Trade War Uncertainty Fuels Gold Price Surge: Is Bullion A Wise Investment?

Table of Contents

The Correlation Between Trade Wars and Gold Prices

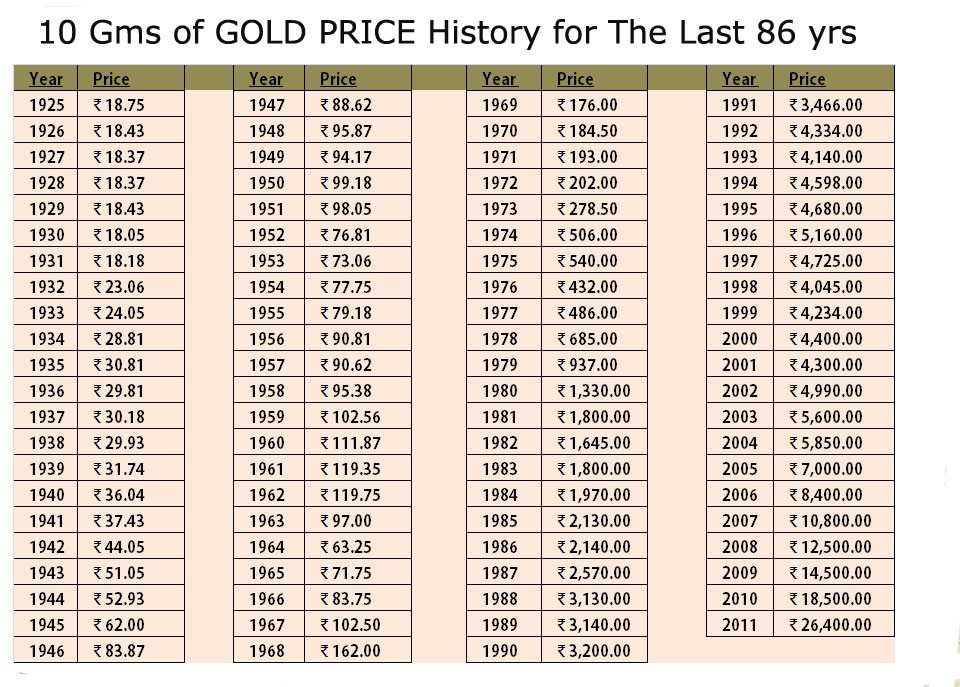

Historically, geopolitical instability and periods of economic uncertainty have had a demonstrably positive correlation with gold prices. When markets experience turbulence – often fueled by trade disputes – investors tend to flock towards safe-haven assets. Gold, with its inherent scarcity and historical value, consistently emerges as a preferred choice. This flight to safety is driven by a decreased confidence in riskier assets like stocks and bonds.

Consider past trade wars and their effects: The 1970s oil crisis and subsequent inflation saw significant gold price increases. Similarly, periods of heightened international tension, such as the Cold War, also correlated with higher gold values. Data clearly shows a consistent pattern: uncertainty breeds demand for gold.

- Increased market volatility leads to higher demand for gold. The inherent uncertainty surrounding trade wars creates volatility, pushing investors towards perceived safe havens.

- Gold is considered a hedge against inflation often triggered by trade disputes. Trade wars can disrupt supply chains and increase costs, leading to inflation, which erodes the value of fiat currencies. Gold acts as a safeguard against this erosion.

- Reduced investor confidence in other asset classes boosts gold's appeal. When the stock market dips due to trade war anxieties, gold's relative stability makes it a more attractive investment option.

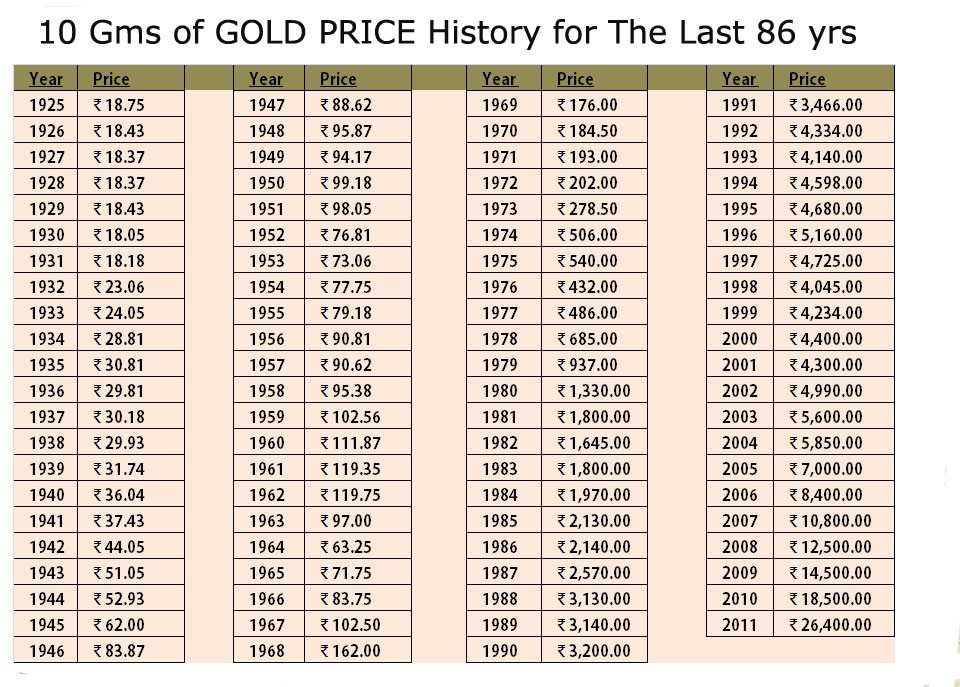

Analyzing the Current Gold Market

Currently, gold prices reflect the ongoing tension stemming from global trade wars. While the exact price fluctuates daily, the overall trend reflects a market sentiment that favors gold. However, it's important to note that other macroeconomic factors also play a vital role:

- Interest rate changes influence the opportunity cost of holding non-interest-bearing assets like gold.

- Currency fluctuations, particularly the US dollar's strength relative to other currencies, significantly impact gold prices (gold is priced in USD).

- Supply and demand dynamics within the gold market – influenced by mining output, jewelry demand, and central bank activity – also affect prices.

Let's break it down:

- Current gold spot price and its recent movements: Track the daily price changes on reputable financial websites to stay informed.

- Analysis of major gold-producing countries and their output: Changes in production from countries like China, Australia, and South Africa directly influence supply.

- Influence of central bank gold reserves on market prices: Central banks' buying and selling activity can significantly impact market sentiment and price levels.

Gold as a Safe Haven Asset: Diversification and Risk Management

Diversification is a fundamental tenet of sound investment strategy. Spreading your investments across various asset classes reduces the overall risk of your portfolio. Gold, with its historically low correlation with other assets like stocks and bonds, plays a crucial role in this diversification strategy.

- Gold’s low correlation with other asset classes like stocks and bonds: This means that when stocks perform poorly, gold may act as a buffer, mitigating overall portfolio losses.

- How gold can help reduce overall portfolio volatility: Its stability during market downturns helps cushion against significant losses.

- The importance of considering your risk tolerance before investing in gold: Assess your comfort level with price fluctuations before investing a significant portion of your portfolio.

Different Ways to Invest in Gold (Bullion)

There are several ways to gain exposure to gold:

- Buying physical gold bars or coins: This offers tangible ownership but requires secure storage and insurance.

- Investing in Gold Exchange Traded Funds (ETFs): ETFs offer a convenient and liquid way to invest in gold without the need for physical storage.

- Investing in gold mining companies: This offers leveraged exposure to gold prices but also involves the operational risks associated with the mining industry. Each approach has its own set of pros and cons regarding costs, liquidity, and risk exposure.

Potential Risks and Downsides of Gold Investment

While gold offers significant benefits, it's crucial to acknowledge potential drawbacks:

- Gold prices can fluctuate significantly. While it's a safe haven, it’s not immune to price swings.

- Physical gold storage requires security and insurance. Storing large quantities of physical gold necessitates specialized facilities and insurance to mitigate theft or loss.

- Opportunity cost of investing in gold instead of other assets. Investing in gold means foregoing potential returns from other potentially higher-yielding assets.

Conclusion: Trade War Uncertainty Fuels Gold Price Surge: Should You Invest?

In conclusion, the current surge in gold prices is undeniably linked to the uncertainty surrounding ongoing trade wars. Gold's role as a safe-haven asset, coupled with its low correlation to other asset classes, makes it a compelling addition to a diversified portfolio for risk-averse investors. However, remember that gold investments are not without risk. Price volatility, storage concerns (for physical gold), and the opportunity cost of foregoing other investments are crucial factors to consider.

Before investing in gold bullion during this period of trade war uncertainty, conduct thorough research, understand your risk tolerance, and perhaps consult with a financial advisor. Closely monitoring the gold market remains essential given the continuing global trade tensions. The question of whether or not to invest in gold remains a personal one, dependent upon your individual financial goals and risk appetite.

Featured Posts

-

The Impact Of Trump Administration Pressure On European Ai Development

Apr 26, 2025

The Impact Of Trump Administration Pressure On European Ai Development

Apr 26, 2025 -

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

The Game Stop Experience My Switch 2 Preorder Journey

Apr 26, 2025

The Game Stop Experience My Switch 2 Preorder Journey

Apr 26, 2025 -

The China Factor Analyzing Market Difficulties For Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025

The China Factor Analyzing Market Difficulties For Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025 -

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 26, 2025

Latest Posts

-

Ariana Grandes Hair And Tattoo Choices A Look At The Role Of Professional Stylists And Therapists

Apr 27, 2025

Ariana Grandes Hair And Tattoo Choices A Look At The Role Of Professional Stylists And Therapists

Apr 27, 2025 -

Understanding Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Evolution Hair Tattoos And The Importance Of Professional Guidance

Apr 27, 2025 -

Ariana Grandes Transformation The Impact Of Professional Help On Self Expression Through Hair And Tattoos

Apr 27, 2025

Ariana Grandes Transformation The Impact Of Professional Help On Self Expression Through Hair And Tattoos

Apr 27, 2025 -

The Psychology Behind Ariana Grandes Style Change Hair Tattoos And Professional Assistance

Apr 27, 2025

The Psychology Behind Ariana Grandes Style Change Hair Tattoos And Professional Assistance

Apr 27, 2025 -

Exploring Ariana Grandes Artistic Expression Through Hair And Tattoos A Look At Professional Guidance

Apr 27, 2025

Exploring Ariana Grandes Artistic Expression Through Hair And Tattoos A Look At Professional Guidance

Apr 27, 2025