Tracking The Markets: Dow And S&P 500 Live Updates (May 26)

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 26

On May 26th, the Dow Jones Industrial Average experienced a relatively volatile trading session. The index opened at 33,820, reaching a high of 33,950 before retracting to a low of 33,700. It eventually closed at 33,850, representing a modest gain of 30 points (0.09%). This slight positive performance, however, masked a more nuanced picture of the day's trading activity.

-

Key factors influencing the DJIA's movement: Positive sentiment stemming from better-than-expected corporate earnings reports from several key components, particularly in the technology sector, helped push the index higher. Conversely, concerns regarding rising inflation and potential interest rate hikes introduced some downward pressure. Geopolitical uncertainties also played a minor role in contributing to the volatility.

-

Companies impacting the index: Companies like Apple (AAPL), with a strong earnings announcement, contributed significantly to the positive movement. Conversely, a disappointing earnings report from Boeing (BA) slightly weighed on the index.

-

Overall market sentiment: While the DJIA closed slightly higher, the intraday volatility suggests a degree of uncertainty within the market. The overall sentiment could be described as cautiously optimistic, reflecting a mixture of positive economic indicators and ongoing concerns about future economic headwinds.

S&P 500 Index Performance on May 26

The S&P 500 mirrored the DJIA's volatility on May 26th, but exhibited a slightly stronger upward trend. Opening at 4,180, the index climbed to a high of 4,200 before settling at a low of 4,175. It closed at 4,195, registering a gain of 15 points (0.36%). This outperformance compared to the DJIA suggests a more optimistic outlook among investors on a broader range of sectors.

-

Key sectors driving the S&P 500's movement: The technology and consumer discretionary sectors played significant roles in the index's positive performance. Strong earnings from several tech giants boosted investor confidence.

-

Significant sector-specific news: Positive news regarding upcoming regulations in the pharmaceutical sector had a supportive effect on related companies within the S&P 500, contributing to the overall positive movement.

-

Prominent companies: Tech giants like Microsoft (MSFT) and Alphabet (GOOGL) experienced significant gains, reflecting positive investor sentiment.

Correlation between Dow and S&P 500 Movements on May 26

On May 26th, the Dow and S&P 500 displayed a strong positive correlation. Both indices experienced volatility throughout the day, but ultimately closed with modest gains. This suggests that the broader market sentiment was largely consistent across these two major indices. The relatively similar performance indicates that the factors influencing the DJIA also had a significant impact on the broader market represented by the S&P 500.

-

Overall market trend: The market trend on May 26th can be characterized as slightly bullish, despite the intraday volatility.

-

Global economic events: No major global economic events significantly impacted both indices on this day.

-

Index comparison: A simple comparison chart would visually reinforce the similarity in the movements of both indices on May 26th.

Looking Ahead: Future Market Predictions (May 26 onwards)

Predicting future market movements is inherently speculative. However, based on May 26th's performance and current economic indicators, several factors suggest potential future market directions.

-

Upcoming economic data releases: The upcoming release of inflation data and employment figures will significantly influence market sentiment in the coming weeks.

-

Potential risks and opportunities: Continued inflation could lead to further interest rate hikes, potentially creating headwinds for the market. Conversely, strong corporate earnings and easing geopolitical tensions could provide support.

-

Further resources: For continuous market monitoring, investors should consult reputable financial news sources and seek professional investment advice.

Conclusion: Stay Updated on Dow and S&P 500 Market Movements

The Dow and S&P 500 exhibited moderate gains on May 26th, reflecting a cautiously optimistic market sentiment. However, intraday volatility highlighted the ongoing uncertainties in the market. Continuous monitoring of these key indices remains crucial for developing effective investment strategies. To stay informed about market fluctuations and make well-informed decisions, check back regularly for more Dow and S&P 500 live updates and other in-depth market analyses. Subscribe to our newsletter or follow us on social media for the latest insights and analysis.

Featured Posts

-

Jmye Almelwmat En Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025

Jmye Almelwmat En Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025 -

Port Of Spain Commute Unchanged Despite State Of Emergency

May 27, 2025

Port Of Spain Commute Unchanged Despite State Of Emergency

May 27, 2025 -

The Source Kanye Wests Rambling Rant On Livestreamings Evolution

May 27, 2025

The Source Kanye Wests Rambling Rant On Livestreamings Evolution

May 27, 2025 -

Understanding The Max Payne Movie Experience

May 27, 2025

Understanding The Max Payne Movie Experience

May 27, 2025 -

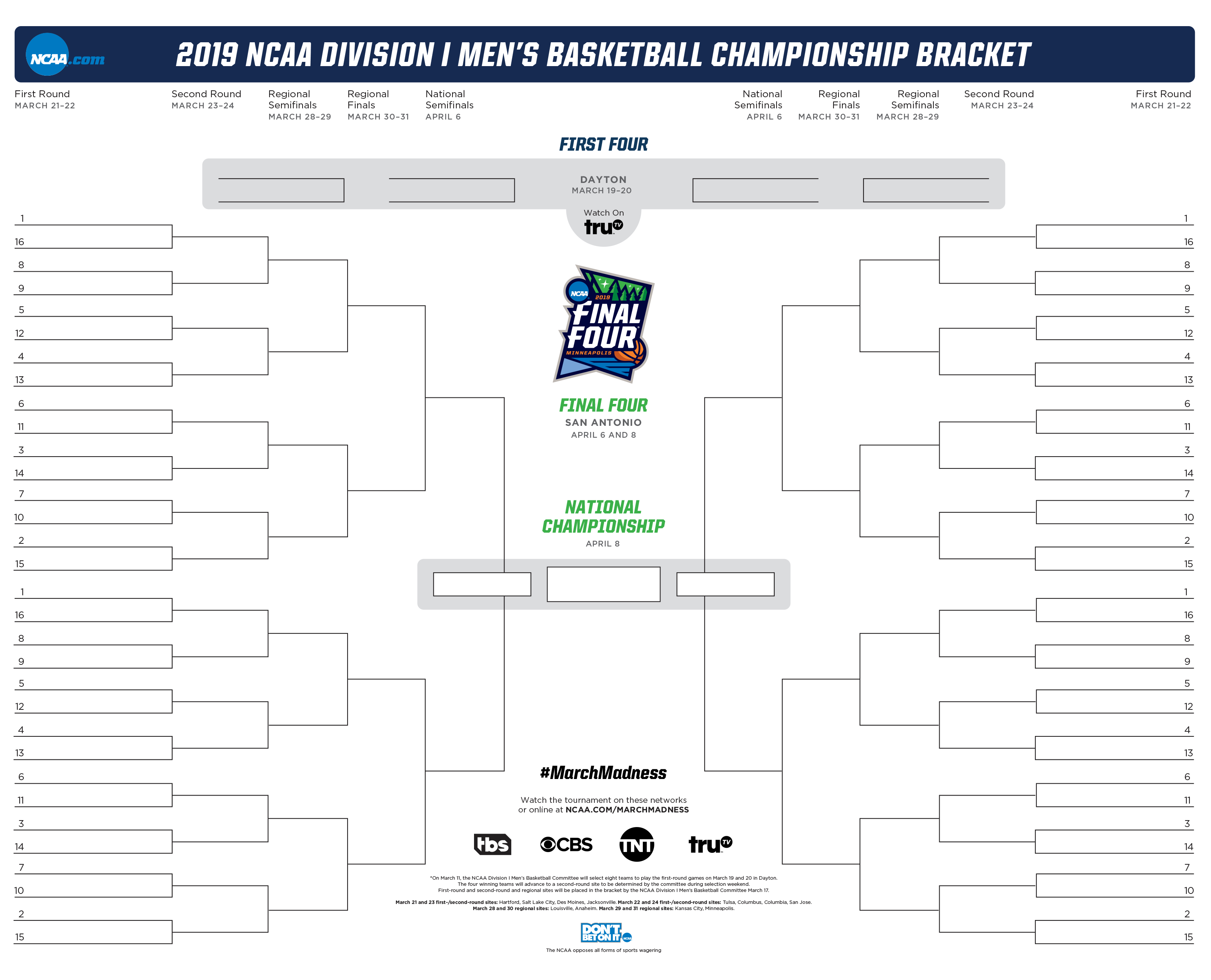

2025 March Madness The Cord Cutters Streaming Guide

May 27, 2025

2025 March Madness The Cord Cutters Streaming Guide

May 27, 2025

Latest Posts

-

Elon Musk And Vivian A Look At The Family Dynamics Following Her Modeling Debut

May 30, 2025

Elon Musk And Vivian A Look At The Family Dynamics Following Her Modeling Debut

May 30, 2025 -

The Musk Gates Dispute Examining The Claims Of Child Poverty

May 30, 2025

The Musk Gates Dispute Examining The Claims Of Child Poverty

May 30, 2025 -

The Public Eye Examining Vivian Musks New Modeling Career

May 30, 2025

The Public Eye Examining Vivian Musks New Modeling Career

May 30, 2025 -

Elon Musks Actions And Their Impact On Child Poverty A Bill Gates Perspective

May 30, 2025

Elon Musks Actions And Their Impact On Child Poverty A Bill Gates Perspective

May 30, 2025 -

Vivian Jenna Wilson From Elon Musks Daughter To Aspiring Model

May 30, 2025

Vivian Jenna Wilson From Elon Musks Daughter To Aspiring Model

May 30, 2025