To Buy Or Not To Buy Palantir Stock Before May 5th: Expert Opinions

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's recent financial health is crucial before deciding whether to buy Palantir stock. Analyzing key performance indicators (KPIs) provides valuable insight into the company's trajectory.

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report offered a mixed bag. While the company exceeded revenue expectations, profitability remained a key focus area. Let's examine the specifics:

- Revenue Growth: Palantir reported a [Insert Actual Percentage]% year-over-year revenue growth in Q4 2022, exceeding analyst predictions of [Insert Analyst Prediction]%. This demonstrates continued growth despite macroeconomic headwinds.

- Earnings Per Share (EPS): The company reported an EPS of [Insert Actual EPS], slightly below expectations of [Insert Expected EPS]. This discrepancy warrants further investigation into the underlying factors.

- Future Guidance: Palantir's guidance for Q1 2023 and the full year of 2023 is [Insert Actual Guidance]. This outlook provides crucial information for assessing the company’s future growth potential. Comparing these figures to previous quarters and industry benchmarks helps to contextualize Palantir's performance and gauge its potential for future success. The focus on long-term growth strategies needs to be considered in evaluating Palantir earnings and revenue.

Government Contracts and Commercial Growth

Palantir's revenue streams are diversified across government and commercial sectors. This diversification mitigates some risk, but the balance between these two segments is a key consideration for Palantir stock investors.

- Government Contracts: Palantir continues to secure significant government contracts, demonstrating the value of its platform in national security and intelligence applications. [Insert examples of recent significant contracts, if available]. This steady stream of government revenue provides a strong foundation for the company's financial stability.

- Commercial Growth: Palantir is actively expanding its commercial client base, targeting diverse industries such as finance, healthcare, and manufacturing. The success of this expansion will be a major factor influencing future Palantir stock performance. [Insert examples of recent commercial partnerships or successes, if available]. The growth in this area demonstrates Palantir's ability to adapt its platform to various sectors. Analyzing the long-term stability of both revenue streams offers a more comprehensive picture of Palantir revenue diversification.

Expert Opinions and Analyst Ratings

The opinions of financial analysts provide valuable perspective, but it's crucial to understand the reasoning behind their predictions.

Bullish vs. Bearish Predictions

Analyst sentiment on Palantir stock is currently [Insert overall sentiment - bullish, bearish, or neutral]. However, there's a significant divergence in opinions:

- Bullish Predictions: Some analysts believe Palantir's long-term growth potential is substantial, citing [Insert reasons, e.g., expanding commercial market, strong government contracts pipeline, technological advancements]. For example, [Analyst Name] at [Institution Name] has a [Price Target] price target for Palantir stock.

- Bearish Predictions: Other analysts express concerns about [Insert reasons, e.g., competition, profitability, macroeconomic uncertainty]. They argue that Palantir's high valuation and reliance on a few large contracts pose significant risk. For example, [Analyst Name] at [Institution Name] has a [Price Target] price target for Palantir stock. These differing views highlight the inherent uncertainty in predicting Palantir stock's future performance.

Factors Influencing Expert Opinions

Various factors influence analyst predictions regarding Palantir stock:

- Macroeconomic Conditions: The overall economic climate, including inflation and interest rates, significantly impact investor sentiment towards growth stocks like Palantir.

- Technological Advancements: Palantir's ability to innovate and adapt to the evolving technological landscape is crucial for its long-term success. Competition in the big data analytics space is fierce, and Palantir’s ability to maintain its edge is a critical factor.

- Competitive Landscape: The emergence of new competitors and the strategies of established players influence Palantir's market share and growth potential. Understanding Palantir competition and its relative market position is crucial in assessing its long-term prospects.

- Palantir stock valuation: The current valuation of Palantir stock relative to its earnings and future growth prospects is a major consideration for investors. This is a key factor influencing many analyst ratings.

Risks and Rewards of Investing in Palantir Stock Before May 5th

Investing in Palantir stock before May 5th presents both significant potential rewards and risks.

Potential Upside

A positive announcement on May 5th could significantly boost Palantir's stock price.

- Exceeding Expectations: If Palantir reports stronger-than-expected financial results or announces major new contracts, the stock price could experience a substantial upward surge.

- Positive Market Reaction: A generally positive outlook for the future could lead to a reassessment of Palantir's valuation by the market.

- Catalyst Events: Any positive news, such as strategic partnerships, product launches, or expansion into new markets, could act as catalysts for increased investment.

Potential Downsides

Conversely, disappointing news could lead to a sharp decline in Palantir's stock price.

- Disappointing Earnings: If Palantir misses revenue or earnings targets, the stock price could experience a significant drop.

- Negative Market Sentiment: Concerns about the broader technology sector or the company's long-term prospects could negatively impact investor confidence.

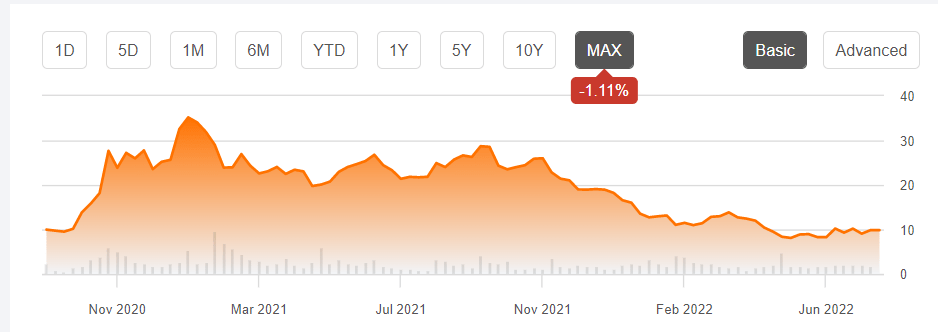

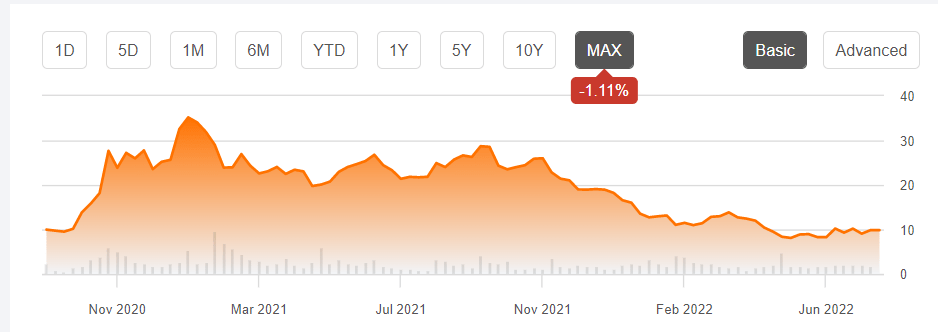

- Increased Volatility: Palantir stock is known for its volatility. Significant price swings can occur based on news and market sentiment, representing inherent risk for investors.

Conclusion

The decision of whether to buy Palantir stock before May 5th is a complex one. Weighing the expert opinions and analyzing Palantir's recent performance and future projections is critical. The potential for significant gains is balanced by the risks associated with investing in a growth stock within a volatile market. Remember to conduct your own thorough research and consider your individual risk tolerance before making any investment decisions concerning Palantir stock. This analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 09, 2025

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 09, 2025 -

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 09, 2025 -

Epstein Files Release Pam Bondis Announcement And What It Means

May 09, 2025

Epstein Files Release Pam Bondis Announcement And What It Means

May 09, 2025 -

Zayava Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 09, 2025

Zayava Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 09, 2025 -

Anchorage Protests Thousands Demonstrate Against Trump Policies Again

May 09, 2025

Anchorage Protests Thousands Demonstrate Against Trump Policies Again

May 09, 2025