Tim Cook's Tariff Announcement Triggers Apple Stock Sell-Off

Table of Contents

The Tariff Announcement and its Implications

Tim Cook's announcement detailed the negative effects of newly implemented tariffs on several key Apple product lines. These tariffs, imposed by [Country imposing tariffs], significantly increased the cost of importing components and finished goods crucial to Apple's manufacturing process.

- Percentage Increase in Tariffs: The tariffs resulted in a [Insert Percentage]% increase in import costs for affected products.

- Affected Product Lines: The announcement specifically mentioned increased costs for iPhones, iPads, Macs, and AirPods, impacting a substantial portion of Apple's revenue streams. The impact was particularly pronounced on products manufactured in [Specific countries or regions].

- Geographic Impact: The tariffs primarily affected Apple's supply chain originating from [Specific countries or regions], significantly impacting the cost of goods sold and potentially altering pricing strategies for various global markets.

These tariffs directly impact Apple's profitability in several ways. Increased production costs could force Apple to either absorb the added expenses, reducing profit margins, or pass them on to consumers through price increases, potentially reducing consumer demand. The increased cost of production also makes Apple less competitive compared to rivals who may not be as heavily impacted by these specific tariffs, creating a challenging market dynamic.

Market Reaction and Apple Stock Performance

The market reacted swiftly and negatively to Tim Cook's tariff announcement. Apple's stock price experienced a sharp decline, falling by [Insert Percentage]% within [Timeframe, e.g., hours] of the announcement. Trading volume spiked significantly, indicating a high level of investor activity and concern.

- Percentage Drop in Apple Stock Price: Apple's stock price plummeted by [Specific Percentage]%, wiping out billions of dollars in market capitalization.

- Timing of the Sell-Off: The majority of the sell-off occurred during [Intraday or after-hours trading], highlighting the immediate market sensitivity to the news.

- Data Sources: Data from sources like the [e.g., New York Stock Exchange, Bloomberg, etc.] confirmed the significant drop in Apple's stock price.

This negative sentiment extended beyond Apple itself. While not all tech stocks experienced the same magnitude of decline, the broader tech sector felt the ripple effect, reflecting investor apprehension about the overall impact of escalating trade wars on global business. This broader sell-off suggests a growing concern amongst investors regarding the potential for widespread economic disruption.

Investor Sentiment and Analyst Reactions

Investor sentiment following the announcement was overwhelmingly negative. Concerns centered on the potential for reduced profitability, decreased consumer demand due to price increases, and the long-term uncertainties surrounding global trade relations. Many investors viewed the tariff announcement as a signal of potentially increased costs and reduced competitiveness for Apple.

- Analyst Comments and Predictions: Several analysts downgraded their Apple stock rating, citing concerns about reduced profit margins and increased uncertainty. Others suggested that Apple might need to reconsider its manufacturing strategy.

- Investor Strategies: Some investors chose to "buy the dip," hoping for a short-term recovery. Others adopted a more cautious approach, opting to sell their shares and await further clarification on the situation before reinvesting.

- Impact on Future Investments: The increased uncertainty caused by the tariffs may prompt Apple to reassess its investment plans and potentially slow down expansion in certain markets.

Long-Term Implications for Apple's Business Strategy

To mitigate the negative impacts of these tariffs, Apple is likely to explore several strategic adjustments. These changes will be crucial in maintaining profitability and competitive standing in a challenging global market.

- Increased Automation and Reshoring: Apple may accelerate its investments in automation to reduce reliance on labor-intensive manufacturing processes in tariff-affected regions. Additionally, reshoring – moving manufacturing operations back to the United States or other countries with favorable trade agreements – could become a key part of their long-term strategy.

- Pricing Strategies: Apple may be forced to adjust its pricing strategies, potentially raising prices in some markets to offset increased production costs while maintaining more competitive pricing in others.

- Impact on Consumer Demand: The ultimate success of Apple’s adaptation will depend on the elasticity of consumer demand. Higher prices may reduce demand, especially in price-sensitive markets.

Conclusion

Tim Cook's tariff announcement and the subsequent Apple stock sell-off serve as a stark reminder of the significant impact global trade policies can have on even the most successful multinational corporations. The increased production costs, negative investor sentiment, and the need for strategic adaptation highlight the challenges Apple faces in navigating an increasingly complex global economic landscape. The long-term consequences will depend on how effectively Apple manages these challenges. Stay informed about the ongoing developments regarding the impact of tariffs on Apple and the broader tech sector. Follow reputable financial news sources for updates on the Apple stock price and Tim Cook's future announcements concerning tariffs and their effects on Apple's financial performance and future prospects. Monitor the Apple stock closely for further market reactions and strategic decisions.

Featured Posts

-

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Guccis Supply Chain Future Uncertain After Vians Departure

May 25, 2025

Guccis Supply Chain Future Uncertain After Vians Departure

May 25, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 25, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 25, 2025 -

Na Uitstel Trump Aex Fondsen Klimmen Stevig Omhoog

May 25, 2025

Na Uitstel Trump Aex Fondsen Klimmen Stevig Omhoog

May 25, 2025 -

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025

Apple Stock Key Levels Breached Ahead Of Q2 Financial Results

May 25, 2025

Latest Posts

-

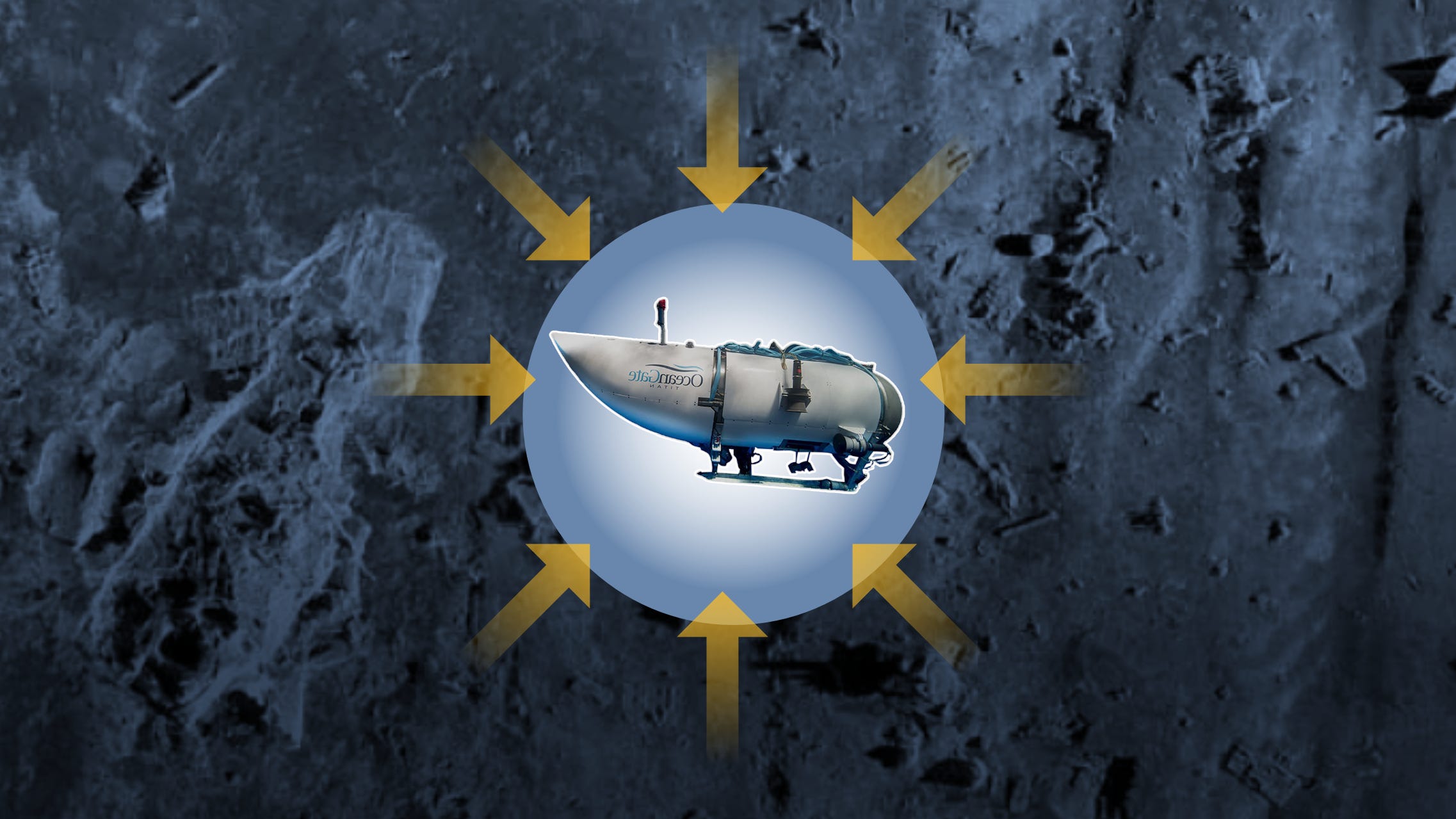

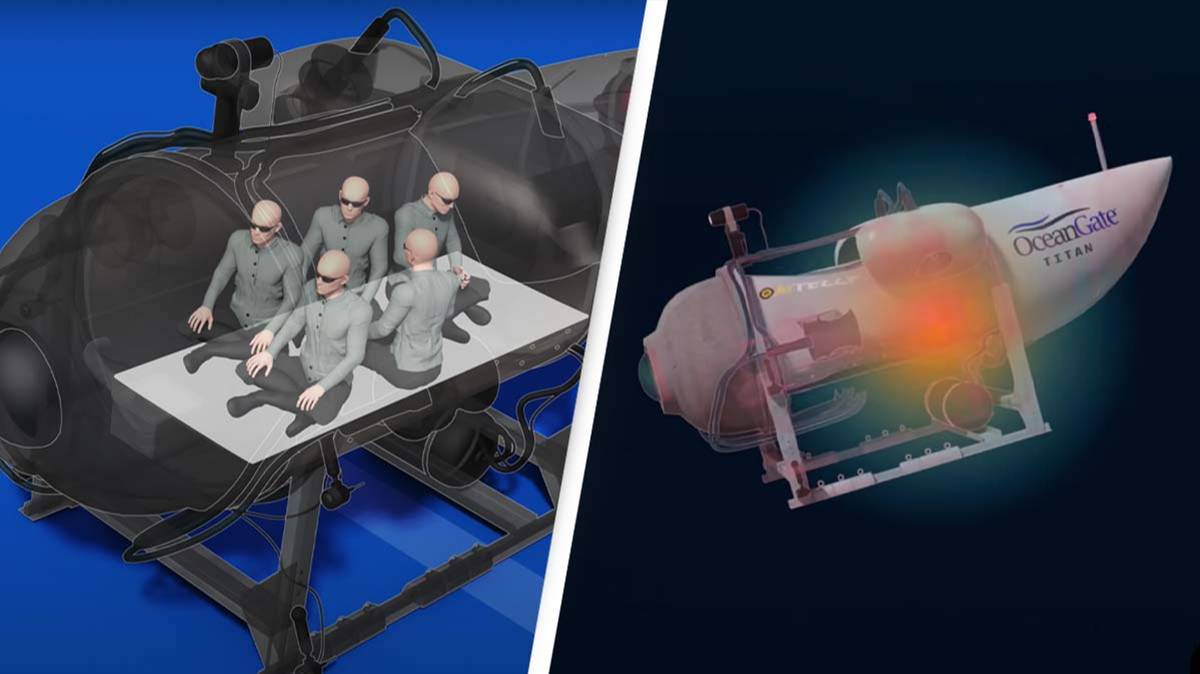

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025 -

From Rowing Machine To 2 2 Million A Fathers Fight For His Sons Health

May 25, 2025

From Rowing Machine To 2 2 Million A Fathers Fight For His Sons Health

May 25, 2025 -

What Was That Bang Titan Sub Implosion Captured On Footage

May 25, 2025

What Was That Bang Titan Sub Implosion Captured On Footage

May 25, 2025 -

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025 -

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025