Tracking The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For ETFs, this is calculated daily by taking the total market value of all the securities held in the ETF's portfolio, subtracting any liabilities, and then dividing by the total number of outstanding shares. Understanding the NAV is fundamental to your investment strategy.

- NAV reflects the underlying asset value: The NAV provides a snapshot of the intrinsic worth of the ETF's holdings. This is in contrast to the market price which can fluctuate throughout the trading day.

- Daily NAV fluctuations show ETF performance: By tracking daily NAV changes, you can assess the ETF's performance over time, understanding how its underlying assets are appreciating or depreciating.

- NAV is crucial for accurate pricing: While the market price might temporarily deviate, the NAV gives a true reflection of the ETF's value, especially important when buying or selling shares.

Sources for Tracking Amundi ETF's NAV

Reliable sources are essential for accurate NAV tracking. Here are some places you can find the daily NAV for the Amundi ETF:

- Amundi's official website: This is the most authoritative source. Amundi, the fund manager, publishes the daily NAV on their investor relations section.

- Financial news websites: Major financial news providers like Bloomberg, Yahoo Finance, and Google Finance typically list ETF NAVs, including the Amundi ETF.

- Your brokerage account platform: Your online brokerage account will usually display the NAV of your holdings, including the Amundi ETF, directly within your portfolio summary.

The NAV is typically updated at the end of the trading day, reflecting the closing prices of the underlying assets. However, there might be slight delays depending on the source. It's always advisable to cross-reference the NAV from multiple sources to ensure accuracy and identify any potential discrepancies. Minor discrepancies are normal due to reporting lags; however, significant variations should be investigated.

- Official sources offer the most accurate data: Prioritize information from Amundi's official website.

- Compare data across multiple sources for verification: This helps ensure accuracy and detect any errors.

- Be aware of potential reporting lags: Understand that there might be a slight delay between the market close and the publication of the NAV.

Interpreting NAV Changes in the Amundi ETF

Understanding NAV movements is key to informed decision-making. The Amundi ETF, being a global equity fund, is affected by numerous factors.

- Positive NAV changes reflect growth: An increase in the NAV generally indicates positive performance of the underlying assets, reflecting a rise in the overall value of the world markets.

- Negative NAV changes reflect losses: A decrease signifies a decline in the value of the ETF's holdings, potentially due to market downturns or specific sector underperformance.

- Currency fluctuations affect the USD value of NAV: As the Amundi ETF is denominated in USD (USD Acc), fluctuations in exchange rates can impact the NAV expressed in other currencies.

- Market price may differ slightly from NAV: The market price you see on an exchange might vary slightly from the NAV due to the bid-ask spread. This difference is usually small and temporary.

Tools and Techniques for Efficient NAV Tracking

Manually tracking NAV can be time-consuming. Fortunately, several tools can streamline the process:

- Automated tracking with portfolio management software: Many financial platforms provide automated portfolio tracking, calculating and displaying NAV changes for all your holdings, including the Amundi ETF.

- Spreadsheet programs: You can create a spreadsheet to manually input the daily NAV from your chosen source and track changes over time.

- Setting up alerts: Most brokerage platforms allow you to set price alerts, notifying you when your Amundi ETF’s NAV reaches a specific threshold (either up or down).

Regular NAV monitoring, even for long-term investors, is crucial for making informed decisions and adapting your strategy to market conditions.

- Automated tracking saves time and effort: Leverage technology to simplify the monitoring process.

- Alerts can help to react to market changes promptly: Be proactive in your investment decisions.

- Regular monitoring allows for informed investment decisions: Stay informed to make the best choices for your portfolio.

Conclusion: Mastering NAV Tracking for the Amundi MSCI All Country World UCITS ETF USD Acc

Tracking the Net Asset Value of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for understanding its performance and making informed investment decisions. By utilizing the resources and tools discussed, you can effectively monitor your investment, interpreting NAV changes in the context of market trends and global economic factors. Remember to use multiple reliable sources to verify the data and consider setting up automated alerts for significant changes. Start tracking the Net Asset Value of your Amundi MSCI All Country World UCITS ETF USD Acc today to make informed investment decisions and optimize your portfolio performance! [Link to Amundi's website]

Featured Posts

-

Exclusive Porsche 911 S T In Riviera Blue Details And Pricing

May 25, 2025

Exclusive Porsche 911 S T In Riviera Blue Details And Pricing

May 25, 2025 -

Choosing The Right Countryside For Your Escape

May 25, 2025

Choosing The Right Countryside For Your Escape

May 25, 2025 -

Yevrobachennya 2025 Chotiri Potentsiynikh Peremozhtsi Za Versiyeyu Konchiti Vurst Unian

May 25, 2025

Yevrobachennya 2025 Chotiri Potentsiynikh Peremozhtsi Za Versiyeyu Konchiti Vurst Unian

May 25, 2025 -

Porsche Macan Buying Guide Find The Perfect Suv For You

May 25, 2025

Porsche Macan Buying Guide Find The Perfect Suv For You

May 25, 2025 -

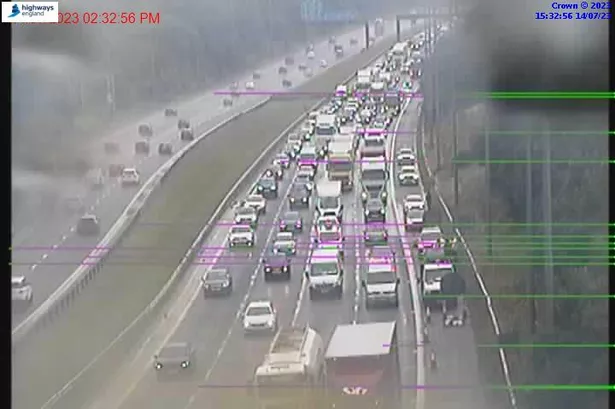

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025

Latest Posts

-

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025 -

Sixty Minute Delays On M6 Southbound Due To Accident

May 25, 2025

Sixty Minute Delays On M6 Southbound Due To Accident

May 25, 2025 -

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025 -

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025 -

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 25, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 25, 2025