Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Where to Find the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Knowing where to access accurate and up-to-date NAV information is the first step. Here are the key sources:

Official Website: The Primary Source for NAV

The most reliable source for the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is the official Amundi website. Typically, you'll find this information within the fund's factsheet or a dedicated "Price & Performance" section. Look for clearly labeled tables or charts displaying the daily NAV, often alongside historical data. (Note: Include a screenshot here if possible, showing the typical location of the NAV on the Amundi website).

Financial Data Providers: Reliable Secondary Sources

Reputable financial data providers offer another avenue for accessing the NAV. Leading platforms include:

- Bloomberg: A professional-grade terminal, offering detailed data and analysis.

- Refinitiv: Similar to Bloomberg, providing comprehensive financial data.

- Yahoo Finance: A widely accessible free platform offering basic ETF information, including NAV.

- Google Finance: Another free and readily available source for ETF data.

When using these platforms, search for the ETF using its ticker symbol (ensure you use the correct ticker for your specific exchange). Always verify the data source's reliability and ensure you are viewing the NAV and not just the market price.

Brokerage Platforms: Convenient Access for Existing Investors

If you hold the Amundi MSCI World II UCITS ETF USD Hedged Dist through a brokerage account, you can often find its NAV directly within your account's portfolio overview. However, note that update frequencies and data accuracy may vary between brokerage platforms. Consult your brokerage's help documentation for specifics on accessing NAV data.

Understanding NAV Calculation and Components

The Net Asset Value (NAV) represents the net worth of the ETF per share. It's calculated using a simple formula:

Total Assets - Total Liabilities = NAV

Components of Assets and Liabilities

- Assets: Primarily consist of the ETF's holdings in various global equities, reflecting the MSCI World Index. This includes the market value of all the stocks the ETF owns. Cash holdings also contribute to the asset value.

- Liabilities: These include expenses like management fees, operating costs, and any accrued liabilities.

Currency Hedging and its Impact on NAV

The "USD Hedged Dist" designation signifies that the ETF employs a currency hedging strategy to minimize the impact of fluctuations between the base currency of the underlying assets (likely a mix of currencies) and the US dollar. This hedging aims to reduce risk for US dollar-based investors. The effectiveness of the hedge will influence the NAV, potentially reducing volatility compared to an unhedged version.

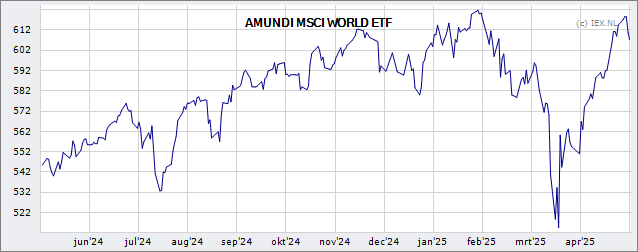

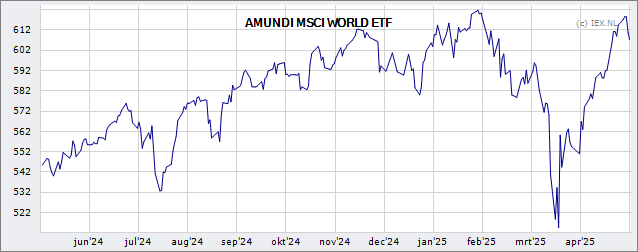

Factors Influencing Daily NAV Fluctuations

Daily NAV changes primarily reflect movements in the market values of the underlying assets within the ETF. Other factors impacting daily fluctuations include:

- Global Market Performance: Positive market movements generally lead to a higher NAV, and vice-versa.

- Currency Exchange Rates: Even with hedging, residual currency fluctuations can influence the NAV, especially short-term movements.

- Dividend Distributions: Dividend payouts from the underlying stocks will affect the NAV, usually causing a slight decrease immediately following the distribution.

Interpreting NAV Changes and Their Significance

Understanding NAV changes is crucial for assessing the ETF's performance.

Interpreting Positive and Negative Changes

- Positive NAV Change: Indicates the ETF's underlying assets have increased in value, reflecting positive market performance or successful hedging.

- Negative NAV Change: Suggests a decrease in the value of the underlying assets, potentially due to negative market conditions or less effective hedging.

NAV vs. Market Price

The NAV represents the intrinsic value of the ETF, while the market price is the price at which it trades on the exchange. A difference between the two (bid-ask spread) is common due to market forces.

Long-Term Performance Monitoring

Tracking NAV over time provides a clear picture of the ETF's long-term performance and the effectiveness of its investment strategy.

Benchmark Comparison

Comparing the NAV's change over time to the performance of its benchmark index (MSCI World Index) helps assess the ETF's ability to track its target.

Tools and Techniques for Tracking NAV Effectively

Efficient NAV tracking requires a systematic approach.

Automated Tracking (if available)

While specific software tailored to this particular ETF might not exist, explore platforms that allow customized ETF tracking and alerts. Many financial data providers offer such capabilities.

Manual Tracking

For simpler tracking, use a spreadsheet to record the daily or weekly NAV obtained from reliable sources like those mentioned earlier.

Setting Alerts

Configure alerts from your brokerage account or financial data provider to notify you of significant NAV changes (positive or negative).

Conclusion: Mastering NAV Tracking for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Effectively tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist requires utilizing reliable data sources like the official Amundi website, reputable financial data providers, and your brokerage platform. Understanding the factors influencing NAV fluctuations and regularly comparing the NAV to the benchmark index allows for informed investment decisions. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist investment by regularly tracking its Net Asset Value (NAV) using the techniques outlined above. Understanding your NAV is key to successful ETF investing!

Featured Posts

-

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 24, 2025

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Escape To The Country What To Expect When Relocating

May 24, 2025

Escape To The Country What To Expect When Relocating

May 24, 2025

Latest Posts

-

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025 -

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025 -

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025 -

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025