Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Accessing the Amundi MSCI World II UCITS ETF Dist NAV is straightforward, with several reliable sources available. Knowing where to find accurate and up-to-date information is vital for effective investment monitoring. Here are some key places to check:

-

Official Amundi Website: The most reliable source is often the asset manager's official website. Amundi provides detailed information on their ETFs, including daily NAV updates. Look for dedicated ETF pages or fund fact sheets.

-

Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and others offer real-time and historical NAV data for a wide range of ETFs, including the Amundi MSCI World II UCITS ETF Dist. These services usually require subscriptions.

-

Brokerage Platforms: If you hold the Amundi MSCI World II UCITS ETF Dist through a brokerage account, your platform likely provides access to real-time pricing and NAV information for your holdings. Check your account statements and portfolio overview.

-

ETF Data Aggregators: Several independent websites and platforms aggregate ETF data from various sources. These aggregators offer convenient access to NAVs and other ETF metrics, often with comparison tools. However, always verify the data's accuracy against official sources.

It's crucial to use reliable sources to avoid discrepancies. While minor differences might exist due to timing and data processing, significant variations should prompt further investigation. The Amundi MSCI World II UCITS ETF Dist NAV is typically updated daily, reflecting the closing prices of its underlying assets.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist NAV

The Amundi MSCI World II UCITS ETF Dist NAV is dynamically influenced by several key factors related to its underlying assets and operational expenses. Understanding these factors allows for a more nuanced interpretation of NAV changes.

Underlying Asset Performance

The primary driver of NAV fluctuations is the performance of the underlying assets – the companies included in the MSCI World Index.

-

Market Fluctuations of the MSCI World Index Components: Positive performance in the global equity markets generally leads to an increase in the ETF's NAV, while negative market movements will decrease it.

-

Currency Exchange Rate Fluctuations: Since the Amundi MSCI World II UCITS ETF Dist invests globally, currency exchange rate movements between the base currency of the ETF and the currencies of the underlying assets can affect the NAV.

-

Dividend Distributions: Dividend payments from the underlying companies are typically reinvested or distributed to ETF shareholders. While distributions reduce the NAV immediately after payment, the overall impact on long-term performance depends on the reinvestment strategy.

Expenses and Fees

The ETF's management fees and other operating expenses reduce the NAV over time. These expenses are deducted from the fund's assets, impacting the overall return.

Other Factors

Other factors, although less significant in day-to-day fluctuations, can impact the NAV. These include:

- Capital Gains: Profits from selling assets within the ETF will impact the NAV.

- Share Buybacks: If the ETF repurchases its own shares, this can also affect the NAV.

Utilizing NAV Data for Investment Decisions

Tracking the Amundi MSCI World II UCITS ETF Dist NAV provides valuable insights for investment decisions, but it shouldn't be the sole factor considered.

Interpreting NAV changes involves comparing the current NAV to past values to assess performance. A rising NAV generally indicates positive performance, whereas a falling NAV suggests negative performance. However, consider the timeframe – short-term fluctuations are normal, while long-term trends are more significant.

Buy/Sell Decisions and Portfolio Rebalancing

-

Arbitrage Opportunities: Comparing the NAV to the market price of the ETF can reveal potential arbitrage opportunities (buying low, selling high). However, transaction costs need to be factored in.

-

Long-Term NAV Trends: Monitoring long-term NAV trends helps assess the success of your investment strategy. If the trend consistently deviates from expectations, it might be time to re-evaluate your investment approach.

Remember, using NAV alone for investment decisions is insufficient. Consider other factors, including trading volume, expense ratios, and broader market conditions.

Understanding the Amundi MSCI World II UCITS ETF Dist Distribution Policy and its impact on NAV

The Amundi MSCI World II UCITS ETF Dist's distribution policy significantly influences the NAV. Understanding this policy is crucial for accurate tracking and investment planning.

The ETF distributes dividends periodically, typically annually or semi-annually. These dividends are paid out from the investment returns generated by the underlying assets. This distribution directly impacts the NAV, causing a decrease immediately following the distribution as the assets are reduced.

The frequency and amount of distributions are outlined in the ETF's prospectus. It is essential to consult this document to understand the exact payment schedule and tax implications. Remember that dividend distributions are taxable income for investors, so the tax implications should be taken into account when evaluating the overall returns. Proper understanding of the distribution policy is crucial for accurately interpreting NAV movements and assessing the overall investment performance.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Tracking

Successfully tracking the Amundi MSCI World II UCITS ETF Dist NAV requires utilizing reliable sources like the official Amundi website, financial data providers, or your brokerage platform. Remember to consider the various factors influencing NAV, including underlying asset performance, expenses, and dividend distributions. While NAV is a key metric, using it in conjunction with other investment indicators provides a more comprehensive view. Actively track your Amundi MSCI World II UCITS ETF Dist NAV and leverage this information to make better investment choices. For more in-depth knowledge on ETFs and NAV tracking, explore additional resources available online and consult with a qualified financial advisor.

Featured Posts

-

Ferraris Inaugural Bengaluru Service Centre What To Expect

May 24, 2025

Ferraris Inaugural Bengaluru Service Centre What To Expect

May 24, 2025 -

Chetyre Pobeditelya Evrovideniya 2025 Po Prognozu Konchity Vurst

May 24, 2025

Chetyre Pobeditelya Evrovideniya 2025 Po Prognozu Konchity Vurst

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Learn From Nicki Chapman 700 000 Profit From A Country Property Investment

May 24, 2025

Learn From Nicki Chapman 700 000 Profit From A Country Property Investment

May 24, 2025

Latest Posts

-

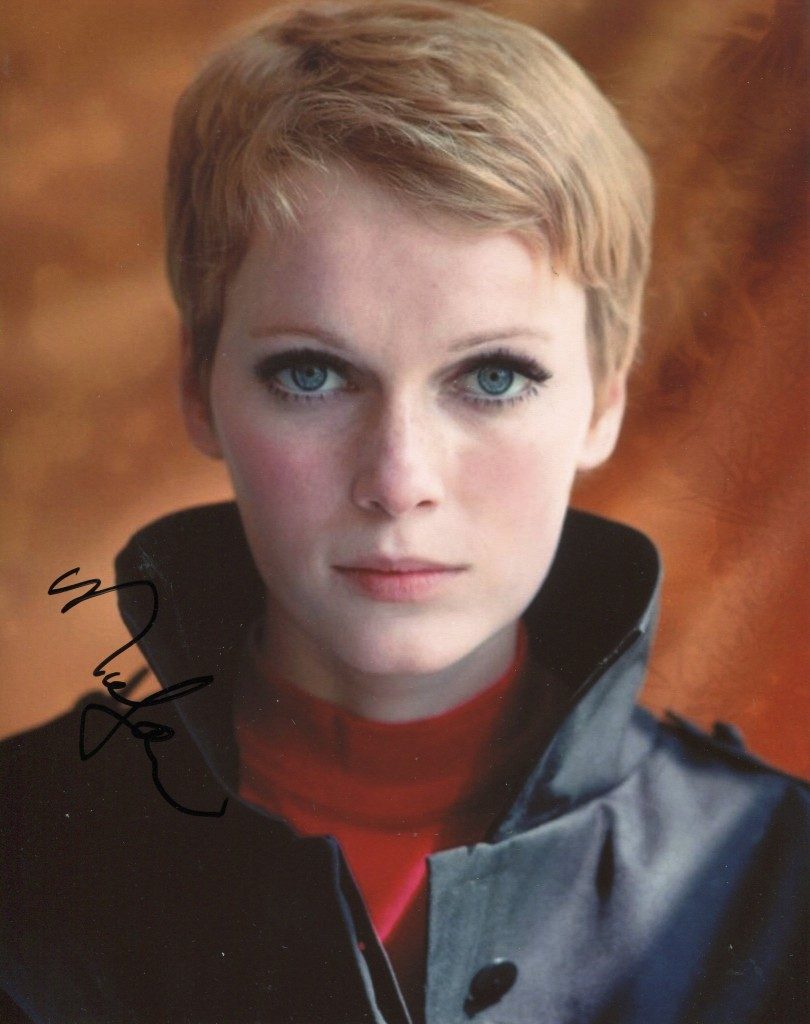

Caine On Mia Farrow A Sex Scene And An Ex Husbands Surprise

May 24, 2025

Caine On Mia Farrow A Sex Scene And An Ex Husbands Surprise

May 24, 2025 -

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penn Questions Dylan Farrows Allegations Against Woody Allen

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025