TikTok's "Just Contact Us" Tariff Workarounds: A CNN Investigation

Table of Contents

The "Just Contact Us" Strategy: A Convenient Loophole?

The CNN investigation alleges that TikTok utilizes a "Just Contact Us" strategy to address tariff-related issues concerning its imports into the US. Instead of formally navigating the complex process of tariff declarations and payments, businesses allegedly contact TikTok directly to resolve any discrepancies or challenges related to import tariffs. The outcome, according to the investigation, is often a reduction or waiver of tariffs, effectively circumventing standard procedures.

This process, while seemingly informal and convenient, raises serious concerns regarding the fair application of US trade policy. The investigation suggests this approach gives TikTok a competitive advantage over companies diligently following established import tariff regulations.

- Examples from the CNN Investigation:

- Businesses reported successfully negotiating lower tariffs after contacting TikTok directly, citing instances of misclassification or overcharging.

- Several importers claimed their tariff burdens were significantly reduced following informal communication with TikTok representatives.

- The investigation uncovered discrepancies between the reported tariff payments and the actual import values of TikTok's goods.

Analyzing the Legal Implications of TikTok's Actions

The legal framework surrounding tariffs and import regulations in the US is complex and rigorously enforced. The US Customs and Border Protection (CBP) establishes clear guidelines for the classification and valuation of imported goods, with specific penalties for non-compliance. TikTok's alleged "Just Contact Us" strategy raises questions about whether their actions constitute a violation of these regulations, potentially falling under the umbrella of tariff evasion.

- Key Legal Arguments:

- Prosecution Argument: TikTok's informal approach undermines the established process, potentially leading to unfair competition and revenue loss for the US government.

- Defense Argument: TikTok may argue that their actions were aimed at resolving legitimate discrepancies in tariff classification and valuation, not intentionally evading tariffs.

The potential penalties for violating US import regulations are substantial, ranging from financial penalties to legal action and potential operational restrictions.

The Impact on Competitors and the US Economy

TikTok's alleged circumvention of tariffs creates a significant competitive disadvantage for other businesses operating in the US market. Companies that comply diligently with import regulations bear a higher cost of goods, potentially reducing their market share and profitability. This unfair advantage, if proven, could distort the market and hinder fair competition.

- Economic Consequences of Tariff Avoidance:

- Loss of government revenue due to underpayment of tariffs.

- Damage to the competitiveness of US businesses that comply with regulations.

- Potential distortion of the market and reduction of fair competition.

- Negative impact on US employment and economic growth.

TikTok's Response and Future Implications

TikTok's official response to the CNN investigation has been [insert TikTok's official statement here, if available]. However, the investigation raises serious questions about the company’s future operations in the US. Depending on the findings of further investigations and potential legal actions, TikTok could face significant challenges, including substantial fines and potential regulatory changes impacting its business model.

- Potential Future Actions:

- Increased regulatory scrutiny of TikTok's import practices.

- Potential changes to US trade policies regarding digital platforms.

- Enhanced enforcement of import regulations to prevent similar practices by other companies.

Conclusion: Understanding the Ramifications of TikTok's "Just Contact Us" Tariff Workarounds

The CNN investigation into TikTok's "Just Contact Us" strategy highlights significant concerns regarding the fair application of US tariffs and the potential for large corporations to circumvent established trade regulations. The alleged actions raise critical legal, economic, and competitive implications, affecting both US businesses and the broader economy. Transparency and compliance with US trade regulations are paramount to maintaining a level playing field and fostering a healthy business environment.

To stay informed about future developments regarding TikTok's tariff practices and the ongoing debate surrounding TikTok's "Just Contact Us" tariff workarounds, continue researching relevant keywords such as TikTok tariffs, import tariffs, US trade policy, tariff evasion, trade law, and import regulations. Understanding these issues is crucial for navigating the complexities of international trade and ensuring fair competition.

Featured Posts

-

Hegseths Signal Chats Wife And Brother Involved In Military Plan Disclosure

Apr 22, 2025

Hegseths Signal Chats Wife And Brother Involved In Military Plan Disclosure

Apr 22, 2025 -

Supreme Court Hearing On Obamacare How Trumps Position Impacts Rfk Jr

Apr 22, 2025

Supreme Court Hearing On Obamacare How Trumps Position Impacts Rfk Jr

Apr 22, 2025 -

New Security Initiatives China And Indonesia Forge Closer Links

Apr 22, 2025

New Security Initiatives China And Indonesia Forge Closer Links

Apr 22, 2025 -

The Trump Administrations Trade Agenda And Its Consequences For American Finance

Apr 22, 2025

The Trump Administrations Trade Agenda And Its Consequences For American Finance

Apr 22, 2025 -

The Importance Of Middle Management Driving Productivity And Employee Engagement

Apr 22, 2025

The Importance Of Middle Management Driving Productivity And Employee Engagement

Apr 22, 2025

Latest Posts

-

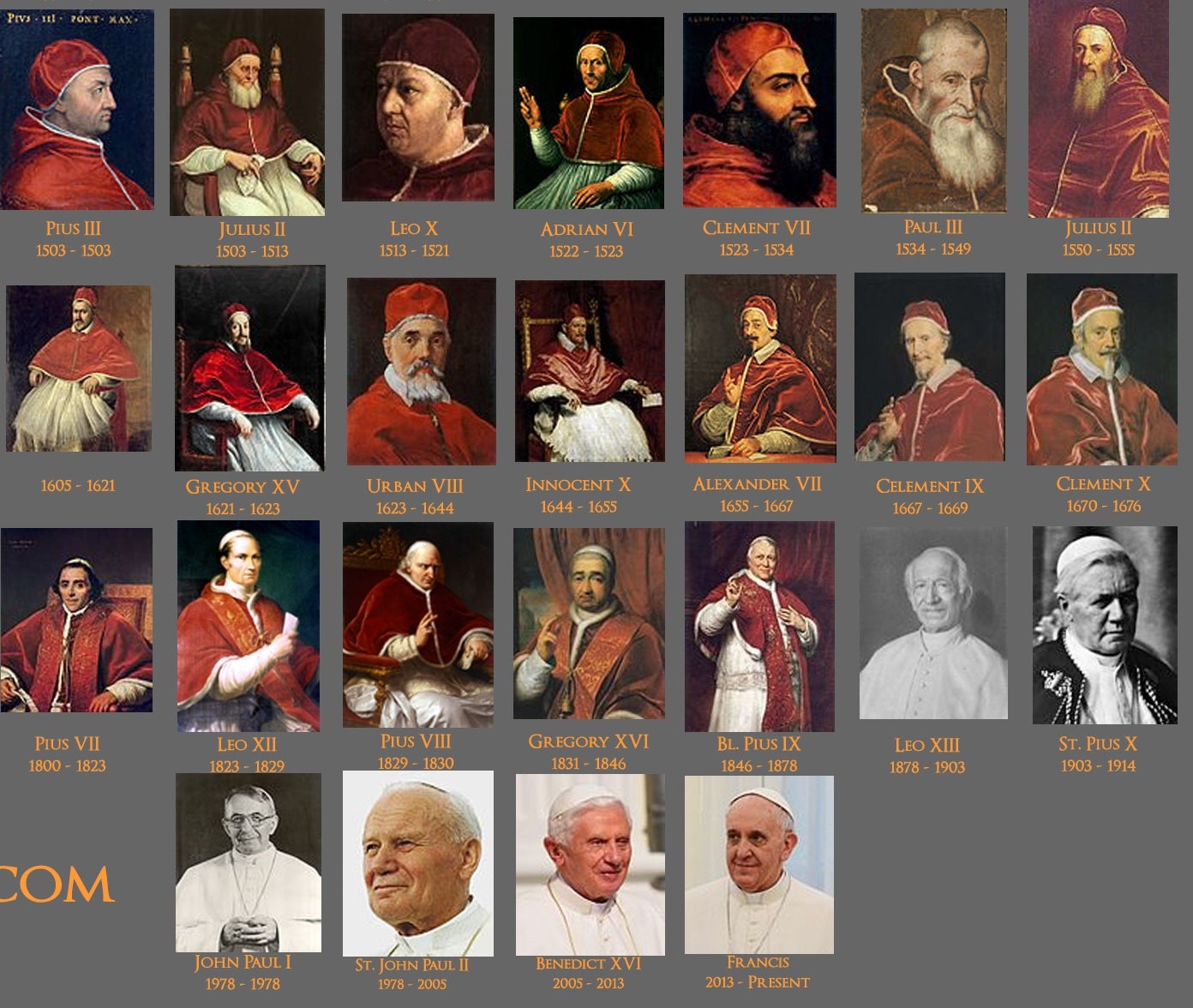

The Next Papal Election Analyzing Potential Candidates

May 12, 2025

The Next Papal Election Analyzing Potential Candidates

May 12, 2025 -

Next Pope Predicting The Future Leader Of The Catholic Church

May 12, 2025

Next Pope Predicting The Future Leader Of The Catholic Church

May 12, 2025 -

Analyzing The Next Papal Election Key Factors And Potential Candidates

May 12, 2025

Analyzing The Next Papal Election Key Factors And Potential Candidates

May 12, 2025 -

Possible Successors To Pope Francis Leading Cardinals And Their Platforms

May 12, 2025

Possible Successors To Pope Francis Leading Cardinals And Their Platforms

May 12, 2025 -

Potential Popes Analyzing The Leading Contenders For The Papacy

May 12, 2025

Potential Popes Analyzing The Leading Contenders For The Papacy

May 12, 2025