Top 12 AI Stocks To Watch: Reddit's Best Picks

Table of Contents

Top AI Chip Manufacturers Fueling the Revolution

The foundation of the AI boom rests on powerful chips capable of handling complex computations. These AI chip manufacturers are at the forefront of this technological revolution, and their stocks are frequently discussed on Reddit.

NVIDIA (NVDA): The Undisputed King of AI Chips

- Dominant Market Share: NVIDIA holds a commanding lead in the GPU market, crucial for AI processing.

- Strong Revenue Growth Forecasts: Analysts predict continued robust revenue growth driven by the soaring demand for its GPUs in AI data centers and high-performance computing.

- High Demand for GPUs in AI Data Centers: The increasing adoption of AI across various sectors, from cloud computing to autonomous vehicles, fuels the demand for NVIDIA's high-end GPUs. This makes NVDA a top pick for many Reddit investors.

Advanced Micro Devices (AMD): A Strong Competitor Gaining Market Share

- Competitive Pricing: AMD offers competitive pricing compared to NVIDIA, making its GPUs attractive to a broader range of customers.

- Improved Performance: AMD has significantly improved its GPU performance in recent years, closing the gap with NVIDIA.

- Expanding Product Portfolio for AI Applications: AMD is actively developing and expanding its product portfolio tailored for AI applications, positioning itself for future growth.

Intel (INTC): Investing Heavily in AI Chip Development

- Catching Up with NVIDIA and AMD: Intel, a veteran in the semiconductor industry, is aggressively investing in AI chip development to regain its competitive edge.

- Potential for Significant Growth in the Future: While currently lagging behind NVIDIA and AMD, Intel's vast resources and experience offer significant potential for future growth in the AI chip market. Reddit discussions often speculate on Intel's potential for a comeback.

Software Giants Leading the AI Software Charge

Beyond hardware, the software powering AI applications is equally crucial. These tech giants are leading the charge, consistently mentioned in Reddit's AI investment conversations.

Microsoft (MSFT): Significant Investments in OpenAI and Integration of AI into its Products

- Azure Cloud Platform Dominance: Microsoft's Azure cloud platform is a key beneficiary of the growing demand for AI cloud services.

- Strong AI Research and Development: Microsoft's significant investment in OpenAI and its ongoing AI research and development efforts solidify its position in the AI landscape.

- Integration with Various Applications: Microsoft is actively integrating AI into its various products and services, offering a broad range of AI-powered solutions.

Alphabet (GOOGL): Leader in AI Research and Development with Google AI

- Diverse AI Applications (Search, Cloud, Autonomous Vehicles): Google's AI capabilities span various sectors, from search and cloud computing to autonomous vehicles.

- Strong Brand Recognition: Google's strong brand recognition and reputation for innovation provide a significant competitive advantage.

- Vast Data Resources: Google's vast data resources are a crucial asset for training and improving its AI algorithms.

Amazon (AMZN): Dominance in Cloud Computing with AWS and AI-Powered Services

- Strong AWS Growth: Amazon Web Services (AWS) is the leading cloud provider, benefiting significantly from the increasing adoption of AI in the cloud.

- Extensive AI Applications Across Various Sectors: Amazon leverages AI across various sectors, from e-commerce to logistics, creating a synergistic ecosystem.

- Massive Data Advantage: Amazon's massive data advantage provides a significant competitive edge in AI development and application.

Promising AI-Focused Companies with High Growth Potential

Beyond the established giants, several smaller companies are making waves in the AI space and are frequently discussed amongst Reddit's AI investor community.

C3.ai (AI): Enterprise AI Software

- Key Strengths: Focuses on enterprise AI applications, offering a platform for businesses to build and deploy AI solutions.

- Growth Prospects: Growing demand for enterprise AI solutions suggests significant growth potential.

- Potential Risks: Competition from larger tech companies and the overall volatility of the tech sector.

Palantir Technologies (PLTR): Big Data Analytics and AI

- Key Strengths: Expertise in big data analytics and AI, serving government and commercial clients.

- Growth Prospects: Expanding into new markets and applications.

- Potential Risks: Dependence on government contracts and intense competition.

Upstart Holdings (UPST): AI-Powered Lending Platform

- Key Strengths: Utilizes AI to improve lending decisions, potentially reducing risk and increasing efficiency.

- Growth Prospects: Expansion into new financial products and markets.

- Potential Risks: Regulatory scrutiny of AI in lending and potential economic downturns.

UiPath (PATH): Robotic Process Automation (RPA)

- Key Strengths: Leading provider of RPA software, automating repetitive business tasks.

- Growth Prospects: Increasing adoption of automation across industries.

- Potential Risks: Competition from other RPA vendors and the potential for automation to displace jobs.

BigBear.ai (BBAI): AI-Driven Solutions for National Security

- Key Strengths: Focus on national security applications, leveraging AI for intelligence and defense.

- Growth Prospects: Growing government spending on national security and AI.

- Potential Risks: Dependence on government contracts and potential for budget cuts.

Investing in AI Stocks: Risks and Considerations

While the potential for high returns in the AI sector is undeniable, investors need to acknowledge several key risks:

- Volatility of the Tech Sector: The tech sector is known for its volatility, and AI stocks are no exception.

- Potential for Overvaluation: The hype surrounding AI can lead to overvaluation of certain stocks.

- Dependence on Technological Advancements: Success in the AI sector is heavily reliant on continued technological breakthroughs.

- Regulatory Risks: Government regulations related to AI could impact the growth and profitability of AI companies.

Diversification and robust risk management strategies are crucial when investing in AI stocks. Don't put all your eggs in one basket.

Conclusion: Making Informed Decisions on Top AI Stocks

This article has highlighted twelve AI stocks frequently discussed on Reddit, offering a glimpse into the exciting yet potentially risky world of AI investing. While the potential for high returns is significant, remember that these investments are subject to market fluctuations and inherent technological risks. The companies presented represent a mix of established tech giants and promising newcomers, each with its unique strengths and challenges.

Stay ahead of the curve by continuing to monitor these Top 12 AI Stocks and further researching Reddit’s most discussed AI investment opportunities. Remember to always conduct your own due diligence before investing in any of these Top AI Stocks. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Gina Maria Schumacher Detaljan Pogled Na Zivot Kceri Legendarnog Vozaca

May 20, 2025

Gina Maria Schumacher Detaljan Pogled Na Zivot Kceri Legendarnog Vozaca

May 20, 2025 -

Boosting Mental Resilience Overcoming Challenges And Thriving

May 20, 2025

Boosting Mental Resilience Overcoming Challenges And Thriving

May 20, 2025 -

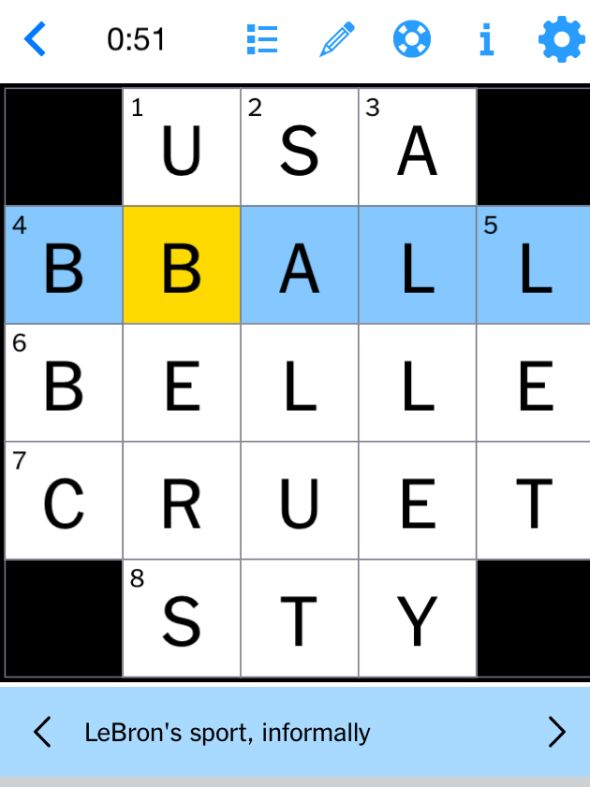

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025 -

Descente De La Brigade De Controle Rapide Bcr Surprise Dans Les Marches Abidjanais

May 20, 2025

Descente De La Brigade De Controle Rapide Bcr Surprise Dans Les Marches Abidjanais

May 20, 2025 -

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025

Latest Posts

-

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025 -

Vybz Kartels Skin Bleaching A Struggle With Self Love

May 21, 2025

Vybz Kartels Skin Bleaching A Struggle With Self Love

May 21, 2025 -

The Goldbergs Cast Characters And Their Real Life Counterparts

May 21, 2025

The Goldbergs Cast Characters And Their Real Life Counterparts

May 21, 2025 -

The Goldbergs Exploring The Shows Best Episodes And Running Gags

May 21, 2025

The Goldbergs Exploring The Shows Best Episodes And Running Gags

May 21, 2025