting market sentiment, e.g., inflation, geopolitical events].

- The tech sector, which CRWV is a part of, suffered disproportionately compared to other sectors, suggesting investor apprehension about growth stocks in the current climate. This general negative sentiment likely impacted investor confidence in CRWV.

Interest Rate Hikes and Their Ripple Effects

- The ongoing cycle of interest rate hikes by the Federal Reserve continues to impact investor behavior. Higher interest rates increase borrowing costs for companies, potentially slowing growth and reducing profitability, particularly for high-growth companies like CRWV.

- The Federal Reserve's recent announcements [cite specific announcements and predictions] regarding future interest rate adjustments may have further fueled investor uncertainty, leading to a sell-off in growth stocks like CRWV. Investors may be shifting their portfolios towards more conservative investments offering higher yields in the current interest rate environment.

CoreWeave (CRWV)-Specific News and Events

Beyond the general market conditions, company-specific factors could have also contributed to Thursday's CRWV stock decline.

Analysis of Any Company-Specific Press Releases or Announcements

- [If applicable, mention any press releases or announcements issued by CoreWeave on or around Thursday. For example: "CoreWeave released a statement on Thursday regarding [topic of press release], which may have negatively impacted investor sentiment." Provide a link to the press release if available.]

- [If no specific news is available, state that no significant company-specific news was released that could explain the decline, strengthening the argument for market-wide factors as the primary cause.]

Analyst Ratings and Price Target Changes

- [If applicable, discuss any changes in analyst ratings or price targets for CRWV. For example: "Several prominent analysts, including [analyst name] from [firm name], downgraded their rating for CRWV, citing [reasons for downgrade]. This negative outlook likely contributed to the sell-off."]

- [If no analyst changes are found, mention the lack of significant analyst downgrades as a factor supporting the hypothesis that the decline was primarily driven by broader market forces.]

Technical Analysis of CRWV Stock Chart

A technical analysis of the CRWV stock chart can shed light on the dynamics of the decline.

Identifying Key Support and Resistance Levels

- [Describe the key support and resistance levels observed on the CRWV chart on Thursday. For example: "The stock broke through key support at $[price], indicating significant selling pressure. Previous resistance levels at $[price] were unable to hold."]

- [Mention relevant technical indicators, such as moving averages, Relative Strength Index (RSI), or others that might indicate oversold conditions or strong downward momentum.] Include a chart or graph if possible.

Trading Volume and Volatility

- [Compare the trading volume on Thursday to average daily volume. For example: "Trading volume on Thursday was significantly higher than the average daily volume, suggesting strong selling pressure."]

- [Analyze the volatility of the stock on Thursday compared to previous days. Increased volatility can indicate heightened market uncertainty and potential for further price fluctuations.]

Conclusion: Understanding and Navigating Thursday's CoreWeave (CRWV) Stock Decline

Thursday's CoreWeave (CRWV) stock decline appears to be a complex event influenced by a combination of market-wide factors, including broader market volatility and the impact of rising interest rates, and potentially some company-specific news or analyst sentiment. Understanding these interacting forces is crucial for investors seeking to navigate the fluctuations in CRWV's stock price. While the decline presents risks, it also potentially offers opportunities for long-term investors with a high-risk tolerance and a solid understanding of the company's fundamentals. Are you prepared to navigate future fluctuations in CoreWeave (CRWV) stock?

Featured Posts

-

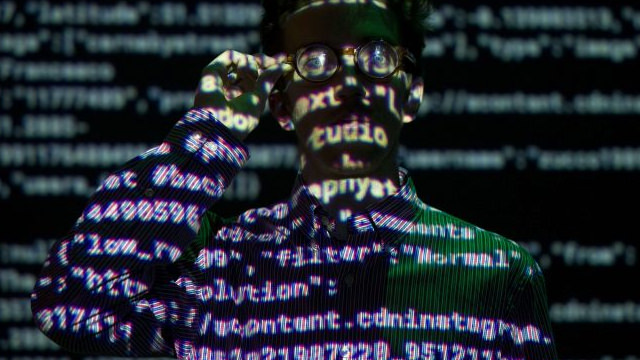

The Rise Of Streamer Revenue And Its Implications For Consumers

May 22, 2025

The Rise Of Streamer Revenue And Its Implications For Consumers

May 22, 2025 -

Record Forest Loss Wildfires Drive Unprecedented Destruction Globally

May 22, 2025

Record Forest Loss Wildfires Drive Unprecedented Destruction Globally

May 22, 2025 -

Allentowns Historic Penn Relays 4x100m A Sub 43 Finish

May 22, 2025

Allentowns Historic Penn Relays 4x100m A Sub 43 Finish

May 22, 2025 -

Is Western Separation Realistic A Saskatchewan Political Panel Explores The Issues

May 22, 2025

Is Western Separation Realistic A Saskatchewan Political Panel Explores The Issues

May 22, 2025 -

Route 15 On Ramp Closure Details On The Crash And Traffic Impact

May 22, 2025

Route 15 On Ramp Closure Details On The Crash And Traffic Impact

May 22, 2025

Latest Posts

-

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025

Wordle April 27th Solution Hints And Clues For Puzzle 1408

May 22, 2025 -

March 13th Wordle Solution 363 Hints And Clues

May 22, 2025

March 13th Wordle Solution 363 Hints And Clues

May 22, 2025 -

Wordle 1408 Hints And Solution For April 27th

May 22, 2025

Wordle 1408 Hints And Solution For April 27th

May 22, 2025 -

Wordle Hints And Clues Thursday March 13th Wordle 363

May 22, 2025

Wordle Hints And Clues Thursday March 13th Wordle 363

May 22, 2025 -

Wordle 363 Answer March 13th Hints And Clues To Help You Solve

May 22, 2025

Wordle 363 Answer March 13th Hints And Clues To Help You Solve

May 22, 2025