Trade War Fears And Trump's Actions Boost Gold Prices

Table of Contents

Understanding the Safe Haven Appeal of Gold

Gold has long been considered a safe haven asset, a haven investors seek during times of economic and political uncertainty. This appeal stems from two key factors: its role as an inflation hedge and its performance during periods of economic instability.

Gold as an Inflation Hedge

Historically, gold has performed well during inflationary periods. When the value of fiat currencies decreases due to factors like increased government spending or trade wars, the purchasing power of those currencies erodes. Gold, on the other hand, retains its value, serving as a reliable store of wealth.

- Examples: Gold prices rose significantly during the inflationary periods of the 1970s and during various periods of hyperinflation in other countries.

- Explanation: Gold's value isn't tied to a specific government or economy, making it less susceptible to the devaluation of fiat currencies. This lack of correlation with paper money makes it an effective hedge against inflation.

- Keywords: Inflation, hedge, purchasing power, currency devaluation, precious metals.

Gold's Role During Economic Uncertainty

Geopolitical instability and economic uncertainty often drive investors towards perceived safe havens, and gold frequently fills this role. Trade wars, in particular, create significant uncertainty, impacting global markets and investor confidence.

- Examples: The US-China trade war and other trade disputes in recent years have seen spikes in gold prices as investors sought to reduce risk.

- Discussion: Risk aversion and a "flight to safety" are typical investor reactions to economic uncertainty, leading to increased demand and higher prices for gold.

- Keywords: Geopolitical risk, economic uncertainty, risk aversion, flight to safety, safe haven asset.

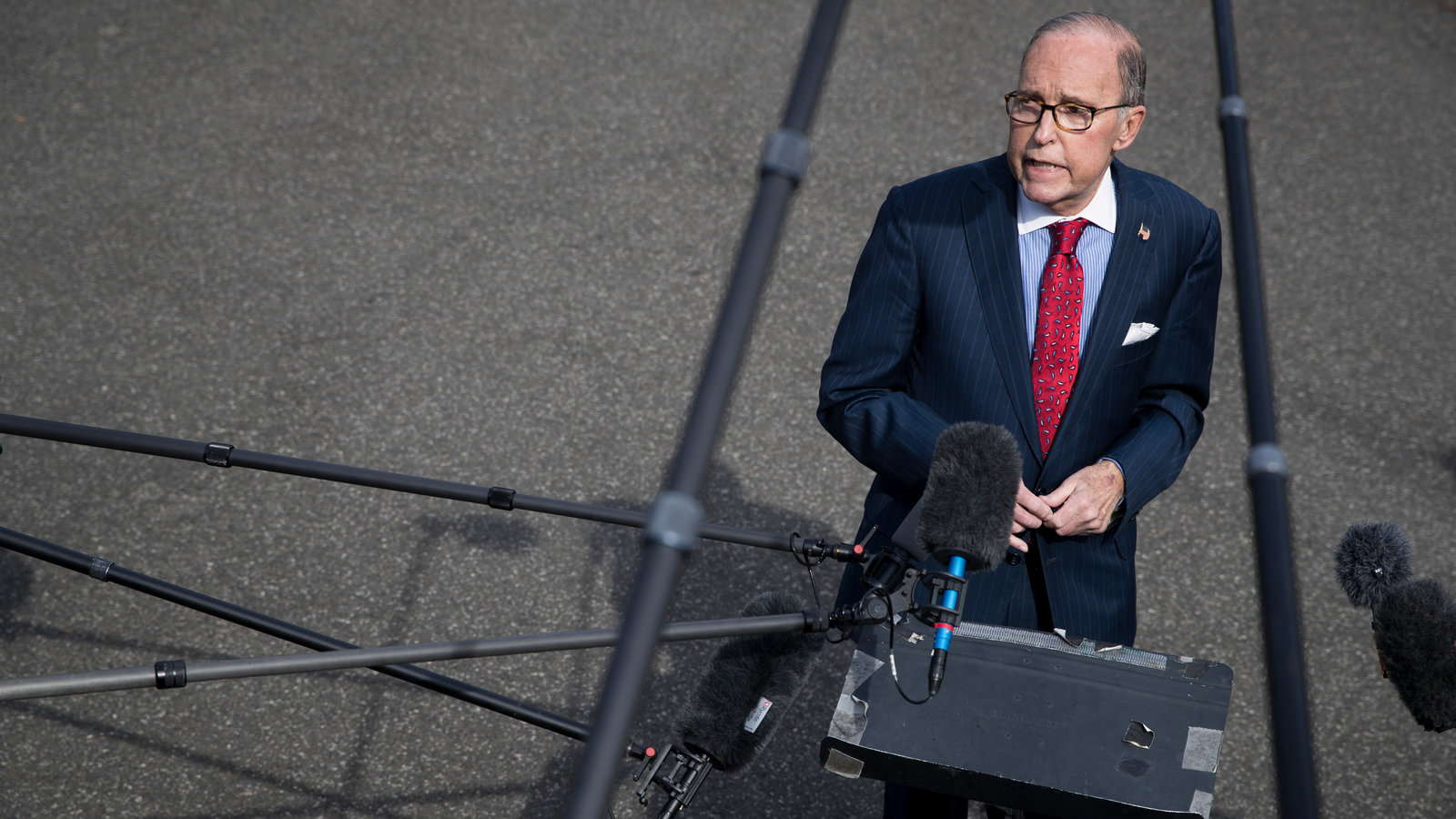

Trump's Trade Policies and Their Impact on Gold

Former President Trump's trade policies played a significant role in shaping the economic landscape and, consequently, influencing gold prices. His actions created considerable global economic uncertainty, driving investors towards the perceived safety of gold.

Impact of Tariffs and Trade Disputes

Trump's imposition of tariffs and engagement in numerous trade disputes led to increased market volatility. This uncertainty, coupled with concerns about global economic growth, spurred demand for gold.

- Specific Examples: The tariffs imposed on goods from China and other countries led to market disruptions and increased investor anxiety, boosting gold prices.

- Market Reactions: Market uncertainty and fears of a global recession often translate into increased demand for gold as a safe haven.

- Keywords: Tariffs, trade disputes, US-China trade war, global trade, market volatility, economic growth.

Investor Sentiment and Market Psychology

Negative investor sentiment, fueled by concerns over Trump's trade policies and their potential consequences, significantly influenced investment decisions. The media's portrayal of these events also played a crucial role in shaping market psychology.

- Influence of News and Media: Headlines detailing escalating trade tensions, negative economic forecasts, and market downturns often spurred investors to seek the safety of gold.

- Investor Confidence: Decreased investor confidence and increased fear, uncertainty, and doubt (FUD) about the economic future often lead to higher gold demand.

- Keywords: Investor sentiment, market psychology, fear, uncertainty, doubt (FUD), gold investment.

Investing in Gold During Trade War Fears

With the understanding that trade wars and economic uncertainty can boost gold prices, it's important to understand how to invest in this precious metal.

Different Ways to Invest in Gold

There are several ways to gain exposure to gold as part of a diversified portfolio:

- Physical Gold: Purchasing gold bars or coins offers direct ownership but requires safe storage.

- Gold ETFs (Exchange-Traded Funds): ETFs provide diversified exposure to gold without the need for physical storage.

- Gold Mining Stocks: Investing in companies involved in gold mining offers leveraged exposure but carries higher risk.

- Keywords: Gold ETFs, gold mining stocks, physical gold, gold bars, gold coins, precious metals investment.

Diversification and Risk Management

It is crucial to remember that gold, like any other investment, carries risk. Diversification is key to mitigating this risk. Gold should be considered one component of a well-balanced investment portfolio, not the sole investment.

- Why Diversification Matters: Gold's price can fluctuate significantly, and relying solely on gold for investment exposes you to considerable risk.

- Balanced Portfolio Recommendations: A diversified portfolio should include a mix of assets, such as stocks, bonds, and real estate, alongside gold to achieve optimal risk-adjusted returns.

- Keywords: Diversification, risk management, portfolio allocation, asset allocation, investment strategy.

Conclusion

Trade wars and the policies of former President Trump have created a climate of economic uncertainty, significantly impacting investor behavior and boosting gold prices. Gold's role as a safe haven asset, combined with its status as an inflation hedge, makes it an attractive investment during such periods. Investors can choose from various avenues to incorporate gold into their portfolios, including physical gold, gold ETFs, and gold mining stocks. However, remember that diversification and prudent risk management remain crucial for successful investing. Invest in gold today to protect your portfolio and safeguard your financial future against the uncertainties of global trade and economic volatility. Explore gold investment options now. Protect your portfolio with gold.

Featured Posts

-

Economic Slowdown Hits Paris Luxury Market Decline Impacts Budget

May 25, 2025

Economic Slowdown Hits Paris Luxury Market Decline Impacts Budget

May 25, 2025 -

G7 Meeting Tariffs Unmentioned In Final Communique

May 25, 2025

G7 Meeting Tariffs Unmentioned In Final Communique

May 25, 2025 -

Exploring The Design Of Robuchon Monaco Francis Sultanas Contribution

May 25, 2025

Exploring The Design Of Robuchon Monaco Francis Sultanas Contribution

May 25, 2025 -

Dazi Usa E Prezzi Abbigliamento Guida Completa Per Consumatori

May 25, 2025

Dazi Usa E Prezzi Abbigliamento Guida Completa Per Consumatori

May 25, 2025 -

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025

Latest Posts

-

Analyzing Michael Schumachers Relationships With Fellow Drivers

May 25, 2025

Analyzing Michael Schumachers Relationships With Fellow Drivers

May 25, 2025 -

Apres Laurent Baffie Thierry Ardisson Revele La Verite Sur Tout Le Monde En Parle

May 25, 2025

Apres Laurent Baffie Thierry Ardisson Revele La Verite Sur Tout Le Monde En Parle

May 25, 2025 -

Ultima Hora La Muerte De Eddie Jordan Conmociona Al Mundo Del Deporte

May 25, 2025

Ultima Hora La Muerte De Eddie Jordan Conmociona Al Mundo Del Deporte

May 25, 2025 -

Melanie Thierry Une Analyse De Sa Carriere Au Cinema Et A La Television

May 25, 2025

Melanie Thierry Une Analyse De Sa Carriere Au Cinema Et A La Television

May 25, 2025 -

Zwischen Fest Und Fussball Der Hsv Kaempft Um Den Aufstieg

May 25, 2025

Zwischen Fest Und Fussball Der Hsv Kaempft Um Den Aufstieg

May 25, 2025