Tracking The Net Asset Value (NAV) Of Amundi MSCI World Ex-US UCITS ETF Acc

Table of Contents

Methods for Tracking the Amundi MSCI World ex-US UCITS ETF Acc NAV

Tracking the NAV of your Amundi MSCI World ex-US UCITS ETF Acc investment requires reliable data sources. Here are the primary methods:

Official Sources: Amundi Website

The most accurate and reliable source for the Amundi MSCI World ex-US ETF NAV is the official Amundi website. This ensures you're accessing data directly from the fund manager, eliminating potential inaccuracies from third-party providers.

- Website URL: [Insert Amundi Website URL Here – Replace with actual URL] Look for a section dedicated to fund factsheets or performance data.

- Update Frequency: The NAV is typically updated daily, reflecting the closing market prices of the underlying assets. The specific update time will be noted on the website.

- Data Formats: Data is usually available in PDF format (factsheets) and sometimes as downloadable CSV files or accessible via an API (Application Programming Interface) for more advanced users.

Using official data is paramount; it eliminates discrepancies and ensures you have the most accurate representation of your investment's value.

Financial Data Providers

Reputable financial data providers like Bloomberg, Refinitiv, and Yahoo Finance also offer Amundi ETF NAV data. These platforms aggregate information from multiple sources, providing a convenient central point for tracking various financial instruments, including ETFs.

- Examples of Providers: Bloomberg Terminal, Refinitiv Eikon, Yahoo Finance

- Subscription Costs: Access to comprehensive data on these platforms often involves subscription fees, varying based on the level of access required. Yahoo Finance, however, offers free, albeit potentially less detailed, data.

- Data Accuracy Comparisons: While generally reliable, data from these providers might have slight variations or lags compared to the official Amundi data due to reporting differences.

Consider the cost-benefit of subscribing to a professional data provider based on your investment needs and trading frequency.

Brokerage Platforms

Most brokerage accounts automatically display the current NAV of your held ETFs, including the Amundi MSCI World ex-US UCITS ETF Acc. This is a convenient method for tracking your investment’s value within your portfolio.

- Popular Brokerage Platforms: Interactive Brokers, Fidelity, Schwab, TD Ameritrade (Adapt this list to your target audience's region)

- Limitations and Delays: Data displayed on brokerage platforms is usually sourced from data providers and may experience slight delays in updates compared to the official Amundi source.

Factors Affecting the Amundi MSCI World ex-US UCITS ETF Acc NAV

Several factors influence the daily fluctuations in the Amundi MSCI World ex-US UCITS ETF Acc NAV:

Market Fluctuations

Global market conditions significantly impact the ETF's NAV. Positive market sentiment usually leads to NAV increases, while negative sentiment results in decreases.

- Factors influencing market movements: Interest rate changes, economic growth rates, geopolitical events (wars, political instability), and investor confidence all play significant roles.

- Correlation with Holdings: The ETF's NAV directly reflects the performance of its underlying holdings (companies included in the MSCI World ex-US index). A rise in the value of these companies increases the ETF's NAV.

Understanding the broad market trends is crucial to interpreting NAV changes.

Currency Exchange Rates

As an internationally diversified ETF, the Amundi MSCI World ex-US UCITS ETF Acc is exposed to currency exchange rate fluctuations. Changes in the value of foreign currencies relative to the investor's base currency can affect the NAV.

- Impact of Currency Hedging: Amundi may employ currency hedging strategies to mitigate the impact of exchange rate movements, but this isn’t always guaranteed. Check the ETF's prospectus for details.

- Example: If the ETF holds assets denominated in US dollars and the US dollar appreciates against the investor's Euro, the NAV (in Euros) will likely decrease even if the underlying asset value remains unchanged.

Pay close attention to currency movements, especially if you're investing in a currency different from the ETF's base currency.

Dividends and Expenses

Dividend distributions from the underlying companies and the ETF's management fees impact the NAV.

- Dividend Reinvestment: Dividends received are usually reinvested automatically, increasing the number of shares an investor holds and potentially influencing the NAV.

- Management Fees: These fees are deducted from the fund's assets, slightly reducing the NAV over time.

It’s essential to understand how dividends and expenses contribute to your overall return.

Interpreting the Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Understanding how to interpret NAV data is crucial for effective investment management.

Analyzing NAV Changes

Analyzing daily or weekly NAV changes provides insights into short-term performance, but it’s crucial to consider the long-term perspective.

- Time Horizon: Short-term NAV fluctuations are normal and often don't reflect the ETF's long-term potential.

- Avoid Emotional Decisions: Don't make impulsive buy or sell decisions solely based on short-term NAV volatility.

Focus on long-term trends and your overall investment strategy.

Comparing NAV to other Benchmarks

Compare the ETF's NAV performance to its benchmark index (MSCI World ex-US) to assess its tracking efficiency.

- Tracking Error: This measures the difference between the ETF's return and the benchmark's return. A lower tracking error is generally preferred.

- Performance Relative to Benchmark: Analyze whether the ETF is outperforming or underperforming its benchmark, and consider potential reasons.

This comparison provides a better understanding of how the ETF is managing its investment strategy.

Using NAV for Investment Decisions

Use NAV data, along with other relevant factors, to inform your investment decisions.

- Buy/Sell Decisions: While NAV is a factor, it shouldn't be the sole driver of your buy/sell decisions. Consider your investment goals, risk tolerance, and market outlook.

- Portfolio Management: Track NAV to monitor your portfolio's overall performance and make necessary adjustments to maintain your desired asset allocation.

Conclusion: Mastering Amundi MSCI World ex-US UCITS ETF Acc NAV Tracking

Tracking the Amundi MSCI World ex-US UCITS ETF Acc NAV effectively involves utilizing official sources like the Amundi website, reliable financial data providers, and your brokerage platform. Understanding the impact of market fluctuations, currency exchange rates, and dividend distributions on the NAV is crucial for interpreting the data accurately. Regularly monitoring the NAV, comparing it to the benchmark, and considering it within a broader investment strategy enables informed decision-making. Stay informed about the performance of your Amundi MSCI World ex-US UCITS ETF Acc investments by regularly monitoring its NAV. Learn more about efficient NAV tracking techniques for your ETF portfolio.

Featured Posts

-

Reaction To Glastonbury 2025 Lineup Anger And Disappointment

May 24, 2025

Reaction To Glastonbury 2025 Lineup Anger And Disappointment

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage

May 24, 2025 -

Your Escape To The Country What To Expect And How To Prepare

May 24, 2025

Your Escape To The Country What To Expect And How To Prepare

May 24, 2025 -

Olivia Rodrigo And The 1975 Confirmed For Glastonbury 2025 Festival

May 24, 2025

Olivia Rodrigo And The 1975 Confirmed For Glastonbury 2025 Festival

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Latest Posts

-

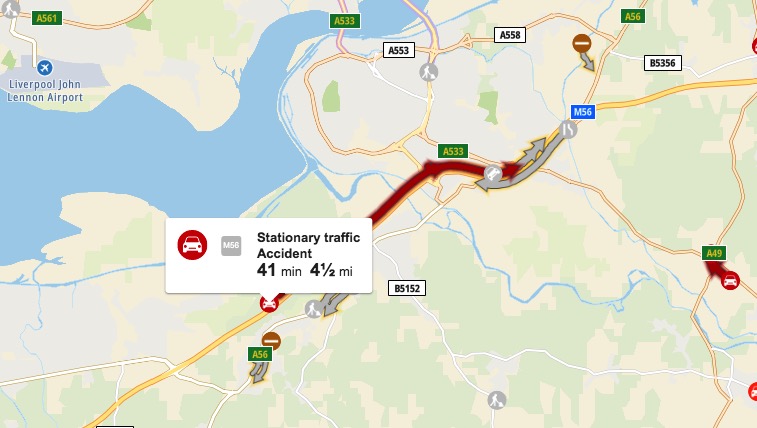

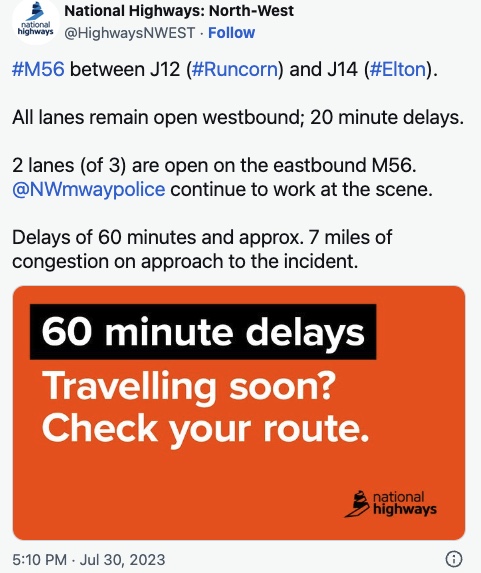

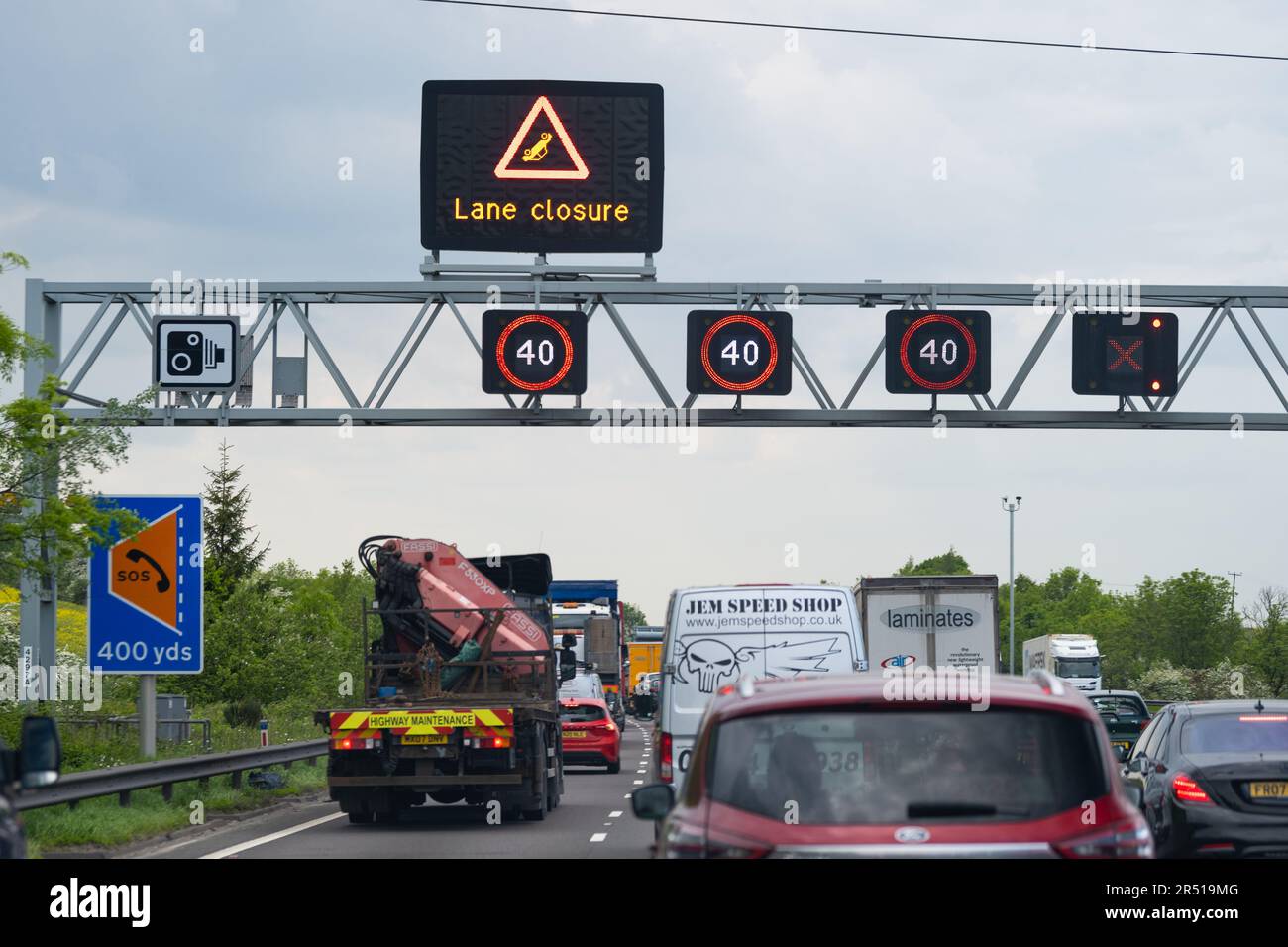

M56 Delays Cheshire Deeside Border Traffic Update Following Collision

May 24, 2025

M56 Delays Cheshire Deeside Border Traffic Update Following Collision

May 24, 2025 -

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Princess Road Closed Emergency Services Deal With Pedestrian Vs Vehicle Incident

May 24, 2025

Princess Road Closed Emergency Services Deal With Pedestrian Vs Vehicle Incident

May 24, 2025 -

M62 Manchester To Warrington Westbound Lane Closure For Resurfacing

May 24, 2025

M62 Manchester To Warrington Westbound Lane Closure For Resurfacing

May 24, 2025 -

M6 Motorway Closed Van Accident Leads To Extensive Delays

May 24, 2025

M6 Motorway Closed Van Accident Leads To Extensive Delays

May 24, 2025